“When life itself seems lunatic, who knows where madness lies? Perhaps to be too practical is madness. To surrender dreams — this may be madness. Too much sanity may be madness — and maddest of all: to see life as it is, and not as it should be!” – Miguel de Cervantes Saavedra, Don Quixote

To short the unshortable market.

This is our quest, to follow the logic, no matter how hopeless, no matter how far out of whack valuations become. To fight for the proper valuations, without question or pause, to be willing to hedge into rallies that run without pause. And we know, if we'll only be true, to this simple strategy, that our hearts will be peaceful and calm, when the market's depressed.

Yes, we feel a bit quixotic shorting the markets these days, especially when the whole World is literally against us. This morning, it was Goldman's pet ECB Chairman, Mario Draghi, who saved the markets, saying the ECB will not follow the Fed and will maintain their Free Money policy for as long as it takes – longer even:

Yes, we feel a bit quixotic shorting the markets these days, especially when the whole World is literally against us. This morning, it was Goldman's pet ECB Chairman, Mario Draghi, who saved the markets, saying the ECB will not follow the Fed and will maintain their Free Money policy for as long as it takes – longer even:

“I do not see cause to deviate from the indications we have been consistently providing in the introductory statement to our press conferences,” the ECB President said in a speech in Frankfurt on Thursday. “We have not yet seen sufficient evidence to materially alter our assessment of the inflation outlook — which remains conditional on a very substantial degree of monetary accommodation.”

The ECB president countered such demands (to end easing) saying that the current policy path — which expects that interest rates will “remain at present or lower levels for an extended period of time, and well past the horizon” of asset purchases — is still appropriate to make sure that growth and inflation are solid enough to withstand the end of stimulus.

“Before making any alterations to the components of our stance — interest rates, asset purchases and forward guidance — we still need to build sufficient confidence that inflation will indeed converge to our aim over a medium-term horizon, and will remain there even in less supportive monetary policy conditions,” Draghi said. “It is clear that continued support for demand remains key.”

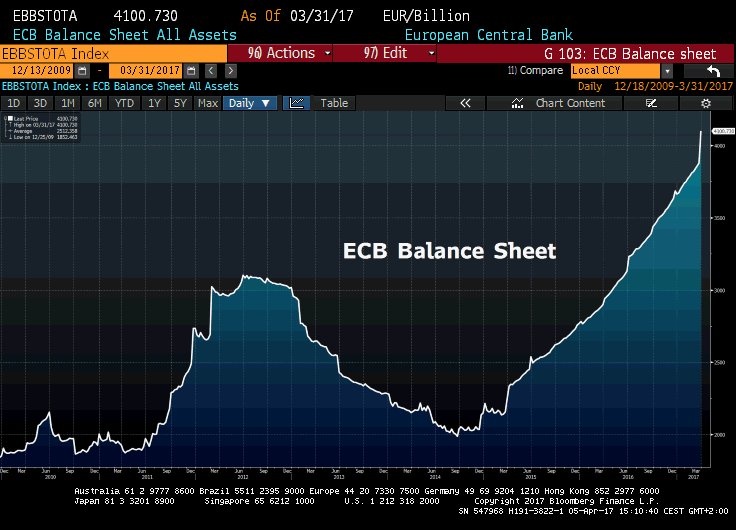

As you can see from the chart above, the ECB has added 10% to their balance sheet in Q1 already and they are currently on-par with the Fed with $4.5Tn sitting on their books. The Global markets breathed a big sigh of relief at 4am as they were very worried that both the Fed and the ECB would be attempting to unwind their balance sheets at the same time, while that may not happen, what will happen is that we will instead extend the timeframe of the Great Unwinding – a drag on the Global Economy that will haunt us well into the next decade at this point.

As you can see from the chart above, the ECB has added 10% to their balance sheet in Q1 already and they are currently on-par with the Fed with $4.5Tn sitting on their books. The Global markets breathed a big sigh of relief at 4am as they were very worried that both the Fed and the ECB would be attempting to unwind their balance sheets at the same time, while that may not happen, what will happen is that we will instead extend the timeframe of the Great Unwinding – a drag on the Global Economy that will haunt us well into the next decade at this point.

