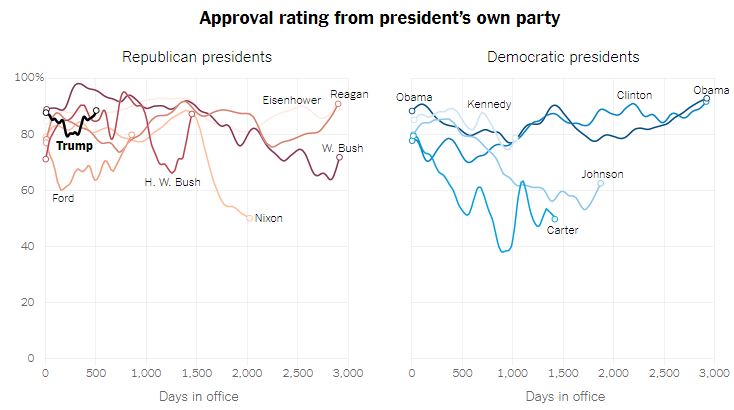

You know, you shouldn't have to wake up in the morning and have that be your number one concern. The President of the United State of America is, traditionally, a stabilizing force in the World, not an agent of chaos! While, Republican voters seem to be loving the chaos so far (90% of them approve of the President) – how many times can he roll the dice before he craps out and pisses off the whole table?

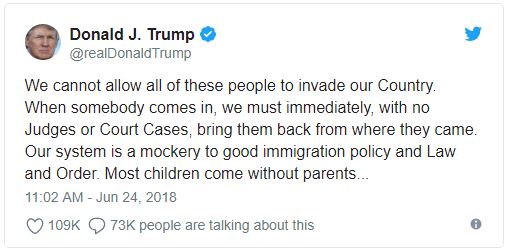

Aside from escalating the Trade War this weekend by barring Chinese investments in US tech firms (sending the markets tumbiling again), Trump has decided to suspend Due Process, which is in both the 4th and 15th Amendments to the Constitution because that's how important people used to think it is! Now, ordinarilly we'd say "Well the President can't just suspend due process, this isn't a dictatorship, we have a system of checks and balances to reign in a President from having absolute power. Even if he could get a Republican Congress to go along with something so outrageous, we have a Supreme Court full of lifetime apointees who will prevent him from violating the Constitution."

"

First they came for the Socialists, and I did not speak out—

Because I was not a Socialist.

Then they came for the Trade Unionists, and I did not speak out—

Because I was not a Trade Unionist.

Then they came for the Jews, and I did not speak out—

Because I was not a Jew.

Then they came for me—and there was no one left to speak for me."

The ACLU released a statement Sunday condemning Trump’s tweets, calling his suggested approach “both illegal and unconstitutional.” The organization then called on “any official who has sworn an oath to uphold the Constitution and laws” to disavow Trump’s suggestion “unequivocally.” Well, good luck with that.

The ACLU released a statement Sunday condemning Trump’s tweets, calling his suggested approach “both illegal and unconstitutional.” The organization then called on “any official who has sworn an oath to uphold the Constitution and laws” to disavow Trump’s suggestion “unequivocally.” Well, good luck with that.

While US Republican's may approve of what the President is doing, the Rest of the World certainly does not with Asian markets turning down 1% this morning and Europe down over 1% and our Futures, as of 8:30, indicate about a 0.5% drop at the open. It's not a big deal so far – all we're going to do is retest last week's lows – only if we begin to fail them will it be time to add more hedges than we already have (quite a lot!).

There are direct and indirect effects to the trade war. Harley Davidson (HOG), for example, says the EU's retaliatory tariffs will add $2,200 (10%) to the cost of the average motorcycle. Harley says it will not raise retail prices or wholesale prices to dealers to cover the costs of the tariffs, because it "believes the tremendous cost increase, if passed onto its dealers and retail customers, would have an immediate and lasting detrimental impact to its business in the region, reducing customer access to Harley-Davidson products and negatively impacting the sustainability of its dealers’ businesses."

That will translate to a $100M hit to the bottom line in 2018 and, in a complete policy backfire, HOG plans to address the issue by moving its export manufacturing to the EU! Just because the policy is clearly failing to have the desired effects doesn't mean Trump will change them. This is a slow-motion train-wreck we'll be hearing about as thousands of companies report their earnings woes in the next few quarters.

