A down week?

A down week?

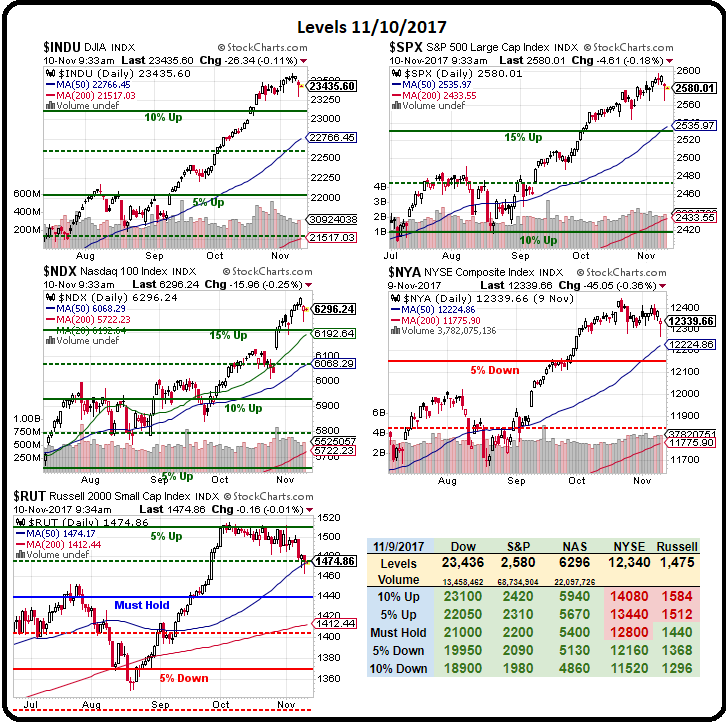

What is that? Since when do markets go lower? Well, they don't generally (any more) and this market hasn't had a down week since the first week of September, when the S&P was at 2,450 so it was a nice 150-point run (6.12%) before pulling back and the 5% Rule™ says we can expect a 30-point weak retracement to 2,570 and that's exactly what we got but 2,570 is still a 5% gain (2,572.5 actually) and, as long as that holds – it's still bullish – just a minor correction.

As you can see (or at least extrapolate) on our Big Chart, 2,600 is the 20% line on the S&P so of course we're going to get a pullback there. It's going over that line that's going to be siginficant and, rather than a bearish hedge, we're going to be needing bullish hedges to play the upside from there.

That's right, we already have bearish hedges in our Short-Term Portfolio and our Options Opportunity Portfolio and we don't want to get rid of those but, above the milestone S&P 2,600, we are going to want to hedge the hedges – in case the next 20% move up wipes them out and turns them into very expensive, unused insurance. When we hedge a hedge we go long the laggards – the indexs that are underperforming in anticipation that they would catch up.

We tend to take a hedge like that each quarter and, in May (19th), I was on China Global Television discussing the Brazil Crisis and we decided it was low enough to make a bullish play out of it and our trade idea at the time was:

So I like EWZ down here ($32.75) and we can take advantage of this dip with the following:

- Sell 5 EWZ 2019 $25 puts for $2 ($1,000)

- Buy 10 EWZ 2019 $25 calls for $11.50 ($11,500)

- Sell 10 EWZ 2019 $35 calls for $5.50 ($5,500)

That's net $5,000 on the $10,000 spread that's over $7,000 in the money to start. The upside potential is $5,000 which would be a 100% return on your money and your worst-case downside would be owning 500 shares of EWZ for net $30/share ($15,000). The ordinary margin on the short puts is just $780 so it's a very margin-efficient play as well.

As you can see, we have already blasted over our targets and the short puts are already down to $1.25 ($625) while the $25/35 spread is now $15.50/$8 so net $7.50 ($7,500) for a net net $6,875, which is a nice $1,875 (37.5%) return and well on the way to the full $10,000 so this trade will still make another $3,125 (45%) over the next 14 months if EWZ is kind enough to hold $35 – that's almost half of our original gains.

In October, we saw that Russia was our lagging index given that Putin was doing so much "winning" that we were, in fact, sick of all the winning – as his agent suggested we would be last year. My trade idea from the 11tth's Report, titled "Which Way Wednesday – Are the Markets Now Too Big to Fail?" was for Putin's ETF (RSX):

So why not back a winner and invest in Russia? At least we know the leadership there is stable – I don't see Putin having any Twitter wars with his staff or members of the Duma, do you? It's a shame we missed the dip in June but Russia is begining to usurp the US on the International stage, so why not place a small bet on Rex Tillerson's favorite country? Here's a nice spread for RSX:

- Sell 10 RSX 2019 $20 puts for $1.75 ($1,750)

- Buy 15 RSX 2019 $20 calls for $3.30 ($4,950)

- Sell 15 RSX 2019 $25 calls for $1.05 ($1,575)

Here we're laying out just $1,625 in cash on a spread that will return $7,500 if RSX is over $25 in Jan, 2019. That's a potential gain of $5,875 (361%) in 16 months and the risk is owning 1,000 shares of RSX at $20, plus the $1,625 cash if all is lost on the spread so net $21.08 is still $1.17 (5%) cheaper than it is now as your worst case.

