It's time for the Fed conference.

It's time for the Fed conference.

Central Banksters from around the World will fly to Jackson Hole, Wyoming to congratulate each other on what a great job they are all doing while ignoring protestors who will do their best to point out what a terrible job the Central Banksters have been doing on restoring the actual economy – where 80% of the people are one missed paycheck away from poverty.

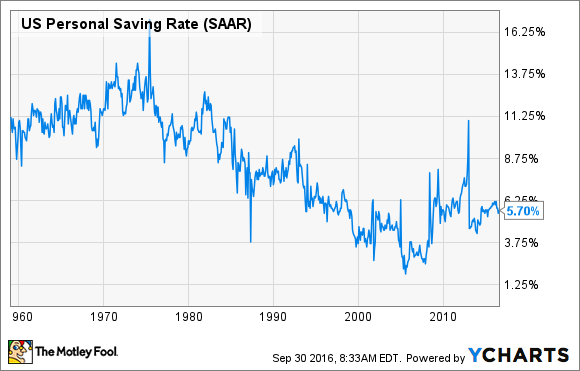

According to the latest data from the U.S. Bureau of Economic Analysis, the personal saving rate in the United States is 5.7%. This means that out of every $100 in after-tax income Americans bring in, approximately $5.70 is being saved for things like retirement, emergency expenses, and rainy-day savings.

You should be saving between 10% to 15% of your income. Fidelity recommends a minimum of 15%, but keep in mind that this includes any employer matching retirement contributions. So, if your employer contributes say, 4% of your salary to your 401(k), this implies that you should be saving 11% of your income.

Total debt (including mortgages, auto loans and student loans) is expected to surpass the amounts owed at the beginning of the Great Recession by the end of 2016, NerdWallet found, mostly due to mortgages and student loans. Many Americans find it difficult to stick to savings goals and that’s even worse if you have a family. The amount that a two-parent, two-child family needs just to pay the bills (but not have money left over for savings) ranges from about $50,000 to more than $100,000 depending on where a family lives

Total debt (including mortgages, auto loans and student loans) is expected to surpass the amounts owed at the beginning of the Great Recession by the end of 2016, NerdWallet found, mostly due to mortgages and student loans. Many Americans find it difficult to stick to savings goals and that’s even worse if you have a family. The amount that a two-parent, two-child family needs just to pay the bills (but not have money left over for savings) ranges from about $50,000 to more than $100,000 depending on where a family lives

Mortgage debt jumped from $159,020 per household in 2010 to $172,806 in 2016, and debt from auto loans grew from $20,032 in 2010 to $28,535 in 2016. Nationwide, total household debt (including mortgages, auto loans and student loans) now equals almost $12.4 trillion, up from about $11.7 trillion in 2010. That's adding $200Bn per year in debt accounting for ALL of our Retail Sales growth since the recession.

Median household income has grown 28% over the last 13 years, said Sean McQuay, a personal finance expert at NerdWallet, but expenses have outpaced it significantly. Case in point: Medical costs increased by 57% and food and beverage prices by 36% in that period. Rent has risen 3.9% in the last year alone, according to the Bureau of Labor Statistics. “The economy is doing better, but we’re really not seeing that trickle down to individual households the way we’d hope,” McQuay said.

Median household income has grown 28% over the last 13 years, said Sean McQuay, a personal finance expert at NerdWallet, but expenses have outpaced it significantly. Case in point: Medical costs increased by 57% and food and beverage prices by 36% in that period. Rent has risen 3.9% in the last year alone, according to the Bureau of Labor Statistics. “The economy is doing better, but we’re really not seeing that trickle down to individual households the way we’d hope,” McQuay said.

