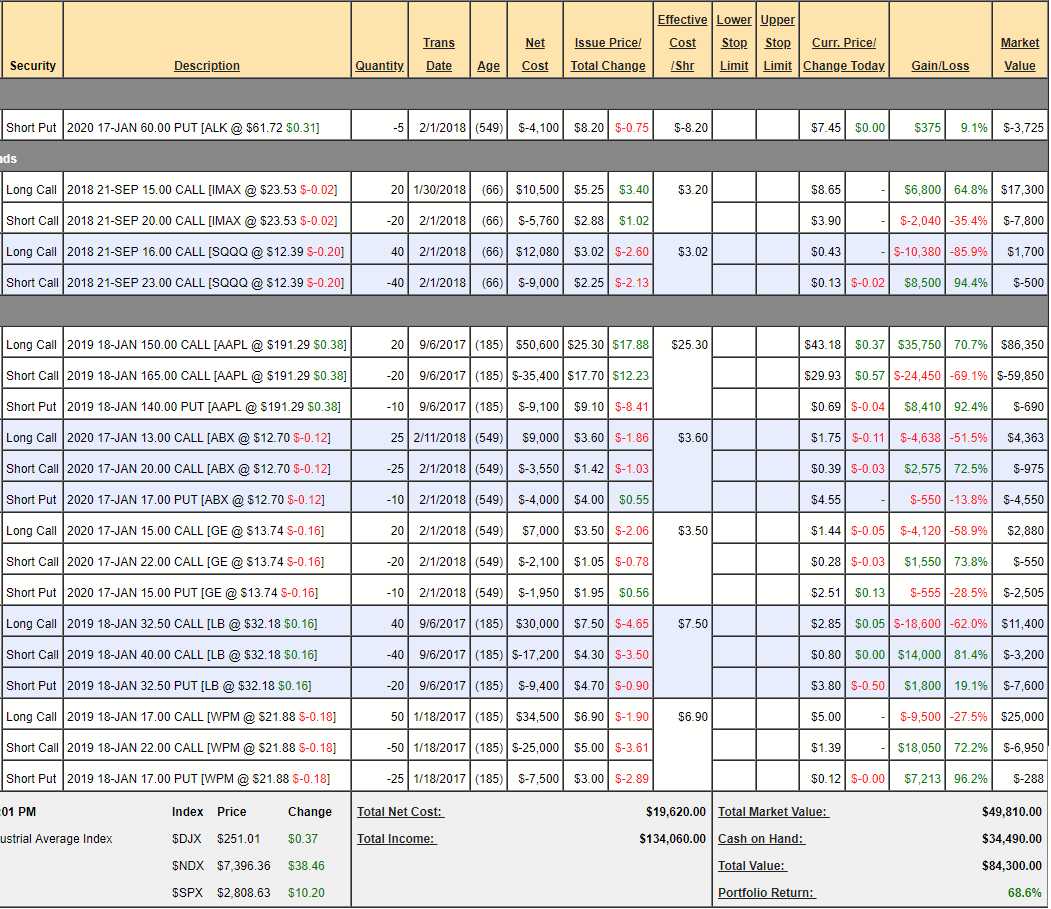

Money Talk Portfolio Review: I am doing the show tomorrow so I have to put this together first. Sadly, we dropped a lot since our June 14th review, when we were at $92,727 (85.5%) but now down to $84,300 (68.6%), mostly due to LB's pullback and our inability to roll SQQQ like we did in the STP/OOP. Nonetheless, up 68.6% since Sept doesn't suck and now we can make some adjustments!

I'm a bit concerned about the rest of the summer so we're going to be cautious – especially with these gains to lock in.

- ALK – I'm very confident in the next $51.80 entry so no change here. Earnings are 7/26 so we'll watch those carefully but expectations are low (about $1.65) and they made $2.51 last Q2, so I'm only worried about guidance. Anticipate making $3,725 more on this one.

- IMAX – Lots of blockbusters ahead should be good for them but this spread is well in the money and can be cashed out for $8.80/4.10 for net $4.70 ($9,400) out of a possible $5 so it's not worth the risk as we can't make interim adjustments so we'll take the profit off the table.

- SQQQ – We still need a hedge and there's not much left in this one. We bought it for net $3,080 and now we can sell the Sept $16 calls for 0.45 ($1,800) so our cost of insurance since Feb was $1,280 – not too terrible. We'll leave the short $23 calls to expire worthless and set up a new hedge of 20 June 2019 $10 ($3.50)/Jan $15 ($1.30) bull call spreads at net $2.20 ($4,400). The spread is $2.35 in the money ($4,700), so it's money well-spent as we can't lose unless our other positions go higher.

- AAPL – We are way over our goal and the Jan $150 ($43.30)/165 ($30) bull call spread is $13.30 ($26,000) and the short $140 puts are 0.70 ($700) for net $25,300. If we ride it out, we will make $4,700 more at $165 and that's up 18.5% in 6 months – not terrible but I think we can do better with $25,300 in cash so let's take this one off the table!

- ABX – Gold has not been doing well but, long-term, I expect it to make a comeback. In a case like this, where the stock is below our target, we can roll to a lower spread, closing out the 25 $13 ($1.75)/20 ($0.39) for $1.36 ($3,400) and picking up the $10 ($3.45)/$15 ($1.10) bull call spread at net $2.35 ($5,875). We originally spend net $1,500 and now we're spending $2,475 putting us in the much lower $12,500 spread for net $3,975, so our upside potential is now $8,525, which is still very good. Currently, we're showing a loss of $2,613 so, if it turns around to a winner of $8,525, that will be a net $11,138 gain in the portfolio.

