Up and up the markets go, when the madness stops, no one knows.

There's simply no reality to these market moves any more. We just finished our May Portfolio Review and our net gain was only 2.7% while the S&P gained 3.1% because we're a bit too bearish for this rally and our hedges are killing us and today we're up yet again in the Futures, back to 2,440 on /ES, where we had success shorting them last week.

The Nasdaq (/NQ) is up 50 points from Friday's close at 5,733 and there's no reason for this excitement – it's just a normal pumped-up Monday and, so far, not even a weak bounce from the Nasdaq's fall from 5,900 to 5,700 (ignoring the spike below). These moves are not just mechanical and fake but obviously so but I'll bet you already forgot that we had this conversation last Monday, when I said:

It's really all about the Nasdaq (/NQ) which, so far, has fallen from 5,900 to below 5,700 but we'll be looking for a weak bounce over the 5,700 line (40 points) to 5,740 so going long on /NQ is a no-brainer this morning with tight stops below the line. If we make a strong bounce (5,780) today, then all of Friday's sell-off can be quickly forgotten but failing the weak bounce would be a bearish sign and we'd be looking for other indexes to short as well.

Mondays are, of course, meaningless days in the market, especially in the summer and we'll have to wait until tomorrow to see what's really going on but a huge correction like we had on Friday COULD lead people to contemplate that some of the overbought crap they have in their portfolios may not actually be worth 100 times earnings.

That was June 12th and here's what the Nasdaq has done since:

You can see why we remain skeptical, right? The Nasdaq did exactly what our 5% Rule™ predicted, exactly when it predicted and we made nice money going long on the Nasdaq last week and then we made good money going short and the reason we can make these predictions is because the movement is so obviously manipulated – we can spot it a mile away and stay ahead of it. We'll still be looking for a strong bounce this week but a 2nd failure means we're likely consolidating for move down, not up and a 5% correction from 6,000 (even though we didn't get there) is 5,600 and it's very possible we'll see that before we see 6,000 (if at all).

Similarly, we went into the weekend long on Oil Futures (/CLQ7) at $44.75 and Gasoline (/RBQ7) at $1.42 which we went over in last Wednesday's Live Trading Webinar and you can see both of those have made a bit of progress and we expect to see more into the July 4th weekend but we'll be quick to take profits off the table as the longer-term macros for oil and gasoline are not favorable.

However, speaking of market manipulation, our friends at the NYMEX have done a fantastic job of rolling out all those fake, Fake, FAKE!!! July contracts, with just 75,660 left and 3 days to dump them and they've moved them into fake, Fake, FAKE!!! August contracts (510,730) as well as Sept (2,943), Oct (103,719) and Nov (108,475) which adds up to the EXACT SAME 1.1Bn FAKE!!! contracts they've been carrying in the front months all year long.

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Jul'17 | 44.68 | 45.06 | 44.45 | 44.82 |

08:25 Jun 19 |

– |

0.08 | 24516 | 44.74 | 75660 | Call Put |

| Aug'17 | 44.89 | 45.28 | 44.68 | 45.04 |

08:25 Jun 19 |

– |

0.07 | 161553 | 44.97 | 510730 | Call Put |

| Sep'17 | 45.11 | 45.51 | 44.92 | 45.26 |

08:25 Jun 19 |

– |

0.06 | 8792 | 45.20 | 288493 | Call Put |

| Oct'17 | 45.35 | 45.72 | 45.15 | 45.52 |

08:25 Jun 19 |

– |

0.11 | 1701 | 45.41 | 103719 | Call Put |

| Nov'17 | 45.60 | 45.97 | 45.40 | 45.74 |

08:25 Jun 19 |

– |

0.07 | 2208 | 45.67 | 108475 | Call Put |

| Dec'17 | 45.85 | 46.24 | 45.65 | 46.00 |

08:25 Jun 19 |

– |

0.06 | 5885 | 45.94 | 308326 | Call Put |

| Jan'18 | 46.13 | 46.42 | 45.89 | 46.30 |

08:25 Jun 19 |

– |

0.13 | 1078 | 46.17 | 86730 | Call Put |

| Feb'18 | 46.14 | 46.64 | 46.14 | 46.64 |

08:25 Jun 19 |

– |

0.26 | 707 | 46.38 | 38206 | Call Put |

Of the 75M barrels worth of fake orders for July, less than 15M barrels will actually be delivered despite over 3 BILLION barrels worth of contracts (3M) being traded during the month of July alone. All that trading to deliver 15M actual barrels is either the most ridiculously inefficient system ever devised by mankind or a gigantic con job used to manipulate the price of oil by creating a false sense of market demand for the 2nd most abundant liquid on the planet. We report – you decide…

