Alphabet (GOOGL) knocked it out of the park with earnings last night and are jumping over $50 higher (5%) after last night's earnings report and that will take them to just under $900Bn but still behind AAPL at $941Bn but now firmly ahead of AMZN ($875Bn) and MSFT ($830Bn) in the race to become the World's first Trillion Dollar Company.

As you can see from this chart, throw in Facebook and the top 5 S&P companies have the market capitalization of the bottom 282 – the difference between mega-caps and what we used to call large-caps has never been greater but it mirrors the more uneven distribution of wealth in our society where the people in the Top 10% THINK they are doing well, only because they really can't comprehend the wealth of the Top 0.01%, which starts at 1,000 times more than they make and 3,000 more than they own.

These Monster Companies, just like our Monster Billionaires can throw their money around and buy almost anything and get away with almost anything like Monopolizing On-Line Retail, Using Your Personal Information to make a Profit or even becoming President of the United States. It is truly terrifying to think of what kind of damage a bad Billionaire could do but thank goodness the US has a system of checks and balances that…. oops…

These Monster Companies, just like our Monster Billionaires can throw their money around and buy almost anything and get away with almost anything like Monopolizing On-Line Retail, Using Your Personal Information to make a Profit or even becoming President of the United States. It is truly terrifying to think of what kind of damage a bad Billionaire could do but thank goodness the US has a system of checks and balances that…. oops…

Oh well, if you can't beat them – invest in them, I guess. To that end, Alphabet (GOOGL) just beat earnings by $2.21/share, coming in at $11.75 per $1,211 share, now $1,262 in pre-market. If we assume they keep it up and make $46 for the year, then $1,262/46 is 27 times earnings, which is a lot, but maybe not for a company that made $32/share last year so about 40% bottom-line growth is not all tax cuts – this company is a MONSTER!

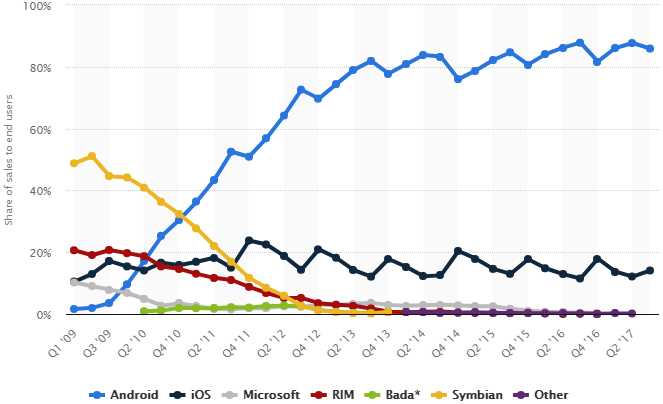

GOOGLE barely pulled back when the EU fined them $5Bn for engaging in anti-competitive behavior for giving Android away at a loss but GOOGL's solution will be to charge for Android and PRESTO!, they make much more than $5Bn installing an operating system on 1.3Bn phones – even if they just charge manufacturers $10 ($13Bn). Giving Android away for free has already made them the default operating system in 85% of the World's phones – $5Bn isn't even a wrist-slap to GOOGL, who have already destroyed all competition except for fellow Trillionaire, Apple (AAPL) who have the rest of the marke with iOS.

This is like fining Hitler for invading Poland in 1946 – a bit late to undo the damage – the war is already over only Hitler lost and AMZN/AAPL have won since it's virtually impossible to get developers to start making apps for systems with no traction – as even Microsoft (MSFT) discovered. MSFT recently threw in the towel on the Windows Phone, which failed despite the fact that 5.7Bn people (80%) have computers with Window on them. They aren't out of the phone business but the new Surface Phone will almost certainly run on Android and, sadly for Microsoft, people are likely to opt to use Google over Bing on those phones too.

