What can go wrong?

What can go wrong?

Well, for one thing, the Fed could tighten. As you can see from the Fed's own projections, which are to be released tomorrow (but are on their web site today), the Fed is projecting a Fed Funds Rate of 2.9-3.9% next year. This year it was a much wider -0.1 to 2.9% and we're right in the middle at 1.25% but what if we're in the middle next year at 3.5%? Are you ready for a 2.25% rate hike? Is anybody?

Certainly people with adjustable mortgages are not ready or revolving debt (reccord highs) or variable loans like Corporations tend to have, which would add $400Bn to their $2Tn debt balance. Are the banks ready to have their loan margins squeezed as rates climb, which is often the case?

Even just 3% would require 7 rate hikes in 8 meetings – unless the Fed hikes us this year, then it would be 6 of 8 or, if they surprise us and hike tomorrow, they buy a bit of fexibility next year and "only" have to hike rates 0.25 every other meeting, plut one. Their other projections are on track. The market thought lowering the Q3 GDP forecast (see yesterday's Morning Report) would keep the Fed off the table but they are only projecting 2.0-2.4% GDP for 2017 and LESS next year – so we're right on track.

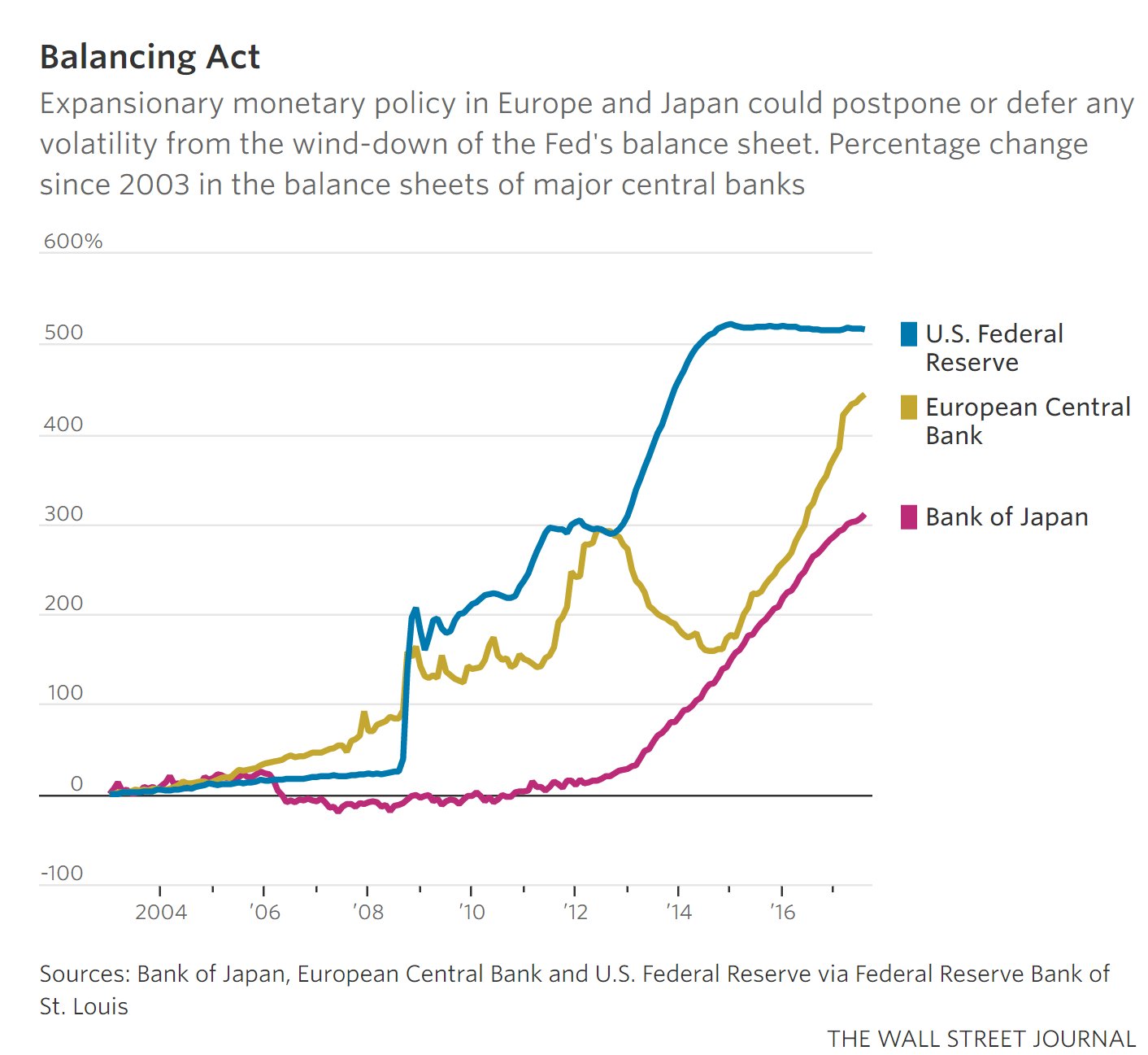

Unemployment is below their target, Inflation is above – there's really no excuse for the Fed NOT to raise rates so don't be surprised if everyone is surprised tomorrow by a quarter-point hike, hurricane or no hurricane. Of much more concern than the rates going up (though the repercussions of that alone will be tragic) is the potential unwinding of the Fed's Balance Sheet, which currently stands at $4.47 TRILLION and that's up about $3.7Tn since 2008.

Unemployment is below their target, Inflation is above – there's really no excuse for the Fed NOT to raise rates so don't be surprised if everyone is surprised tomorrow by a quarter-point hike, hurricane or no hurricane. Of much more concern than the rates going up (though the repercussions of that alone will be tragic) is the potential unwinding of the Fed's Balance Sheet, which currently stands at $4.47 TRILLION and that's up about $3.7Tn since 2008.

Even if the Fed "only" withdraws their money over the same 8 years they put it in, that's $500Bn a year coming OUT of the economy – no wonder they project a significantly lower GDP next year! Meanwhile, the BOJ and the ECB have been putting in $400Bn a month and Japan's stimulus is so out of proportion to their $5Tn economy (1/4 of ours and Europe's) that an unwinding there would be catastrophic but NOT unwinding while we do and the ECB does would collapse their currency and be equally catastrophic.

Nonetheless, the Nikkei has flown back to it's century high of 20,200, which we last hit in late 2015 before crashing 25% back to 15,000 a year later. A year is a long time and tops can last a while but let's keep an eye on /NKD as we are about to conduct a really good test as to whether a stock market can remain at a top – even as the economy of the country collapses.

