Will the last short seller please turn out the lights?

Will the last short seller please turn out the lights?

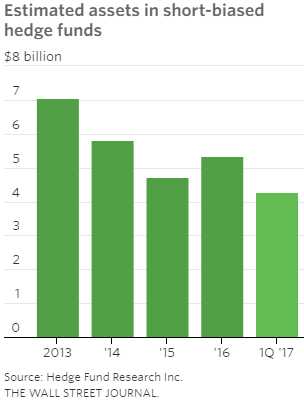

According to S3 Analytics, Bets against the SPDR S&P 500 (SPY), the largest ETF tracking the broad index, fell to $38.9Bn last week, the lowest level of short interest since May, 2013. The same thing is going on in hedge funds as we're well below 2013 levels in short funds – people have simply given up on the idea that this market is going to go down – and that's probably the best time to short it!

In our Portfolio Reviews this week, we have been pressing our hedges by using about 1/4 of the money we have made on our longs, simply trying to lock in our gains as we certainly don't expect the market to make 4-7% every month – that would be silly, right? These days, you have to wonder as the S&P is up 25% from the mid-point (not the lows) of 2015 and early 2016 (2,000) yet, as I noted in yesterday's Live Trading Webinar (Members Only, but you can see the replay here) the earnings of the components of the S&P are not matching those gains at all:

Apple (AAPL) is the top component of the S&P. With an almost $800Bn market cap, it makes up 3.7% of the index. In 2015 they had $233Bn in sales and made $53Bn, last year they had $215Bn in sales and made $45Bn and this year they are looking for $220Bn in sales and $46Bn in profit yet AAPL is trading 60 points higher (66.6%) than it was at the beginning of last year (after 2015 earnings were reported). What has AAPL actually done to justify a 66% gain? Mostly, it was drastically undervalued but, other than that – it has added no profits to the overall S&P. In fact, it has subtracted them!

AAPL is also the largest Dow component and $1 in share price is 8.5 Dow points (yes, it's an idiotic system). So AAPL alone is responsible for 510 points (12.5%) out of the Dow's 4,100 point run from 17,500 (23%). Now I love AAPL, it was our Stock of the Year in 2013, 2014 and 2015 (this year it is WPM), so I'm fine with their value now, it was simply too cheap before. By the way, we make 2-year plays so 2017 was our target exit on AAPL and we got our price, of course (and we still have longs to 2019).

Microsoft (MSFT) is the 2nd largest component on the S&P 500 at 2.7% of the index ($573Bn market cap) and, in 2015, they had $93Bn in sales and $12.2Bn in profits while in 2016, sales fell to $85Bn but they did manage $16.7Bn in profits – up 37% and this year flat but it' a big, flat number, so who's going to complain? MSFT has gained 50% over that time and that's $25 and that's 200 Dow points from MSFT.

Amazon (AMZN) is not in the Dow but, at almost $500Bn, it's 2% of the S&P 500 and AMZN is up 66.6% from $600 to $1,000 so, if it was a Dow component, it would have added 3,400 points by itself – see how silly the Dow is? Earnings-wise, AMZN has been impressive with sales going from $107Bn in 2015 to $136Bn last year and on track for $142Bn this year (slowing drastically, which is why Bezos got desperate and bought Whole Foods (WFM)). Earnings went from $600M to $2.4Bn to maybe $2.6Bn this year (oops again), but investors don't care about profits, do they? Why not pay 200 times earnings?

FaceBook (FB) comes in at #4 and also about 2%, running neck and neck with AMZN at $476Bn. FB has doubled their 2015 average price, now $165 and that's fair because 2015 sales were $18Bn and last year they hit $27Bn and this year is looking like $38Bn with profits going from $3.7Bn to $10.2Bn to $14.5Bn projected this year. Hey, where can I buy some of that?

And that's an important point, by the way – we don't knee-jerk not like all companies. We have a Long-Term Porfolio with over 50 positions we love. Our issue is that most of the other 6,550 public companies seem a little expensive to us and that means the indexes they are shoved into are overpriced as well.

