Jobs Report today (8:30).

Jobs Report today (8:30).

So far, under Trump, we've added 250,000 less jobs than under Obama in his last 9 months and today should make it worse as only about 195,000 jobs are expected to have been created in November, Trump's 10th month in office. September was the real disaster for Trump, with just 20,000 jobs created but last month was a bit of a comeback, with 261,000 jobs but that may get revised lower – so watch out for that. It wouldn't matter if we had an ordinary President, but Trump is big on keeping scores and he promised the moon and the stars on jobs and has, so far, woefully failed to deliver.

Much worse than not delivering enough jobs is the horrific erosion of wages for all jobs since Trump took office. Due to reversals in labor policies under the Trump Administration, hourly earnings growth has slowed 0.4% since the election and, while that may not seem like a big deal, when you multiply it by all 160M employed people it's the same as losing another 640,000 jobs worth of salary.

Creating jobs at slave wages was never the goal of the Obama Administration while Trump actually ran on a promise to put people back to work in coal mines which, LITERALLY, has songs written about how it's the worst job on the planet. Obama's job plan was to create a new, renewable energy economy and put $90Bn into funding companies like Solyndra, which lost $535M and was the GOP excuse for killing the program but it was too late to kill the jobs that were created and today, 10 years later, clean energy jobs outnumber coal, oil and natural gas combined. And those are, generally, high-paying jobs with great growth prospects that are bringing manufacturing back to America.

If I were Vladimir Putin, with half my fortune in oil, I'd be very concerned about that trend and, indeed, Trump is working hard to reverse the trend by putting tariffs on solar photovoltaic imports of 35% – exactly at the point where solar energy has pushed past fossile fuels as the least expensive way for Americans to consume energy. This will DOUBLE the cost of solar panels for consumers, turning solar from cost-effective to unaffordable overnight.

If I were Vladimir Putin, with half my fortune in oil, I'd be very concerned about that trend and, indeed, Trump is working hard to reverse the trend by putting tariffs on solar photovoltaic imports of 35% – exactly at the point where solar energy has pushed past fossile fuels as the least expensive way for Americans to consume energy. This will DOUBLE the cost of solar panels for consumers, turning solar from cost-effective to unaffordable overnight.

The implications of a decision to raise the cost of foreign imports will ripple through the energy industry, from installers to the utility sector and even the military, which has come to rely on solar for many of its operations. But nowhere will the impact be greater than on disadvantaged communities that are just beginning to reap the benefits of renewable energy, and the jobs that come with it. 88,000 American jobs will be lost if this tariff is imposed.

The steady decline in residential solar prices over the last ten years, which had dropped 70 percent before the trade case began, has opened solar access to millions of Americans. Solar provides families the opportunity to take ownership of their energy, reduce their carbon footprint and save money. It has also allowed states, local governments and utilities to invest in solar as a cost-effective way to provide energy assistance to constituents who struggle to pay their energy bills.

The steady decline in residential solar prices over the last ten years, which had dropped 70 percent before the trade case began, has opened solar access to millions of Americans. Solar provides families the opportunity to take ownership of their energy, reduce their carbon footprint and save money. It has also allowed states, local governments and utilities to invest in solar as a cost-effective way to provide energy assistance to constituents who struggle to pay their energy bills.

