The final Q3 GDP Report is out this morning.

The final Q3 GDP Report is out this morning.

While the quarterly figure is supposed to come in at 3.3%, the first Q was only 1.2% and Q2 was 3.1% and that averages 2.53%, far, far below Trump's claim of 3% and, in order to hit 3% for the year, Q4 would have to jump to 4.5% – and that's not very likely at all. 2.5% GDP growth is better than last year's 1.5% average growth rate but far, far shy of 2015's 2.92% because, in reality, it's hard to grow an $18,570,000,000,000 economy 3%, which would be adding $557Bn.

$557Bn is the entire GDP of Argentina, the 21st ranked country by GDP. Saudi Arabia is 20th at $646Bn, which is 3.4% of our economy. Isreal's GDP is $318Bn, just 1.7% of our own so, essentially, the US builds an entire Israel and absorbs it into our economy every 6 months. Singapore is $296Bn, Ireland is $293Bn, Portugal $204Bn… you get the idea – $557Bn is a lot of money – and that's why people who tell you we're going to punch up to that level and beyond are full of crap and assume you have no idea how to do the math, so you'll swallow their crap and repeat it to other people as if it's a fact.

According to the Tax Policy Center's report on the Trump Tax Plan that just passed the House and Senate, we are growing something by 5% of our GDP but, unfortunately, it's the level of Debt to our GDP, which already stands at 108% with just over $20Tn in debt. Even at just 1.5%, our Government is spending $300Bn a year in interest on that debt but the Fed is raising rates at least 1% next year so that will add another $200Bn in interest payments, taking up 40% of our anticipated GDP growth.

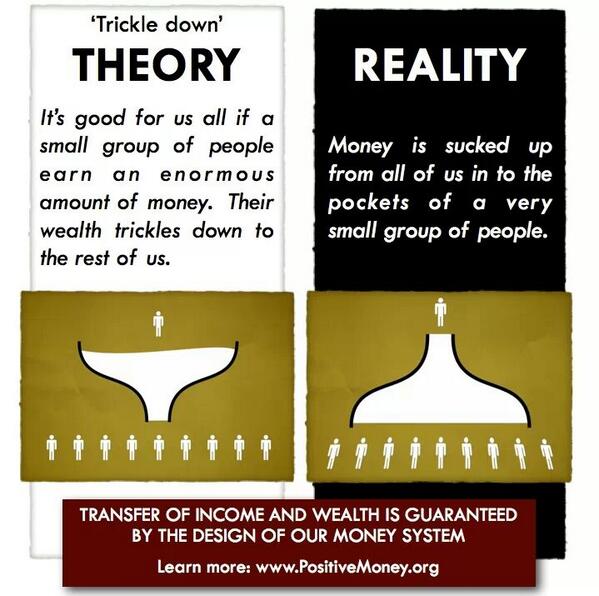

That can quickly get much, MUCH worse if inflation kicks up and people demand more for bonds to keep up or if the Dollar devalues if, for example, someone were to pass irresponsible tax legislation that gave huge tax breaks to the rich while doing nothing to improve the lives of 90% of the people who live in the country, which would leave little possibility for GDP growth unless, of course, the Top 10% turn around and give back all the money we're giving them by raising wages and building factories.

That's right, we're back to the Trickle Down joke theory and now we are depending on it to magically boost the economy enough to offset the enourmous tax giveaway Team Trump is passing. If it doesn't work, there is no plan B – there won't be enough money in the Treasury to fund stimulus and we're already $20Tn in debt (two Chinas!) and there are no countries on the planet big enough to bail us out if our economy begins to collapse – so we'd better hope Donald Trump is right and this is the way to go – because we're gone baby!

That's right, we're back to the Trickle Down joke theory and now we are depending on it to magically boost the economy enough to offset the enourmous tax giveaway Team Trump is passing. If it doesn't work, there is no plan B – there won't be enough money in the Treasury to fund stimulus and we're already $20Tn in debt (two Chinas!) and there are no countries on the planet big enough to bail us out if our economy begins to collapse – so we'd better hope Donald Trump is right and this is the way to go – because we're gone baby!

8:30 Update: GDP was a slight miss at 3.2% and that means we'll need 4.6% growth in Q4 to hit Trump's promised 3% for the year and, of course we believe whatever Trump says, he would not lie to us. Unfortunately, we're not seeing any evidence yet that growth accelerated 50% in Q4 but it's only December 21st – there's plenty of time to turn things around by the end of the year, right?

The Bank of Japan is not as enthusiastic about their own GDP but the World's 3rd largest economy whose main importer is the United States can't possibly be an indicator of our own economic health, let alone the World, right? This morning they decided to hold rates steady at -0.1% but, if you buy a 10-year note, you can still get 0.0%, so get them while they're hot! The BOJ will also continue to push 80,000,000,000,000 Yen into buying their own bonds at -0.1%, essentially flushing that money down the toilet while pretending their own 270% debt to GDP ratio is sustainable.

