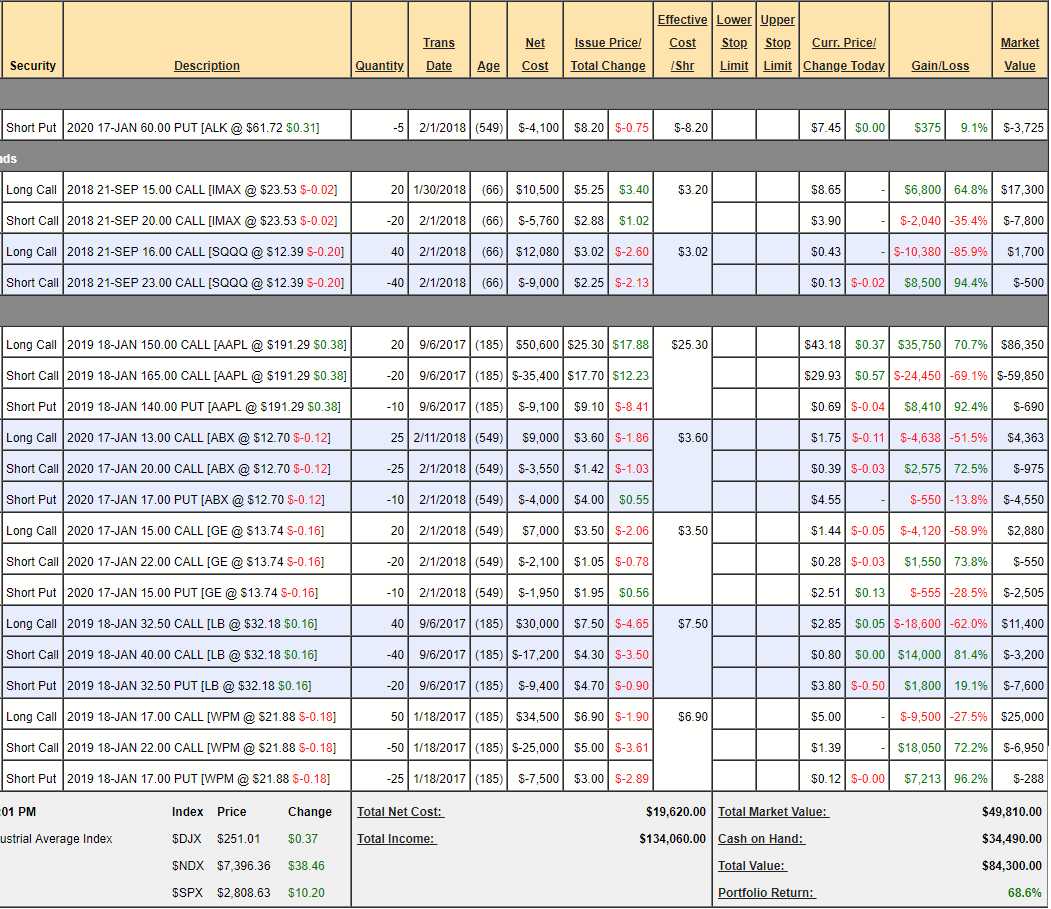

Money Talk Portfolio Review: I am doing the show tomorrow so I have to put this together first. Sadly, we dropped a lot since our June 14th review, when we were at $92,727 (85.5%) but now down to $84,300 (68.6%), mostly due to LB's pullback and our inability to roll SQQQ like we did in the STP/OOP. Nonetheless, up 68.6% since Sept doesn't suck and now we can make some adjustments!

I'm a bit concerned about the rest of the summer so we're going to be cautious - especially with these gains to lock in.

- ALK - I'm very confident in the next $51.80 entry so no change here. Earnings are 7/26 so we'll watch those carefully but expectations are low (about $1.65) and they made $2.51 last Q2, so I'm only worried about guidance. Anticipate making $3,725 more on this one.

- IMAX - Lots of blockbusters ahead should be good for them but this spread is well in the money and can be cashed out for $8.80/4.10 for net $4.70 ($9,400) out of a possible $5 so it's not worth the risk as we can't make interim adjustments so we'll take the profit off the table.

- SQQQ - We still need a hedge and there's not much left in this one. We bought it for net $3,080 and now we can sell the Sept $16 calls for 0.45 ($1,800) so our cost of insurance since Feb was $1,280 - not too terrible. We'll leave the short $23 calls to expire worthless and set up a new hedge of 20 June 2019 $10 ($3.50)/Jan $15 ($1.30) bull call spreads at net $2.20 ($4,400). The spread is $2.35 in the money ($4,700), so it's money well-spent as we can't lose unless our other positions go higher.

- AAPL - We are way over our goal and the Jan $150 ($43.30)/165 ($30) bull call spread is $13.30 ($26,000) and the short $140 puts are 0.70 ($700) for net $25,300.