What a long, strange trip it's been.

This morning the Nikkei is back to its 20-year high of 20,900 but still far shy of the all-time high of 39,000 – hit way back in 1989. We'll forget ancient history and focus on the current move, which is now up 5,000 points since the summer of 2016 – just barely over a year ago. There's nothing too strange about that, the other Global markets have similar gains and Japan's Corporate Profits are up 23% over the same period – so 2/3 of the move may even be justified.

Japan, along with most of the World's markets, has been quite the under-performer for the past decade. Back in May, I was interviewed on China Global Television and we were discussing Brazil's scandals and we decided we liked Brazil's ETF (EWZ) for a bullish play, saying:

So I like EWZ down here ($32.75) and we can take advantage of this dip with the following:

- Sell 5 EWZ 2019 $25 puts for $2 ($1,000)

- Buy 10 EWZ 2019 $25 calls for $11.50 ($11,500)

- Sell 10 EWZ 2019 $35 calls for $5.50 ($5,500)

That's net $5,000 on the $10,000 spread that's over $7,000 in the money to start. The upside potential is $5,000 which would be a 100% return on your money and your worst-case downside would be owning 500 shares of EWZ for net $30/share ($15,000). The ordinary margin on the short puts is just $780 so it's a very margin-efficient play as well.

It was an easy fill and we didn't even officially add it to the Options Opportunity Portfolio until June 13th, when I repeated the trade at the new net of $4,100 but, either way, we're well on the way to our $10,000 goal and already at $7.500 so up 50% over the Summer is a good way to start, right. Remember – I can only tell you what is likely to happen and how to make money trading it – the rest is up to you!

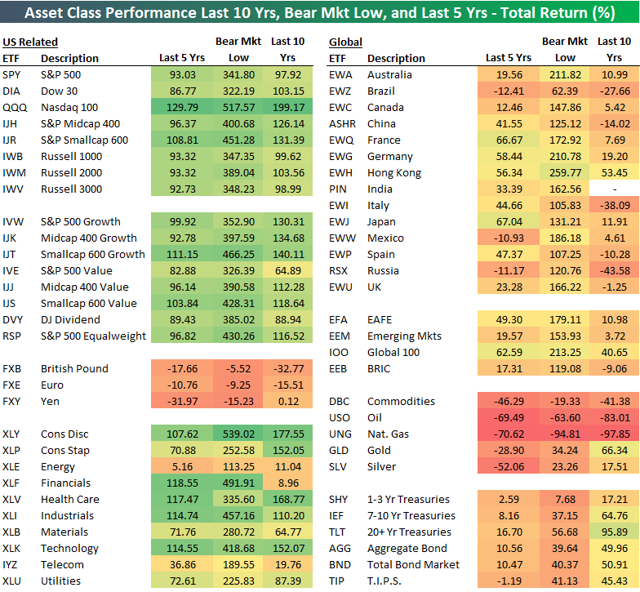

Brazil was and still is a laggard in the Global Picture, down 27.66% over the last 10 years vs up 199.17% for the Nasdaq — hard to believe they are on the same planet, right? Even the S&P is "only" up 100% since this time in 2007 but it's up 341.8% since the 3/9/09 bear market low but that's still miles behind the Nasdaq, which is now up 517.57% off the lows.

Interestingly, we're not being led higher by Technology so much as we are by Consumer Discretionary, which is up 25% more than tech over 10 years and oupacing it by 121% frrom the lows. Only in the last 5 year has Tech really gone on the attack in an attempt to catch up. Energy, on the other hand, has been PATHETIC, gaining just 11% since 2007 but, in context, even that is pretty good, considering Oil is 83% lower than it was at the time and Natural Gas is an amazing 97.85% cheaper over the past 10 years. THAT is why Coal is dead – Natural Gas is cheaper!

We can use the above Bespoke chart to think about where to invest next if this bull rally is to contine. At Philstockworld, we are value investors, so we don't just play for things to catch up. I was liking Brazil in the summer because it seemed like it was really hitting rock bottom in relation to the country's economic output – not just because it was lagging the rest of the World's rally. As noted by fellow value investor, Walter Schloss:

"I believe stocks should be evaluated based on their intrinsic worth, NOT on whether they are over- or under-priced in relationship with each other. For example, at the top of a bull market one can find stocks that may be cheaper than others but they both may be selling much above their intrinsic worth.

"If one were to recommend the purchase of Company A because it was COMPARATIVELY cheaper than Company B, he may find that he will sustain a tremendous loss. On the other hand, if a stock sells at, say, one-third of its intrinsic value based on sound security analysis, one can buy it irrespective of whether other stocks are over- or under-priced.

"Stocks are NOT over-priced or under-priced compared to other companies but compared to themselves. The key to the purchase of an undervalued stock is its price COMPARED to its intrinsic worth."

That's right, all of us value investors tend to capitalize words for emphasis… This is a concept we try to drill into the heads of our subscribers at PSW – we look for VALUE stocks and THEN we set up options spreads that both leverage and hegdge our positions – just in case we're wrong. We also SELL premium to maximize our chance of success and, as long as we pick more winners than losers and as long as the market doesn't correct past our hedges (usually down 20% is covered) – we generally perform vey well – even better than the Nasdaq's 200%, 10-year return rate.