Of course, we're not here to pass judgment – we don't care IF a market is being manipulated as long as we understand HOW the market is being manipulated and we're able to play along at home, right? Many of the "traders" at the NYMEX work for the companies that sell you oil and it doesn't matter if they lose money trading (and you lose a lot of money churning 3Bn fake orders each month) as long as they can jack up the price you pay at the pump because every extra dime you pay for gasoline is multiplied by 400M gallons consumed each day. $40M per dime, per day is the value of manipulating oil – a scam that costs US consumers $50-$100Bn each year – thank you NYMEX! See: Goldman’s Global Oil Scam Passes the 50 Madoff Mark

Of course, we're not here to pass judgment – we don't care IF a market is being manipulated as long as we understand HOW the market is being manipulated and we're able to play along at home, right? Many of the "traders" at the NYMEX work for the companies that sell you oil and it doesn't matter if they lose money trading (and you lose a lot of money churning 3Bn fake orders each month) as long as they can jack up the price you pay at the pump because every extra dime you pay for gasoline is multiplied by 400M gallons consumed each day. $40M per dime, per day is the value of manipulating oil – a scam that costs US consumers $50-$100Bn each year – thank you NYMEX! See: Goldman’s Global Oil Scam Passes the 50 Madoff Mark

That's right, I have been pointing out this scam for a decade yet nothing ever changes. Meanwhile, we continue to make money playing along at home and I continue to call on our Congresspeople to take action and put a stop to it because, although it's a very profitable scam – it's destroying this country!

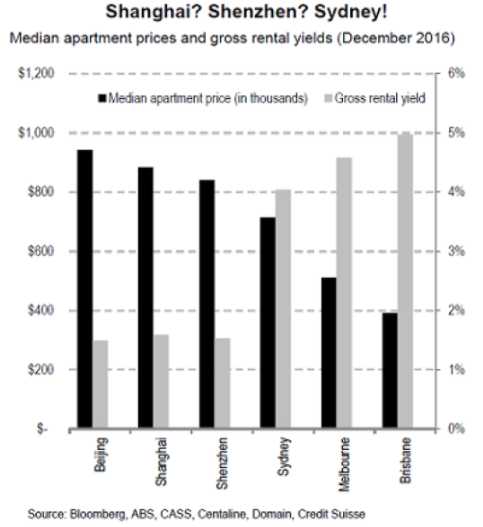

Speaking of countries that are being destroyed, I'll be going on China's CGTN this evening to talk about their runaway housing market. Despite Government efforts to reign in the madness, new home prices across the country were still rising at a 10.4% annualized clip in May, according to the National Bureau of Statistics.

Chinese Policymakers have prioritized stabilizing an overheated market ahead of a Communist Party reshuffle later this year, reiterating the need to avoid dramatic price volatility that could threaten the financial system and harm social stability but it may already be too late as Australia, which has had a similar housing boom, is already beginning to come apart at the seams with stagnating rents and collapsing construction (down 30% since last June).

Prices in China's Shenzhen actually fell 0.6% last month and Beijing and Shanghai were flat while other bubbles are still being blown like Guangdong province's Qingyaun City, where prices for new condos are being officially collared at no more than 5% higher and no more than 15% lower than "similar markets in the past month." While you can drive a truck through those restrictions – it's indicative of how dangerous the Government perceives the market to be getting.

Despite all the controls, Chinese banks lent out another $100Bn in May to new home buyers, indicating neither the consumers nor the banks are really getting the message that the Government is trying to cool off the housing market or, perhaps, the message is loud and clear and people are rushing to get in while they still can though, unfortunately – like US home-buyers in 2006 – many of these new home-buyers have gone their whole lives without seeing a real estate market go down – the really don't understand the risks they are taking as the leverage up their life savings into homes that no one can really afford.

Despite all the controls, Chinese banks lent out another $100Bn in May to new home buyers, indicating neither the consumers nor the banks are really getting the message that the Government is trying to cool off the housing market or, perhaps, the message is loud and clear and people are rushing to get in while they still can though, unfortunately – like US home-buyers in 2006 – many of these new home-buyers have gone their whole lives without seeing a real estate market go down – the really don't understand the risks they are taking as the leverage up their life savings into homes that no one can really afford.

Watch the rents – rents are dynamic, when they start dropping, the party may soon be over!

Back on June 1st, in our Morning Report, we listed some of our concerns about China and a hedge to play it with, which was itself a roll from our orignal short using China's short ETF (FXP) from April 3rd. As we expected, our adjustment is paying off and FXP is now at $25.52 with our goal at $26 by September. We weren't wrong initially – just early! The net of the trade is now $3,890 out of a potential $8,000 if we get it right so still good for a new trade if you can settle for a double.

Be careful out there.