Finally!

Finally!

We keep betting on it and it finally happens but don't get exicted about this teeny, tiny pullback – it will take a lot more than this little action to derail the bull market. I know it's very much in vogue to ignore "facts" and "news" but we're Fundamental Investors – we can't help ourselves and, when the conditions weaken, we bet against the market, no matter how good the charts look. As I noted in Friday's Morning Report:

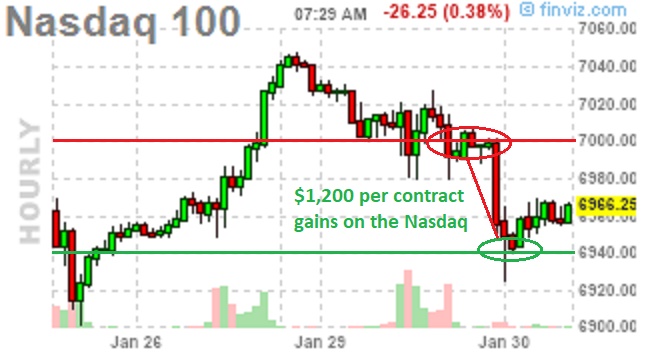

That means our index shorts (see yesterday's Morning Report) are back on in the Futures and we do have S&P (/ES) 2,850 this morning and Nasdaq (/NQ) 7,000 along with Dow (26,425) and Russell (/TF) 1,610 but, as with yesterday, we favor shorting the S&P and the Nasdaq as they cross below with very tight stops over the lines. The once-again weak Dollar is supporting the indexes for now but it's not likely to last (China and Japan won't put up with it past this level).

We're not shy about going back to the well and this is just another one of those ways the rich get richer in ways the poor don't even have access to (Futures accounts). We discussed our hedges earlier in the week and I would strongly suggest not going into the weekend without any as it may occur to some people that a declining GDP might not support a 12.5% rise in the S&P since the beginning of Q4.

We didn't get a good entry signal (crossing below the lines from above) until Monday morning, when I sent out a 5am note to our Members saying:

Futures dipping a little bit but nothing exciting so far. I still have 6 short /ES at 2,854 and 4 short /NQ at 6,999.68 and still long 8 /DX at 89.10. Wasn't any news over the weekend to change my mind about March Futures.

The 14-point drop on the S&P (/ES) Futures to 2,840 was good for $700 per contract but we dropped back to 2 contracts yesterday afternon – in case it bounced and also because we picked up other hedges – so we didn't need the additional protection. This morning, at the levels indicated, I put out a note to our Members to take the short money and run here as this leg of the sell-off was only caused by panic in the Health Care Sector, as Amazon (AMZN), JP Morgan (JPM) and Berkshire Hathaway (BRK.A) are getting together and forming a Health Care alliance.

The 14-point drop on the S&P (/ES) Futures to 2,840 was good for $700 per contract but we dropped back to 2 contracts yesterday afternon – in case it bounced and also because we picked up other hedges – so we didn't need the additional protection. This morning, at the levels indicated, I put out a note to our Members to take the short money and run here as this leg of the sell-off was only caused by panic in the Health Care Sector, as Amazon (AMZN), JP Morgan (JPM) and Berkshire Hathaway (BRK.A) are getting together and forming a Health Care alliance.

In fact, these levels are now good for an upside play but I like the Dow (/YM) best above the 26,200 line, with tight stops below and it's lined up with S&P (/ES) 2,840, Nasdaq (/NQ) 6,960 and Russell (/TF) 1,590 so the same rules as when we short but now looking for bullish crosses over the lines.

The Futures are an important tool that let you react to changing market conditions after hours and pre-market. For our portfolios, we rely on index hedges, like the one I suggested to cover our Money Talk Portfolio on Friday using the Nasdaq again, but in a different way:

SQQQ is the ultra-short Nasdaq ETF that's a 3x inverse of QQQ. So, if the Nasdaq drops 10%, SQQQ goes up 30% (in theory, it's not perfect). I'm going to add the following trade as a hedge and WE EXPECT TO LOSE MONEY ON THIS ONE – it's like life insurance, you pay for it but you hope that, each year, it's a waste of money!

- Buy 40 SQQQ Sept $16 calls for $2.80 ($11,200)

- Sell 40 SQQQ Sept $23 calls for $1.20 ($4,800)

- Sell 5 ALK 2020 $60 puts for $8.20 ($4,100)

That's net $2,300 and $2,620 in margin (from the short puts) to protect our current $36,975 gains and our potential profits – not a large price to pay and, if the Nasdaq drops 10%, then SQQQ (now $16.25) should climb 30% to $21.12 and put the $16 calls $5.12 in the money for $20,480, so we'd be up $18,180 and the max pay-out on the spread is $28,000 so about $26,000 of downside protection – which is half of what we started with!

ALK is a stock we feel is very underpriced but you can use any stock you'd REALLY like to buy as an offset on these hedges but, keep in mind, if the market does tank, you REALLY will be buying that stock!

