Happy anniversary!

Happy anniversary!

It's been 5 years today since ECB President and Goldman Sachs (GS) stooge, Mario Draghi said: "The ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough." At the time, the EuroStoxx index was at 2,000 and now we're at 3,500, a 75% gain in 5 years and Germany's DAX is up over 100%, from 6,000 to 12,281 as of yesterday's close. That's an average gain of 20% a year for 5 consecutive years – happy anniversary indeed!

The Euro has fallen 20% over that time period, making the gains somewhat less impressive but not too much and "only" down 20% is very surprising as the Yen is down 30% over the same period and the ECB's money supply is up 30% as well. Actually, the EU money supply is up closer to 100% since 2008, Draghi's "whatever" was just icing on that already well-iced cake.

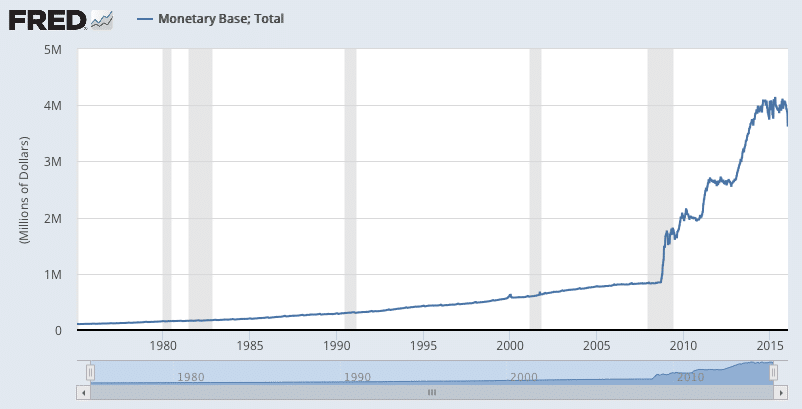

None of that comes close to the flood of Dollars that have been printed since 2009 with $3Tn new Dollars in circulation which QUADRUPLED the supply of US Dollars in the World. Keep in mind those are hard Dollars which the banks then turn around and lend out 10 times each, which is $30Tn more Dollars or 1.5 times our entire GDP so, when you hear our GDP is growing at 2%, you should say "WTF?" as our money supply has been growing at an average of 30% per year for a decade…

That money, in turn, gets pumped into the stock market, which also levers up the cash by about 10:1 on inflows and PRESTO! – it's a "recovery". Steely Dan said "You Can't Buy a Thrill" but you can certainly buy an economy if you are a motivated Central Bank and no one was more motivated than the former Managing Director of Goldman Sachs, Mario Draghi, whose "former" firm is up 120% since he did "whatever it takes" for them.

It's kind of cute the way people think there will be no consequences to 300% increases in the money supply. The way gold, silver and uother commodities are trading – you would think no one ever heard of inflation. In reality, inflation is everywhere – just not in the places the Federal Reserve counts it.

- College Tuition has been gaining and average of 6% per year since 1997 – up 225% since you started saving.

- Prescription drugs have averaged 13.4% annual increases for the past 20 years – and now you have no health care…

- Gas (which the Fed does count) has gone up 3.4% a year for two decades.

- Home Prices, despite the crash, have recovered to an average of 4.1% – about double the rate of inflation but, if you pay 2% property taxes – you may as well be renting.

- Movie Tickets have gained 3.3% per year

- Disney Tickes have gained 5.3% per year

- Cable Television has gone up 5.8% per year and much more now that we need internet too (Basic Cable with HBO was $22.35 in 1995).

Those are real inflation numbers that are impacting the American consumers and certainly wages have not kept up with inflation since the early 1980s and were substantially negative during the crash.

So where are these Trillions of Dollars going? Well, to start with, the Banks lost well over $5Tn during the crash and we pretty much GAVE them that money back (we, as in the American people went an additional $5Tn in debt to bail out the banks and yes, Draghi's Goldman Sachs is one of the banks that got bailed out). A lot of the other money went overseas into tax-haven accounts as artifiically low rates (also funded by you, the taxpayer) allowed companies to move profits over-seas so they wouldn't have to be a tax-paying sucker like you are. Over $2Tn is now "offshore" for US companies alone and, of couse, their paid politicians are working on ways for them to "repatriate" the profits without penalty – ultimately at your expense too!