There is simply nothing sustainable about Japan's 1.2 QUADRILLION Yen Debt. Yes, there are 90 Yen to the Dollar(ish), so it's "only" $13.3Tn but that's over 250% of their GDP and it's two thirds of our debt at 1/4 the size of our economy so, proportionately, 2.66 times worse off than we are. How will Japan deal with rising rates? Do you know what the interest on $13.3Tn is? At 3% it's $400Bn – getting close to 10% of Japan's economy in interest payments alone.

Meanwhile, Japan's budget deficit is 10% of GDP and tax revenue is only 10% of the GDP and $400Bn x 90 is 36 TRILLION Yen so add that to the deficit chart and then contemplate whether you would lend Japan money at 3%. This is pretty much what happened to Greece only Japan is many times worse off than Greece ever was with one crucial exception – Japan can print it's own money.

Meanwhile, Japan's budget deficit is 10% of GDP and tax revenue is only 10% of the GDP and $400Bn x 90 is 36 TRILLION Yen so add that to the deficit chart and then contemplate whether you would lend Japan money at 3%. This is pretty much what happened to Greece only Japan is many times worse off than Greece ever was with one crucial exception – Japan can print it's own money.

That's what it's all about folks – the power to print money allows contries to go into near infinite debt and Japan is the ultimate experiment in pushing QE to the limit. Unfortunately, Japan's GDP growth hasn't even cracked the 1% line since QE started in 2010 but, rather than give up in 2012 (after 2011 reversed the gains of 2010) they doubled down – and then they doubled down again and again.

So hear we are, a bunch of economies that have been living on QE life-support for 10 years and now the Central Bank Doctors are going to pull the plug and see how it goes. Wait, they are not just pulling the plug, they are going to start drawing back all the blood they've been steadily transfusing as well. Well take two happy pills and call us in the morning – because you're going to need them next year!

Did I say next year? I mean next decade, of course. Because, EVEN IF, the unwind goes smoothly, it will also go relentlessly and it will be a burden on our economy for a decade. While that's going on, President Trump plans to cut our tax revenues to Japanese levels in hopes of stimulating the economy. If we follow that plan and our debt trajectory matches Japan's – we'll be close to $30,000,000,000,000 in debt by the time Trump is dragged out of the White House in 2025 (yes, the next election will be fixed and no, he won't be impeached).

Did I say next year? I mean next decade, of course. Because, EVEN IF, the unwind goes smoothly, it will also go relentlessly and it will be a burden on our economy for a decade. While that's going on, President Trump plans to cut our tax revenues to Japanese levels in hopes of stimulating the economy. If we follow that plan and our debt trajectory matches Japan's – we'll be close to $30,000,000,000,000 in debt by the time Trump is dragged out of the White House in 2025 (yes, the next election will be fixed and no, he won't be impeached).

