![]() This is a huge storm.

This is a huge storm.

We haven't had a storm like this hit the land in over a decade and 2-3 FEET of rain are expected where Harvey hits land in the Gulf Basin. That will take many refiners off-line and Gasoline (/RB) and that's already fantastic for our long Futures contracts, which we discussed during Wednesday's Live Trading Webinar (Oil, /CL too) and /RB is already up over $2,000 per contract at $1.725 while Oil is, so far, struggling to retake $48 but that's still good for $500 per contract every time we go from $47.50 (our long line) to $48.

Also, the Natural Gas (/NGZ7) long trade idea from Monday morning's PSW Report at $3.07 already popped 0.10 for an $1,000 per contract gain – you're welcome! And, by the way, at the time (Monday morning) we were shorting oil at $50 so the trip down to $47.50 was a $2,500 per contract winner until we called for the turn – aren't Futures fun? Speaking of fun, the Russell Futures (/TF) are back to our shorting line at 1,377.50 and closing in on the other lines we discussed in Wednesday morning's Report, which were:

As we expected, we did hit our strong bounce lines on on the Futures in yesterday's action at Dow 21,800 (21,850), S&P 2,442.50 (2,450), Nasdaq 5,850 (5,870) but missed Russell 1,377.50 (1,372.50) so we shorted the Russell at the 1,370 line and, this morning, we're already up $250 per contract at 1,365. That's exactly what we said we'd do – wait for the strong bounces and short them as they cross back under. Now we're waiting to see if the other indexes cross back under or if the RUT comes up to join them and confirms a more bullish rally. Dow (/YM) 21,850 is my next favorite short.

That is the Russell chart from Tuesday morning's Report and, since then (when we were long), we have drifted back towards our shorting line at 1,377.50 but, to stay short, we need to see failure at Tuesday's opening lines (Dow 21,850, S&P 2,450 & Nasdaq 5,870) and it's tricky today as we have the hurricane boosting energy stocks (higher prices and repair work for OIH companies) but we think that will be temorary and, as we predicted in Monday's Report, Durable Goods is a total disaster, down 6.8% and ex-Transports were even worse as leading Economorons predicted a 0.5% increase and we're actually down 0.1% so a 120% miss by the kind of people the Fed relies on to make decisions.

