Wheeeee, what a ride!

Wheeeee, what a ride!

That $6,205 profit is just what we made playing the bounce overnight on the Russell as I said to our Members at 10:54pm (yes, we work all night!):

I take it back, picked up 2 long /TF for fun (1,429).

/YM also tempting above the 23,400 line with tight stops below. Getting back the 1,000-point drop would be $5,000 per contract!

The Dow (/YM) Futures also did well, topping out all the way back at 24,100 with a stop-out at 24,000 for a gain of $3,500 per contract. Again, this is why we love trading the Futures – this is just our overnight money but it also serves to lock in the gains we made on our hedges and now (6:30 am) we're looking to play for a bounce off 2,600 on /ES, 6,400 on /NQ, 1,450 on /TF and 23,750 on /YM but, if they break down, we'll use the 2,600 line on the S&P for shorting so, either way – we are able to make fine adjustments to our portfolios on the fly.

Now that we're down 10%, we'll see how 2,550 holds up on the S&P (/ES) but we should get a nice 2% move higher as simply a weak bounce from here so we're targeting 2,600 as a weak bounce and 2,650 as a strong bounce and anything less than that is going to be a sign of further weakness. We already tested 2,650 at 4am and failed and, as I noted above, we're ready to short at the weak bounce line if it fails or go long if it holds. Though it was ugly, the sell-off was not unexpected – as I said to our Members:

Submitted on 2018/01/30 at 10:21 amAt some point, they have to start taking some profits. Always tricky to call a top but what's so dangerous about this market is how low the volume has been on the way up and how narrow the focus has been on index leaders. When selling does begin – there aren't going to be many buyers and things can drop really fast.

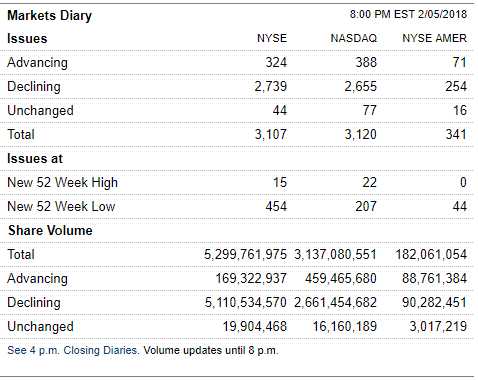

This is what I mean by "there aren't going to be many buyers." Yesterday's declining volume was 5.1Bn shares (96% of all volume) while advanciing volume was 169M shares (4%). That is what caused the market to drop like a rock attached to a bigger rock and, so far, there's no proper sign of a floor – we're just playing for the technical bounces off the 10% line at the moment.

This is what I mean by "there aren't going to be many buyers." Yesterday's declining volume was 5.1Bn shares (96% of all volume) while advanciing volume was 169M shares (4%). That is what caused the market to drop like a rock attached to a bigger rock and, so far, there's no proper sign of a floor – we're just playing for the technical bounces off the 10% line at the moment.

We need 10 TIMES more buyers than yesterday just to get the declining volume to "only" outnumber advancing volume 4:1. Kind of hard to get bullish when confronted by logic, right? That brings me to another comment I made to Members back in December:

Submitted on 2017/12/05 at 12:01 pmDip – It will take a while. As a rule of thumb, dip buyers have to be burned 3 times in a row before they learn their lesson and it's been 4 years since they've had a real lesson.

People will step in to buy any dip (we saw that in 2008) and I'm not saying this is 2008, when it turned out that Bank "earnings" were flat-out fraudulent and energy prices collapsed and wrecked that sector and the housing market collapsed and wrecked that sector and we were in an all-out panic mode. Now we are actually in a pretty good economy with lots of positives and improving earnings and not too crazy housing or energy prices and the only people allegedly faking earnings are Tesla (TSLA) and AliBaba (BABA).

Most companies are doing pretty well – just not so well that they deserve these kinds of multiples, which has kind of been my theme for warning you over the past month – whose ridiculous, unwarranted gains have finally been erased over the past few days. I know I've been sounding like a stick in the mud and I know I've been against deploying too much cash "until the correction" but this is why I wanted to wait and now, I'm still waiting to make sure 10% is enough of a correction to satisfy the Market Gods (Algos). Here's a quick summary of how we got here:

- Jan 4th: Follow-Through Thursday – Dow 25,000 and Bust? — "You can't just keep rewarding the market for doing the same thing it always does otherwise, as I warned back on November 29th, we will all be Billionaires. While I'm sure you want to be a Billionaire, what's the point of it if everyone is a Billionaire? If that happens, you're going to be nothing if you aren't a Trillionaire – that's what happened in Zimbabwe, where they were printing $100,000,000,000 bank notes in 2009, right before their currency completely collapsed."

