Where's our Apple?

Where's our Apple?

Last week I told you it would take an AAPL (earnings) a day to keep the Dow over 22,000 and this week we've been faltering at that line and, while it's not yet time to panic, the Apple tree is looking a little picked over at this point. With the Dow at 22,000, a 2.5% correction would send us down 550 point and we haven't had a WEEK like that since May (16th, just after earnings – lining up with next Wednesday) , when the Dow fall from 21,000 to 20,600 as earnings wound down.

Traders are herd animals and easily spooked and the Dow hasn't given up a full 500 since last July and the two times before that we had big corrections were 2,500-point drops – in Aug of 2015 and again in July, both times falling from around 18,000 to 15,500. But hey, this time is different, right? Now we're at 22,000 and we haven't had a proper consolidation since November – it's the new normal, right? Right???

Back on May 16th, the title of our morning report was "Toppy Tuesday – S&P 2,400 – Again" and I was skeptical, as I had been all month, that the market would hit such a milestone without at least a minor (2.5%) pullback – as dictated by our fabulous 5% Rule™. We were shorting the indexes at the time because I felt that AAPL was boosting the markets too much and the rest were actually weakening, saying:

Back on May 16th, the title of our morning report was "Toppy Tuesday – S&P 2,400 – Again" and I was skeptical, as I had been all month, that the market would hit such a milestone without at least a minor (2.5%) pullback – as dictated by our fabulous 5% Rule™. We were shorting the indexes at the time because I felt that AAPL was boosting the markets too much and the rest were actually weakening, saying:

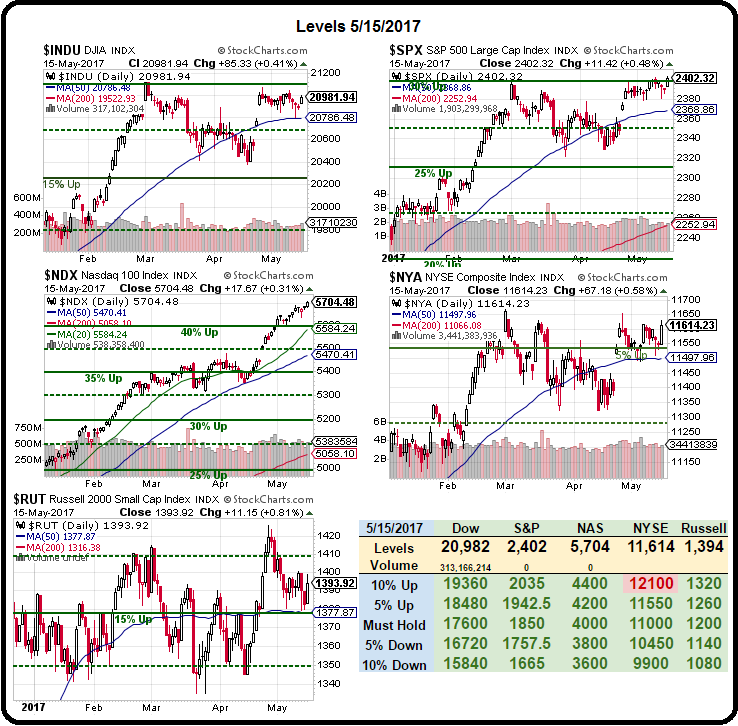

It seems like every Tuesday I have to point out that Mondays are meaningless and, so far, we've made good money shorting the S&P Futures (/ES) at 2,400 as well as Dow (/YM) 21,000 and Russell (/TF) 1,400 but the Nasdaq (/NQ), now 5,708 keeps going up and up, which is no surprise with Apple (AAPL) at $156 – up 10% since April 25th and AAPL is 15% of the Nasdaq by itself.

That adds 1.5% to the Nasdaq and the rest of the Nasdaq's 3% move came from the Dollar falling from 100 on the 25th to 98.35 this morning (-1.65%) and that's the story of how we got here. The fact that the S&P STILL can't get over 2,400 DESPITE the weaker Dollar and the stronger Apple does not give me the warm fuzzies about the strength of this weekly rally so, once again – we are going to be shorting the indexes at the levels we keep shorting them at and once again, later in the week, I will tell you how much money we made and you will say: "why can't I ever catch trades like that." It's a vicious cycle…

Remember, I can only tell you what the market is going to do and how to make money trading it – that is the extent of my powers.

The crash was blamed on "Turmoil at the White House" over revalations that Trump had attempted to push Comey to back off the Flynn investigation – which, in retrospect, seems like just a tiny little incident that doesn't hold a candle to all the BS that's going on now (we were so innocent back then). But hey – RECORD HIGHS – so why worry about it? Let's just go with the flow. After all, what can go wrong?

