15 Charts that Disturb Us about American ‘Capitalism’

Courtesy of The Myth of Captialism

Capitalism is the greatest system ever to lift people out of poverty and create wealth, but the “capitalism” we see today in the United States is a far cry from competitive markets. What people see today is a grotesque, deformed version of capitalism. The distorted representation we see is as far away from the real thing as Disney’s Pirates of the Caribbean are from real pirates.

Central to capitalism is choice, freedom, and opportunity to compete. However, true consumer choice is an illusion in today’s economy.

A few massive firms dominate their respective industries in monopolies and oligopolies. Economists call this industrial concentration, and it’s reminiscent of the age of robber barons under J.P. Morgan, Carnegie, Rockefeller, Gould, and Duke. As industries become highly concentrated in the hands of very few players, it threatens competition, increases inequality, and chokes economic growth. Economic power and political power becomes entrenched in the hands of a few players, squeezing out competitors.

American capitalism is now comprised of monopolies, duopolies, and oligopolies. We’ve compiled a list of charts that help paint a picture of today’s reality. (Believe it or not, since we collected these charts, many new mergers have been announced. It is impossible to keep pace with companies gobbling each other up.)

1. Fewer and fewer businesses are starting in the US

Despite illusions of ‘disruptors’ changing industries like ride-sharing and social media, in reality business dynamism (the number of entrepreneurs starting new businesses) is very low in the US.

2. More large firms dominate industries

This chart shows the percent of industries controlled by the top 4 firms. From beer to glass to tires – Americans have little choice when purchasing their products.

3. Decline of Competition

Firms do not even talk about competition anymore. This chart from the Economist shows that in annual reports, companies have less and less need to discuss competition from other firms.

4. Merger Waves

This chart shows the history of mergers – when companies purchase other companies and merge to form one larger firm. Mergers were extremely common right before the turn of the century during the Gilded Age. There were 1580 mergers in just 3 years between 1897-1899.

Since the late 1990’s, there have been multiple waves of mergers, creating giant companies that can easily swallow up competitors. But 2017 was the all-time North-American merger mania high with a whopping 18,070 mergers and acquisitions.

The following chart shows M&A Volume plotted against anti-trust cases:

We’ll now take you on a tour of mergers by industries. There are many more examples, and these are the tip of the iceberg.

5. Mergers in the railroad industry

After multiple railroad company bankruptcies in the 1970s, Congress passed the Staggers Act in 1980 to deregulate the industry. Following this, the number of Class I railroads dramatically shrank from over 30 to just four. Broadly, deregulation was a success. However, once railroads came down to the final four, prices started rising again as competition has disappeared.

While railroads may appear to be an oligopoly with a few major players, they are in fact local and regional monopolies. For many shippers, they are only serviced by a single railroad. For example, two-thirds of coal shipped by rail is captive to a single railroad.[i] Today there are two major duopolies for grain transportation—BNSF Railway and Union Pacific Railroad serve the Western United States, and CSX Transportation and Norfolk Southern serve the East.[ii]

6. Mergers in the banking sector

Six years after the banking system blew up, the five biggest firms controlled 44% of the $15.3 trillion in assets held by US banks. Those banks – JPMorgan Chase, Bank of America, Citigroup, and USB – collectively held almost $7 trillion.

In 1990, the five biggest U.S. banks held less than 10% of industry assets, but that figure has steadily marched higher ever since. Today, Wells Fargo controls basically the same percentage of assets as the entire top five did in 1990.

The Federal Reserve has established rules taking effective in 2015 that will prohibit mergers that result in a combined company's liabilities exceeding 10% of the industry's total. However, the damage is already done. As you can see below, bank mergers have created fewer and fewer competitors.

7. Mergers in semiconductors

Over the past few years we have seen a wave of consolidation in almost all areas of technology. In 2014 and 2015 almost a dozen chipmakers changed hands in a wave of mergers. The wave is continuing. Analysts in the semiconductor sector expect additional merger attempts this year across the industry.

Broadcom proposed a $100 billion dollar acquisition of Qualcomm, which was only recently blocked by Trump who cited national security concerns over the Singaporean-based company. If that merger had succeeded, it would have been the largest technology deal in history. If the two companies had been American, the deal would have gone through. Broadcom has just this week moved its headquarters back to the US, and we will await their further attempts to gobble up competitors stateside.