The Fed will be meeting today and HOPEFULLY they will raise rates because every day they don't raise rates costs us money as we are subsidizing the low rates these companies borrow at and we are also getting screwed when we go to a bank and they pay us 0.25% interest on money they lend out 10x to our neighbors at 4% (40% – 0.25% = 39.75% profit). The spread between what the banks pay you and what they lend out for has never been higher and bank profits have never been higher and the only person who gets hurt here is you – so it's a victimless crime, right?

The Fed will be meeting today and HOPEFULLY they will raise rates because every day they don't raise rates costs us money as we are subsidizing the low rates these companies borrow at and we are also getting screwed when we go to a bank and they pay us 0.25% interest on money they lend out 10x to our neighbors at 4% (40% – 0.25% = 39.75% profit). The spread between what the banks pay you and what they lend out for has never been higher and bank profits have never been higher and the only person who gets hurt here is you – so it's a victimless crime, right?

The rest of the money is in the markets, in bonds, in housing and some of it is still floating around in circulation and that's going to cause HUGE problems when and if the real economy picks up as the velocity of money has been dead for years and that's what's keeping general inflation low – as people cut back on so many things in order to pay for the things that keep blazing up in price.

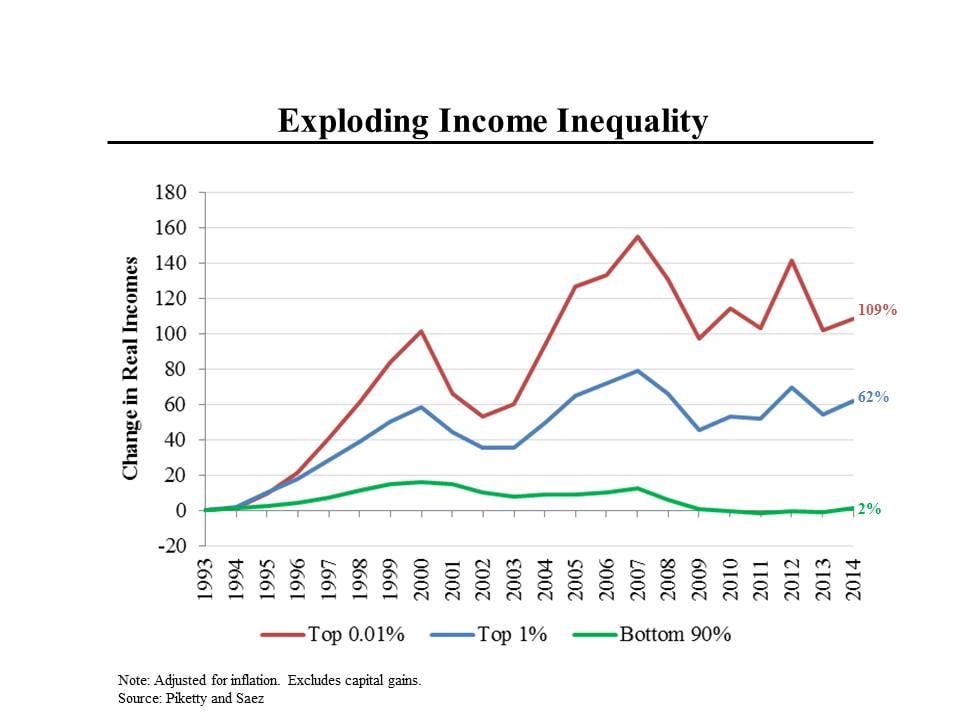

Of course, the suffering of the masses is of no concern to those of us at the top of the heap, right? People in Donald Trump's income bracket (Top 0.01%) have more than doubled their income in the past 20 years while the income for the bottom 90% has gone up an inflation-adjusted 2% over the same period. For those of us only in the Top 1%, we've had to suffer with only a 62% increase in wages but it's enough to keep the economy going and, since we (in the Top 1%) own 85% of the stocks – it's been more than enough to fuel a nice market rally.

