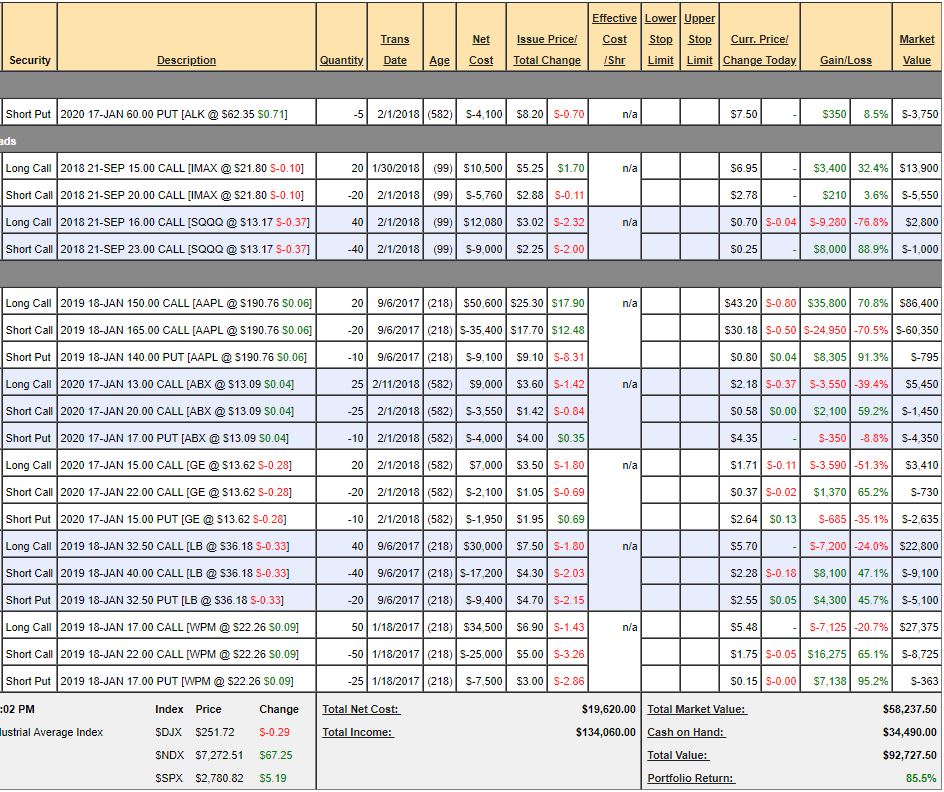

Money Talk Portfolio Review: I won't be doing the show again until July so we haven't touched a thing in it since Feb 1st. Nonetheless, a well-balanced portfolio is it's own reward and we're up another $6,010 from our 5/17 Review, which is very impressive as it's just a $50,000 Portfolio. Well, it's $92,727 now as we're up 85.5%!

The funny thing is, this portfolio is full of FU positions that we simply left alone! It doesn't get much more low-touch than this, the only adjustment we ever made was to get more aggressive on IMAX...

- ALK - Good for a new trade and I want to add a bull call spread.

- IMAX - Well-behaved now.

- SQQQ - Notice how this simple hedge as covered us up to $28,0000 for $3,000 since Feb and is good until Sept and, in all that time, we're only down $1,280? That's the total cost of our insurance in this portfolio - insurance that would have paid us back $28,000 out of our initial $50,000 principle of the markets had gone horribly wrong. Hedging does not have to be complicated, or expensive!

- AAPL - Accounting for a lot of our profits.

- ABX - A late starter but I like them with gold coming back.

- GE - Not as devastating as you'd think considering we went in in Feb.

- LB - Back on track but only have until Jan to get to $40 so no more missteps.

- WPM - Gosh I love this company!

Well that was easy. It''s a near perfect portfolio and you can see why I started a hedge fund because ordinary investors like the people who watch Money Talk up in Canada are like "WOW!" and you guys are like "Yawn - only 85%?"