Here we go again!

The Nasdaq has run up to our 5,440 shorting line (/NQ) but, sadly, none of the other indexes are following suit. Back on our March 16th PSW Report, the levels we laid out for shorting were:

- Dow Futures (/YM) at 2,100

- S&P Futures (/ES) at 2,390

- Nasdaq Futures (/NQ) at 5,440

- Russell Futures (/TF) at 1,390

In our live Member Chat Room, the week before (11th) I had laid out the shorting lines and expected bottoms for all of our Futures indexes with charts and graphs and I'll reprint them here as they are still aprropriate – even 3 weeks later:

2,380 to 2,340 is 1.7% and we expect 8-point bounce to 2,348 (check) and 2,356 and notice 2,356, not 55 is a good line to short again.

Have to call this 21,000 – even though we didn't make it and call the fall 420, even though it didn't and we have 20,580 with 85-point bounces to 20,666 (because who doesn't like Satan?) and 20,750 will be the strong bounce line.

5,440 or fight is very appropriate as that's how Polk screwed the Mexicans out of California in the first place. On the Nasdaq, it's also the northern limit of expansion and 100 points is 1.8% so I'm going to say we should look at the lines of a 2.5% correction, which would be way down at 5,304 so let's pretend we tested 5,300 for a 140-point drop and call it 30-point bounces to 5,330 (weak) and 5,370 (strong). If my theory is right, 5,370 will be rejected and we will then fall back to test the 5,300 line (or at least 5,304). Failing that will indicate ALL the indexes should be testing 2.5% drops.

I'm going to have to call RUT 1,400 and 1,350 means 10-point bounces to 1,360 and 1,370 and 1,365 happens to be the -2.5% line on the RUT so failing that indicates the Nas may soon be joining us (followed by Dow and SPX too).

This is, of course, a simple application of our fabulous 5% Rule™ and no, it's not TA – it's just math! With the Apple-driven Nasdaq back at the high-water mark, we'll need to see a break higher in order to get bullish on the other indexes and, if not, down we go again! Of great concern to the bulls should be the fact that AAPL itself has been getting stronger so the rest of the Nasdaq must be getting weaker for it to have made no net progress.

And all this is just in time for earnings season where the expectations couldn't be much higher with 9.1% growth expected for the S&P 500 though the comps are pretty easy as we were down 7% last year once Q1 was fully accounted.

And all this is just in time for earnings season where the expectations couldn't be much higher with 9.1% growth expected for the S&P 500 though the comps are pretty easy as we were down 7% last year once Q1 was fully accounted.

Our working theory (and why we are leaning short into earnings) is that November reports were clouded by giddy expectations of a fantastic Trump Presidency that lead the mainly Republican CEOs and CFOs to brighten up their outlooks to include trade advantages, tax advantages, currency advantages, etc.

Of course, none of that has actually happened yet (and maybe never will) and I certainly haven't heard too many companies raise guidance into Q1 and Art Hogan of Wunderlich agrees with me, saying to the WSJ:

“The fundamentals just don’t support valuations where we’re at. Some of what was baked in there was that we’d get corporate tax cuts and deregulation boosting earnings.”

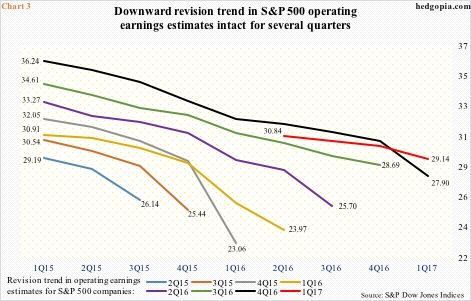

Every single quarter since Q1 '15 has started off with great expectations, only to be revised down 5%, 10%, even 20% as the reports actually came in. That's had limited effect on the market as the S&P has only moved more than 2% up or down twice the month after earnings – up 8.3% in Q3 '15 (when the earnings were so terrible that the Fed had to refill the punch bowl) and down 5.1% in Q4 '15 (when the idiots finally sobered up).

Every single quarter since Q1 '15 has started off with great expectations, only to be revised down 5%, 10%, even 20% as the reports actually came in. That's had limited effect on the market as the S&P has only moved more than 2% up or down twice the month after earnings – up 8.3% in Q3 '15 (when the earnings were so terrible that the Fed had to refill the punch bowl) and down 5.1% in Q4 '15 (when the idiots finally sobered up).

That then becomes worrying when the Dow is already up from 18,000 to 20,700 (15%) in anticipation of earnings being up 9.1%. It's already and overshoot and it's based on assumptions that are looking to be unrealistic – at best!

We'll hear what the Fed has to say about all this later, when they release the minutes of the last meeting (2pm). Then we wait until Friday's Non-Farm Payroll Report to see if America is Working, though we already had great ADP numbers this morning.

Taser (TASR) will be having a big announcement at noon today. Taser is our Stock of the Decade, so I have literally been talking about them for 7 years. As noted in the 2016 preview for our Options Opportunity Portfolio:

- TASR – Taser is only our Stock of the Decade and this drop to $17 is your chance to join us on the way to $30. I like this trade as it stands and, if TASR goes lower, we'll be happy to get more aggressive.

As you can see, we hit our $30 goal in August and we cashed out, of course but we took advantage of the dip in Jan and sold 5 more 2019 $20 puts for $3.20 ($1,600) and all TASR has to do is expire over $20 and we keep the $1,600. As of yesterday's close, those puts were still $2.93 so still a great deal to sell since the worst case is you get "stuck" with 500 shares of TASR at net $17.07, $5 (22.7%) below the current price!