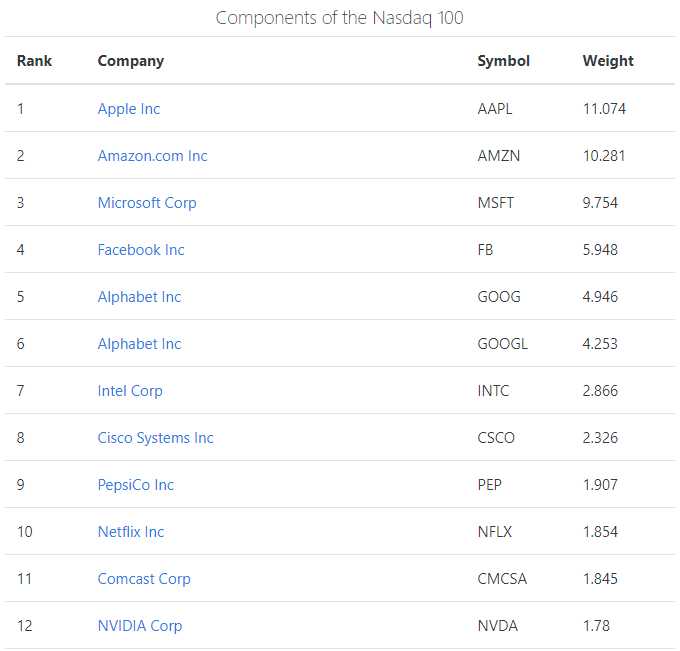

Meanwhile, Alphabet makes up 9.2% of the Nasdaq's weighting because both GOOG and GOOGL are components – even though they are essentially the same stock but only GOOGL has voting rights yet people still buy GOOG with no rights because, well, because they are idiots…

Meanwhile, Alphabet makes up 9.2% of the Nasdaq's weighting because both GOOG and GOOGL are components – even though they are essentially the same stock but only GOOGL has voting rights yet people still buy GOOG with no rights because, well, because they are idiots…

Actually, everyone buying GOOG(L) stock is an idiot because the "Founders Stock", which you can't buy, has 10x the voting rights per share of all other shares meaning it doesn't matter how much of GOOG(L) you own because, if you don't own over 90% of the regular voting stock – you still have no say in the company. So far, it's hard to disagree with what the company has been doing though, even at $46/share, GOOGL is only dropping $20Bn to the bottom line vs $55Bn for AAPL yet the companies are carrying roughly the same valuation.

So, either GOOGL is over-valued or AAPL is under-valued or a little of both but, either way MSFT, who also make about $20Bn a year and and AMZN ($3Bn) or even FaceBook ($15Bn) should not be swimming in AAPL's pool at the Trillion-Dollar water-mark so, overall, the entire Nasdaq is dangerously over-valued here – even though we feel AAPL is still a bargain at $1,000,000,000,000.

They are 36% of the Nasdaq by weight and other Nasdaq companies, like Netflix (NFLX) and Tesla (TSLA). are dangerously over-priced with the whole index having a p/e ratio of 27, 10% higher than the S&P 500 which is 50% above its historical average. So far, we've been hearing great reports from the Banksters and the Monopolies but earnings season is still young and the Nasdaq is still my favorite index short. This morning the Nasdaq (/NQ) Futures are hitting 7,460 as GOOGL explodes higher and we can short that at the line (tight stops above), but I think it's going to be a good time to press our shorts in the Short-Term Portfolio – as we need to lock in the gains on our Long-Term Portfolio positions (see our reviews from last week).

SQQQ should drop to near $12 this morning and we can hopefully double down on our Jan $10 calls at about $2.50 per contract ($3.20 avg) and then, when we get a bounce, we'll look to sell the Jan $20 calls, now 0.70, for about $1.20 and then we'll net into the $10/20 spread for $2 so we'll be at the money with our protection. This works even better as a new trade as it gives you great protection as it's a 3x ETF so a 20% drop in the Nasdaq will pop SQQQ 60%, from $12 to $19.20 and that would put the long calls over $9 for a gain of $7 (350%), which is the kind of leverage we like to have on our hedges.

Oops, now there are rumors that China may be adding stimulus to their economy so no shorting yet – we'll have to wait and see how high we pop but hopefully 7,475 and certainly 7,500 will be a great shorting line on /NQ.