2,480!

That's where we called the short on S&P (/ES) Futures last week and we fell back to 2,460 ($1,000 per contract gained!) and now we're back at 2,480 so what do you think we're doing? I already put a note out to our Members this morning in our Live Chat Room, saying:

Markets blasting up yet again for no particular reason. Now I like /YM short at 21,950 with tight stops but then again at 22,000, /NQ 5,900 is good as well and you know 2,480 was my target short on /ES and that's lined up with 1,430 on /TF – definitely a short the laggard day.

We're also shorting Oil (/CL) at $50 but long on Natural Gas (/NGZ7) at $3.07 and long on the Dollar (/DX) at $92.75 – all fun trades for a Tuesday morning. We're waiting on Construction Sepdning and ISM at 10 am but we already had terrible Personal Income numbers (0% gain vs 0.3% expected by leading economorons) while spending went up 0.1% (more and more in debt) and PCE Prices were also flat – because consumers simply don't have any more money to spend. We'll also get auto sales throughout the day and those are not likely to be very good.

Apple (AAPL) has earnings this evening and I don't see how they'll justify $150 since most people are probably waiting for the new iPhone at the moment. Expectations may have gotten a bit ahead of themselves and Apple, unlike Tesla, isn't into self-promotion and tends to give conservative guidance estimates as well. Apple, of course, is a huge mover of the Nasdaq, S&P and the Dow so big fireworks there if they disappoint.

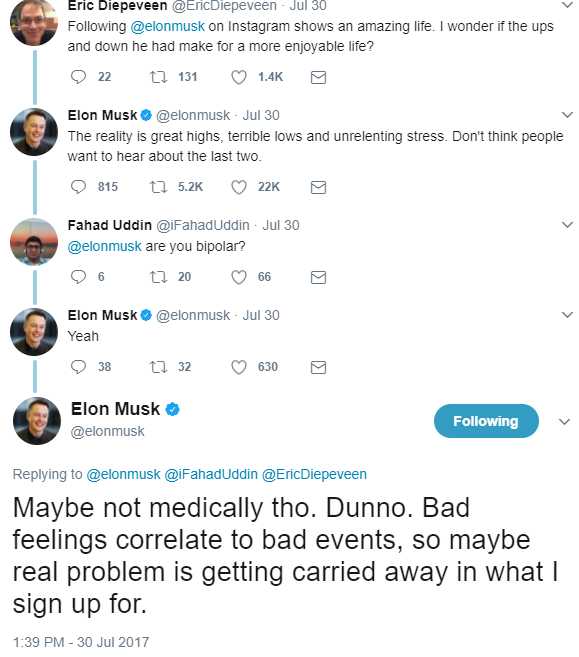

Tesla (TSLA) goes tomorrow night and this ought to be fun as they burned through $2,342,000,000 in the last two quarters alone and they finished Q1 with "just" $4.1Bn in cash – not enough to get through the year at their current pace and I'm betting they will have burned close to $2Bn last Q alone meaning they have just 3 months left to live without raising more capital. No wonder Elon Musk put out a series of painfully introspective tweets, which have since been removed from his Twitter feed (can't have prospective investors reading those, can we?).

Tesla (TSLA) goes tomorrow night and this ought to be fun as they burned through $2,342,000,000 in the last two quarters alone and they finished Q1 with "just" $4.1Bn in cash – not enough to get through the year at their current pace and I'm betting they will have burned close to $2Bn last Q alone meaning they have just 3 months left to live without raising more capital. No wonder Elon Musk put out a series of painfully introspective tweets, which have since been removed from his Twitter feed (can't have prospective investors reading those, can we?).

A company that is about to pass the hat for another $2Bn+ to keep them open for 6 more months can hardly afford to have their CEO seeming exhausted – let alone "bi-polar" – good job erasing the tweets guys – unfortunately, the Internet never forgets!

Indeed the Tesla Model 3 does look like it was slapped together by an exhausted kid who finished the interior as an after-thought, probably working on it furiously in the back of the room while the other kids were walking up to hand in their projects. The blank dashboard with a lone touch-screen sticking out of the middle is not "visionary" nor is it "minimalist" – it's simply sloppy. People like information, they like things to look at on their dashboard. Maybe I'm just old and my friends are old but compared to what other manufacturers are offering – Tesla's Model 3 seems to be just missing stuff.

Nonetheless, we cashed in our Tesla shorts on the last big dip and they didn't go high enough for us to short them again so we're actually hoping for a big pop tomorrow – and then we'll short it! Speaking of shorts – told you so on Amazon (AMZN) and they finished down at $987 yesterday and our short trade idea from last week was to buy the Jan $1,100 puts for $101.50 ($10,150) and sell the Jan $1,050 puts for $72.50 ($7,250) and sell the Jan $1,200 calls for $21.50 ($2,150) to drop the net of the trade to $7.50 ($750) and that spread will pay $5,000 if AMZN stays below $1,050 for a $4,250 (566%) gain and it's already netting $2,400 – up $1,650 (220%) in less than a week – you're welcome!

We'll see if AMZN gets a bounce off the $950 line but I am inclined to cash this one in early, especially if we're going to get back into shorting TSLA – as you don't want too many crazy momo plays running at once.

We'll be through the bulk of earnings after this week and, so far, they've lived up to great expectations (if you ignore the financial engineering) with AAPL the last huge market-mover to report. Now we get down to the smaller companies – which is why we like those Russell (/TF) shorts – everyone can't be making money on flat consumer spending and small-cap companies can't juggle their books like their bigger brothers.

If AAPL does knock it out of the park, however, we could see 22,000 on the Dow and 6,000 on /NQ yet still we'll be shorting those lines. The markets are overbought and I don't know what will trigger the sell-off but something will. Last week we thought it would be collapsing oil prices but they've held up so far and the collapsing Dollar didn't bother anyone. If anything – it chased more people INTO equities to protect their assets but that's an awful reason to give up your CASH!!! and we still love our CASH!!!

We're having a Live Trading Webinar this afternoon at 12:00, EST – you are welcome to tune in as we discuss a few good ways to hedge this market.