- Jan 5th: Friday Follies – Trump Promises Dow 30,000 — "Meanwhile, we still expect a 10% correction as people take some profits off the table in our lower-tax environment and we're still thinking that Q4 earnings and 2018 guidance are going to be disappointing to investors – especially for companies who will be repatriating those overseas profits and paying one-time tax bills (good buying opportunities if they sell off on that news, however)."

- Jan 9th: 2,750 Tuesday – S&P 500 Hits it’s Next Benchmark — "Not only is the S&P testing the 2,750 line but the Nasdaq 100 (/NQ) Futures are just under 6,700 – and that's up 10% since October! We're using the Nasdaq's ultra-short ETF (SQQQ) as our primary hedge at the moment as we really can't believe earnings are going to live up to the hype but it's not really about earnings – it's about the new tax law and what it can drop to the bottom line."

- Jan 10th: Weakening Wednesday – Did China Find the Market’s Achilles Heel? — "Even more of a danger to stock indexes would be rising bond rates and the 30-year notes have already jumped 4% in the past 30 days to 2.8%, a critical juncture as that puts it above the dividend rate of the S&P 500 and, since bonds are "safe", it makes for a compelling argument for some investors to begin cashing in their outsized market gains and putting the money away into inflation-beating (per the Fed) bonds for long-term security."

- Jan 16th: Terrific Tuesday – Futures Blast Market to New Highs – Just Because — "There is some really crazy stuff going on in the markets at this point. Coca-Colar (KO), for example, is trading at 45 times earnings and 36 times cash flow even though revenues dropped 14.6% year over year. Merk (MRK), another Dow Component and another S&P heavy-weight, is trading at 56 times earnings and 39 times cash flow despite 3-year average sales declines of 3.3% PER YEAR. McDonalds (MCD) is trading at almost 50x cash flow but "only" 25x earnings thanks to massive stock buybacks – something that is saving many companies these days. Sales at McDonalds are down 10.4% from the prior year and the stock has jumped over 50%, from $115 to $175 as "punishment"."

- Jan 18th: Thin Air Thursday – Markets Begin to Gasp At New Highs — "As we're moving into earnings season, this last leg of the market bubble is being driven by earnings revisions due, mostly, to Trump Tax Breaks but, as we warned about in December, the reality simply isn't enough to justify the gains. This is a great BoA/Merrill chart showing how guidance for the S&P has moved up from 148 to almost 151 since the Tax Plan passed.

- Up and up the markets go but we see shorting opportunities this morning IF we cross back below Dow (/YM) 26,100, S&P (/ES) 2,800, Nasdaq (/NQ) 6,810 and Russell (/TF) 1,585. The rule of thumb for shorting the futures is wait for 2 to cross below and then pick the next one that crosses and keep very tight stops back above the line and if ANY of the indexes go back above their line – kill the trade and wait for the next set-up.

- As I pointed out on Thanksgiving, traders will be disappointed with Q1 results because Corporations were only effectively paying 13% of their income in taxes so "cutting" the official tax rate to 20% really doesn't make much of a difference. The S&P 500 has added over $2Tn in market cap since than and certainly $2Tn hasn't actually flowed into the index. In fact, S&P net money flows on any given day are usually from $5 to $10Bn so, even if ALL 40 market days since Thankgiving were $10Bn inflows, that would only account for 20% of the indexes gain and, in reality, it's about half that so the rest is speculation that will need another 400 days of inflows to actually support the current prices.

- Jan 22nd: Monday Market Movement – With No Government, What Will Move Us? — "We're not going to be able to have a stable growth economy if all the benefits accrue to the top so we're remaining cautios on earnings and, as I noted, we added a couple of hedges to our Short-Term Portfolio on Friday, which were also published in our Top Trade Alerts. From a Futures perspective, we're watching Dow (/YM) 26,000, S&P (/ES) 2,810, Nasdaq (/NQ) 6,850 and Russell (/TF) 1,600 and, as usual, we short the last one to cross under with very tight stops if ANY of the indexes get back over their line so risking very small losses against nice potential gains."

