Here's my agenda for Money Talk (BNN 7pm) tonight:

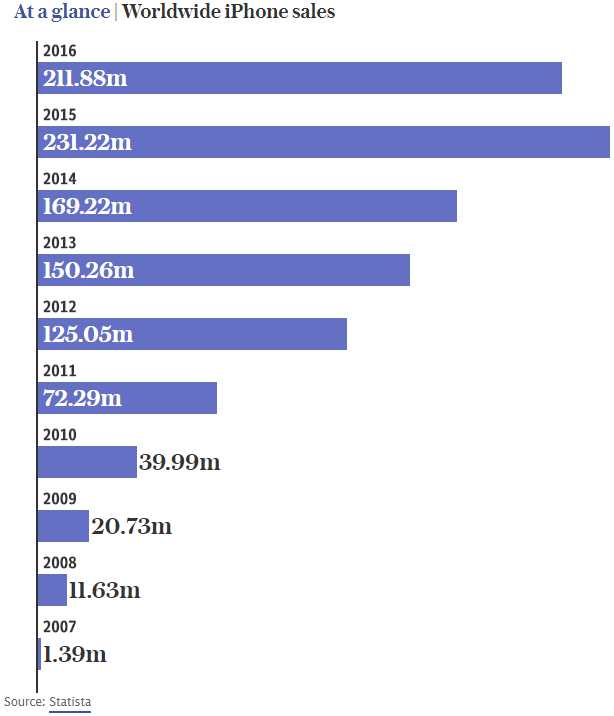

Apple (AAPL) was our Stock of the Year in 2013 ($55), 2014 ($75) and 2015 ($105) but we hit our $130 target so we moved on (WPM is our current Stock of the Year) but we do like Apple again as they are coming into another up cycle in sales, which should take them up over $180 by next year.

Apple (AAPL), who usually give conservative guidance, indicated that they expect $52Bn in sales in Q3 (July, Aug, Sept - which is their Q4), presumably indicating a sales boost of the IPhone 8. AAPL is very secretive but there is an event on Sept 12th and, generally, devices go on sale a week after they announce so Sept 17th makes sense, especially as the 5, 6 and 7 were all released in the 3rd week of September as well.

This will end Apple's fiscal year with about $228Bn in sales and about $49Bn in profits and on track to hit $250Bn next year with $55Bn in profits which puts a $1Tn valuation ($195/share) firmly in reach as the p/e would be only 18 and, don't forget, AAPL is sitting on $250Bn in cash which, thanks to Trump, it's likely they will be able to bring home from overseas at a very low tax rate, which could lead to a massive dividend distribution or stock buyback.

That being the case, we could play AAPL to certainly stay over $160 with the following spread:

- Sell 10 AAPL 2019 $140 puts for $9.10 ($9,100)

- Buy 20 AAPL 2019 $150 calls for $25.30 ($50,600)

- Sell 20 AAPL 2019 $165 calls for $17.70 ($35,400)

Your net cash outlay on the spread is $6,100 and the potential upside on the spread is $30,000 if AAPL is just over $165 on expiration day (Jan 18th, 2019) for a gain of $23,900 (392%).