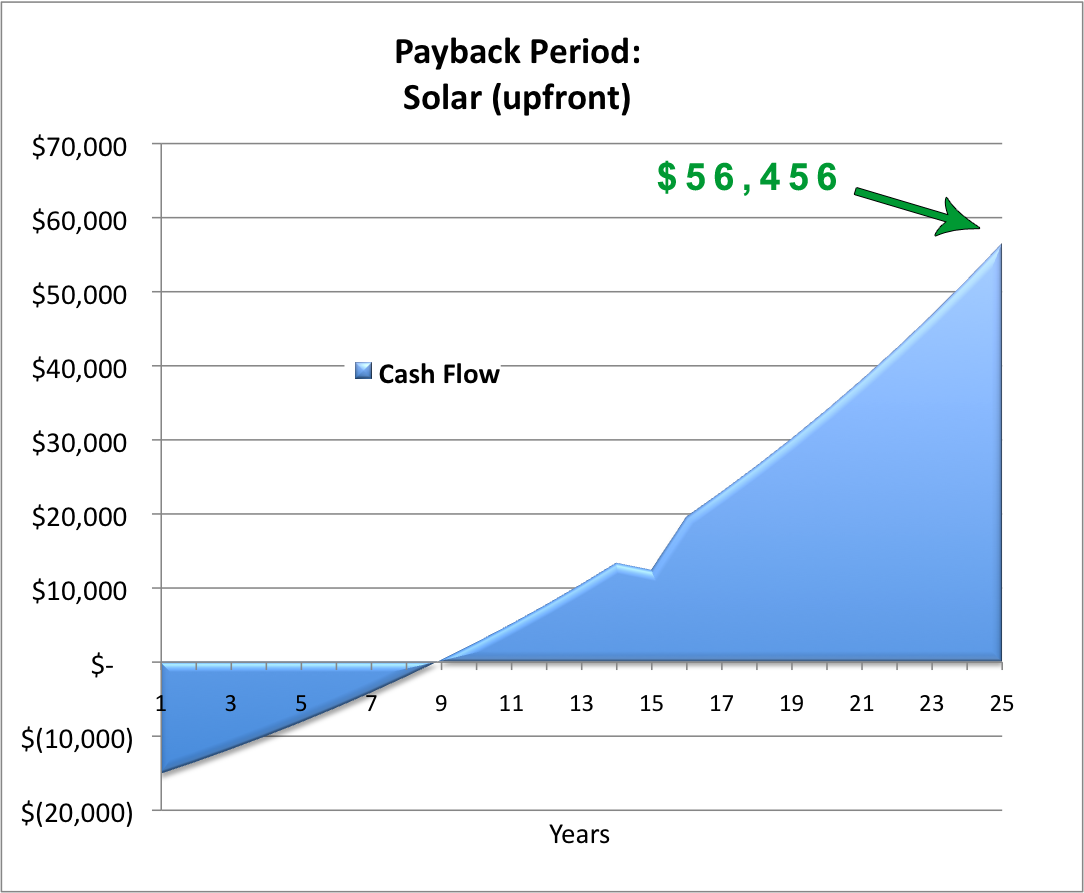

Once coal, oil and gas lose these customers, they are gone forever. As you can see from the chart, a home solar system currently pays for itself in 9 years and returns $56,456 in savings over the next 16 years ($3,528/yr) for the average home and those solar prices have been getting lower and lower and have become a major threat to fossil fuels – which was kind of the goal back when we wanted to save the planet.

Obama's job creation plan is still having a beneficial impact on America 10 years later but Trump is doing his best to reverse that – as he is with every Obama policy. The job stimulus was something Obama passed in his first month in office. Trump hasn't actually passed anything so far in his first year – so there's really nothing to criticize. In fact, I dare you to read the Official White House "plan" for "Bringing Back Jobs And Growth" and figure out how, after one year – they have done anything to do either.

There is literally so much crap going on in the Trump administration that we tend to forget that he's doing a terrible job of being President and running the country. As the administration lurches from crisis to crisis, starting new fires as quickly as the "deep state" career politicians can put them out, things in the country are deteriorating yet we allow a strong stock market to distract us from paying attention to the actual economy.

8:30 Update: 228,000 jobs were created in November, so 10% better than expected but Unemployment is steady at 4.1%, which is not a terrible number. Teenage Unemployment remains high, at 15.9% as more and more older workers can't afford to retire. Despite Trumps claims that more people are going to work, Labor Force Participation is the same 62.7% it was when he took office, nor has the Employment/Population Ratio, which is still 60.1%.

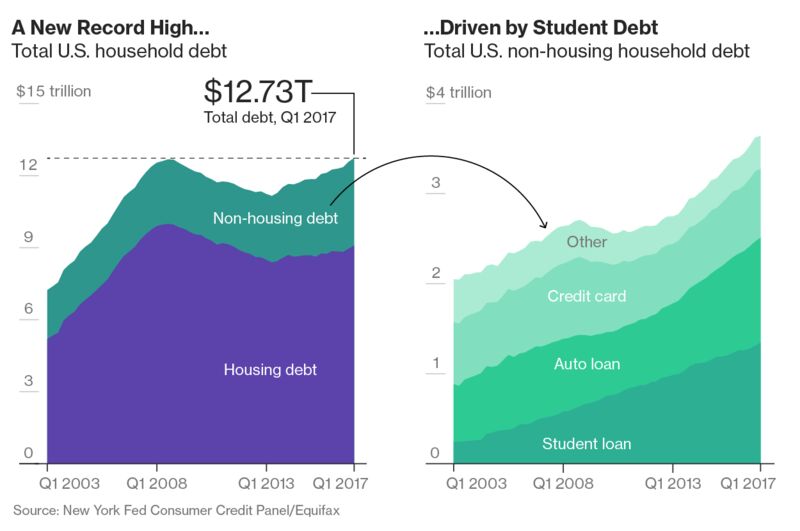

It's not a bad report and it should give the market a reason to rally but, before I was interrupted by the report, I was going to point out that it's being driven by a massive uptick in Consumer Debt, pushing us back to the danger-zone level of $13 TRILLION we hit back in early 2008 – just before the market collapsed.

A record 11% of that debt is now Student Loan Debt at $1.4Tn and the Trump Administration is finally passing it's first bill but the Trump Tax Plan will eliminate the tax deduction for Student Loan Interest AND it will ask students to pay taxes on deferments, like Scholarships or reduced tuition grants – as if they were income. Where that money would come from, I have no idea though. Maybe we could make a scholarship that pays the tax on the first scholarship you got but then that would be taxed too and we'd need a 3rd scholarship to pay for the tax on the 2nd scholarship but then that too would be taxed… Isn't America great – again?