Rounding out the top 10 S&P 500 components are:

- Johnson and Johnson (JNJ): 1.7%, 2015: $70Bn/15.4Bn, 2016 $72Bn/16.5Bn, 2017 $76Bn/19.6Bn

- Exxon Mobile (XOM): 1.6%, 2015 $260Bn/16Bn, 2016 $219Bn/7.8Bn, 2017 $271Bn/15Bn

- Berkshire Hathaway (BRK.A): 1.5%, 2015 $211Bn/24Bn, 2016 $223Bn/24Bn, 2017 $239Bn/17.6Bn

- JP Morgan (JPM): 1.5%, 2015 $93.5Bn/24.4Bn, 2016 $95.7Bn/24.7Bn, 2017 $102Bn/24.4Bn

- Google A (GOOG): 1.39%, 2015 $75Bn/16.3Bn, 2016 $90Bn/19.5Bn, 2017 $108Bn/23.7Bn

- Google C (GOOGL): 1.39%, 2015 $75Bn/16.3Bn, 2016 $90Bn/19.5Bn, 2017 $108Bn/23.7Bn

What? Google is listed twice? Yes, that's right, the company gets counted as 2 $670Bn companies, even though it's just one and their earnings are double-counted as well so subtract $20Bn from any unadjusted reports you see. Just one of those funny little financial errors that they let people base their retirements on… I'm going to include "#11" – just so we have an even 10 ACTUAL companies to look at:

- Wells Fargo (WFC): 1.2%, 2015 $86Bn/$23Bn, 2016 $88Bn/22Bn, 2017 $89Bn/21Bn

Our Top 10 S&P 500 components account for 20% of the index and, in 2015, they had $1.2Tn (1/3 of all US retail sales) in sales and made $192Bn in profits. This year, they are projecting $1.37Tn in revenues (up 14%) and $201Bn in profits (up 4.7%). Sales are not a big deal – especially when AMZN adds $35Bn of them at no profits. It's EARNINGS that matter and what kind of fools pay 25% more money for for companies that have grown their earnings just 4.7% in two years???

Remember, a fool and his money are soon parted – especially when they don't bother hedging!

From the above, we can conclude that the S&P is 10-20% overvalued and now we have to wonder which Jenga piece will cause it all to collapse? Our bet is currently on oil because, if the Saudis don't initiate another 1Mb/d production cut at their OPEC meeting next week (in St Petersberg!), we're very likely to see oil fall 10-20% promptly and that will make people think the Global Economy is slowing (has nothing to do with it, oil is just overpriced at $47.50 (and we've been short /CL Futures there – see this week's other reports but we're cashed out now into the weekend – too dangerous!)).

Of course the Saudis are highly motivated to keep oil prices up because it will affect their $2 TRILLION IPO of the state-owned Aramco oil company coming up in Q1 of 2018. If oil is at $45 or less, you can cut at least $200Bn off that deal so for Saudi Arabia to cut 1Mbd ($47M) for 180 days "only" costs them $8.5Bn – it's a no-brainer that they will cut production – even if they have to do it themselves. The catch-22 for the Saudis, however, is that's $8.5Bn less sales for Aramco and less profits, which could also affect the IPO price so the OPEC meeting is in Russla to make one of those famous deals where Donald's boss, Putin gets another $10Bn in exchange for his help in propping up oil prices (how do you think he made $70Bn as President?).

Of course the Saudis are highly motivated to keep oil prices up because it will affect their $2 TRILLION IPO of the state-owned Aramco oil company coming up in Q1 of 2018. If oil is at $45 or less, you can cut at least $200Bn off that deal so for Saudi Arabia to cut 1Mbd ($47M) for 180 days "only" costs them $8.5Bn – it's a no-brainer that they will cut production – even if they have to do it themselves. The catch-22 for the Saudis, however, is that's $8.5Bn less sales for Aramco and less profits, which could also affect the IPO price so the OPEC meeting is in Russla to make one of those famous deals where Donald's boss, Putin gets another $10Bn in exchange for his help in propping up oil prices (how do you think he made $70Bn as President?).

So maybe it won't be oil (we'll know next week) but it will be SOMETHING that snaps traders out of their zombie-buying state and panics them into a correction. Could be next week, could be next month but these prices are not sustainable with these earnings and, sooner or later, reality comes knocking.

Two dozen other dirty lovers

Must be a sucker for it

Cry cry but I don't need my mother

Just hold my hand while I come to a decision on it

Sooner or later

Your legs give way, you hit the ground

Have a great weekend,

– Phil