Unemployment is LOW!

Unemployment is LOW!

As noted in the Fed's Beige Book (which we discussed in Wednesday's Live Trading Webinar), low unemployment is restraining growth due to a lack of qualified applicants. Low immigration isn't helping either – to the point of crops rotting in the fields due to lack of laborers. The Fed is becoming very concerned about rising wage pressure, which can quickly eat into Corporate Profit Margins – especially when they are still having trouble pushing price increases through to the consumers.

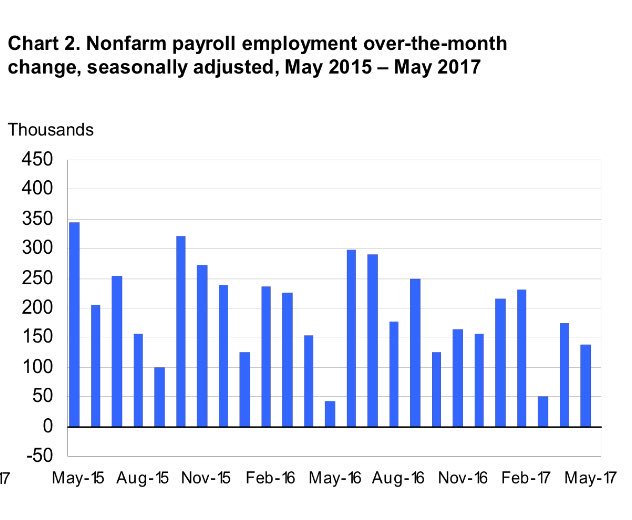

The ever-weakening Dollar means the workers have less buying power with the Dollar falling 6% since Trump took office (making America eh again) – effectively cutting the buying power of 160M workers by 6%, which is like losing 9.6M jobs yet today Trump will celebrate and take credit for 1M new jobs created under his regime – at the same 200,000/month pace we've been on for 5 years (thanks Obama).

What we really have is a net loss of 8.6M jobs worth of buying power and it's been great for Corporate Profits as companies get paid in weak Dollars (very good for S&P companies, who get half their revenues overseas) and pay their workers in weak Dollars, which greatly inflates their Net Income – for now. Restaurants are one of the first industries feeling the pinch of diminishing buying power as traffic is down 2% overall, most notably on 433M less lunches taken.

Restaurants are doing what every industry will have to do in a tight labor market, they are raising prices and HOPING not to lose too many customers as a trade-off. Unfortunately for restaurants, food at home is getting cheaper at the same time – making the trade-up to a meal out a more and more expensive decision for consumers.

Restaurants are doing what every industry will have to do in a tight labor market, they are raising prices and HOPING not to lose too many customers as a trade-off. Unfortunately for restaurants, food at home is getting cheaper at the same time – making the trade-up to a meal out a more and more expensive decision for consumers.

The pain is spreading to suppliers. Meat giant Tyson Foods Inc. recently said a 29% drop in quarterly earnings was due partly to the decline in restaurant traffic. “Consumers are buying fresh foods, from supermarkets, and eating them at home as a replacement for eating out,” Tyson Chief Executive Tom Hayes said.

The average price of a restaurant lunch has risen 19.5% to $7.59 since the recession, as rising labor costs pushed owners to raise menu prices—even as the cost of raw ingredients has fallen. According to the Bureau of Labor Statistics, the U.S. last year posted the longest stretch of falling grocery prices in more than 50 years.

Nonetheless, the market marches onward to record highs with the S&P (/ES) Futures tapping 2,437 this morning and Russell Futures (/TF) back to 1,405, which we like for a short with tight stops above (see our 5% Rule™ discussion from our Live Member Chat Room, where we called this move yesterday). Speaking of Futures, we went long on Oil (/CL) at $47 and Gasoline (/RB) at $1.56 early this morning, also in our Live Member Chat Room, taking advantage of the overnight weakness to re-load our oil longs.

If you wish to join our Members and get these trade ideas LIVE, when they are fresh – you can SIGN UP HERE and we can begin sharing our investing ideas with you.

8:30 Update – Oops, only 130,000 jobs created vs. 184,000 expected by leading economorons. Keep in mind March was 79,000 and April 211,000 so this is confirming a weakening of job creation AND they are revising April down by 37,000 jobs, to 174,000 and March is now being revised down to 50,000! WTF? Is Trump really destroying America this quickly? Is that even possible for one man to have such a profoundly negative effect on the economy?

8:30 Update – Oops, only 130,000 jobs created vs. 184,000 expected by leading economorons. Keep in mind March was 79,000 and April 211,000 so this is confirming a weakening of job creation AND they are revising April down by 37,000 jobs, to 174,000 and March is now being revised down to 50,000! WTF? Is Trump really destroying America this quickly? Is that even possible for one man to have such a profoundly negative effect on the economy?

More to the point, is it really possible for the markets to be this oblivious to data that's turning sour? I already called for shorting the indexes above so hopefully you caught those levels and now we'll just sit back and see how much damage this report does. Of course, on the bright side, it keeps the Fed on the easy side and the markets might like that but it will be hard to close at all-time highs into the weekend uncertainty now.

The Dollar is tanking on this news (96.80) and we do like it long down here (/DX) but, overall, this is a disturbing report and I'm not sure if I've mentioned it lately but I sure do like CASH!!! – especially while you can get so much of it for your stocks at such a low Dollar rate and then the Dollars become your investment while you wait for stocks to get cheaper (and they will).

This is also a good time to review our Nasdaq hedging ideas: "3 Different Ways to Hedge Your Portfolio."

Have a great weekend,

– Phil