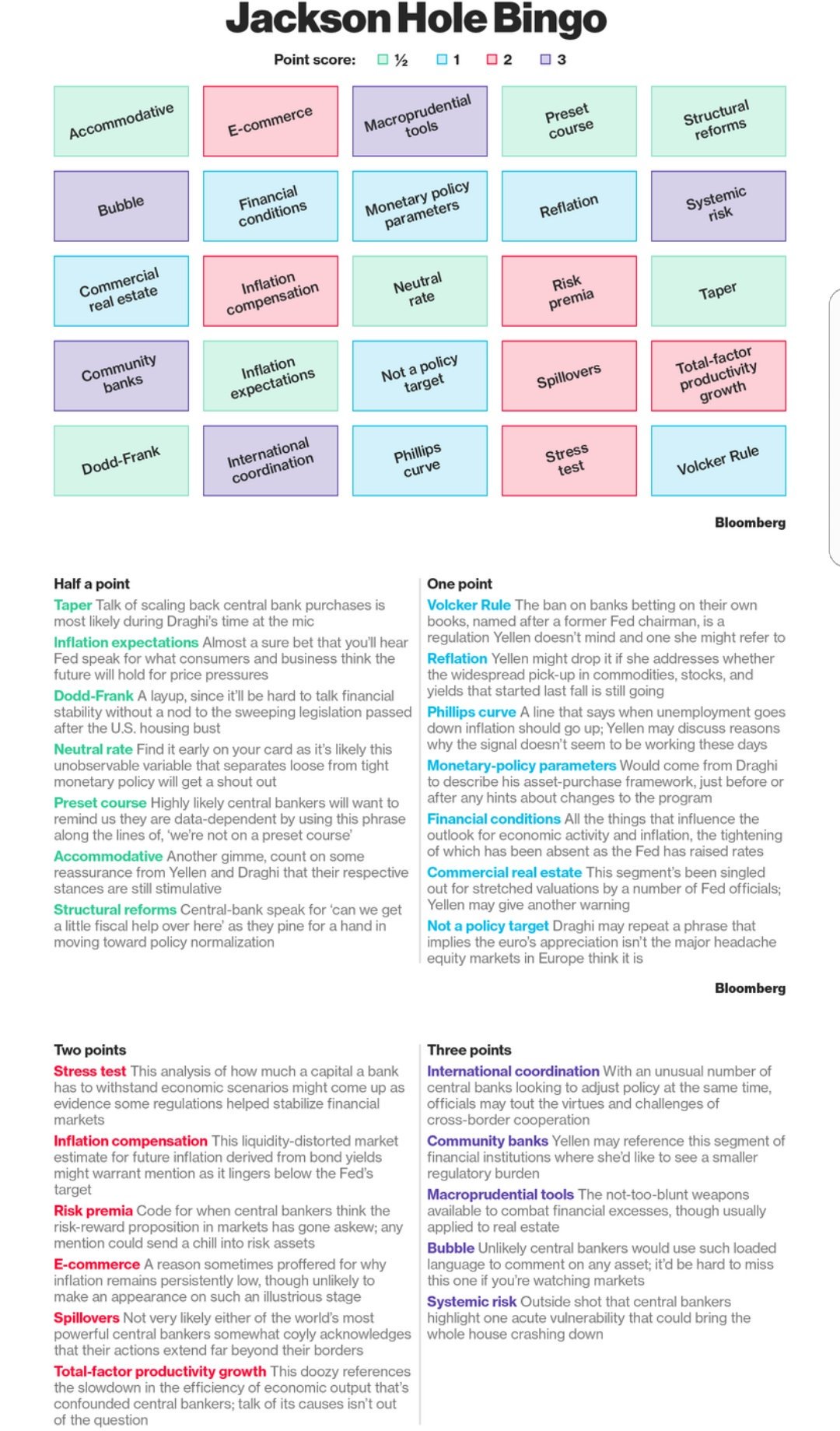

Speaking of the Fed – it's time for the Jackson Hole meeting and Bloomberg has a fun game of Jackson Hole Bingo we can all play to get ready. Substitute shots for points and I think we may really be onto something!

That's right, not even Bloomberg take the Fed seriously anymore because, clearly, they don't have a clue what they are doing. While they will break their arms this weekend patting themselves on the back for staving off a financial crisis – who's to say we wouldn't have been much better off if they had left things alone? We had a liquidity crisis because we had too much debt so the Fed stepped in and provided liquidity and now the World has twice as much debt as we had when the crisis began. Things are not "fixed" – they are merely papered over (see yesterday morning's PSW Report).

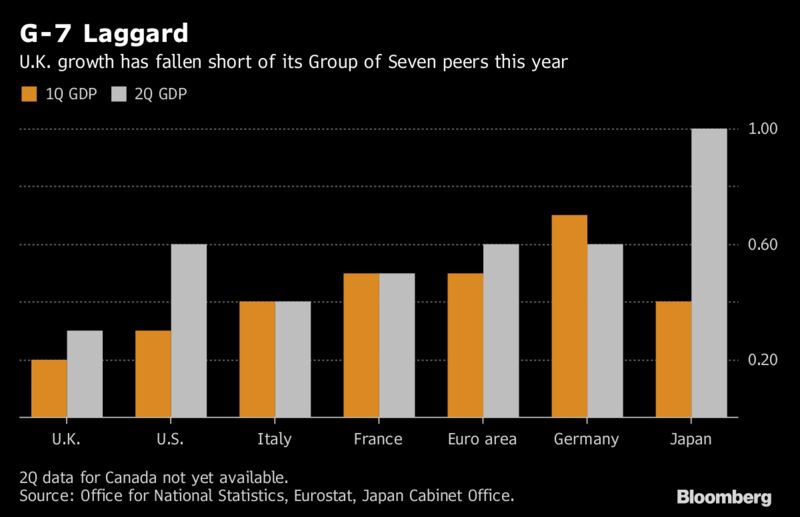

Not only are our Durable Goods numbers anemic but UK Consumer Spending is up just 0.1% with 0.3% GDP growth and NONE of the G7 have cracked 1% GDP growth so far this year yet the market continue on at RECORD HIGHS – deluded by the constant influx of FREE MONEY and promises of ever more by the Central Banksters, who have no other ideas for fixing the Global Economy other than more and more debt.

Not only are our Durable Goods numbers anemic but UK Consumer Spending is up just 0.1% with 0.3% GDP growth and NONE of the G7 have cracked 1% GDP growth so far this year yet the market continue on at RECORD HIGHS – deluded by the constant influx of FREE MONEY and promises of ever more by the Central Banksters, who have no other ideas for fixing the Global Economy other than more and more debt.

The PBOC is an outlier at the moment as China has been pulling funds from the Financial System, pulling down $50Bn this week alone. The withdrawals come at a challenging time for the money market, with banks traditionally hoarding cash to satisfy quarter-end regulatory checks. Some signs of stress are already beginning to show, with lenders being forced to pay the highest costs since 2014 for three-month funds and borrowing costs in Shanghai rising to 2.9% on Interbank Lending (3.68% for the 10-year).

Venezuela, in case you didn't know, is now paying 32.43% on their 10-year bonds – that's worse than Greece at the height of the crisis in a country that is twice the size of Greece but, unlike Greece in Europe, like Mexico in the hurricane map above, Americans don't even care enough about their southern neighbors to even bother labeling their country!

Rembmer when we didn't worry about Greece and I said we should but most people didn't and then the markets pulled back 20% in 2011? Ah, good times!

Have a nice weekend,

– Phil