The market is so predictable.

The market is so predictable.

There's a ton of money to be made from predictable, so we're certainly not complaining. After a meaningless spike higher, the S&P calmed right down and finished right at our 2,782 line (2,730, actually) and this morning, as expected, the index is pulling back as the Dollar rises back to the top of it's range. Eventually, one of these will break out and the other will fall – but which one will prevail?

We had a good run on /ES, all the way from 2,600 (barely touched two weeks ago) back to 2,728 and a 28-point run means we're looking for a 5.6-point retrace back to 2,723 (weak) and 2,717 (strong) and, even as I write this (7:30), the Futures bounced off 2,723, failed 2,728 again and are now testing 2,723 again but I think they'll fail as the Dollar is at 92.87 and rising and that's up half a point so we'll look for 2,717 and see how that's doing. The Futures on the S&P (/ES) pay $50 per point so it's a quick $300 if that bet plays out and, of course, simply stop out over 2,723 to limit the risk.

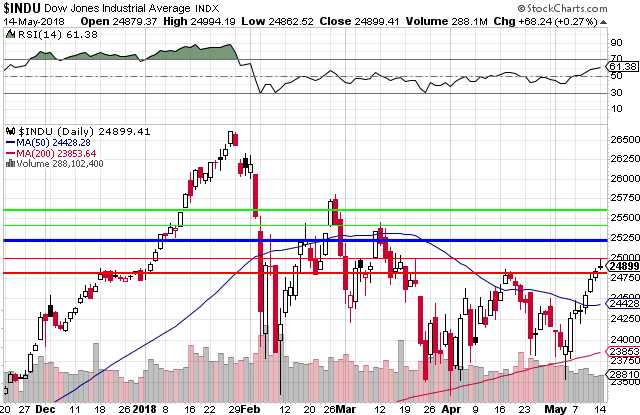

The Dow is also having fun around it's own 20% line but, in this case, it's been unable to get over the line (25,200). 26,250 is the 25% line and that's 1,050 away but we'll call it 1,000 so we can call the bounce lines 200 points and that makes our up and down range from 25,200: 24,800, 25,000, 25,400 and 25,600 so we can chart that like this:

The Dow is also having fun around it's own 20% line but, in this case, it's been unable to get over the line (25,200). 26,250 is the 25% line and that's 1,050 away but we'll call it 1,000 so we can call the bounce lines 200 points and that makes our up and down range from 25,200: 24,800, 25,000, 25,400 and 25,600 so we can chart that like this:

The Dow strayed down to the 200 dma at 23,750 so the run to 24,950 yesterday was 1,200 points and we'll call those rejection lines 250 points to 24,700 (weak) and 24,450 (strong) but that would take us back below the 20% line and that would be a big negative so very bad if 24,700 does not hold.

Exxon (XOM) and Chevron (CVX) have been boosting the Dow as oil and gasoline test new highs but what's great for them is not so good for the industrials that use oil and gas to produce goods but, fortunately, there are not too many Industrial companies left in the Dow Jones Industrial Average. 3M (MMM), Boeing (BA), Caterpillar (CAT), Dow (DD) and GE (GE) are the only manufacturers who might care about oil and 3M not so much, really and CAT benefits as higher oil means more digging for it and BA benefits as it creates demand for their newer, fuel-efficient planes. Apple (AAPL), Cisco (CSCO), Coke (KO), Intel (INTC) and Nike (NKE) are not really oil-dependent and that's it for all of the Dow you could even call manufacturers these days.

On the Nasdaq, we're playing around the 30% line at 7,020 and the 25% line is 6,750 and 6,480 is the 20% line but let's call it 6,500, 6,750 and 7,000 and that makes for 100-point bands on the move from 6,500 to 7,000 but what we care about here is just the retraces off 7,000 at 6,900 and 6,800 – those have to hold up for us to keep our 7,000 caps on!

On the Nasdaq, we're playing around the 30% line at 7,020 and the 25% line is 6,750 and 6,480 is the 20% line but let's call it 6,500, 6,750 and 7,000 and that makes for 100-point bands on the move from 6,500 to 7,000 but what we care about here is just the retraces off 7,000 at 6,900 and 6,800 – those have to hold up for us to keep our 7,000 caps on!

Keep in mind, on the Nadaq, that's the 30% line and, even though we are giving the markets 10% due to the tax cuts, it's still at the top of it's 20% range from there so pretty overbought and we've seen the Nasdaq fall 500 points from here twice this year and, at $20 per point on the /NQ futures, that's a whopping $10,000 per contract of potential gains on the short side! As I said to our Members yesterday morning in our Live Chat Room:

Big Chart looks all clear and the Futures are up so not much to do but watch and wait today. 7,000 is the 30% line on the Nasdaq and if that isn't resistance, then we're probably breaking up to retest the highs. Dow 25,000 also very significant, of course.

Both caught harsh rejections yesterday and now we wait and see just how low we can go on our indexes. The Russell (/RTX) is our toppiest index, over the 10% line at 1,584 and testing 1,600 but here we'll run the numbers line to line from the 5% at 1,512 so 72 points means 14-point bounce lines around 1,584 would be 1,556, 1,570, 1,598 and 1,612 and that looks like this:

Both caught harsh rejections yesterday and now we wait and see just how low we can go on our indexes. The Russell (/RTX) is our toppiest index, over the 10% line at 1,584 and testing 1,600 but here we'll run the numbers line to line from the 5% at 1,512 so 72 points means 14-point bounce lines around 1,584 would be 1,556, 1,570, 1,598 and 1,612 and that looks like this:

I'd say the 1,600 line and the 2,728 lines are make or break for the day and both look like they are breaking now (8:30) as the Dollar spikes over 93, wich is almost 1% higher than it was yesterday so no surprise the markets would reprice themselves at least 0.5% lower as it's that kind of relationship. And lets not forget the Big Daddy Index, the one that rules them all – the NYSE, which has almost all of the components of the Dow and the S&P in it's 2,800 company portfolio.

In the case of the NYSE, it's right at it's Must Hold line (12,800) and, since we've said we're giving the indexes 10% in recognition of the tax cuts boosting earnings – that's NOT GOOD, since it's 10% below the 10% line (math!). In this case, we'll look at the -5% line at 12,160 so it's a 640-point move and that makes for 125-point bounce lines @ 12,550, 12,675, 12,925 and 13,050 which would look like this:

If the NYSE is below 12,800, then bearish bets make the most sense and, when it's over, we can get a bit more hopefully bullish but the trend is not our friend the longer 12,800 acts as overhead resistance. When the NYSE is lagging, it indicates the other indexes are not broadly rallying, which means those rallies can be very, very fragile. Of course, if the Dollar keeps going up (global tensions), then commodities might collapse and that's been the NYSE and the S&Ps best sectors so – oops!

Understanding these relationships and understanding the channels the indexes (and stocks) tend to move in is the key to making short-term money in the market. Generally, we're long-term, Fundamental Investors and we don't really care about this nonsense but, while we are waiting for our long bets to pay off – we like to have fun betting against the suckers who think the market is about to make a new high – or a new low. Usually, it doesn't so we place our bets on those lines with tight stops if they break and that keeps our risk low while our rewards can be very, very high. See – easy!