Buy selling puts in stocks we really, Really, REALLY want to own if the market does correct, we offset the cost of our hedge significantly and, unless something specifically bad happens to our stock, it's not likely we lose both sides at once and, as a stand-alone, consider that if the market drops 20% and ALK drops 20% from $65 to $52, we'd be "forced" to buy 500 shares at $60 for a $4,000 loss while the spread would be paying us $28,000 – that's not a bad trade-off!

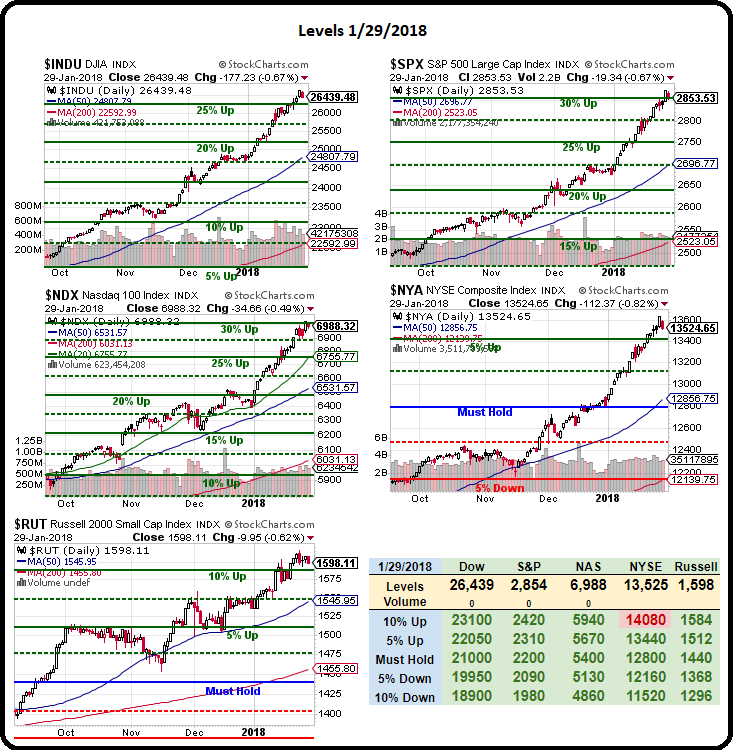

So, how low can we go and when is it a bearish turn and not just a correction? Fortunately, we have our fabulous 5% Rule™ to tell us that:

Over the long haul, the S&P moves in 800-point units, from 800 to 1,600 to 2,400 and now on the way to 3,200, half of which is 2,800 so that's a very significant line that we overshot without any consolidation this month. That is not at all what happened at 2,000, which was halfway to 2,400 from 1,600 and, franly we didn't even have much consolidation at 2,400 before blasting higher, which means it's still very possible we pull back to there (down 20% from here).

Short-term, we're using the 2,800 line and the 5% Rule™ tells us to watch the 1.25%, 2.5% and 5% lines closely so that's 2,835, 2,870 and 2,905 and, as you can see, we hit the 2.5% line at 2,870 and pulled right back to the 1.25% line at 2,835.

Our 5% Rule™ tells us to expecxt consolidation along those lines and now we need to see if we are consolidating for a move back below the 1.25% line or for another try at the 5% line and, to calculate that, we look for the weak and strong bounce lines above and below and see which ones are being obeyed.

In the context of the bigger move, from 2,800 to 2,870 it's 70 points so we expect a 14-point (20%) pullback as a weak retracement in the very least before going over. That's 2,856 and you can see that line was rejected on the way up, which is normal. A strong retrace would be 28 points (40%), taking us down to 2,842 and we're a bit below that now so, if you are bullish, what you don't want to see this morning is 2,842 being rejected – as that makes it much more likely we're consolidating for a move down.

Oops, not looking good, is it? We're being rejected there all morning but it's thin-volume Futures, so we take the action with a grain of salt. To double-check our levels, we'll do the math of a bounce from the assumption that the 1.25% line is strong and will hold (evidence of that from 1/22-1/26 consolidation above it) at 2,835 and that would be, of course, a 35-point drop so 7-point bounces to 2,842 (weak) and 2,849 (strong). Notice 2,842 comes up both ways – which makes it a very significant line.

So, this morning, we're looking for a move over 2,842 before we even consider being bullish and clearly below 2,835 is bearish (not a spike, mind you but a real move below the trends down for at least 3 15-minute candles). The next critical lines to watch are the bounce lines of the drop from 2,870 back to 2,800 which is 14 points again and that's 2,814 (weak) and 2,828 (strong) so very bearish signal is failing 2,828 because it blows your premise that this is a bullish consolidation and you have to start calling the whole run-up into question, which means zooming back out to the daily chart and considering the entire move over 2,800 was just an overshoot – which is in-line with my fundamental take on the S&P for sure.

If that happens, we have to start expecting at least a 2.5% pullback below 2,800 – to 2,730 and THEN we'll see if that holds and we're consolidating for a proper move back up but, if not, 2,600 is very possible. And thanks to St Jean Luc for giving us the bigger picture with the Big Chart and notice we are still miles above our goals (+10%) for the Dow, S&P and Nasdaq and right at the goals for the broader (and harder to manipulate) NYSE and Russell.