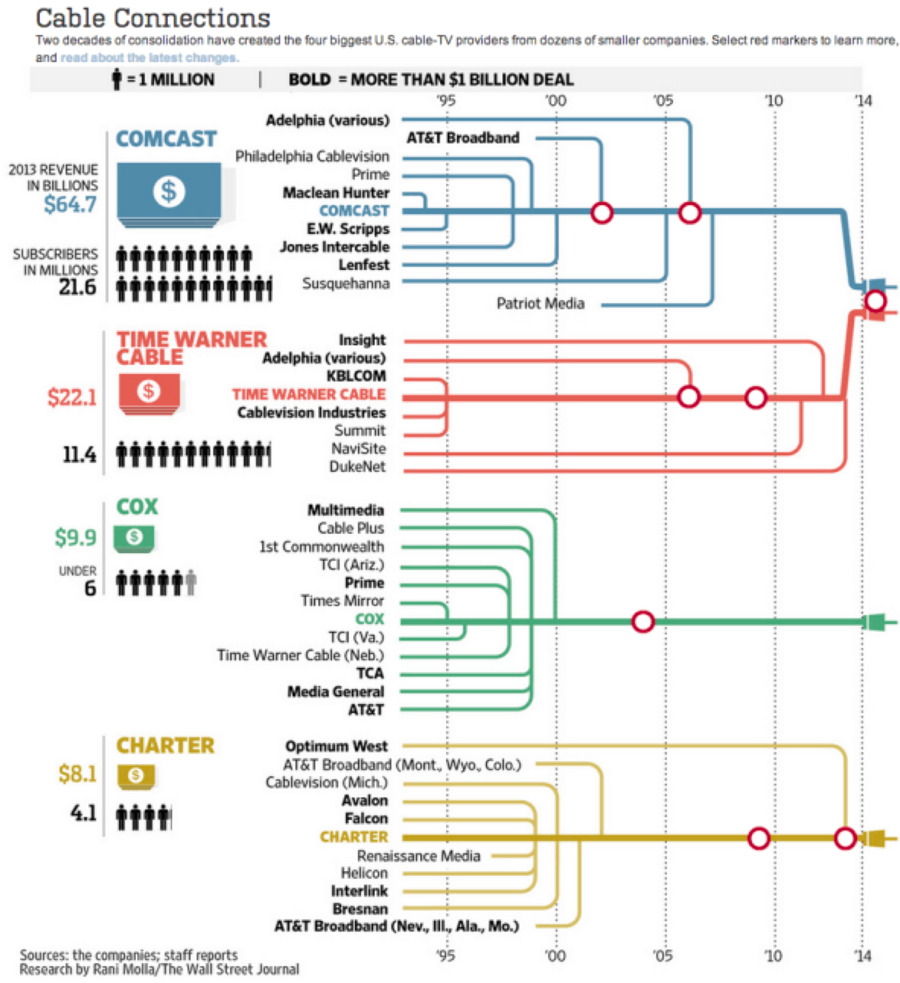

8. Cable-TV Provider Mergers

Three companies control 65% of the nation's cable market but this figure is meaningless. At the local level, the companies face no real competition. This matters a great deal because cable is the only real option if you want to get high speed internet (only 25% have fiber optic and DSL phone lines are much slower).[iii] Most of the US has been carved up geographically.

In 2014 Comcast tried to buy Time Warner. In a rare sign of action on the part of regulators, they quashed the deal. However, almost all the damage due to consolidation is done. The New York Times helpfully put this chart together showing the history of mergers. While the deal did not go through, further consolidation is happening anyway. Today AT&T has proposed an $85 billion purchase of Time Warner, which is currently under antitrust review.

9. Media Mergers

National mass media and news outlets are a prime example of an oligopoly, with 90% of U.S. media outlets owned by six corporations: Walt Disney, Time Warner, CBS Corporation, which is now merging with Viacom, NBC Universal, and Rupert Murdoch’s News Corporation.

As if the media landscape were not concentrated enough, as we write this, Disney has agreed to buy most of Fox’s media assets including its movie and TV studios for $52 billion. Why? Disney already owns Pixar, ABC, ESPN, Marvel, A&E, Lifetime, Touchstone, and many more. The merger will harm not only consumers, but also content creators. Fewer and fewer people will decide what TV shows or movies are made, and what will be produced. The Writers’ Guild of America vehemently opposed the merger. In their words, “In the relentless drive to eliminate competition, big business has an insatiable appetite for consolidation. Disney and Fox have spent decades profiting from the oligopolistic control… often at the expense of the creators who power their television and film operations.”[iv]

Trust in the mass media peaked in 1976 at 72%, and has steadily decreased since the 1980s, reaching an all-time low of 32% in 2016. Over the last 40 years, media trust has shown a strong inverse correlation with corporate ownership, and industry concentration.

