Wheeee!

Wheeee!

Yesterday sure was fun. The Dow Futures (/YM) blasted up to 26,050 at 10am and then, by 3pm, it was back at 25,700, down 350 points (1.34%) in 5 hours. But don't worry, we recovered 100 into the close and now we just tested 26,000 again, which is a good shorting line with tight stops above since yesterday's 300-point drop was good for gains of $1,500 per contract for the shorts.

In our Live Member Chat Room, we stuck with the Russell Futures (/TF) shorts at 1,600 and those fell all the way to 1,575 for gains of $1,250 per contract and we added longs on the Dollar (/DX) at 90 and Coffee (/KC) at $120 while, of course, taking the $1,000 gain on /RB and running – the same short at $1.85 we played all last week in our morning Reports (you're welcome!).

We still like the Russell for a hedge into earnings and, in the Live Member Chat Room, we chose the following hedge at 11:25, just in time for the massive 100-point drop in the Russell but we're back to 1,585, so you can still make the hedge on the Ultra-Short ETF (TZA) as follows:

- Sell 30 TZA 2020 $10 puts for $2.50 ($7,500)

- Buy 40 TZA July $10 calls for $1.80 ($7,200)

- Sell 40 TZA July $15 calls for 0.60 ($2,400)

That gives you a net credit of $2,700 and a $20,000 upside on the July spread if TZA pops from $11.40 to $15 (31%) and, since it's a 3x short ETF, that would mean the Russell would have to drop about 10%, back to 1,425, which doesn't seem like much of a stretch after yesterday's quick plunge. If the Russell doesn't fall, then we take the remaining $2,700 and invest it in rolling the long July calls to something lower in January and then cover with short Jan calls and then we have a full year of insurance in exchange for our promise to buy 3,000 shares of TZA for $10. The idea, of course, is that our longs make much more money than our TZA shares would lose – hedges are all about balance.

We already have a TZA hedge in our Options Opportunity Portfolio but there we picked up 50 of the April $11/15 bull call spreads for $4,500, which also pays $20,000 back so it's $15,500 of "term insurance", withouth the obligation to buy the ETF. So far, since 1/5, we've lost $500 on the spread but our portfolio is up $5,000 – which is what I mean by balance – the hedge is simply insurance that protects the longs in case of a tragedy but, if there is no tragedy, then our system of "Being the House" assures us we'll make more than enough money to cover it.

We already have a TZA hedge in our Options Opportunity Portfolio but there we picked up 50 of the April $11/15 bull call spreads for $4,500, which also pays $20,000 back so it's $15,500 of "term insurance", withouth the obligation to buy the ETF. So far, since 1/5, we've lost $500 on the spread but our portfolio is up $5,000 – which is what I mean by balance – the hedge is simply insurance that protects the longs in case of a tragedy but, if there is no tragedy, then our system of "Being the House" assures us we'll make more than enough money to cover it.

We also sent out a Top Trade Alert at 2:47pm on a bullish trade that was added to the OOP on H&R Block (HRB) as they announced deal with WalMart (WMT) to be their exclusive provider of tax software but the key to the deal is HRB's ability to upsell WalMart shoppers on their services. We like HRB whenever they are low in the channel and particularly into tax season (when people start thinking about them again) so our play for the Options Opportunity Portfolio was:

- Sell 5 2020 $25 puts for $4 ($2,000)

- Buy 10 2019 $22 calls for $6.20 ($6,200)

- Sell 10 2019 $27 calls for $3.40 ($3,400)

That's net $800 on the $5,000 spread that's almost entirely in the money already. If HRB squeaks up from here, we make $4,200 (525%) but we will still have the open short puts for another year but, again, I'm very happy to own HRB at $25.

Today Ford (F) is selling off and we already put up a trade idea for them last week and we'll look for an opportunity to make a cheap entry in our portfolios if we get a good pullback this week. F made the Watch List but, at $13+ we were waiting for a chance to come in at a lower price (closer to $12) – especially so we can get a good price selling puts in what is likely to be a covered stock play to capture the lovely 0.60 dividend. We'll take a close look at this one in this afternoons Live Trading Webinar (1pm, EST).

With a dividend-payer like F, we have very long-term plans and our allocation blocks in the $100,000 OOP are $20,000 each (10 blocks with 2x margin) so, initially, we wouldn't want to own more than $10,000 worth and maybe double down later so we could buy, for example, 1,000 shares of F at $12.50 ($12,500) and sell 10 of the 2020 $10 calls for $3 ($3,000) and 10 of the 2020 $10 puts for $1 ($1,000) and that nets us into 1,000 shares for $8,500 ($8.50/share) with a promise to buy 1,000 more at $10, which requires a negligible $624 in margin.

