Wheeeee!

Wheeeee!

Finally a nice little dip and we nailed it yesterday as I said to our Members at 3:08pm in our Live Chat Room:

- /NKD down 125 today but the US indexes could care less.

- /YM 25,400 is a fun short with tight stops above.

- /ES 2,760 finally got a reject

- /NQ 6,700 finally caused a pause – also a good shorting line

- /TF 1,565 is good to play for the cross below

- DAX 13,400 is a good check line too

- Check out the 5-year charts. There are 30 year-old traders with 5 years' experience who have no idea whatsoever that markets can go down. ?

I put out an Alert to our Members at 6:06 am (and tweeted it too) calling for profit taking on the dip, saying:

I'm taking the money and running here, /NQ was my play and now testing S2 at 6,644 and my fresh horse is now /TF below 1,550 (but I doubt it) with /YM at 25,235 and /ES at 2,738. If anything, I'd play long for the bounce here but huge winner ($11K) so I'm just happy to watch for now.

Seems like we're only selling off because the Dollar dove and took /NKD down 250 and our indexes followed it lower – otherwise I'd be more inclined to stick with it.

/RB is still a good short at $1.85, of course, with tight stops above.

So far (8am), all we've had are very weak bounces so we'll short again when those lines cross back below, shorting the laggard after at least 2 of them cross with very tight stops above, of course. It would be a real sign of weakness if we fail those levels and we do have our SQQQ hedges to carry us through – in case of a real disaster.

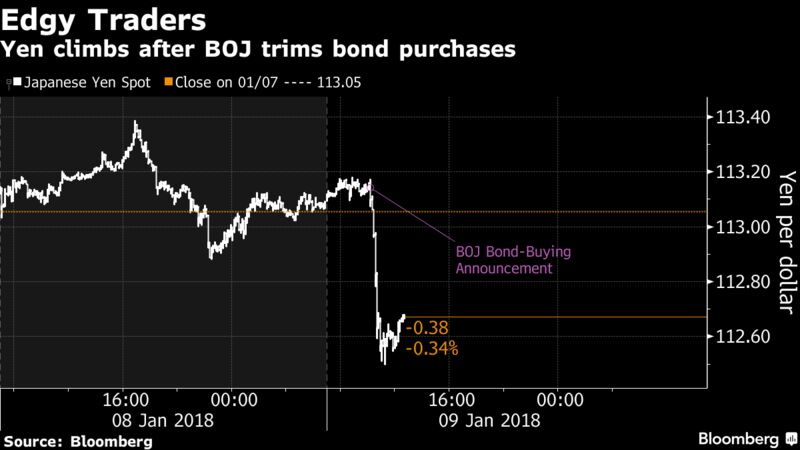

This market dip was caused this morning by China's announcement that it is ready to "slow or halt" US Treasury purchases and that sent the Dollar diving – especially as the Bank of Japan had already announced it too was trimming its purchases of long-dated bonds. “If the [largest] foreign holder of U.S. Treasuries were to suddenly stop, that would cause a problem,” understated MUFG chief macro strategist Derek Halpenny. “The dollar needs to weaken to a level that attracts buyers back to the U.S.”

Even more of a danger to stock indexes would be rising bond rates and the 30-year notes have already jumped 4% in the past 30 days to 2.8%, a critical juncture as that puts it above the dividend rate of the S&P 500 and, since bonds are "safe", it makes for a compelling argument for some investors to begin cashing in their outsized market gains and putting the money away into inflation-beating (per the Fed) bonds for long-term security.

We have a $20Bn, 10-year note auction today at 1pm and we'll see if anyone shows up for that but, without China and Japan buying our bonds and the Fed curtailing their own bond buying – what will the real rate need to be? Especially with the Dollar's sudden weakness making the need for interest protection that much greater. Over the next two weeks, there's a looming glut of bond supply from the U.S., the U.K., Japan and Germany – things are getting interesting indeed!

We have a $20Bn, 10-year note auction today at 1pm and we'll see if anyone shows up for that but, without China and Japan buying our bonds and the Fed curtailing their own bond buying – what will the real rate need to be? Especially with the Dollar's sudden weakness making the need for interest protection that much greater. Over the next two weeks, there's a looming glut of bond supply from the U.S., the U.K., Japan and Germany – things are getting interesting indeed!

Not only are bond returns getting more attractive but Credit Default Swaps, which are used to protect the bonds, are also trading at decade lows, making it even more attractive to move money into bonds in Q1. What will the market be able to offer investors to compare to a risk-free 2.8% annual return? At these prices? This is why we're still mainly in CASH!!! ahead of Q4 earnings and 2018 guidance – we're not so sure the market can justify these levels anymore.

Meanwhile, we can amuse ourselves with our Futures plays. We hit our $1.85 shorting goal on Gasoline (/RB) this morning and we're waiting to see what kind of bounces we get on the indexes to hopefully re-short those. As noted above, they can cross our lines and then we can short or we can play the bounce lines using our fabulous 5% Rule™ which tells us the Dow, for example, fell from 25,400 to 25,225, which is 175 points so a 20% weak bounce would be 35 points, to 25,260 and let's call 25,300 the strong bounce line, where we'd like to poke short again (with very tight stops above).

On the Nasdaq (/NQ) the drop was 6,700 (ignoring spikes) to 6,650 is 50 points so 10-point bounces are 6,660 (very satanic) and 6,670 and remember, weak bounce failures are a sign of — weakness!

S&P (/ES) 2,760 to 2,740 is just a 20-point drop and you'd think 4-point bounces to 2,744 and 2,748 would not be a problem but I see 2,744 failing already.

The Russell (/TF) is always fun to play as it's so volatile and I'd have to call this 1,565 back to 1,550 which gives us 3-point bounces to 1,553 and 1,556 and the RUT is testing that strong bounce line – so that will be our leading indicator this morning.

So the RUT is my favorite short at the moment, at 1,556 with very tight stops above that line and, if we get a real strong bounce on all our indexes – THEN we can do a little dip buying but the macros (bonds, Central Bank tapers) aren't suddenly going to go away later this morning – this is the new market reality and what we're going to see is whether or not the market responds to reality. That, in itself, would be a good clue for how to play it.

Meanwhile, Crypto mania continues at Kodak (KODK) of all things announced they will be doing an ICO (Initial Coin Offering) and the stock doubled yesterday and is doubling again this morning because – Crypto!

We're going to like KODK short here ($12), probably playing the July $7.50 puts for 0.50 or less as a fun play. Actually Kodak has a good idea to actually use blockchain to tag images and track ownership rights of photos, which will make it much easier to pay photographers for using their materials without going through middlemen.

On the other hand, now Movie Pass parent Matheson Analytics (HMNY) has jumped in on the game and they are announcing a possible ICO but they are vague about the details so it's probably total BS and only good for a 50% gain. And THAT, my friends, is how the Nasdaq is sailing to record highs for no reason whatsoever. This is exactly what happened in 1999, when every company just slapped a .com at the end of their name to attract investors and money poured into the Nasdaq, driving up all the prices until the whole thing collapsed under its own weight.

In fact, Warren Buffett was just on CNBC this morning, saying: "I would buy a 5-year put on every cryptocurrency." Them's fighting words!

This is all very silly and we are still mainly on the sidelines into earnings. Join us today for our Live Trading Webinar (1pm, EST) and we'll look over our new Watch List and, of course, check in on our Futures trades.