10. Airline Mergers

Congress deregulated the Airlines in 1978. Deregulation increased profitability, but the industry went through cycles of boom and bust, primarily related due to oil prices and high fixed costs. As the New York Times put it, “An industry that is not naturally competitive went from being a regulated cartel, to a brief period of ruinous competition, and then to an unregulated cartel — with predictable effects on the quality of service.”[v] Airlines devised frequent flier programs and “fortress hubs” to maximize their pricing power.

Carriers know to stay out of each other’s hubs. Powerful airlines also buy up slots at airports to prevent new entrants, much like John D. Rockefeller bought up key swaths of land in Pennsylvania to block independent drillers from building pipelines that would enable them to escape Standard Oil’s control over the railroads.[vi]

Because we have little choice when it comes to airlines, they can nickel and dime us every time we fly. Extra charges will top $82 billion by the end 2017, according to a study of global carriers by IdeaWorks and CarTrawler. This is a 264% increase from the 2010 figure of $22.6 billion.[vii]

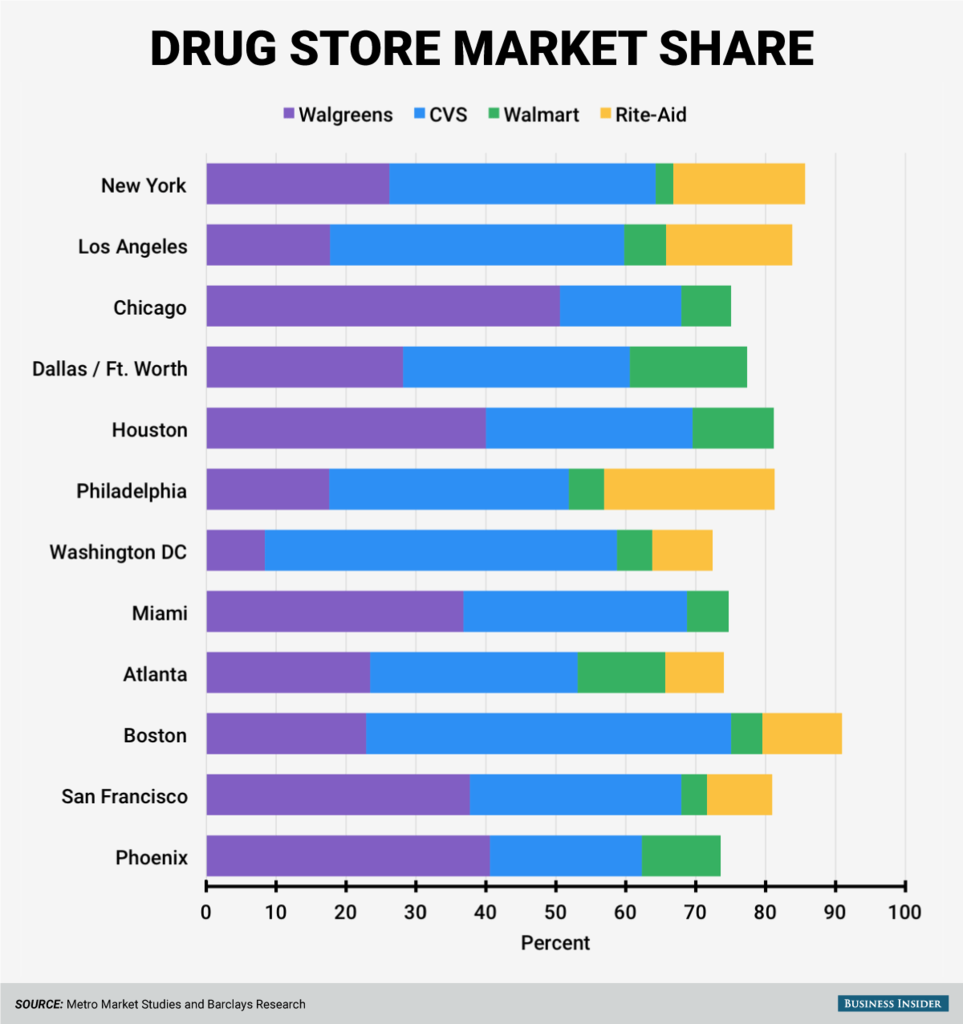

11. Drug Store Market Share

The top 4 firms control almost 70% of the market and about $230 billion dollars of annual profits.

As of February 2018, Rite Aid is now merging with Albertsons (the grocery company) to form a ‘food, health, and wellness’ giant. The duopoly of Walgreens and CSV is even further solidified.

