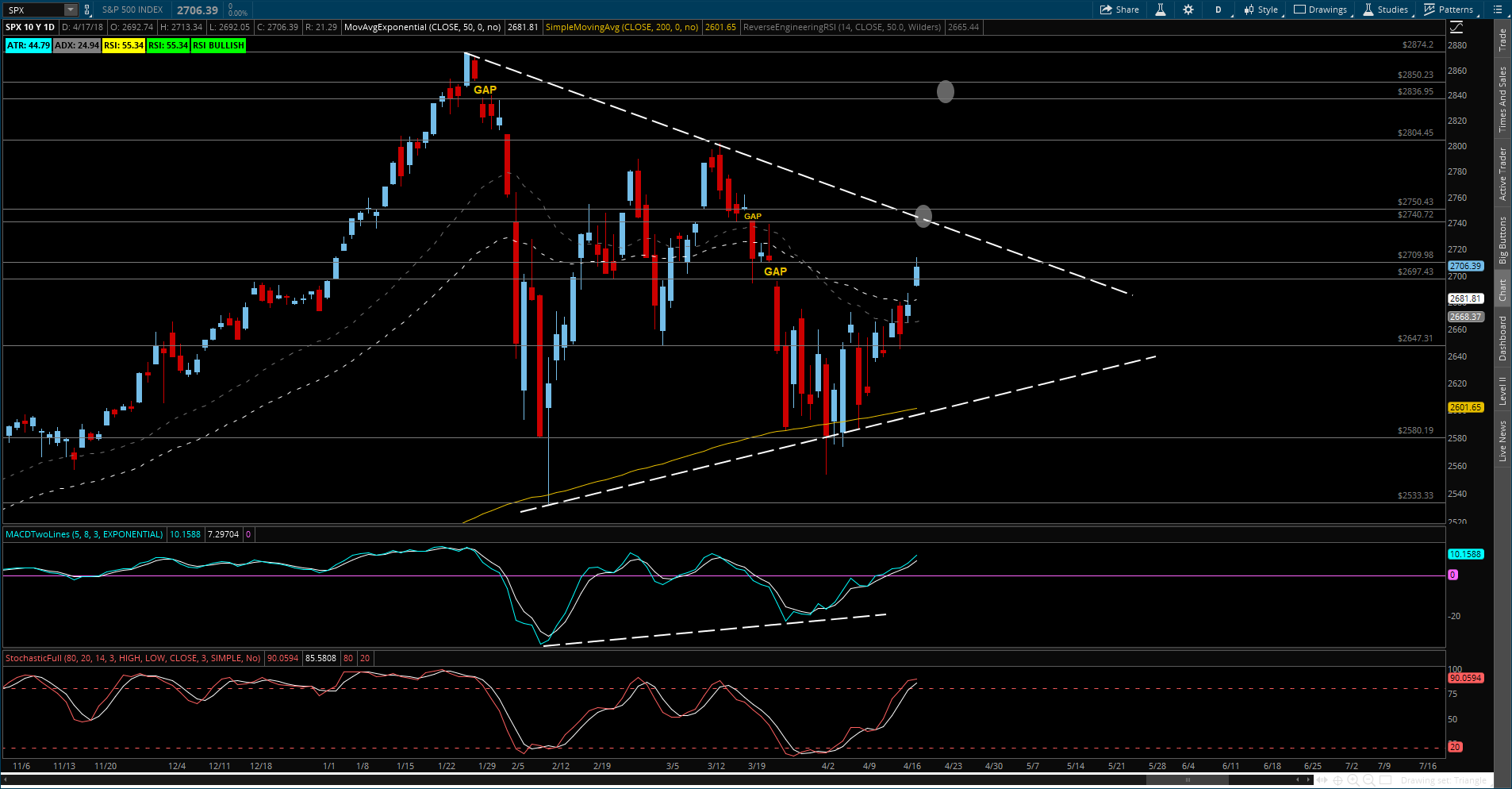

As you can see from the chart (click to enlarge) we're still making one of those triangle squeezy thingy pattens but the top of the down wedge is still at our 2,740 line and it will be three more weeks of this nonsense (while earnings pour in) until it resolves itself but, with the nose of the triangle lower than where we are now (2,717) – the odds favor the short bet on /ES Futures.

We made a quick $300 per contract yesterday morning from our morning call as /ES fell from 2,700 back to 2,693 (stopping out at 2,694) but then lost $75 per contract trying to play it again as it popped over. After that, we went to "watch and wait" mode, as planned – and that's where we are this morning, waiting to see which way things break. There's a Beige Book release by the Fed at 2pm and then Dudley speaks at 3:15 on "Economic Outlook and Monetary Policy."

There's very little going on in the news and not much change in Fundamentals and earnings have been OK this week, with 31 (82%) out of 38 reports showing beats this week. Of course, that's what we expected early in the season and if this can't lift the S&P back to at least 2,640 then WE'RE DOOMED!!!! Sure, I think we're doomed anyway but that's only because of the Global Fundamentals and the market is usually pretty good at ignoring that.

