I do like CBI as they should benefit from an infrastructure bill - if they ever actually pass one.

As a new trade, I'd sell 10 of the CBI 2020 $12.50 puts for $1.90 ($1,900) and consider that free money and put it into 10 of the 2020 $15 ($3.25)/20 ($1.60) bull call spreads at $1.65 ($1,650) and you still have a small credit on the $5,000 spread and worst case is you own them for less than $12.50.

Also folks, don't forget about the LTP trade and earnings trade from the morning post (I'm putting it here so Top Trade People will get it too):

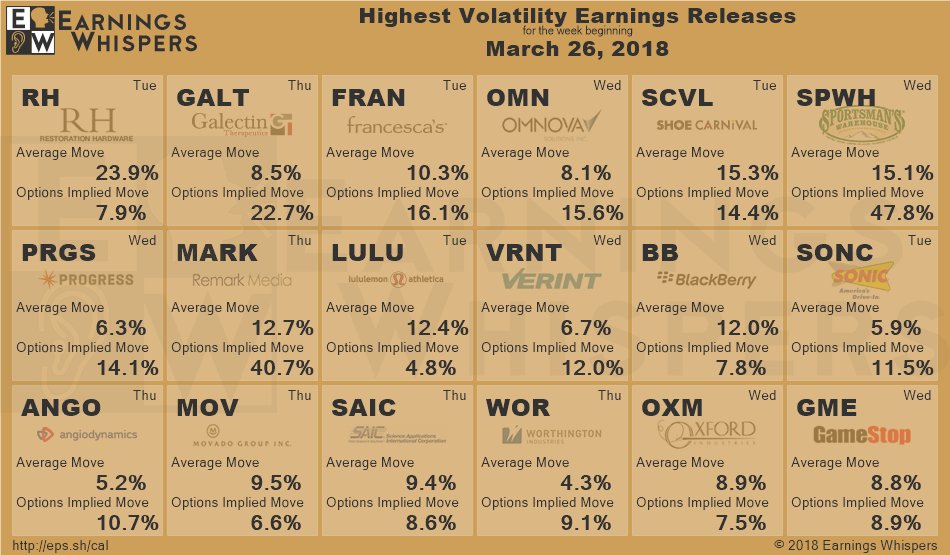

I may change my mind after earnings. McCormick (MKC), the spices company, knocked it out of the park this morning with an 18.5% beat and IHS Markit (INFO) beat by 10% while FactSet (FDS) beat by 14% so things are good in the world of spices and data so far. Lululemon (LULU) reports this evening along with Shoe Carnival (SCVL), Restoration Hardware (RH) and Sonic (SONC) and SONC is cheap at $24.79 but the others are not cheap at all and I'll be interested to see if they can justify their high valuations.

As you can see from Earning's Whispers' chart, options on SONC imply a higher move than it usually makes and we can turn that to our advantage by selling premium into earnings. In this case, the Sept $22.50 puts are $1.25 and that would net us into the stock at $21.25, which is a $3.50 (14%) discount to the current price so that's a no-brainer to sell if you don't mind owning SONC for $21.25 as the worst case. We can leverage that further by betting $25 will hold up and add a spread as follows:

- Sell 10 SONC Sept $22.50 puts for $1.25 ($1,250)

- Buy 20 SONC Sept $22.50 calls for $3.50 ($7,000)

- Sell 20 SONC Sept $25 calls for $2.20 ($4,400)

The net cost of that spread is $1,350 and it pays $5,000 if SONC is over $25 at September expiration.