It's been a busy weekend.

It's been a busy weekend.

Last Wednesday, we put up our Watch List for 2018 and we had about a dozen trade ideas, right off the bat, that we were adding to our Long-Term Portfolio and Options Opportunity Portfolio. Over the weekend, we've added 10 more actionable trade ideas for the OOP and LTP – so don't complain there's nothing to buy in this toppy market – we even had a nice hedging play for you on Friday. While we're still expecting a correction – it's likely to be just another buying opportunity in a generally bullish market.

Considering how sure I am that we're going to have a 10% correction this quarter, I was actually surprised at how many stocks there are trading for good prices. Granted, I was looking at thousdands of stocks and found only dozens to buy – but I thought we'd find far fewer than that. I suppose it's because the rally has been fairly narrow in scope – leaving many good stocks behind in favor of chasing the popular stocks to new highs.

It's still too scary to short things, which is a shame – because there are so many things that are tempting to short like Tesla (TSLA) at $316 (always a good short), Amazon (AMZN) at $1,230 ($600Bn!), Netflix (NFLX) at $210 and whatever Uber is currently trading for! We'll get AMZN's numbers at the end of the month but, last I heard, they should be about $60Bn in sales and $1Bn in profit for the quarter, which will put them up around $2Bn for the year or less than $5 per $1,230 share so it will only take AMZN 246 years to pay back investors at that pace.

The investing premise on AMZN is, of course, that they will grow into their valuation but then their valuation jumps was faster than their growth – up 50% in 2017, in fact – yet people just keep snapping it up – with half of that growth coming since October.

How will Amazon justify a $600Bn valuation? It's earning $2Bn now and it's selling about $180Bn a year worth of stuff while WalMart (WMT) sells $500Bn so let's say AMZN gets as big as WMT and controls 10% of all Retail in the US – that sill doesn't get their p/e below 100x earnings. To get to where they are prices, Amazon has to take over half of all retail in the US and, if they did that, the US economy would collapse so it's logically impossible to assume AMZN will grow into it's valuation AND the market doesn't collpase.

There's a lot of that kind of wrong-way thinking in current stock valuations – much like there was in the Dot Com Bubble days, when "traditional" brick and mortar stores were first forecast to bite the dust. Amazon is one of the only survivors from the Dot Com Bubble, but that was 20 years ago and, in all that time, with all those advantages, they've only gotten to $180Bn in sales out of $5Bn in US Retail, which is 3.6%. 3.6% isn't bad but, at this point, I think everyone has heard of AMZN and knows what they can do yet 96.4% of the shoppers mysteriously choose not to use them.

I have the same problem with NetFlix (NFLX), who are "valued" at $90Bn at $210/share and that's 25% higher than Time-Warner (TWX) at $93.60 ($73Bn) (which is interesting as T has offered $85Bn for them) and they've been around since 1985 with HBO, Cinemax, Warner Bros Films, CNN, TBS, TNT, etc. and have 49M US subscribers and antoher 80M around the World while NFLX claims to have 100M subscribers yet, strangely, NFLX only generates $10Bn in revenues and $400M in profits while TWX generates $30Bn in revenues and $4Bn in proifts.

I have the same problem with NetFlix (NFLX), who are "valued" at $90Bn at $210/share and that's 25% higher than Time-Warner (TWX) at $93.60 ($73Bn) (which is interesting as T has offered $85Bn for them) and they've been around since 1985 with HBO, Cinemax, Warner Bros Films, CNN, TBS, TNT, etc. and have 49M US subscribers and antoher 80M around the World while NFLX claims to have 100M subscribers yet, strangely, NFLX only generates $10Bn in revenues and $400M in profits while TWX generates $30Bn in revenues and $4Bn in proifts.

