Who says you can't make money in this market?

Who says you can't make money in this market?

In yesterday's Live Trading Webinar we closed out the long Silver (/SI) trade we discussed in last week's Webinar, as well as last Thursday's PSW Report, where I said:

We actually picked up some Silver Futures (/SI) as they fell back to $15.85 and that's down $2.15 (12%) since September and our 5% Rule™ says that's a 10% drop with a 20% overshoot and, while that's no guarantee of a bottom (real support comes at $15.50) – it's worth a poke down here as we don't expect the Dollar to pop 94 very easily and Gold (/YG) is testing $1,250, which is good support on the yellow side.

Yesterday's Fed Statement sent both gold and silver flying higher (and BitCoin lower) and we took the money and ran live, during the Webinar with a $10,000 overall gain on 8 contracts that gained 0.25 each at $50 per penny, per contract (the day's gain is coming of a dip). It's not that we don't still like gold and silver – it's just that making $10,000 in a week is good money – so why risk a reversal? If they don't pull back to give us another entry, then we'll find something else to trade (and we identified several in yesterday's Webinar).

Yesterday's Fed Statement sent both gold and silver flying higher (and BitCoin lower) and we took the money and ran live, during the Webinar with a $10,000 overall gain on 8 contracts that gained 0.25 each at $50 per penny, per contract (the day's gain is coming of a dip). It's not that we don't still like gold and silver – it's just that making $10,000 in a week is good money – so why risk a reversal? If they don't pull back to give us another entry, then we'll find something else to trade (and we identified several in yesterday's Webinar).

The reason we're cautious today is the Dollar (/DX) is down at 93 and that's too low, especially with our Fed in a tighening cycle and already the BOE failed to match the raise and, if the ECB holds off on raising rates too, the Dollar will pop so, this morning, in our Live Member Chat Room, I said to our Members:

If ECB stays easy then Dollar likely to pop so I do like /DX long over 93 with tight stops below.

I think /CL can be played long over $56.50 with tight stops below and /RB over $1.65 with tight stops below now.

I like /NG at $2.66 but it doesn't like me!

Futures are fun to play when you are sitting with a ton of CASH!!! on the sidelines. We can jump in and out very quickly and take advantage of short-term moves. Dollar (/DX) contracts pay $100 on an 0.10 move and requre $1,980 in margin to trade and 93 is such a good stopping line that we can play 10 contracts for $19,800 in margin and, hopefully, the Dollar adds a point for $10,000 worth of gains for the day if the ECB also keeps their rates lower than ours. Making 50% in a day is a good way to keep up with the still running-away makets without all that messy owning stock, right?

It's all connected as the rising Dollar will push commodities (and the indexes) down a bit lower and that then gives us good entries on the commodities, which will begin to recover when the Dollar calms down. These are very predictable things and all we need to do is keep up with the news (rate decisions this week) and think about how it affects things and then we place our bets accordingly.

Another key to playing the Futures is to maintain positive risk/reward ratios. Playing the Dollar bullish at the 93 line with tight stops below risks $20-50 losses (per contract) while the upside, if we get lucky and pop over 94, can be thousands of Dollars. If 93 does fail, we wait for the Futures to pop back over or try again at 92, also with tight stops. We're not doing this in a vacuum, of course, we're primarily driven by the logic that, if the US is tightening and the EU and ECB are not – then the Dollar should rise in relative value – not at all complicated!

People should not fear Futures trading – it's a valuable tool in a trader's toolbox and that's why we teach it during our live Webinars. The reason we went long on oil and gasoline is because it's manipulated BS and tends to go up into every weekend to screw consumers at the pump – that's one of the most reliable recurring trades in the market! The only trick to that one is picking the bottom for the week, which usually comes either Wednesday or Thursday and we wisely waited yesterday for a better entry this morning.