So, cash and margin we're in 1,000 shares of Ford for $9,124, which is $9.124 per share and, assuming the dividend stays at 0.60, we'll pick up another $1.20 in dividends between now and Jan 2020, which will drop our net to $7.924 and either F is under $10 and we're assigned another 1,000 shares – in which case we'd just sell calls again and lower our basis – or it's over $10 and we get called away with a 25% profit or we roll the short calls out 2 years and sell more puts.

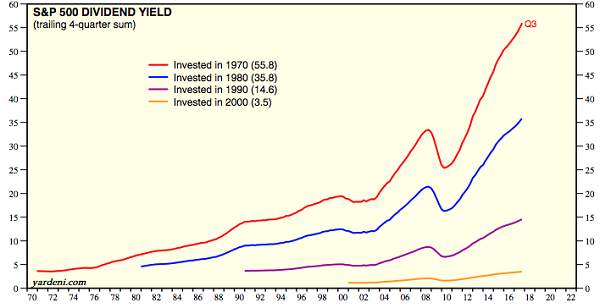

Starting with a $12.50 stocks we drop our basis to $7.924 in two years so we can figure in 6 years we can whittle that basis down to zero if all goes well, getting 100% of our cash back to buy other stocks with while still owning 1,000 shares of Ford and still collecting those dividends. I know it's a dull, tedious strategy but it's very effective over time:

Starting with a $12.50 stocks we drop our basis to $7.924 in two years so we can figure in 6 years we can whittle that basis down to zero if all goes well, getting 100% of our cash back to buy other stocks with while still owning 1,000 shares of Ford and still collecting those dividends. I know it's a dull, tedious strategy but it's very effective over time:

- We start the trade by using $9,124 in cash margin for 1,000 shares of F

- After 2 years, we've collected $1,200 in dividends, dropping our cost to $7,924.

- In Jan 2020, we sell another $3,000 (conservatively) of puts and calls and drop the basis to $4,924

- After 2 years, we collect another $1,200 in dividends, dropping our cost to $3,724

- In Jan 2022, we sell another $3,000 of puts and calls and drop the basis to $724

- After 2 years, we collect another $1,200 in dividends and have a $476 in cash and 1,000 shares of F

That's when it gets interesting because now we have ALL of the original $9,124 in cash and margin back and a margin credit on our unencumbered 1,000 shares of F, hopefully at least $15,000 worth. We can still sell puts but we don't have to and we can just sell $2,000 worth of calls every 2 years along with $2,000 worth of dividends means now we're collecting $2,000/year back on stock that cost us net $0.

Imagine we did that with just 5 stocks in 2018 for about $50,000 in a $100,000 portfolio and now it's 2024 and we have $60,000 worth of stocks and $100,000 in cash and then we start the cycle again but now we're collecting $10,000/yr from the $60,000 in stocks AND we're working our basis down on the next set so, in 2030, we'll have $120,000 worth of stock and $50,000 in "dividends" (call sales + dividends) and $100,000 in cash = $150,000 in cash with $540,000 worth of buying power (at 2x margin).

At this point, we are collecting $20,000/yr in "dividends" from our stocks and we can double up on our sales cycle and, in 2036 we'll have our $100,000 back and now we have $240,000 in stocks (and we're not even assuming they gain value) and we're collecting $40,000 a year in dividends and we have $250,000 in cash so now our buying power is $1M and we can go to 4x, buying 20 dividend stocks at a time and still using only 1/2 of our buying power.

At this point, we are collecting $20,000/yr in "dividends" from our stocks and we can double up on our sales cycle and, in 2036 we'll have our $100,000 back and now we have $240,000 in stocks (and we're not even assuming they gain value) and we're collecting $40,000 a year in dividends and we have $250,000 in cash so now our buying power is $1M and we can go to 4x, buying 20 dividend stocks at a time and still using only 1/2 of our buying power.

By 2040, we actually have $1M in stocks and cash and our "dividends" are now $80,000 a year. I'm 55 and in 2040 I'll be 77 so if I have $100,000 to invest now, I'll be getting 80% of that money, EVERY YEAR, in dividends alone while still building on my $1M asset pile in 2040. That's not boring at all, is it? Not only that but, historically, dividend-paying stocks tend to keep up with inflation so it will be an inflation-adjusted $80,000/yr to splurge on early-bird specials.