That Brazil trade above made 50% since May, that's just 5 months. Now, looking back at the above chart, we can contemplate the National Laggards to look for another bet. Do we still like Brazil? Yes, so we'll make another 33% from here staying with our spread, which means it's still a nice play for those of you satisfied with 33% returns in 16 months. 2%/month is better than the bank, so why not?

China's A Shares (ASHR) have done far worse than you'd imagine but their debt and banking nonsense are what I consider the most likely flash point for a global melt-down – so I don't think I want to place my next bet at a potential ground zero. Italy has been a disaster but they deserve it – another shaky banking franchise there. Spain is splitting apart so that's not good and the UK is splitting from Europe – also not good. Russia is interesting as they just won the US elections and will likely consolidate their control in 2018 – that makes RSX interesting as a resurgence play.

China's A Shares (ASHR) have done far worse than you'd imagine but their debt and banking nonsense are what I consider the most likely flash point for a global melt-down – so I don't think I want to place my next bet at a potential ground zero. Italy has been a disaster but they deserve it – another shaky banking franchise there. Spain is splitting apart so that's not good and the UK is splitting from Europe – also not good. Russia is interesting as they just won the US elections and will likely consolidate their control in 2018 – that makes RSX interesting as a resurgence play.

Russia is being held back by the turmoil in the states (they are the subject of investigations in the House, the Senate, the FBI, CIA and, of course, the Meuller Investigation) so they are lagging the way a company under investigation tends to lag. Low oil prices have been hurting them but just this morning both Russia and Algeria stated they will work with OPEC to cut production and drive up oil prices to screw you at the pump – isn't that great?!? They've also given marching orders to Donald Trump, who is doing his part by removing mileage requirements from autos that Obama put in place, which drove the US fleet average from 20mpg to 35mpg over the past 10 years – lowering the overall demand for oil.

So why not back a winner and invest in Russia? At least we know the leadership there is stable – I don't see Putin having any Twitter wars with his staff or members of the Duma, do you? It's a shame we missed the dip in June but Russia is begining to usurp the US on the International stage, so why not place a small bet on Rex Tillerson's favorite country? Here's a nice spread for RSX:

- Sell 10 RSX 2019 $20 puts for $1.75 ($1,750)

- Buy 15 RSX 2019 $20 calls for $3.30 ($4,950)

- Sell 15 RSX 2019 $25 calls for $1.05 ($1,575)

Here we're laying out just $1,625 in cash on a spread that will return $7,500 if RSX is over $25 in Jan, 2019. That's a potential gain of $5,875 (361%) in 16 months and the risk is owning 1,000 shares of RSX at $20, plus the $1,625 cash if all is lost on the spread so net $21.08 is still $1.17 (5%) cheaper than it is now as your worst case.

What we like about trades like that is a limited downside. Even if all goes poorly and Russia is below $20 in 16 months, we don't feel it's likely to go much below $20 and that means we can turn it into a long-term hold that diversifies our portfolio internationally – so little harm done, even if it fails. On the plus side, this spread is $3,375 in the money to start – so all Russia has to do is not go lower and we double our money. THAT is the way we like to play the market at PSW!

I have to go be on TV this morning and we'll be discussing this Nasdaq Chart at the Nasdaq and what it means for the next 45 days of trading. We expect a bit of a pullback after the Fed minutes today (2pm) but then it's all about earnings next week – and then it's going to be all about the Fed's Dec 13th meeting and then it will be Christmas – what a year!

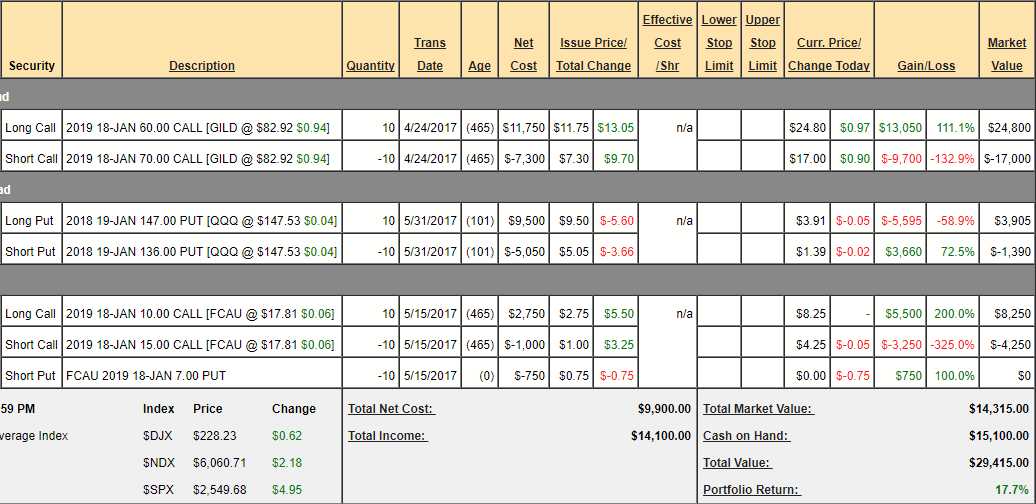

Our Nasdaq Portfolio is up 17.7% in 6 months – and that's despite our QQQ hedge performing poorly. This is a short interview, so I doubt we'll get to that this morning, but here's the portfolio:

If you want us to make more live picks at the Nasdaq – let them know, they've been downplaying them since June but I get a lot of good feedback for our public picks and I think they should get more air time, don't you?

Of course we still like last week's TZA trade idea into the Fed, by the way.