Yet no analysts question what constitutes a "subscriber" for NFLX or why there's a 10x discrepency in profits per subscriber. In fact, they happily treat one subscriber as good as another and even "value" NFLX higher than TWX, though you don't see people offering NFLX $85Bn in cash for their business. That's because it's a BS model that is 50-75% smoke and mirrors and, much like it was during the mortgage bubble – a lot of these valuations for high-flying momentum stocks can collapse in on themselves very quickly – and that is how our market bubble is likely to collapse.

Obviously, a lot of investors are expecting lower taxes to bring about MASSIVELY better returns but, as we reviewed in early December, those investors are likely to be disappointed by the actual difference since most companies pay nowhere near the top tax rates in the first place. We're reserving our final judgement until we get the earnings reports over the next 45 days, beginning this week with Friday's Big Bank reports along with a few interesting plays along the way:

Most of the banks are up about 20% for the year and Wells Fargo (WFC) even shook off the fake account scandal and is now trading at $62.75 or about 16 times forward earnings. Banks generally carry low p/e ratios because, sometimes, things go wrong and they lose money but that doesn't seem to apply anymore and bank p/es are drifting towards the 20s – as if there's nothing at all to ever worry about – just 10 years after it was PROVEN there's lots to be worried about!

As a banking hedge, I love the ultra-short banking ETF (FAZ), which is way down at $11.27 and we can play for an earnings failure with a simple spread that carries no margin and no net premium. So, if we want to turn $500 into $1,000, we can play the following:

- Buy 5 FAZ March $10 calls for $1.35 ($675)

- Sell 5 FAZ March $12 calls for $0.40 ($200)

The net on that spread is actually $475 and it pays $1,000 if FAZ is over $12 at March expirations (16th) and, since FAZ is a 3x ultra-short ETF, it won't take much of a move down in the Financials, for it to pop the 6.5% we need to get over $12. So that will give us something fun to watch into Friday and we'll see how it goes for our first earnings play of the season.

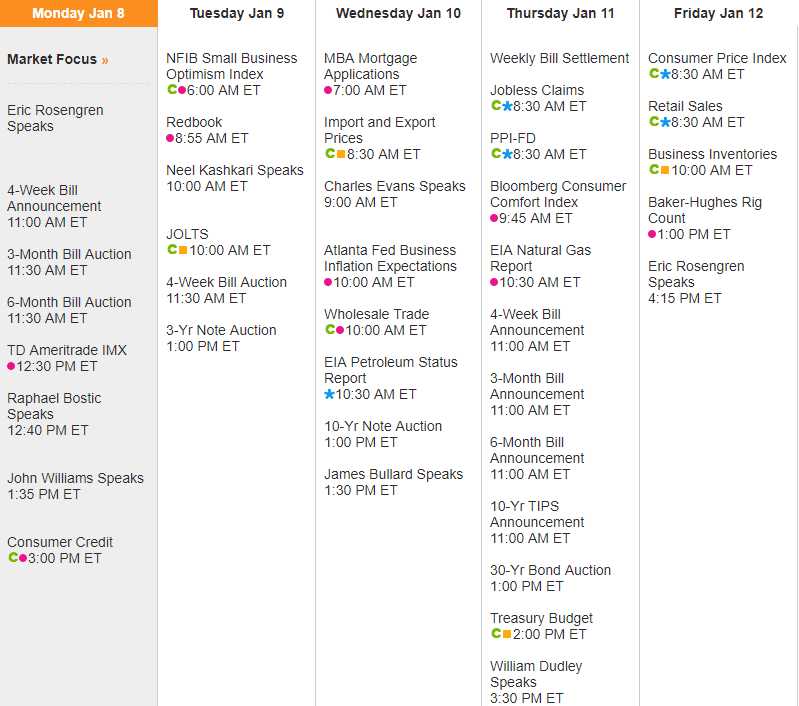

Meanwhile, it's a slow data week highlighted by Retail Sales on Friday but little else so, before earnings are out, we'll get a sense of whether or not the markets can gain any more ground without a catalyst to drive them (other than Fed speakers, of course).