On the indirect side, Boeing (BA) stands to lose a 180-plane, $18Bn order from China, who are meeting with Airbus to discuss moving the massive order to a more friendly environment. Meanwhile, China is boosting their own market to offset any damage done by Trump's Tariffs by cutting reserve requirements at banks by $108Bn, a 0.5% cut in the reserve ratio. Nonetheless, both China and the EU have warned this weekend that trade wars with the US will lead to a Global Recession.

The U.S. is due to impose tariffs on $34 billion of Chinese imports from July 6, and Trump has threatened to impose levies on another $200 billion of Chinese goods. If that threat is realized, it could cut as much as half a percentage point off China’s economic growth, and also hit the American economy – and that is just 1/10th of the tariffs Trump has said he wants to place!

It's a busy data week led by Consumer Confidence tomorrow, Durable Goods on Wednesday, GDP Thursday and Personal Income, Spending and Sentiment on Friday so a great look at consumers this week into Q2 earnings reports:

| Date | ET | Release | For | Actual | Briefing.com Forecast | Briefing.com Consensus | Prior |

|---|---|---|---|---|---|---|---|

| Jun 25 | 10:00 | New Home Sales | May | 673K | 666K | 662K | |

| Jun 26 | 09:00 | S&P Case-Shiller 20-city Index | Apr | 6.8% | 6.8% | 6.8% | |

| Jun 26 | 10:00 | Consumer Confidence | Jun | 128.2 | 127.1 | 128.0 | |

| Jun 27 | 07:00 | MBA Mortgage Applications Index | 06/23 | NA | NA | 5.1% | |

| Jun 27 | 08:30 | Durable Orders | May | -1.3% | -1.0% | -1.7% | |

| Jun 27 | 08:30 | Durable Goods –ex transportation | May | 0.5% | 0.4% | 0.9% | |

| Jun 27 | 08:30 | Adv. Intl. Trade in Goods | May | NA | NA | -$68.2B | |

| Jun 27 | 08:30 | Adv. Wholesale Inventories | May | NA | NA | 0.0% | |

| Jun 27 | 10:00 | Pending Home Sales | May | 1.0% | 0.8% | -1.3% | |

| Jun 27 | 10:30 | Crude Inventories | 06/23 | NA | NA | -5.9M | |

| Jun 28 | 08:30 | GDP – Third Estimate | Q1 | 2.2% | 2.2% | 2.2% | |

| Jun 28 | 08:30 | GDP Deflator – Third Estimate | Q1 | 1.9% | 1.9% | 1.9% | |

| Jun 28 | 08:30 | Initial Claims | 06/23 | 222K | 220K | 218K | |

| Jun 28 | 08:30 | Continuing Claims | 06/16 | NA | NA | 1723K | |

| Jun 28 | 10:30 | Natural Gas Inventories | 06/23 | NA | NA | +91 bcf | |

| Jun 29 | 08:30 | Personal Income | May | 0.4% | 0.4% | 0.3% | |

| Jun 29 | 08:30 | Personal Spending | May | 0.5% | 0.4% | 0.6% | |

| Jun 29 | 08:30 | PCE Prices | May | 0.2% | 0.2% | 0.2% | |

| Jun 29 | 08:30 | PCE Prices – Core | May | 0.2% | 0.2% | 0.2% | |

| Jun 29 | 09:45 | Chicago PMI | Jun | 60.5 | 61.0 | 62.7 | |

| Jun 29 | 10:00 | Univ. of Michigan Consumer Sentiment – Final | Jun | 99.3 | 99.0 |

99.3 |

We'll probably test good old 2,728 on the S&P (/ES) and here's a chance to prove a bullish consolidation if it holds. The Nasdaq (/NQ) is down to 7,159 and still almost 10% above our 6,500 target but the Dow (/YM) is falling fast at 24,400 – just another 1,000 points to hit a proper retrace there and, of course, the Russell (/TF) thinks Trade Wars don't matter but, if the VIX is over 15 – I'd short the crap out of /TF – now 1,683 with tight stops over 1,700.

Stay tuned – it's going to be an exciting week!