Gasoline (/RB) contracts require $4,125 in margin and pay a whopping $420 per penny, per contract – not for the feint of heart. With oil, we have the Saudis backstopping us as we near $60 on Brent (/BZ), which is $54 on /CL because they have TRILLIONS of Dollars riding on their upcoming Aramco IPO and they will do ANYTHING to keep Brent over $60 ahead of that looming disaster. Why a looming disaster? Let's look at yesterday's EIA Report:

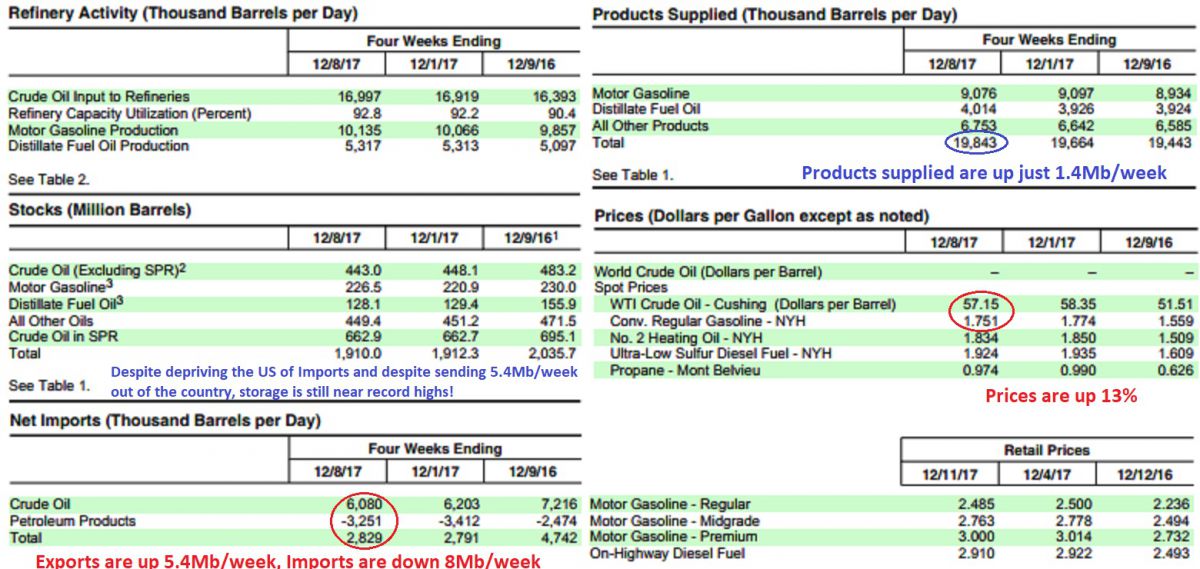

As you can see, the US refiners are not making more oil than they did last year – that's up just 1.4Mb/week but they are now shipping 5.4Mb/week MORE out of the country, a total of 22.757 MILLION Barrels of Petroleum Products are being shipped OUT of the US each week to other countries. That represents more than 1/2 the oil we import (42Mb/week). If it wasn't for Republicans changing the laws and removing the caps on exports – America would practically be energy independent now!

Even with this insane amount of product being shipped out of the country and even with the additional 8Mb/week decline in Imports, the US inventories are still essentially full, indicating that Americans have, in just one year, cut consumption by over 2Mb/day (10%). The games the oil industry is playing by exporting refined product makes it LOOK like America is steadily consuming oil and the same games are being played in Europe but the reality is the Obama-era fuel consumption laws are kicking in hard and it's making a dramatic difference in our demand for oil – especially the oil used for gasoline.

That's bad news for Aramco, which is priced based on the value of their oil reserves, which are expected to be pumped over the next 40 years. If the US is able to cut it's conumption by 10% in just one year and we're still very early in the electric conversion cycle – then what will happen to the value of all that oil Aramco has in the ground? This is no surprise to the Saudis – why else do you think they are trying to cash in now – before people realize how fast consumption rates are really declining in developed markets (and China and India won't help, as they are trying to go green).

So, long-term, we remain bearish on oil but short-term, we have our weekend pump jobs and we have the Saudis pulling out all the stops to manipulate the markets into their $2,000,000,000,000 IPO.