- Jan 23rd: Tariffic Tuesday – Trump Declares Trade War in Davos — "Tariffs and trade wars have never worked and Trump vasly underestimates the Global Economic power China now commands. This can all turn very ugly, very fast and – if we weren't hitting the top of the market before – I'd say we're forcing one now though these are slow-moving effects and it may take about 6 months to be able to look back at this moment and say "Yep, that's where things really went to Hell."

- Jan 24th: Record High Wednesday – Diving Dollar Boosts Equity Markets — "Unfortunately, we have to consider that earnings are also priced in Dollars so companies that aren't earning 12.5% more than they earned last year are actually losing ground when priced in gold, silver, Euros, Yen, Yuan, BitCoin, oil, etc… This is especially true for S&P 500 companies who make more than half their money overseas and are currently getting the most favorable conversion rates in decades – making this a great time to repatriate money."

- Jan 25th: Thrilling Thursday – Nasdaq 7,000 Is Our Next Summit — "Sometimes, the crowd gets things right though not this time – this time the crowd is full of idiots who are chasing a trend off a cliff… Meanwhile, if this rally doesn't calm down – we're going to need a bigger chart (we are shorting Nasdaq Futures (/NQ) below the 7,000 line with tight stops above as well as S&P Futures (/ES) below the 2,850 line."

- Jan 29th: Monday’s Market Magic Trick – Rising Without the Fed? — "People consistently overpaying for housing led to the housing crisis that tanked the Global Economy in 2008 and now, Corporations are binge-buying their own overpriced stock with all the free, ARTIFICIALLY low-interest money that has been floating around in order to bail people out of the housing collapse. Isn't it obvious that this is only going to lead to a stock price collapse down the road???"

- "I'm not saying the economy sucks or is even in trouble (though China is and Japan is) but it's not so great that we should be paying 30 times earnings for hardware stores or sneaker companies or soft drink makers – all of whom historically trade at more like 15 times earnings than 30. We had this same conversation about housing back in 2005, 2006 and 2007 and it took 3 more years of record gains before the market finally corrected so far be it for me to keep you from having fun but please, Please, PLEASE: Be careful out there!"

.jpg) Then, last Wednesday, I went on Money Talk and led the show off stating: "I think we'll follow-through another 2.5% to the downside," which turned out to be an understatement. Fortunately, we put our money where our mouth was, adding a hedge on the Nasdaq Ultra-Short (SQQQ), which we went over in yesterday's morning report, so I won't do it again here.

Then, last Wednesday, I went on Money Talk and led the show off stating: "I think we'll follow-through another 2.5% to the downside," which turned out to be an understatement. Fortunately, we put our money where our mouth was, adding a hedge on the Nasdaq Ultra-Short (SQQQ), which we went over in yesterday's morning report, so I won't do it again here.

It's good to do a little review so we remember how we got here and what our premise was – because it's tempting to throw all that out the window and panic while the 10% correction you've been predicting is actually happening but, so far – this is all going according to plan – "even when the plan is horrifying." So, at this point, we have our hedges and we're not worried yet but we will want to add more hedges if we think things are breaking another 10% lower and it's our 5% Rule™ that takes the emotion out of that decision.

The same way we expect bounces of 50 and 100 points on the S&P that will not get us excited, we may also see what we call an overshoot that goes 50 or 100 points below our 2,550 target and we won't be jumping on the down 20% bandwagon until we see 2,450 fail. Now, knowing that we go back to Fundamentals and we have to consider whether the market SHOULD be down 20%, to 2,250 and that's what we call our "Must Hold" line on the Big Chart (2,200 actually) and no, we don't really expect that much of a correction – therefore we're leaning a bit bullish here at 2,550, expecting a bounce is more likely than another 50-point drop.

This is, so far, simply a much-needed correction in a market that had gone too far, too fast. It would be fantastic if we settle down here and move around the 2,550 line for a while – up and down 100 points and consolidate while the rest of earnings play out because a quick rebound won't be healthy and an additional drop will quickly erode confidence and possibly lead to too much of a correction – though we'd be thrilled to buy down there – as we still have most of our cash on the sidelines.

Meanwhile, we have our Watch List and we'll be adding more stocks now that we have a few more bargains in the market. Most of the stocks on our list are still playable but it's a WATCH List, not a BUY List – as we need to see a solid base form before jumping back in. Meanwhile, the best use of our sideline cash is making adjustments to our exisiting positions and we'll be exploring that today and in tomorrow's Live Trading Webinar (1pm, EST).