Of course, the suffering of the masses is of no concern to those of us at the top of the heap, right? People in Donald Trump's income bracket (Top 0.01%) have more than doubled their income in the past 20 years while the income for the bottom 90% has gone up an inflation-adjusted 2% over the same period. For those of us only in the Top 1%, we've had to suffer with only a 62% increase in wages but it's enough to keep the economy going and, since we (in the Top 1%) own 85% of the stocks – it's been more than enough to fuel a nice market rally.

In December, 2008, it was hard to find people who were willing to buy Apple (AAPL) for $85 per share and the main knock on them was who would be willing to pay $600 for a phone? Now the new IPhones are over $1,000 and no one bats an eye and Apple's stock is at $153 AFTER splitting 7:1 so, effectively $1,071 per 2008 share and people are still buying it because they are making $9 per $150 share and should make over $10 next year for a p/e of 15 – still underprices after 1,000% gains! That's why Apple was our PSW Stock of the Year in 2013, 2014 and 2015.

This year, we made an inflation play with Wheaton Prescious Metals (WPM) in our Secret Santa's Inflation Hedges (it was SLW then) and our trade idea back in December was: "SLW is nice and low in the channel and we can go lower still by selling 10 of the 2019 $15 puts for $2.80 ($2,800) and buying 15 of the 2018 $15 ($4.75)/20 ($2.65) bull call spreads at net $2.10 ($3,150) so a net outlay of $350 on the potential $7,500 spread has an upside of $7,350 if all goes well."

All has been going well and WPM has been drifting along the $20 line and we still have 6 months to go but already the bull call spread is $3.35 out of a possible $5 ($5,025) and the short $15 puts are $1.20 ($1,200) for net net $3,825, which is up $3,475 (992%) and can still almost double from here if WPM holds $20 as we plan. That's a pretty good Trade of the Year!

Our goal as investors is simply to stay ahead of inflation but we need to stay ahead of real inflation – not the BS 2% "target" the Fed likes to quote. In the real World, if you aren't adding 5% to your savings every year, you are falling behind and we engage in portfolio strategies that are meant to keep you well ahead of the curve. While most of our investments are conservative value plays, like WPM, we do take advantage of short-term opportunities to make a little extra cash.

I was being interviewed over at the Nasdaq last week, for example and we talked about our Chipotle (CMG) trade idea, which we also featured in last Wednesday morning's PSW Report:

"CMG Aug $370 calls are $14.30 and were $47 two weeks ago. Those are a fun way to play for the bounce and you can also, if you are brave, sell the $360 puts for $12.30 to net into the $370s for $2 or CMG for $362 – depending which way it goes."

CMG went even lower and we adjusted the trade (in Monday's Top Trade Alert) to:

In the STP, we have 5 short Dec $370 puts at $29.50 ($14,750), now $47 ($23,500) and we can roll those along to 7 of the 2019 $300 puts at $33 ($23,100) for $400 out of pocket and we're about net $20 on the 7 short $300 puts for $280 entries, worst case. The new short puts go into the LTP and we'll take the loss in the STP (a way of transferring cash between the portfolios). The 10 Aug $370 calls at $14.25 ($14,250), now $5.50 ($5,500) and again we'll take the loss in the STP and, in the LTP, we'll open 10 2019 $320 ($68.50)/$420 ($28.50) bull call spreads for $40 ($40,000).

So, in the STP, we take an $18,000 loss and, in the LTP, we make a new net $25,750 spread that pays back $100,000 (almost 300% profit) if CMG can get back to $420. Good for a new trade, of course.

Now that we're past earnings, we'll see how CMG does. Our short-term trade did not work out but we flipped that loss into a longer-term investment in our much larger, Long-Term Portfolio. As we're short the $370 puts, anything over that line should be good for $50,000 and the rest will be gravy (or salsa, I guess).

We're waiting on the Fed today and Amazon (AMZN) tomorrow but we've already been shorting oil at $48.50 (/CL) after losing money at $47.20, $47.50 and $48. 4th time's a charm, maybe? We're also short the Russell (/TF) still (1,445) and Nasdaq (/NQ) hit 5,950, which is also a good short and Dow (/YM) is at our 21,650 shorting line too and S&P (/ES) is being rejected at 2,480 – esentially all of yesterday's shorting targets are being hit this morning – so this can get very interesting – especially with the Fed at 2pm.

Be careful out there!