80Tn Yen is "only" $902Bn, not even a Trillion in annual stimulus for a $5Tn economy (and falling) – what could possibly go wrong? So far, in the Abe/Kuroda error, the Yen has plunged from 130 to the Dollar to 88.59 which means the buying power of the Japanese people has decreased by 32% over the past 4 years. The Dollar, over the same period, had gone up from an index value of 80 (against the global currency basket) to over 100 – which is up 25% but, since the Trump error began, we've given back 10% so 2.5% GDP growth but the buying power of every Dollar you've saved over your entire life has fallen 10% at the same time. Smoke and mirrors, baby!

So the S&P 500 is up 28% since the election but the Dollars it's priced in have dropped 10% so really we're only up 18% in steady money returns and, as I pointed out last week, the S&P 500 priced in BitCoins has crashed 94.8% since the election so, if the BitCoin Rally is here to stay, all these silly stocks are effectively worthless as BitCoin traders see them as having no value at all. Will the market find a floor at 0.15 BitCoins (down from 3) or will we keep gapping lower. As with Trump's "truths" – you can't have it both ways:

Meanwhile, we do our best to scratch out some profits in this crazy market. Yesterday we had our Live Trading Webinar and we had about $300 worth of winning Futures trades during the session but we left with 2 short Oil (/CL) Futures and we just cashed those in for an $800 gain for the Day and we're still short 2 Gasoline (/RB) Futures and long 2 Natural Gas (/NG) contracts – so we'll see how things pan out. Congratulations to all of our Members who played along.

Meanwhile, we do our best to scratch out some profits in this crazy market. Yesterday we had our Live Trading Webinar and we had about $300 worth of winning Futures trades during the session but we left with 2 short Oil (/CL) Futures and we just cashed those in for an $800 gain for the Day and we're still short 2 Gasoline (/RB) Futures and long 2 Natural Gas (/NG) contracts – so we'll see how things pan out. Congratulations to all of our Members who played along.

You can see the replay of the Webinar HERE and we had lots of fun discussions with plenty of actionable trades. Sitting in CASH!!! is very exciting as we have nothing but opportunites in front of us and we're able to pick and choose our spots.

One spot we chose not to pick was Bed Bath and Beyond (BBBY), who I said I liked but I hoped they would miss earnings and disappoint so we could initiate a trade at a cheaper price. Well they did miss and now they are down 12.5% at $21.50, which brings their market cap down to $3Bn DESPITE earning 0.44 per share (vs 0.36 expected) or $63M on $3Bn in revenues. Q4 is half the year for BBBY so 3 x $60M is $180M + another $180M is a super-conservative $360M with a p/e of less than 10 so the sell-off is ridiculous and we would love to add a trade here (though we're not rushing in in case they get cheaper). At the moment I like:

- Sell 10 BBBY 2020 $20 puts for $3.60 ($3,600)

- Buy 15 BBBY 2020 $15 calls for $9.50 ($14,250)

- Sell 15 BBBY 2020 $22.50 calls for $4.50 ($6,750)

That works out to net $3,900 on the $11,250 spread so the upside potential at $22.50 is $7,350 (188%) if BBBY manages to get back over $22.50 in two years. The ordinary margin on the short puts is just $1,783, so it's a super-efficient trade and your worst case is owning 1,000 shares of BBBY at net $23.90, so it's an aggressive trade as the stock is cheaper than that now but we feel it's a great value here BUT, keep in mind we think it will go a bit lower, maybe test $20 so we're probably only going to buy 1/3 now and see what happpens.

Another huge sale is being throwin on GNC Holdings (GNC), who are handing out 14.6M shares of stock to holders of $99M worth of debt. That values the stock at $6.78 but it dilutes current shareholders by 21%, so the stock is dropping 21% but I like paying off debt with stock instead of cash so the 20% drop in the stock, to $3.95, is a great buying opportunity. In fact, you can still sell the 2020 $5 calls for $2 so, here's the play:

- Buy 3,000 shares of GNC for $3.95 ($11,850)

- Sell 30 2020 $5 calls for $2 ($6,000)

- Sell 30 2020 $2 puts for $1.20 ($3,600)

Here your net is $2,250 for 3,000 shares so 0.75/share and that means you would make $12,750 (566%) if called away at $5 in Jan, 2020. Worst case is 3,000 more shares are assigned to you at $2 and then you average $1.375 per share ($8,250). Risking $8,250 to make $12,750 is a pretty good risk/reward ratio and it's the kind of play you can make in an IRA, since the puts have such a low strike ($6,000 even at 100% margin). As with BBY, it's a bit of a falling knife so these are just outlines for trades – we hope to get better prices as they bottom out.