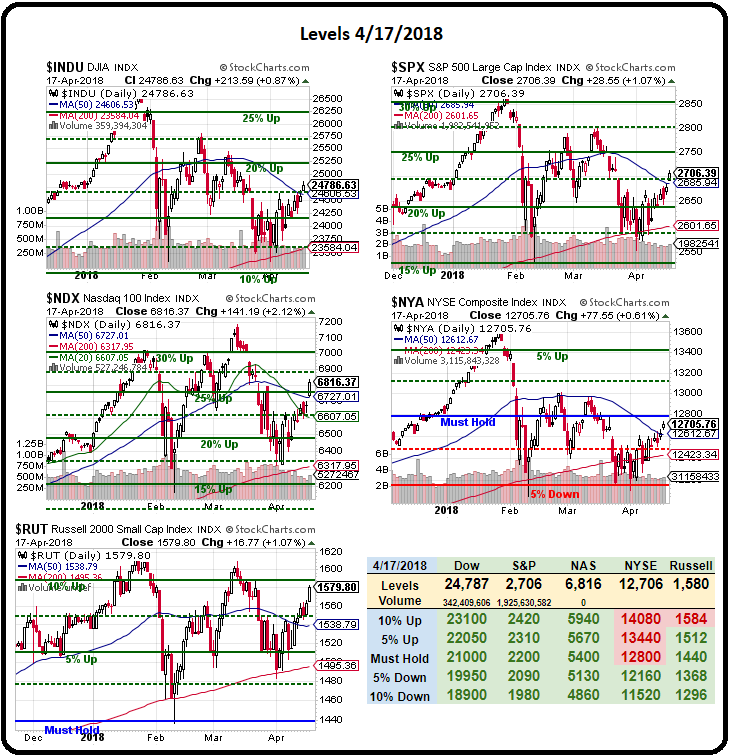

This morning, the Dow (/YM) can be shorted at 24,800, so that's a fun play but 6,850 on the Nasdaq (/NQ) Futures is always one of my favorite shorting lines and we can't argue with the classics – same strategy as yesterday, with tight stops over the lines.

We have a Live Trading Webinar at 1pm where we'll go over some Futures Trading Techniques as well as reveiwing our 5 Member Portfolios.

We're back to the ridiculous money-printing market conditions that caused us to cash out in December. Since Jan 2nd, our Long-Term Portfolio has already gained $72,000 (14.4%), which is ridiculous as it's annualized at over 40% gains which, of course, are unsustainable. I said to our Members yesterday I'd like to cash out at 14.4% and call it a year and we can take the next 8 months off instead of riding out the downturn (yes, it's still coming). Much more relaxing that way…

We're back to the ridiculous money-printing market conditions that caused us to cash out in December. Since Jan 2nd, our Long-Term Portfolio has already gained $72,000 (14.4%), which is ridiculous as it's annualized at over 40% gains which, of course, are unsustainable. I said to our Members yesterday I'd like to cash out at 14.4% and call it a year and we can take the next 8 months off instead of riding out the downturn (yes, it's still coming). Much more relaxing that way…

Of course we have our hedges in the Short-Term Portfolio but we wouldn't need them if we didn't have any long risk, right? The STP is up too and our well-balanced Options Opportunity Portfolio, which you can follow over at Seeking Alpha, is up 5.4% in month 4 while our Butterfly Portfolio is now up 6.7% and the very low-touch Money Talk Portfolio (we only adjust it when we're on the show) is up 68.1%, but that one is a holdover from last Sept, not new in Jan like the others.

So, overall, things are going well but when they go this well I get nervous – especially when I don't see where all this found money is coming from. There have not been a lot of inflows to the market and we're very well-diversified, so we're not benefitting from sector rotation and, if anything, we're light on the Tech Stocks that have driven the rally.

Earnings will be put up or shut up time as the indexes are still trading near record highs – along with record-high multiples and the Economist part of my brain (which is very small, as that's all you need for Economics) says money goes to stocks OR bonds and bonds should be making a comeback as rates move higher, which they are doing – very clearly. That makes the notes cheaper and more attractive and the 10-year is now 6% below last year's highs, which is likely to spur some dip-buying which will suck more money away from equities – perhaps violently so if earnings disappoint.

Meanwhile, we'll be keeping an eye on our charts and we won't be too bearish if the indexes are able to hold their 50-day moving averages, which are also the strong bounce lines on our Big Chart. We're just playing for small rejections along the way in the Futures, hoping we'll get lucky and catch a big dip soon. As to going long – show my a run that doesn't look forced or manipulated and I might buy into it but, even as I write this, /NQ has already fallen back to 6,837, which is up $260 per contract so we can lock in gains of $250 on those and the Dow (/YM) is down below 24,775 so that's now the stop and we lock in $125 per contract gains, which is not bad for an hour's work and it certainly pays for our Egg McMuffins.

More Futures Trades and a Portfolio Review in our Live Trading Webinar, today at 1pm, EST.