Same old, same old…

Same old, same old…

We're at the same levels we were at on Tuesday (a bit weaker), when we extensively went over the technicals, so we're not going to do that again. As you can see on the S&P chart, our short at 2,728 on the S&P Futures (/ES) is still holding up and we see no reason to change it today or over the weekend. Similarly, our big shorting hedge on the Nasdaq (/NQ) is still up $2,000 per contract (from 7,000) at 6,900 and our predicted bottom is a $10,000 per contract gain at 6,500 if "sell in May" becomes a thing around the holiday weekend.

We primarily use the Futures for hedges as we are generally bullish in our 5 Member Portfolios and that means we like to have a little extra protection – especially when the broad market is shut down and we can't make any adjustments. We're very happy with the portfolio performance so far this year and, in fact, we're too happy so, as we've been discussing in our recent Morning Reports as well as our weekly Live Trading Webinars, I think it would be far wiser to go to CASH!!! into the summer and we'll see if July earnings make us want to buy again.

We're not officially doing that because PSW is a teaching site so we teach people how to manage portfolios in good markets and bad but CASH!!! is a very valid strategy and allows you to take a nice vacation and have a life – those are good things! Personally, our Hedge Fund is over 90% in cash and my kids' college accounts are 100% in cash into the summer – but you can play the market any way you want!

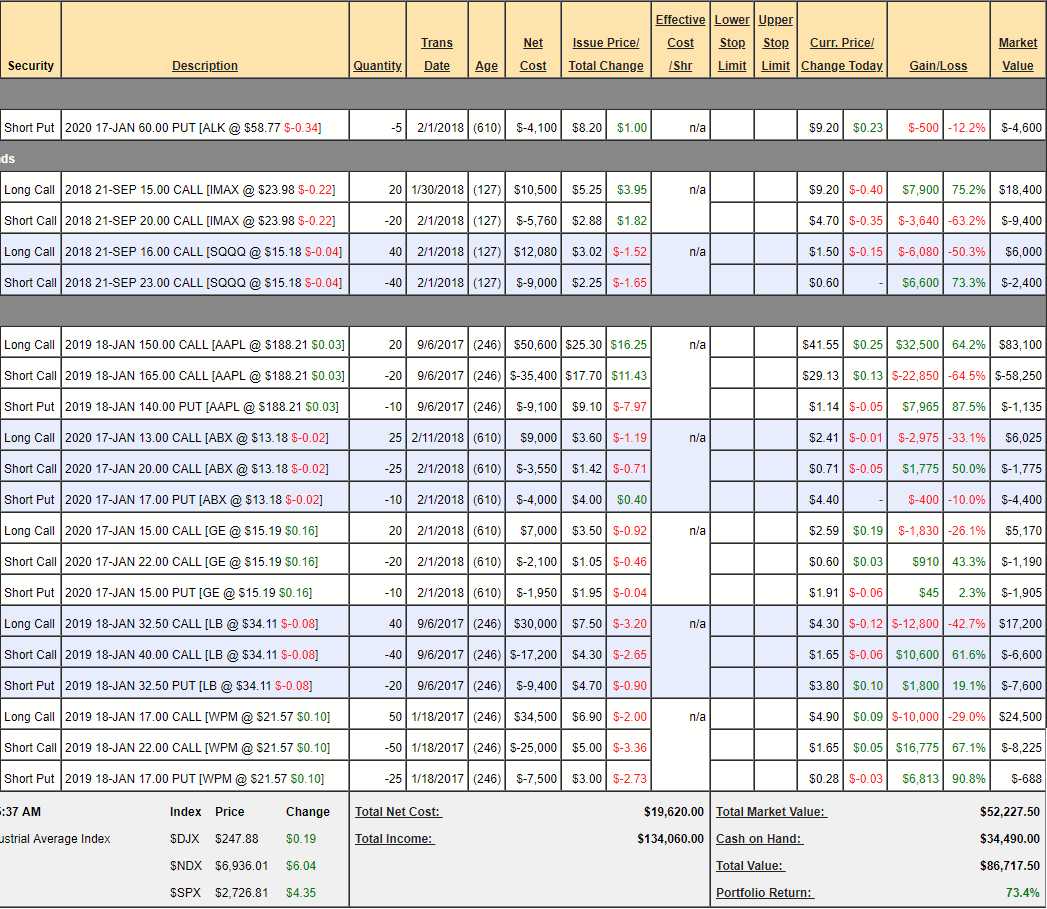

One portfolio that we make available to the general public is our Money Talk Portfolio, where every trade idea is announced live on the show and we make no adjustments other than on those appearances. I haven't been on since Feb 1st but, even so, the trade ideas in this ultra low-touch portfolio are already up 73.4% since September – not bad for 8 months and only a few adjustments.

Being well-balanced is the key to any good portfolio and, of course, it's important to have hedges. Our SQQQ hedge in the MoneyTalk Portfolio however, is getting long in the tooth and needs to be rolled but the LBrands (LB), IMax (IMAX), Apple (AAPL) and Wheaton Precious Metals (WPM) have already rocked higher with Barrick Gold (ABX), GE (GE) and Alaska Air (ALK) all still good as new trades. This was a $50,000 portfolio we predicted would hit $118,535 by Jan 2020, which would be up $68,535 (137%) so up 73% is better than expected with 19 months left on these positions.

As we discussed in this week's Live Trading Webinar, trading is a profession (if you want to do it properly) and you should know EXACTLY how much money every one of your positions is supposed to make and you should always know if they are on or off track towards making those positions. Once you have control of your portfolio, it's much easier to make the necessary adjustments to corect those positions that are going off course.

Yes, sometimes we cut our losses and sometimes, like NOW – it's wise to cash out early since we SHOULD only be up about 40% at this point so up 73% is nearly double what we expected so, logically, if we cash out and take 3 months off – we'll still be right on track and, if we happen to miss a market correction while we're getting a tan – then we come back to buy cheaper stocks with 173% of our original principle. There's really no downside – other than the irrational fear that you'll "miss" a rally.

There are always plenty of stocks to buy. Even as worried as I am about the broad market being overbought, we still added a new Top Trade Idea on Monday (see our recent Top Trade Review for other ideas). There's always something to trade and something is always on sale so there's no such thing as "missing" a rally unless the only way you know how to make money is in a bull market.

Fundamentalists don't need bull markets, we only need traders and analysts to be idiots and let perfectly good stocks (like ALK, ABX and GE) go below their fair values because they have no idea how companies actually operate other than whatever profit prints out on a spreadsheet on their quarterly report.

- The ALK trade puts $4,600 in your pocket and uses $2,787 of ordinary margin. Pays up to $4,600

- The ABX trade puts $150 in your pocke and uses $1,768 of ordinary margin. Pays up to $17,500

- The GE trade costs $2,075 in cash and uses $1,453 of ordinary margin. Pays up to $14,000

So that's how we can make $37,775 by Jan 2020 on those 3 trades that I still like which pay you a net cash credit of $2,675 and uses just $6,008 of ordinary margin on the puts. See – ALWAYS something we can trade!

More and more I am struck by how AWFUL most analysts are and the crap that passes for Financial News these days is a total joke but, of course, what do you expect for nothing? We give away plenty of free picks but our Members know the really good stuff costs money and many of them join after making money with our free picks – it's a subscription that pays for itself!

Speaking of hot stuff – best wishes to those in Hawaii – our hearts are with you…

Have a great weekend,

– Phil