You can see the spike down in May that followed our call to short everything and boy, was that profitable:

- Dow 20,600 paid $2,000 per contract

- S&P 2,355 paid $2,250 per contract

- Russell 1,350 paid $5,000 per contract

In addition, we had long suggestions in that very same post and, though we posted a new hedge on Tuesday, there are still plenty of bargain stocks to be had in an overbought market. Just this morning, in our Live Member Chat Room, we were discussing strategy on Chicago Bridge and Iron (CBI), who are on sale after an earnings miss, as well as GNC Holdings (GNC), which is a must-read for our Members as we go deeply into our entire Long-Term Portfolio (LTP) strategy as well as position management techniques.

Speaking of great calls, there's still time to get on boad with our Trade of the Year, on Wheaton Precious Metals (WPM), who were called SLW when we took the trade back in December (see: "Secret Santa's Inflation Hedges for 2017"). Panic over the prospect of an unbalanced, egomaniacal leader with nuclear weapons has sent silver and gold flying higher – and it's also possible that Kim Jong Un may have some nukes as well!

We're not in a full-blown panic yet but that's a 5% move in Silver (/SI) over the past 2 days – pretty unusual with a flat Dollar (93.40). Gold has jumped from $1,260 to $1,286 (2%), so a bit behind silver but still a healthy move for the metal.

Our trade idea on WPM was:

- Sell 10 WPM 2019 $15 puts for $2.80 ($2,800)

- Buy 15 WPM Jan (2018) $15 calls for $4.75 ($7,125)

- Sell 15 WPM Jan (2018) $20 calls for $2.65 ($3,975)

The net cash outlay for that spread was $350 and WPM is now just under our $20 goal and the spread is now priced at $3.45 ($5,175) while the short puts are just 0.20 ($300) so a net of $4,875 is a profit of $4,525 (1,290%) in just 8 months – far above our 100% guaranteed return (you're welcome!). Meanwhile, the spread is merely "on track" to the full $7,500 return so, even at $4,525 – it stands to make $2,975 more (65%) into January, which, for ordinary trading sites, would be the kind of trade they brag about for years to come. At PSW, we call them LEFTOVERS!

Still, if you are a free reader, you take what you can get and 65% in 5 months is certainly not bad. It would certainly cover the $3/day you would be spending to have a full PSW Report Subscription, where you would make 3x MORE THAN THAT ON THE SAME TRADE!

In that same post, we also had an upside bet on gold (/YG) using Barrick Gold (ABX), which was $14.55 at the time. Our trade idea for Barrick was:

We can promise to buy ABX for just $13, by selling 10 2019 $13 puts for $2.63 ($2,630) and our upside bet can be 20 2018 $12 ($4.10)/17 ($1.95) bull call spreads net $2.15 ($4,300) for a cost of $1,670 on the $10,000 spread.

So you are putting up $1,670 in cash and the margin requirement on the sale will be roughly $1,350 in an ordinary margin account. What have we accomplished? Well, if ABX goes up, your $1,670 becomes $10,000, gaining $8,330 (498% gain on cash) as a very nice general inflation hedge. So nice, in fact, this trade is in the running for our 2017 Trade of the Year!

As with WPM, ABX is already at our Jan target and the bull call spread is already $3.60 ($7,200) while the short 2019 $13 puts have dropped to 0.82 ($820) for a net of $6,380 and a profit (so far) of $4,710, which is "only" 282%, as it required more cash up front than WPM did. Still, the ABX spread has the potential to return $10,000 at $17+ so still good for a double – if you don't mind picking up our table scraps…

The other two trades from that post were SUN, which has flown higher and is no longer good for a new entry (not enough left to make) and DBA, which is still drifting around it's mid-point and still playable for a few more deflated Dollars. Speaking of inflation, the Fed wants to see MORE of it, per Bloomberg:

A pair of Federal Reserve officials sounded a touch more fretful at the inability of strong labor markets to deliver price gains of the magnitude the central bank wants. St. Louis Fed President James Bullard warned that failure to get inflation to the central bank's 2 percent goal undermines the target’s credibility, echoing some colleagues. “The misses add up over time,’’ he said. Separately, Chicago Fed chief Charles Evans stated it would be reasonable to announce the start of balance-sheet reduction next month, but cautioned disappointing inflation data may delay rate hikes.

Meanwhile, I'd also heed the following from the same Bloomberg feed:

Two of the biggest money managers are telling investors it’s time to dial back on risk. Pacific Investment Management Co. says U.S. stocks and high-yield debt should be pared in favor of lower-risk assets, such as Treasuries and mortgage-backed securities, according to an allocation report by the company, which oversees more than $1.5 trillion. It deems that “asset prices generally are fully valued.’’ T. Rowe Price Group Inc. had a similar view, cutting the stock portion of its asset-allocation portfolios to the lowest level since 2000. The Baltimore-based money manager said it also reduced its holdings of high-yield and emerging market bonds.

We can always make plenty of money in bullish or bearish markets or, as you can see from the above trades – sometimes both at once! The most important thing, in these uncertain times, is to have plenty of CASH!!! and plenty of hedges protecting our long-term longs – that way you can enjoy your summer (I'm on a cruise ship right now) without worrying about what the market is doing!