It's a boring, tedious way to make money but it's also very effective and one of the key tools we like to put in our Members' belts at PSW. Throughout earnings season, we'll be looking for solid dividend-paying companies that are beaten down and fit our 6-year profile for rolling over because, with that plan, anyone who is 20 years from retirement can put one year's salary into a portfolio and have a very good chance of locking in their salary for life going forward. That's what intelligent investing is all about!

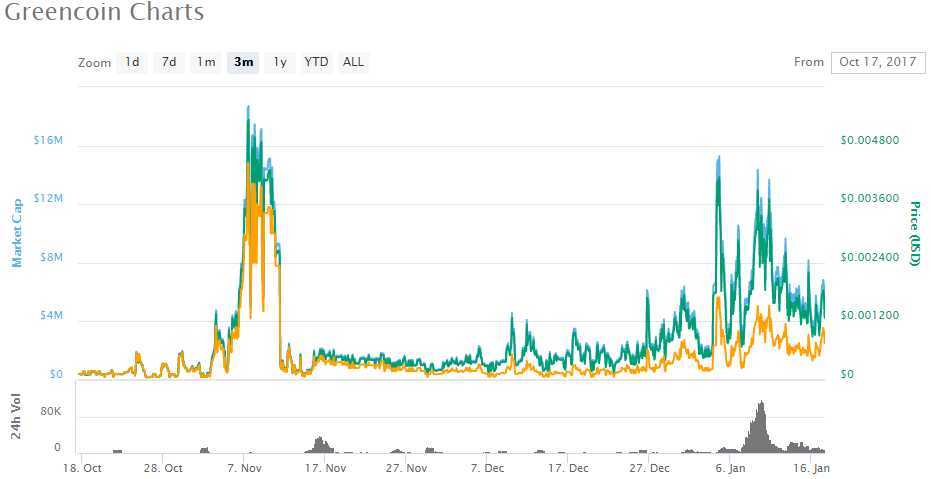

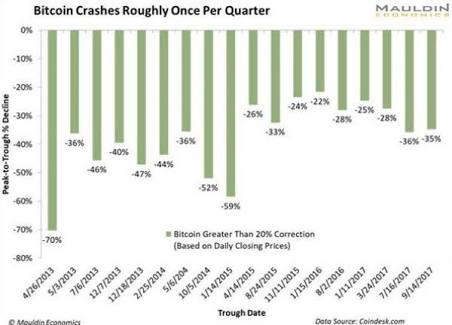

Meanwhile, we'll see if the market is going to spring back from yesterday's pullback but it was a low-volume affair and not much of a sign of anything. BitCoin is crashing down to $10,000 this morning so we're thrilled that we cashed out $10,000 ago and we're not interested in getting back in until it's $1,000 but our GreenCoins (GRE) are holding up very well (surprisingly), still at 0.001370 this morning, though well off the highs but still 5x where we talked about them in early December (the green is the price in Dollars, the yellow is the price in BitCoins).

Our buy-in for GRE remains 0.00022 but we may never see that again while 0.0036 is still a good spot to take profits. GreenCoin is a decade behind BitCoin so we have to be patient – we're not going to make 1,000x overnight and we take 10% off the table whenever we make 10x so, like our dividend-payers, we have our original investment back in our pocket to pursue other opportunities while letting 90% of our original money to keep going for as long as it wants to.

With BitCoin, we came in at $600 and sold the last of ours at $18,500 but let's say we began with 10 at $100 and followed that rule of thumb. We would have spent $1,000 in 10 and then cashed one for $1,000 and another at $10,000 and another at $20,000 and then, hopefully, we would have cashed at least 2 of the 7 left between $20,000 and $10,000 so let's say an average of $15,000. That would leave us with 5 BitCoins and $61,000 in cash from our $1,000 investment and the 5 coins are worth (for now) $10,000 so $111,000 total is more than 1/2 the most we could have possibly made if we timed it perfectly.

With BitCoin, we came in at $600 and sold the last of ours at $18,500 but let's say we began with 10 at $100 and followed that rule of thumb. We would have spent $1,000 in 10 and then cashed one for $1,000 and another at $10,000 and another at $20,000 and then, hopefully, we would have cashed at least 2 of the 7 left between $20,000 and $10,000 so let's say an average of $15,000. That would leave us with 5 BitCoins and $61,000 in cash from our $1,000 investment and the 5 coins are worth (for now) $10,000 so $111,000 total is more than 1/2 the most we could have possibly made if we timed it perfectly.

When investing in fads or even in bubble markets – it's not worth it to try to time things perfectly when we can capture so much of the upside with an intelligent scaling strategy of taking profits off the table at set benchmarks. Don't let greed drive your trading decisions and you will do very well – without all the stress!

Be careful out there.