12. Agriculture and meat processing

Only four corporations provide 57% of all poultry, 65% of all pork, and 79% of all beef sold in the United States.[viii] Today, over 96% of chickens are raised under production contracts with large companies like Tyson, that dictate exactly how they’re raised and fed, the size of facilities, and many other conditions. The pattern of a big company dictating terms to farmers is growing. As of 2012 Census, 34.8% of the entire value of U.S. agricultural production was governed by production or marketing contracts, up from 11% in 1969.[ix]

The impact of agricultural industry concentration has meant the ruin of farmers. Astonishingly, since 1980, 40% of all American cattle farmers and 90% of all hog farmers have gone out of business, while the big players have made dozens of billions of dollars of profit. In the 2000s decade, 71% of all chicken farmers were estimated to be earning less than the federal poverty line.[x]

13. Consumer foods – illusion of choice

Everywhere the illusion of choice, but Americans can only choose from a few firms in everything from soft drinks to toothpaste.

Soft Drinks – The top three firms dominate more than 85% of the market.[xi] Coca Cola is the leader, followed by PepsiCo and Dr. Pepper Snapple.

Toothpaste – Colgate and Procter & Gamble control more than 80 percent of the U.S. market for toothpaste, including such seemingly independent brands as Tom’s of Maine.

14. Beer Market controlled by two companies

During an epic bout of Solitaire at the Department of Justice, the great beer mergers slipped through the attention of antitrust authorities. Astonishingly, the US government has allowed the entire US beer market to be locked up by two companies. The US beer market is an effective duopoly with two players (Molson Coors and AB InBev) controlling over 90% of beer.

Think of that every time you drink a cold one.

15. Anti-trust is deader than a dodo bird

Where are the regulators in all of this? Despite record waves of mergers, and increasing evidence that industry concentration is harmful to consumers and workers, the regulators don’t seem to mind very much:

Why this matters

Monopoly is not capitalism.

In physics, gravitational fields form around objects with dense mass – they become larger and larger as they pull more objects into their gravitational field. This is what is happening with giant firms today.

Competition matters.

If there is no competition, consumers and workers have less freedom to choose. Freedom is essential to capitalism. It is not surprising then that Milton Friedman picked Free to Choose as the title of his extremely popular PBS series on capitalism, and Capitalism and Freedom was the title of his book that sold over 1.5 million copies. He argued that competitive capitalism—the organization of the bulk of economic activity through private enterprise operating in a free market—as a system of economic freedom was “a necessary condition for political freedom.”[xii]

Everyone loses when capitalism is distorted. The damaging effects of Industrial concentration are evident everywhere. As we’ll show in our new book, The Myth of Capitalism: Monopolies and the Death of Competition, rising market power by dominant firms has created less competition, lower investment in the real economy, lower productivity, less economic dynamism with fewer startups, higher prices for dominant firms, lower wages and more wealth inequality. The economic studies are now pouring in like a flood. There are fewer winners and many losers when there is less competition.

If you believe in competitive free markets, you should be very concerned. If you believe in fair play and hate political and economic cronyism, you should be worried. This is an issue that both left and right can agree on – less competition is bad for all of us.

Join us in this discussion, as we diagnose the problem and suggest solutions. It’s time to reverse these trends and bring true capitalism back to America.

[i] http://consumerfed.org/wp-content/uploads/2015/10/Bulk-Commodities-and-the-Rails.pdf

[ii] https://ageconsearch.umn.edu/bitstream/164478/2/Concentration.pdf

[iii] See fiber optic penetration by state https://broadbandnow.com/Fiber

[iv] https://www.avclub.com/the-writers-guild-is-not-happy-about-the-disney-fox-dea-1821301494

[v] https://www.nytimes.com/2017/04/17/opinion/how-the-airlines-became-abusive-cartels.html?_r=0

[vi] Chernow, Ron, Titan: The Life of John D. Rockefeller, Sr., Vintage, p. 208.

[vii] https://www.forbes.com/sites/christinenegroni/2017/11/28/airlines-on-track-to-nickel-and-dime-travelers-for-record-82b-in-extra-fees-in-2017-study-says/#3e03d00b4792

[viii] Suarez-Villa, Luis. Corporate Power, Oligopolies, and the Crisis of the State (p. 63). State University of New York Press. Kindle Edition.

[ix] http://rafiusa.org/programs/contract-agriculture-reform/understanding-contract-agriculture/

[x] Suarez-Villa, Luis. Corporate Power, Oligopolies, and the Crisis of the State (p. 63). State University of New York Press. Kindle Edition.

[xi] https://www.businesswire.com/news/home/20110506005600/en/Research-Markets-Soft-Drinks-Market-Analysis–