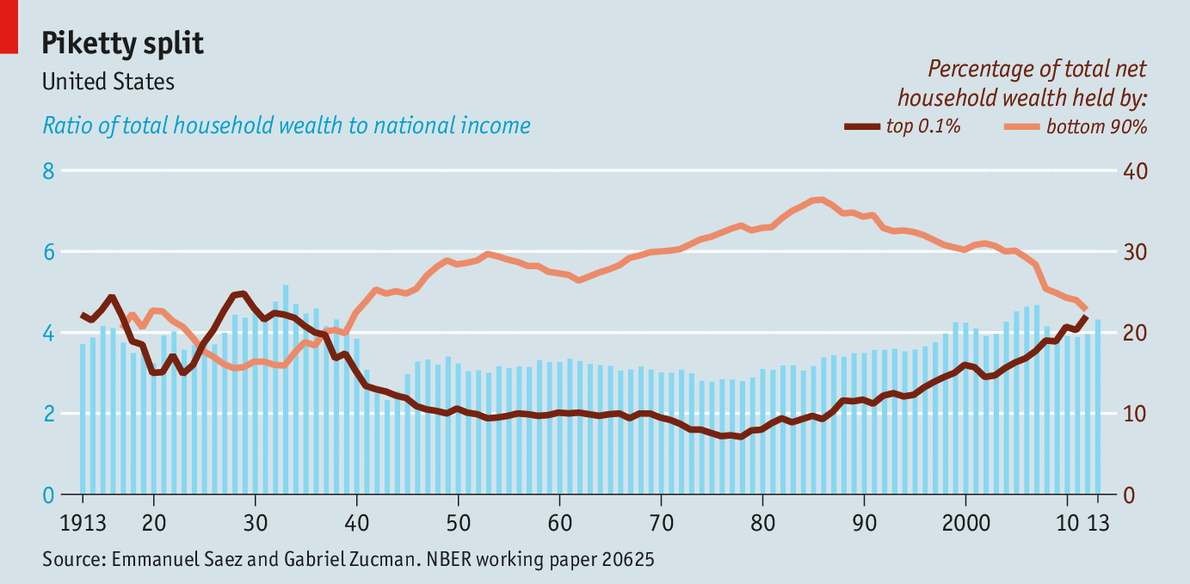

That's the reality the Fed and their fellow Central Banksters are residing over – the greatest increase in income and wealth inequality since the 1920s as the wealth of the Top 1% has passed the total wealth of the bottom 99% and the wealth of the Top 0.1% alone (300,000 Americans) is now more than the bottom 300M (1,000x more per person):

What if the 300,000 people with 1,000x the assets want a 10% return? That's 100x and that means the bottom 300,000,000 people will have to give 10% of their money to the top 300,000 less whatever gains can be accomplished through GDP growth. So, if GDP grows at 3%, the bottom 90% only have to transfer 7% of their money to the top 300,000 – so economic growth IS good for everyone, right?

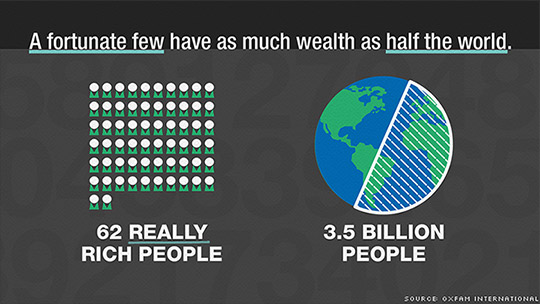

And don't even try to narrow the focus from there because the top 62 people in this World now have more wealth thant the bottom 50% (3.5Bn) combined. In America specifically, it's even more disproportionate, with the 20 richest people owning half the wealth. Donald Trump is only ranked at 156th richest with $3.7Bn – he doesn't even make the list but he does have vast armies protecting his wealth, which is becoming the power-move for those on the Forbes 400 list, who own a staggering 61% of the wealth of the United States while controlling almost all of the rest.

And don't even try to narrow the focus from there because the top 62 people in this World now have more wealth thant the bottom 50% (3.5Bn) combined. In America specifically, it's even more disproportionate, with the 20 richest people owning half the wealth. Donald Trump is only ranked at 156th richest with $3.7Bn – he doesn't even make the list but he does have vast armies protecting his wealth, which is becoming the power-move for those on the Forbes 400 list, who own a staggering 61% of the wealth of the United States while controlling almost all of the rest.

And it's a wise move because, if those 3.5Bn people realized they could double their lifestyle by simply sacrificing 62 people – well, a lot of cultures would call that a real "win/win" scenario, right? Interestingly enough, we are probably soon reaching the end-game of capitalism as we have now concentrated so much wealth in the hands of so few people that there's no longer enough profit in exploiting the bottom 50% to make it worth the time of the top 1%.