After all, taking away opportunities from children is what the Founding Fathers intended, right? There is good news in the debt chart doesn't show an alarming amount of Household Debt yet as most of the gains of the last few years have been in Non-Household Debt, like Margin Debt on the stock market, which has never been higer than it is now – almost triple where it was in 2008 and double where we were even in the Dot Com booom in Feb of 2000:

What could possibly go wrong? As you know, we are in CASH!!! but I'll short the S&P Futures (/ES) today at 2,650 and the Dow at 24,300 (/YM) and the Nasdaq at 6,380 (/NQ) and the Russell at 1,530 (/TF) because I think we're going to sell-off a bit into the close. We generally use a 2 out of 4 rule for shorting and short the laggards as 2 of the indexes cross under and then, if ANY of them cross back over, we get out. So that limits our losses while giving us a nice possibility for gains.

You can still get a nice, cheap entry on last week's Dow Ultra-Short ETF (DXD), which returns 500% on your cash if DXD is over $11 in April. DXD is currently at $9 and it's a 2x ETF so a 22% move in DXD to $11 would take an 11% drop in the Dow to 21,627 so that's our target for a pullback over the next few months. Not a huge drop – just a little correction would be nice.

Getting back to jobs and such, the US population adds about 2M people per year so creating 2M jobs is simply treading water, not "growth". Also 2M is 0.6% of 325M so, 0.6% GDP growth is already baked in by population growth and, so far, we are averaging 2.5% for 3 quarters this year – not at all impressive but hopefully this quarter holds up around 3.4% but that will still leave us with a yearly average of (7.5% + 3.4%)/4 = 2.725%, not quite hitting that 3% mark Trump has been promising.

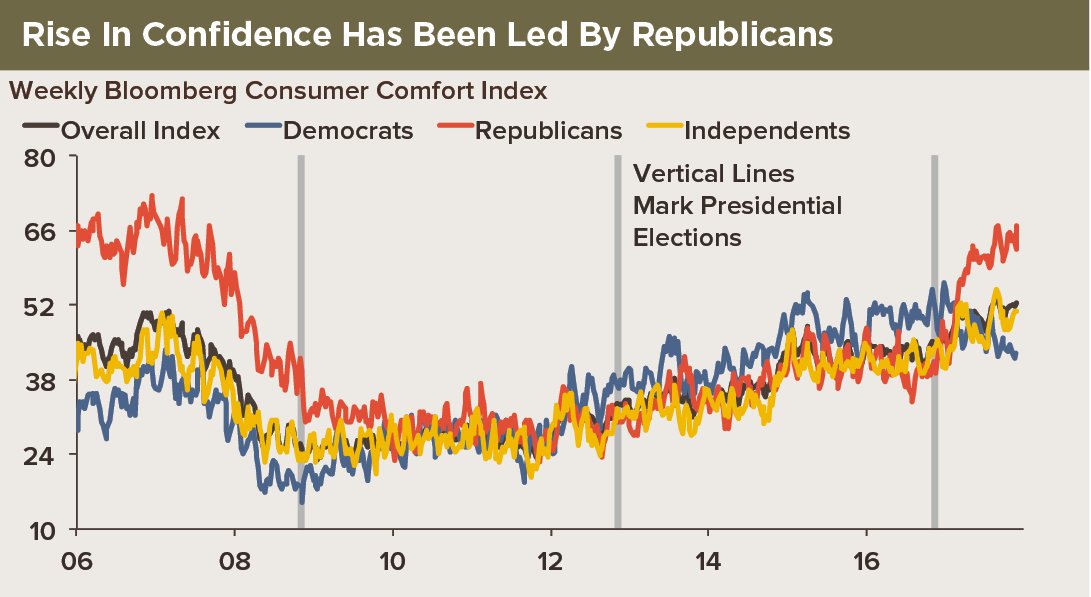

That's another thing I find worrying (did I mention we cashed out of this madness?), Bloomberg just broke down their Consumer Comfort Index and it turns out that the huge rise in Consumer Confidence is being driven ENTIRELY by Trump Fans, who buy into his "chicken in every pot" promises. They say you can't fool all of the people all of the time but you can certainly fool some of the people all of the time – and they are represented on this chart by the red line that says "Republicans":

These are, of course, the same people who were very over-confident in 2008, and they were SHOCKED when the economy fell apart because the Bush Tax Cuts didn't work. Now they are very excited about the Trump Tax Cuts and all-in on the markets while, as you can see – the Democrats, who tend to be students of history (or just students, for that matter) are getting worried.

Even our economic indicators are polarizing!

Have a great weekend,

– Phil