That's true with a lot of our spreads. Of course it would have been nice if ABX had gone up and up and never gave us any trouble but we spent so little cash on our entry that we have plenty of room to make adjustments along the way in our 2-year spread and, if necessary, we can always extend the time-frame a year or so longer or simply walk away with a manageable loss – that is what hedging is all about!

- GE – These guys have been a disaster and we'd down $3,125 on it so far. Do we try to fix it or give up? While GE is having trouble, I certainly don't think they will go bankrupt so, like ABX, we can roll to a lower position, closing out the 20 2020 $15 ($1.42)/22 (0.28) bull call spread for $1.14 ($2,280). The short puts are in at net $13.05, so they are fine and we'll buy 30 the 2020 $13 ($2.30)/18 (0.70) bull call spreads for net $1.60 ($4,800). Here we are spending net $2,520 on top of our net $2,950 original cash position but we're now in a $15,000 spread for $5,470 with $9,530 (174%) upside potential at $18. As we currently show a loss of $3,125, this position will hopefully turn around by $12,655 if GE is at $18+ in Jan 2020.

- LB – They just announced disappointing June sales but the company is in the midst of a turnaround and investors are simply impatient. It's a great opportunity for us to close our 40 Jan $32.50 ($2.85)/40 (80) bull call spreads for $2.05 ($8,200) and move out to 40 2020 $27.50 ($6.65)/35 ($3.75) bull call spreads at $2.90 ($11,600) so here we are spending $3,400 but we are getting an entire year longer to hit a much lower target for $15,000 on the spread. Our original spend was net $3,400 in cash so this doubles us to $6,800 with an upside of $8,200 (120%) and currently we're showing a $2,800 loss so the potential turnaround on this trade is $11,000 at just $37.50.

- WPM – Despite silver getting hit hard, WPM has stayed near out goal but 6 months ahead of schedule. The Jan $17 ($5.10)/22 ($1.40) bull call spread is $3.70 out of a possible $5, so plenty of room to run but the short puts are silly at 0.12 – so let's buy those back for $288 to free up a slot to sell something else. I am concerned the timing is off and WPM will dip so let's cash in our 50 Jan $17 calls for $5.10 ($25,500) and buy 30 of the 2020 $22.50 ($2.75)/30 (0.90) bull call spreads for net $1.85 ($5,550) so we'll be taking just shy of $20,000 off the table and the 2020 spread provides us with $22,500 of protection against the short calls. We have 50 short calls so WPM would have to be more than $4 over their $22 strike ($26) before it's a problem. If all goes very well, the short calls will expire worthless (or at least worth little) and whatever value remains on the long spread is a bonus.

So we are cashing out $54,650 worth of winning positions and the remaining trades have $38,518 of upside potential, which is another 77% against our original $50,000 entry. Of course we'll lose some money on our hedge and things don't always go as planned but the key to successful investing is to have a plan in the first place!

As a new entry, I like a nice, boring play on General Mills (GIS), makers of Bisquick and Cheerios, Cocoa Puffs, Fruit Roll-Ups, Go-Gurt, Haagen-Dazs, Lucky Charms, Old El Paso, Pilsbury, Progresso and dozens of other things you have in your cabinets. Last year, GIS made $2.1Bn on $15.7Bn in sales yet you can buy the whole company for $26.25Bn at $44.25 – that's just silly!

There's no "story" to this, it's a blue-chip stock that's been in business 100 years and will likely be in business 100 more and Amazon doesn't hurt them because they are not a retail store – they just supply stuff that retail stores sell – including Amazon. The drop from $60 was caused by a combination of higher transportation costs and fears of rising labor cost and raw goods costs that, so far, have not materialized.

Also, the company stretched out, buying Blue Buffalo pet food for $8Bn, which was 25x their $329M earnings so WAY higher then GIS's valuation but GIS sells $16Bn worth of stuff and has fantastic distribution so I think they will quickly squeeze another $200M out of Blue Buffalo, which would grow their earnings 25% to perhaps $2.65Bn and even applying a 12x multiple to that gets us to $31.8Bn, 20% higher than the stock is now.

We don't have to shoot for the moon here – or even $60. Let's go for $47.50 (10% higher) with the following spread:

- Sell 10 GIS 2020 $42.50 puts for $3.90 ($3,900)

- Buy 15 GIS 2020 $40 calls for $6.50 ($9,750)

- Sell 15 GIS 2020 $47.50 calls for $2.85 ($4,275)

The net cost of the spread is $1,575 and, if all goes well, at $47.50 or higher in Jan 2020, the spread will pay $11,250 for a gain of $9,675 (614%). If GIS is below $42.50 you do have an obligation to buy 1,000 shares of the stock for $42.50 but the margin requirement should be only about $2,000 and you would take the loss and sell – not buy all that stock (even though it would be great to own, long-term).

As noted above, it would be great if GIS goes up and up and we make 614% in 18 months in our sleep but you can't expect that. The idea is just to have a diversified group of good, conservatively-targeted trades in solid companies that COULD make ridiculous amounts of money and, usually, some of them will and a 614% winner can pay for a lot of losers along the way so, in the end, you are very likely to come out consistently ahead!