Poof!

Poof!

Just like that, half a year has gone by. Who'd have thought, just 6 months ago, that the World would still be here with Donald Trump as President? Given how bad we thought things were going to be, they are actually not so bad. Yes, of course the President's Team is doing everything they can to bring about the Apocalypse but, so far, they've been generally ineffective at, well, everything: "Republicans frustrated as their to-do list grows."

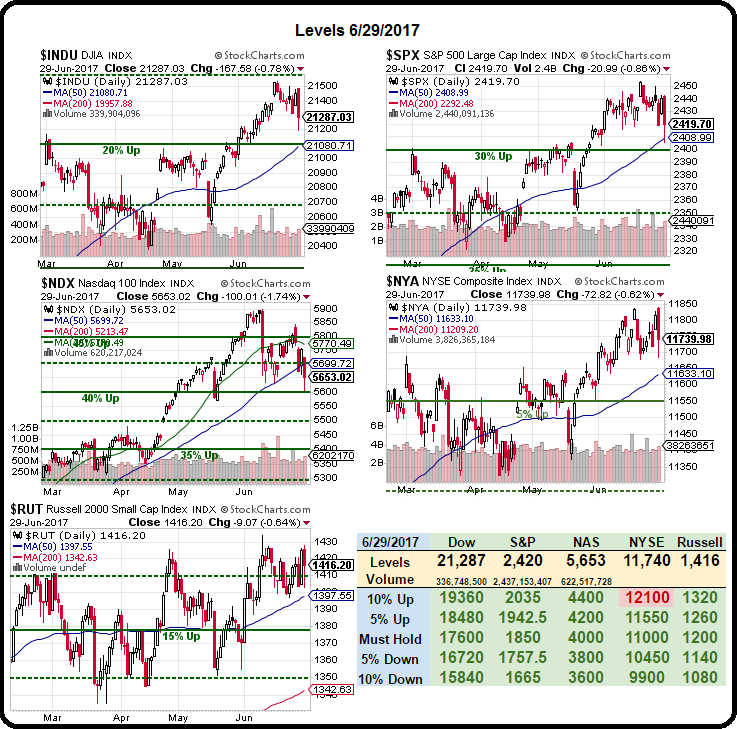

So here we are, closing out the 2nd Quarter with the market near record-highs, despite yesterday's pullback, though we find it hard to trust anything that happens pre-market after yesterday's obviously fake prop-job. It is the last day of the quarter and windows do need to be dressed but, as I predicted in Wednesday's Live Trading Webinar, the sellers took full advantage of the pumpers yesterday and sold into everything they had – giving us the biggest volume day of the month as declining shares and volume overwhelmed advancers 2:1.

The VIX briefly spiked up 50% as the market plunged and that sent SVXY (we're short on them) plunging back down but a long way to go to our $105 target in September so we're expecting to see a general up-trend in volatility over the summer – but let's not get ahead of ourselves and see how the quarter ends first.

The VIX briefly spiked up 50% as the market plunged and that sent SVXY (we're short on them) plunging back down but a long way to go to our $105 target in September so we're expecting to see a general up-trend in volatility over the summer – but let's not get ahead of ourselves and see how the quarter ends first.

Though the Nasdaq is poised to finishe the month down about 1%, that's nothing compared to the amazing run it's had all year and, as evidenced by the chart below, literally nothing else seems to matter as EVERY OTHER INDICATOR has been falling while the Nasdaq has climbed 15% in the past 6 months. We have been using the Nasdaq as one of our primary hedges (SQQQ) and they paid off in spades yesterday but that's nothing to get excited about as these dips don't tend to last long (so far).

More of a concern than macro indicators, however, is how much money it's been costing the G20 to prop up the markets for the past decade as Golbal Debt just hit $217 TRILLION – which is 327% of our $67Tn Planetary Output. In fact, $70Tn has been added in 10 years for an average of $7Tn a year, which is 10% of the Planet Earth's GDP added in debt, each year.

More of a concern than macro indicators, however, is how much money it's been costing the G20 to prop up the markets for the past decade as Golbal Debt just hit $217 TRILLION – which is 327% of our $67Tn Planetary Output. In fact, $70Tn has been added in 10 years for an average of $7Tn a year, which is 10% of the Planet Earth's GDP added in debt, each year.

Now, I know you want to think this is normal but, if it were, then we'd be 1,000% of our GDP in debt every hundred years and the fact of the matter is that we somehow managed to go the last 2,000 years at 246%, or about 1% per decade. 100% per decade is much more than that. See how easy it is to put things in perspective?

Corportate and Personal Debt (Non-Financial) is responsible for the bulk of the gains. The US "only" added $6Tn of Government debt and the Fed's $3.5Tn spending spree doesn't even count as debt nor do Europe and China's money-printing operations but Corporations have funded their growth by borrowing $5Tn per year (without paying it back) in this ultra low-rate environment.

Corportate and Personal Debt (Non-Financial) is responsible for the bulk of the gains. The US "only" added $6Tn of Government debt and the Fed's $3.5Tn spending spree doesn't even count as debt nor do Europe and China's money-printing operations but Corporations have funded their growth by borrowing $5Tn per year (without paying it back) in this ultra low-rate environment.

As you can see from the chart, the Fed never "fixed" anything, they merely transferred the burden of debt from the banks they protect to the non-banks they could care less about. Now that the burden has been shifted, the Fed is ready to raise the interest on those outstanding balances and look how rapidly that is affecting the credit ratings of Emerging Market Countries, which will then force them to pay even higher borrowing costs down the road:

We talked about the transfer of wealth from the poor to the rich that is going on in yesterday's post and, later in the day, in our Live Member Chat Room, I dug up this great chart, saying: "Here's what's wrong with this country in one picture. Remember, when I am talking about the Top 1%, I'm talking about our Corporate "Citizens" as well:"

"The Fed is PLANNING to double that interest on debt figure – it could easily triple and THEN Trump is planning to pump it up 50% from there. So let's see, that's $200Bn x 3 = $600Bn + 50% = $900Bn/year in interest. I wonder what will get cut to pay for that (because raising taxes is out of the question)?"

The US Government isn't the only one that will suffer from rising rates, ALL of that $217Tn will have to be serviced at 3% ($6Tn/yr), 5% ($10Tn/yr) and maybe 7%($14Tn/yr) which is FANTASTIC for the Top 1% and the Banksters (same people, really) but does not bode well for the rest of the planet Earth when 20% of their annual GDP has to go towards servicing the debt.

They set the trap, lured us into the trap and now they are springing the trap – game well played by the Global Banking Cartels known as "Central Banks". And it doesn't matter if you, as an individual, live a debt-free life because your Government has been borrowing on your behalf and now, like Greece – where the garbage is piling up in mountains on the streets – YOU will be forced to live with austerity measures in order to insure the Banksters get their loans repaid – no matter what interest they choose to charge.

They set the trap, lured us into the trap and now they are springing the trap – game well played by the Global Banking Cartels known as "Central Banks". And it doesn't matter if you, as an individual, live a debt-free life because your Government has been borrowing on your behalf and now, like Greece – where the garbage is piling up in mountains on the streets – YOU will be forced to live with austerity measures in order to insure the Banksters get their loans repaid – no matter what interest they choose to charge.

I do not like what I am seeing coming around the corner at us and yesterday's anemic 1.4% GDP and the 2.3% drop in Corporate Profits certainly didn't help. We are still very well-hedged going into the holiday weekend and very much in CASH!!! I'm very concerned about what happens in July.

Have a great weekend,

– Phil