Even if the Fed keeps rates at 3% and Japan doesn't collapse and Europe keeps it together and North Korea doesn't start WWIII and Russia plays nice and the collapse of Venezuela is contained and Global Warming doesn't destroy the East Coast – we'll still have to pay $900Bn Dollars a year in interest alone on our debt. We're paying about $220Bn now so either we cut another $680Bn of Federal Programs (20%) JUST to pay the interest or we rack up another $680Bn of debt per year – which is the path Japan has chosen for their run.

It's funny to watch Greece or Iceland collapse because we don't live there. It might not be so funny when it happens to us – but we'll see for ourselves in the Future. Meanwhile, we sit back and enjoy the rally, which has gone far beyond ridiculous at this point. In fact, we just did a review of our Long-Term Portfolio at noon on Friday and we stood at $1,606,883 (we started with $500,000 on 11/26/13) and, as of yesterday's close, we were at $1,646,961 on the exact same positions – up $40,000 (2.4%) in one day!

That's just stupid – you're not supposed to make that kind of money – it's simply unsustainable. To be fair, our Short-Term Portfolio, which we reviewed on Thursday at $487,027 (started with $100,000 at the same time), which contains the hedges for our LTP, fell to $478,875 so down $8,152, which is down 1.6% so our net gain is only about $32,000 but my issue is with the longs – as that's what non-hedging bulls are being rewarded for being in this market. 2.4% per day??? Can that really be sustained? Can society afford to make the investing class this rich (and then not tax them)?

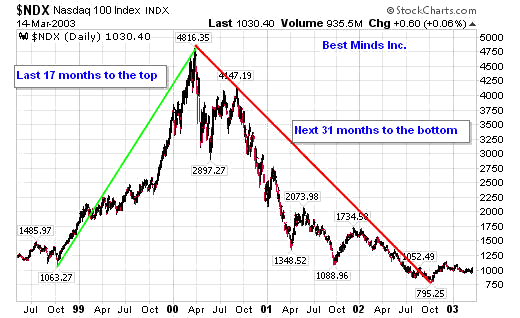

Of course not, it's going to collapse! When it will collapse is another matter entirely. The market was similarly out of control at the end of 1998, when the Nasdaq flew from 1,063 to 2,250 in April – more than double in less than 6 months. People thought that was overdone but , 6 months later, we were up 50% at 3,500 and then Q1 of 2000 saw us run 33% higher than that – to 4,816.

Of course not, it's going to collapse! When it will collapse is another matter entirely. The market was similarly out of control at the end of 1998, when the Nasdaq flew from 1,063 to 2,250 in April – more than double in less than 6 months. People thought that was overdone but , 6 months later, we were up 50% at 3,500 and then Q1 of 2000 saw us run 33% higher than that – to 4,816.

That was a gain of 3,753 (353%) in about 18 months. 18 months ago, the S&P was at 2,000 – we're "only" up 25% since then – hardly a dent in the dot-com boom. Of course, in the dot-com boom, other indexes didn't fly like the Nasdaq, which was relatively small at the time and full of start-ups that had very low IPO prices which made the index jump up as they doubled in value.

The other indexes followed and, for a brief periold of time, the "value" of the Wilshire 5,000 (pretty much all stocks) exceeded the GDP of the United States by 40%. I don't have a more recent chart but add 25% to this chart for the S&P and 4% to the GDP (since 2015) and the numbers are now $18.5Tn in GDP and $27.75Tn so we've now achieved 50% more "value" in the stock market than the "value" of the entire US economy.

If I wanted to make a bullish case, I'd say the Wilshire 5,000 does more business internationally these days so the "economy" we're measuring against should be expanded. Also, the Dollar was indexed at 120 back in 2000 and now it's barely holding 90 so of course stocks are going to be relatively more expensive but, on the other hand, that means we should discount GDP 30% to keep it in constant Dollars and that would bring it back down to $13Tn and that would make the markets 200% of constant GDP, which would be completely ridiculous and oops, I accidentally just made the bear case while trying to make the bull case.

So that, in a nutshell, is why we took about 30% of our LTP profits and put them into more hedges in our STP. By sacrificing 1/3 of our profits on the way up, we hope to lock them in on the way down because – well look at that 1999 chart – imagine having 2/3 of Nasdaq 4,800 money (3,200) after the bubble bursts and we're back to 1,000? You'd be 3x richer than the suckers who didn't hedge and, if it never bursts – we're still 2/3 as rich as the maniacs who don't hedge at all.

I know I sleep better at night!