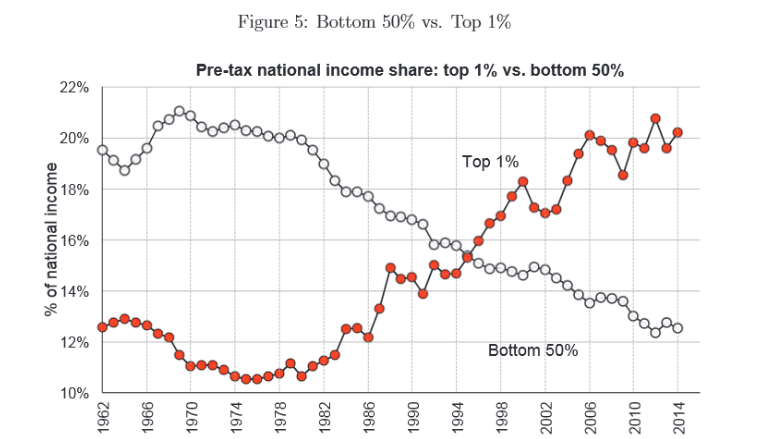

Already the Top 1% in the US are making over 20% of the income in the US while the bottom 50% now only get 12%. That's almost a 2:1 ration of for the top 3M over the bottom 160M and again, like total wealth, in order to give 1M people a 10% raise, we have to give 160M people a 20% pay cut. Given that those people are already living below the poverty line, the Top 1% may soon be forced to seek out other people who still have money in order to increase their fortunes.

Fortunately, the 51-99% (157M) still make 68% of the money and the Top 10% can make 10% more by only taking 3% of that money – which will be accomplished under President Trump's new tax plan, of course. So don't worry about the Top 1%, they should be able to keep growing their wealth at the expense of the rest of the Top 50% for quite a few years before those idiots stop fighting with each other and realize they have a common enemy.

Fortunately, the 51-99% (157M) still make 68% of the money and the Top 10% can make 10% more by only taking 3% of that money – which will be accomplished under President Trump's new tax plan, of course. So don't worry about the Top 1%, they should be able to keep growing their wealth at the expense of the rest of the Top 50% for quite a few years before those idiots stop fighting with each other and realize they have a common enemy.

And yes, the Top 0.1% are your enemy. They take much more than they need and give much less than they can. If you ean $100,000 a year and pay $2,000 in school taxes and, if Jeff Bezos, who made $20Bn last year (200,000 times more than you) didn't pay $400M in school taxes (he didn't), then he didn't pay his fair share, did he. If Jeff Bezos doesn't pay his fair share of school taxes then EVERY OTHER PERSON in the community has to pay to make up for his shortfall and if his shortfall is $399M and the community (all of Seattle) is 1M people – then everyone who is not Jeff Bezos has to come up with $399 more in school taxes.

This is how Trump's tax plan will transfer Trillions of Dollars from the Top 51-2% to the Top 1%, by allowing the Top 1% (which includes Trump and his family, of course) to pay far less – the rest of us simply have to pay far more and, if we don't pay it now, it simply becomes more debt that our country will need to pay eventually.

Japan, in fact, is looking to pay off their massive debts with a 10% sales tax. That, of course, massively, dispropotionally impacts the poor, who spend 100% of their money on goods and services vs wealthy people, who tend to spend 1/3 or less. The income goes to the Top 1% but the debts they leave behind are EVERYBODY's problem.

The Fed keeps all of this going with their ongoing QE programs, that provide the liquidity for the greatest transfer of wealth from the bottom 99% to the Top 1% the World has ever seen:

Expect more of the same this week as Draghi just gave a speech yesterday flat out stating that QE pushes investors into riskier assets and concludes that it is still a good tool to be used to maintain market stability and to foster inflation growth. But, after 8 years of Quantitative Easing, where is the inflation? While we have certainly inflated the stock market, wages and prices have remained stagnant because there are only so many cows a rich person can eat in a day and so many loaves of bread and so much wine he can drink and, when those rich people are actively discouraged from supporting the "lazy" poor – then all the money that fills up their vaults does nothing to increase the overall consumption.

Expect more of the same this week as Draghi just gave a speech yesterday flat out stating that QE pushes investors into riskier assets and concludes that it is still a good tool to be used to maintain market stability and to foster inflation growth. But, after 8 years of Quantitative Easing, where is the inflation? While we have certainly inflated the stock market, wages and prices have remained stagnant because there are only so many cows a rich person can eat in a day and so many loaves of bread and so much wine he can drink and, when those rich people are actively discouraged from supporting the "lazy" poor – then all the money that fills up their vaults does nothing to increase the overall consumption.

These policies are not just destroying America – they are destroying the entire planet and, at the moment, the only people who can do something about it (the Top 10-2%) are too excited to be sucking crumbs off the plates of the Top 1% to realize that they are next on the carving board.