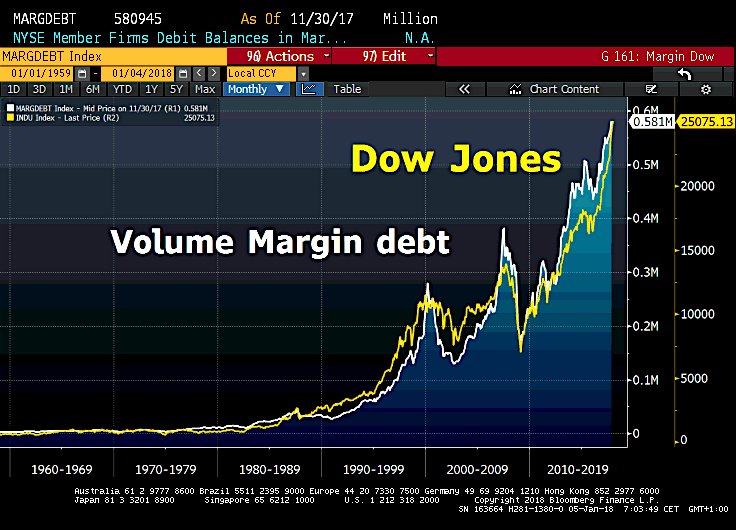

As crazy as it all seems, the makets COULD go up another 20% and there are about 200 trading days for the Dow to gain 5,000 points so 25 points a day would seem calm compared to what the markets are adding this week. Keep in mind how silly this is as it's a $100 TRILLION Global Stock Market and when we have these 1% gains across the board, we're adding $1Tn of "value" in a single day against an $85Tn Global GDP that's growing, at best, 4% for the year ($3.5Tn).

That, in a nutshell, is what's wrong with the World now – we value Coprorations more than we value Governments and Coporations and their Top 1% owners are slowly but surely taking control of our Governments, turning us into a Global Oligopoly in which people don't matter.

Oddly enough, the people love it, though. Especially the Top 10% of the people, who buy stocks, as they seem content to let the Billionaire Class lead us into the land promised by Ayn Rand 60 years ago, one in which "rational self-interest" was promoted and became a magnet for wealthy baby-boomers who wanted to alleviate the guilt they felt in a nation that was, at the same time, fighting a war on poverty and promoting equality for all.

Rand called her philosophy "Objectivism", describing its essence as "the concept of man as a heroic being, with his own happiness as the moral purpose of his life, with productive achievement as his noblest activity, and reason as his only absolute." She supported philosophical realism, and opposed anything she regarded as mysticism or supernaturalism, including all forms of religion, referring to "the virtue of selfishness" in her book of that title, condemning ethical altruism as incompatible with the requirements of human life and happiness and she considered laissez-faire capitalism the only moral social system because in her view it was the only system based on the protection of the rights of the job-creating class.

Does that sound like any Presidents you know? It absolutely sounds like House Speaker Paul Ryan, who makes all his interns read "Atlas Shrugged" and gives out the book for Christmas presents. Slowly but surely, the Oligopoly is taking over the country and America is being run for the interest of the Corporations. In fact, we just gave them Trillions of Dollars in tax relief and had to cut Trillions of Dollars of Social Spending (taking care of humans) to do it – and half the people in this country think that's just great.

Does that sound like any Presidents you know? It absolutely sounds like House Speaker Paul Ryan, who makes all his interns read "Atlas Shrugged" and gives out the book for Christmas presents. Slowly but surely, the Oligopoly is taking over the country and America is being run for the interest of the Corporations. In fact, we just gave them Trillions of Dollars in tax relief and had to cut Trillions of Dollars of Social Spending (taking care of humans) to do it – and half the people in this country think that's just great.

Do they not know they are people? It's hard to say. As George Carlin pointed out "Think about how dumb the average American is and then consider that half of them are dumber than that!" Sometimes, however, when you have a low average, the fault lies with the top not pulling their weight and I have to wonder about the math skills of an investing class that thinks it makes sense to raise the value of Corporations by 50% in two years in an economy that will grow 8% at best. Would you give employees a 50% raise for an 8% increase in output? Of course not, you would destroy your company if you did that. Well, take that obvious concept and replace the word "company" for the word "country" and give it the weekend to hopefully sink in…

Meanwhile, we've done some buying this week and this morning's pump up in the Futures is a good time to pick up some hedges. For starters, we just got a disappointing jobs report, with just 146,000 jobs created in December vs 195,000 expected but Unemployment heald steady at 4.1% and Hourly Earnings were up 0.3%, warming up from 0.2% and, next month, higher minimum wages kick in so this number does nothing to take the Fed off the table.

The Fed will meet Feb 1st, March 15th, May 3rd and June 14th for the first half of the year and it seems they are intent on hiking rates twice during that time. If the markets are still this high at the end of the month, it would be a wasted opportunity not to hike then, especially as they have a chance to adjust their language 6 weeks later if they don't like the result.

The Fed will meet Feb 1st, March 15th, May 3rd and June 14th for the first half of the year and it seems they are intent on hiking rates twice during that time. If the markets are still this high at the end of the month, it would be a wasted opportunity not to hike then, especially as they have a chance to adjust their language 6 weeks later if they don't like the result.

Meanwhile, we still expect a 10% correction as people take some profits off the table in our lower-tax environment and we're still thinking that Q4 earnings and 2018 guidance are going to be disappointing to investors – especially for companies who will be repatriating those overseas profits and paying one-time tax bills (good buying opportunities if they sell off on that news, however).

This morning we have an opportunity to short the indexes at 1,560 on the Russell (/TF), 25,150 on the Dow (/YM), 6,625 on the Nasdaq (/NQ) and 2,733 on the S&P 500 (/ES) and the easiest way to play it is to wait for 3 to cross below the line and then short the laggard and then stop out if ANY of them cross back over. That should keep your losses very small but places no limit on your upside. I'm favoring the Nasdaq shorts myself at the moment.

That's fine for day-trading but, for portfolio protection, we prefer using the Ultra ETFs as hedges. The new stocks we've been adding to our portfolio have, so far, been staying away from tech – as none of them are cheap, so there's not too much sense in shorting the Nasdaq as a hedge. We have been, however, picking up some small-cap bargains so the Russell makes a good vehicle to trade against and (TZA) is the 3x Ultra-Short of the Russell. In our Options Opportunity Portfolio (OOP), we can add the following trade:

- Buy 50 TZA April $11 calls for $1.40 ($7,000)

- Sell 50 TZA April $15 calls for 0.40 ($2,000)

- Sell 5 AAPL 2020 $145 puts for $10.50 ($5,250)

That's a net credit of $250 on the $20,000 spread so our upside potential is $20,250, which is plenty of protection as we don't have that many posititions yet. The margin requirement for the Apple (AAPL) puts is $5,000 and you can substitute any stock you REALLY want to own at a discount and we know we'd love to add AAPL if they ever go on sale.

For this trade to pay off TZA has to go up $3.19, which is 27% and it's a 3x ETF so we're playing for a 9% drop in the Russell from 1,560 to 1,420 – that's the range we're expecting. Of coruse, if the Russell never falls, then probably Apple never falls an our insurance play doesn't cost us anything and we'll adjust the trade along the way to extend the time if we need to. For now, though, we'll sleep much better this weekend knowing we protected the portfolio.

If all goes well, we'll get some profit-taking into the weekend and pick up a nice chunk of change on our index shorts but, if not, then we will be adding a lot of additional trades to our Watch List for next week!

Have a great weekend,

– Phil