What we like about trades like that is a limited downside. Even if all goes poorly and Russia is below $20 in 16 months, we don't feel it's likely to go much below $20 and that means we can turn it into a long-term hold that diversifies our portfolio internationally – so little harm done, even if it fails. On the plus side, this spread is $3,375 in the money to start – so all Russia has to do is not go lower and we double our money. THAT is the way we like to play the market at PSW!

RSX hasn't gone anywhere since then. Well, it's gone a lot of places but it's back to where it was, more or less. Still, because of our "Be the House – NOT the Gambler" strategy, where we always sell premiums to others in our positions, we still win and, so far, the short $20 puts are $1.52 ($1,520) and the $20/25 spread is $3.15/0.85 for net $2.30 ($3,450) for a net net $1,930 which is up $305 (18.5%) in less than a month – despite not really winning on the stock movement.

Meanwhile, at $1,930, this is still a good hedge as it returns $7,500 if Putin can keep winning and, as Trump promised – even if we are sick of all the winning and beg him to stop – he won't stop – ever…

We'll see next week if the S&P can take that 2,600 line and hold it but a rejection here should first give us a correction at least to 2,540 and that's why we chose /ES as our short at 2,590 and we got a run all the way back to 2,565 at the bottom yesterday and 25 S&P points are good for gains of $1,250 per contract in the Futures.

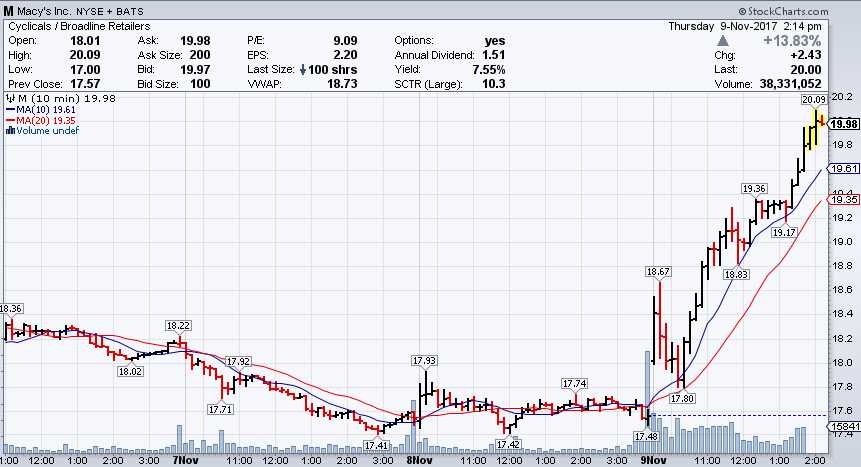

Yesterday morning wwas fun, we saw the earnings on Macy's (M) and I was surprised the stock wasn't moving so, at 10:03, I put out a note in our Live Member Chat Room as well as a Top Trade Alert saying:

M/Jabob – Over $18 already, silly boy.

Earning $3 per $18 share could be my Stock of the Year for next year since LB has gotten away from us.

In the very least, M should be a Top Trade today as we can certainly say we'd LOVE to own them at this level:

- Sell 10 M 2020 $20 puts for $6 ($6,000)

- Buy 30 M 2020 $15 calls for $5.20 ($15,600)

- Sell 30 M 2020 $22 calls for $3 ($9,000)

That's net $600 on the $21,000 spread that's $3 ($9,000) in the money to start (but you have to clear $20 to cash in the longs without impairment). Seriously, this would be my Trade of the Year for 2018 if it were Thanksgiving at this price! M is already in the OOP and LTP and I'll consider later if I want to adjust but today's report justified our targets.

Unfortunately, the stock didn't stay cheap for very long and you can see the reaction right at 10am as our Members began to scoop it up. We finished the day at $19.50 and already the spread is net $3,750 for a one-day gain of $3,150 (525%), which is a pretty good start but it's a $21,000 spread so still $17,250 (460%) left to gain and now we're 13,500 in the money to start – so still a great Trade of the Year candidate and you are only $3,150 behind our Members on this one trade idea, as you wisely saved $3/day by NOT SUBSCRIBING HERE!

There are all kinds of market mismatches to take advantage of and, as promised, now that we have 2/3 of the earnings reports out of the way, we are able to make intelligent guesses as to the outcomes of others. Next week we have Tyson Foods (TSN), Home Depot (HD), Cisco (CSCO), L Brands (LB), Williams-Sonoma (WSM), Manchester United (MANU), Net App (NTAP), Abercrombie and Fitch (ANF) and Buckle (BKE) as potential earnings plays to look at.

LB was going to be our 2018 Stock of the Year and we did add it to our portfolios in August but they have already popped 30% so we had to flip to M, which was lagging but still a potential big winner in the retail space. ANF is interesting as they are down to $830M at $12.18 and they are certainly capable of making more than $40M for a p/e of 20. I think expectations are low enough that anything positive can get them a pop – but I'd take quick money and run on that one.

We'll decide next week which ones we'll play and, if you want to save $21 by not subscribing, we'll be happy to tell you after the fact how well we did!

Have a great weekend,

– Phil