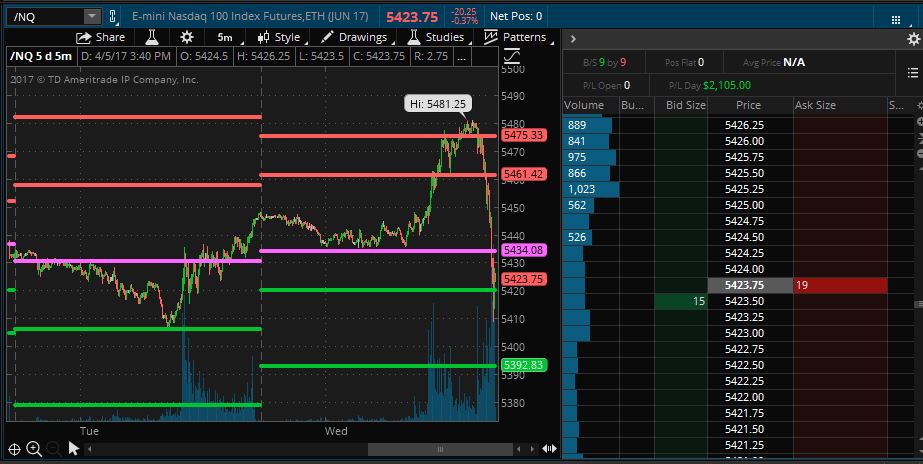

Despite the difficulty going long-term short on the markets, those short-term short trades are super-profitable. I laid our our shorting strategy for you yesterday morning in the PSW Report and we had to wait patiently for the morning rally to die down. In our Live Chat Room, at 10:54, I said to our Members:

/TF hit a wall at 1,380, /YM 2,0828, /ES 2,375 and /NQ 5,467. I'm dying to short but so strong today and oil still hurts so I'm gun-shy.

We waited until 11:25 to begin shorting and we started with the Nasdaq (/NQ) and the Dow (/TF) Futures, saying:

Now I'd say short the laggard, may as well focus on /NQ 5,470 as it could plunge if AAPL thing turns out true and also GOOGL has issues and AMZN and TSLA both silly high. /YM good below 20,750 with tight stops too.

As you can see, we caught a very nice 50-point drop on the Nasdaq (QQQ), good for a quick $1,000 gain per contract and the Dow (DIA) was kind enough to to fall below 20,600, which was good for $750 per contract and, in our 1pm Live Trading Webinar, we added the S&P (SPY) short at 2,375 and the drop to 2,345 paid a whopping $1,500 per contract so, all in all, it was a fun day shorting the unshortable market.

Don't worry, there will be a FREE replay of our Live Webinar available later today (here already, thanks Greg!) so you can follow along live and get all the thrills of gaining $3,250 in less than two hours without having to spend $3/day to sign up for our newsletter – isn't that great?

The nice thing about a toppy market that refuses to die is that you get these little shorting opportunities over and over again and yes, you could play the long side instead but I think the really big money is still coming to the downside, so we're staying on the bear side of the trade for now.

As you can see from the S&P chart, we're at a very critical juncture and could go either way. Yesterday we noted it all hinges on the action at the 50-day moving average, which is currently 2,345 and the S&P closed slightly above it at 2,353 after weakly bouncing off that line earlier in the day. 2,355 is the strong bounce line from the fall from 2,400 to 2,325 that we had in the first half of March and if all we have is a strong bounce since April 27th – that does not bode well for the bulls.

Trump is meeting with Xi today and tomorrow and we have Non-Farm Payrolls tomorrow at 8:30 am with Consumer Credit at 3pm. Next week will be all about CPI and PPI and Retail Sales though we should get indications of declining Consumer Sentiment as well.

More importantly, earnings kick off next week with Citigroup (C), Delta (DAL), First Horizon (FHN), Infosys (INFY), JP Morgan (JPM). PNC (PNC) and Wells Fargo (WFC) all reporting on Thursday – until then, it's a bit of a watch and wait market but look out below if we're not quickly on track for those 9.1% gains in earnings that are already baked into the markets.

Until then – Be careful out there!