Up and up we go.

No big news over the weekend other than more scandals in Trump Land – but what else is new over there? As we noted on Friday, the Dow is still miles away from retaking it's February highs so our attention is currently focused on the S&P 500 at the 2,850 line, which is 30% over the Must Hold Line at 2,200 and our February high on the S&P was 2,872.87 on Jan 26th but, sadly, two weeks later (Feb 9th) we were back at 2,532.69, a drop of 340.18 (11.8%) in 10 trading sessions.

The volume on SPY on the way down was considerably heavier than what we have been getting recently and it's a good idea to do a quick comparison:

| Date | Open | High | Low | Close* | Adj Close** | Volume |

|---|---|---|---|---|---|---|

| Aug 17, 2018 | 283.83 | 285.56 | 283.37 | 285.06 | 285.06 | 65,567,700 |

| Aug 16, 2018 | 283.40 | 285.04 | 283.36 | 284.06 | 284.06 | 69,967,900 |

| Aug 15, 2018 | 282.38 | 282.54 | 280.16 | 281.78 | 281.78 | 102,925,400 |

| Aug 14, 2018 | 282.92 | 284.17 | 282.48 | 283.90 | 283.90 | 43,842,000 |

| Aug 13, 2018 | 283.47 | 284.16 | 281.77 | 282.10 | 282.10 | 65,686,900 |

| Aug 10, 2018 | 283.45 | 284.06 | 282.36 | 283.16 | 283.16 | 77,076,000 |

| Aug 09, 2018 | 285.53 | 285.97 | 284.92 | 285.07 | 285.07 | 35,652,400 |

| Feb 09, 2018 | 260.80 | 263.61 | 252.92 | 261.50 | 259.29 | 283,565,300 |

| Feb 08, 2018 | 268.01 | 268.17 | 257.59 | 257.63 | 255.46 | 246,449,500 |

| Feb 07, 2018 | 268.50 | 272.36 | 267.58 | 267.67 | 265.41 | 167,376,100 |

| Feb 06, 2018 | 259.94 | 269.70 | 258.70 | 269.13 | 266.86 | 355,026,800 |

| Feb 05, 2018 | 273.45 | 275.85 | 263.31 | 263.93 | 261.70 | 294,681,800 |

| Feb 02, 2018 | 280.08 | 280.23 | 275.41 | 275.45 | 273.12 | 173,174,800 |

| Feb 01, 2018 | 281.07 | 283.06 | 280.68 | 281.58 | 279.20 | 90,102,500 |

ALL of last week's volume as we clawed back to the highs (347,987,000) did not equal the volume we had on Feb 6th – forget the rest of the week! It's very easy for the market to rise when there are no sellers, particularly when it does most of its rising in the very thinly-traded Futures markets. Movement like this is a pretty good sign that the markets are being manipulated to put on a good show for the retail buyers so the institutions can dump their stocks on you once the trading session begins.

Since the retail buying is pretty thin and there's no institutional ("smart-money") buying – you end up with very light trading sessions and any attempt as volume selling, like there was on Aug 15th when we had a trade scare – sends the market crashing down quickly as there aren't enough real buyers there to support it. In Friday morning's report, we felt that the Dow would retrace from 25,625 at least to 25,500 and we did get that early in the morning (good for $750 per contract gains – you're welcome!)

We also had a little bit of luck with our Gasoline (/RBV8) Futures longs, which we picked up just over $1.88 and 4 of those are already up $1,400 but it's very early as we expect to see $2 into the holiday weekend (next Friday) for a pretty large gain ($4,000 more per contract!) if all goes well so, still playable ($1.89) – even if you are late to join the party.

We also had a little bit of luck with our Gasoline (/RBV8) Futures longs, which we picked up just over $1.88 and 4 of those are already up $1,400 but it's very early as we expect to see $2 into the holiday weekend (next Friday) for a pretty large gain ($4,000 more per contract!) if all goes well so, still playable ($1.89) – even if you are late to join the party.

Remember kids, if you like being $1,400 richer on Monday Morning, before heading out to work, you can simply subscribe to the PSW Report for just $99 a month or $995 per year and you'll get these Reports (yes, like the one you are reading now) sent to your inbox most days at 8:30 – while I am writing them (they don't get any fresher than that) and almost always the report is fully done by the open at 9:30. That's just $2.72 per day to get all these great Trade Ideas when just one pays for more than a year's Membership!

We like signing up Report Members because they are "passive", in that they give us money and don't participate in our Live Chat Room during the trading day – where the bulk of our trade ideas are published and our 5 Member Portfolios are managed. There's a limit (500) to how many Live Chat Members we can accomodate, so we're not actively looking to expand that group but Report Members, Top Trade Members and even Trend Watcher Members – who can view the live Chat Room (delayed) but can't chat – those we can have thousands of. So please – tell your friends!

Passive Incomes are great and, in fact, once you are a Member, you can generate your own passive income by simply referring people to free trials of PhilStockWorld and you get rewarded for each one that decides to sign up. We have a lot of people pulling down very nice incomes from this side gig!

Passive Incomes are great and, in fact, once you are a Member, you can generate your own passive income by simply referring people to free trials of PhilStockWorld and you get rewarded for each one that decides to sign up. We have a lot of people pulling down very nice incomes from this side gig!

Meanwhile, in our main gig, we see no reason for the Futures to be up so much and we have some lovely test lines so it's a good morning to go short at the following lines: Dow (/YM) 27,750, S&P (/ES) 2,860, Nasdaq (/NQ) 7,400 and Russell (/RTY) 1,700. The best way to short the Futures is to wait for 2 or 3 to cross below their lines and then short the laggard(s) and, when the last one crosses, the bear move is confirmed. If ANY of the indexes get back above their lines – then stop out quickly and live to short another day!

It's normal to get pullback at resistance lines and, as I noted above, the 30% line on the S&P at 2,850 is a very good one. It has already been rejected twice in the last 30 days so 3rd time may be a charm but what NEW news is going to put us over the top. I suppose it is hoped that we resolve our trade issues with China this week but I very much doubt that will happen and, more to the point – imagine the tantrum Donald will throw if he doesn't get his way… THAT is going to be the fun bet and that bet is to the downside!

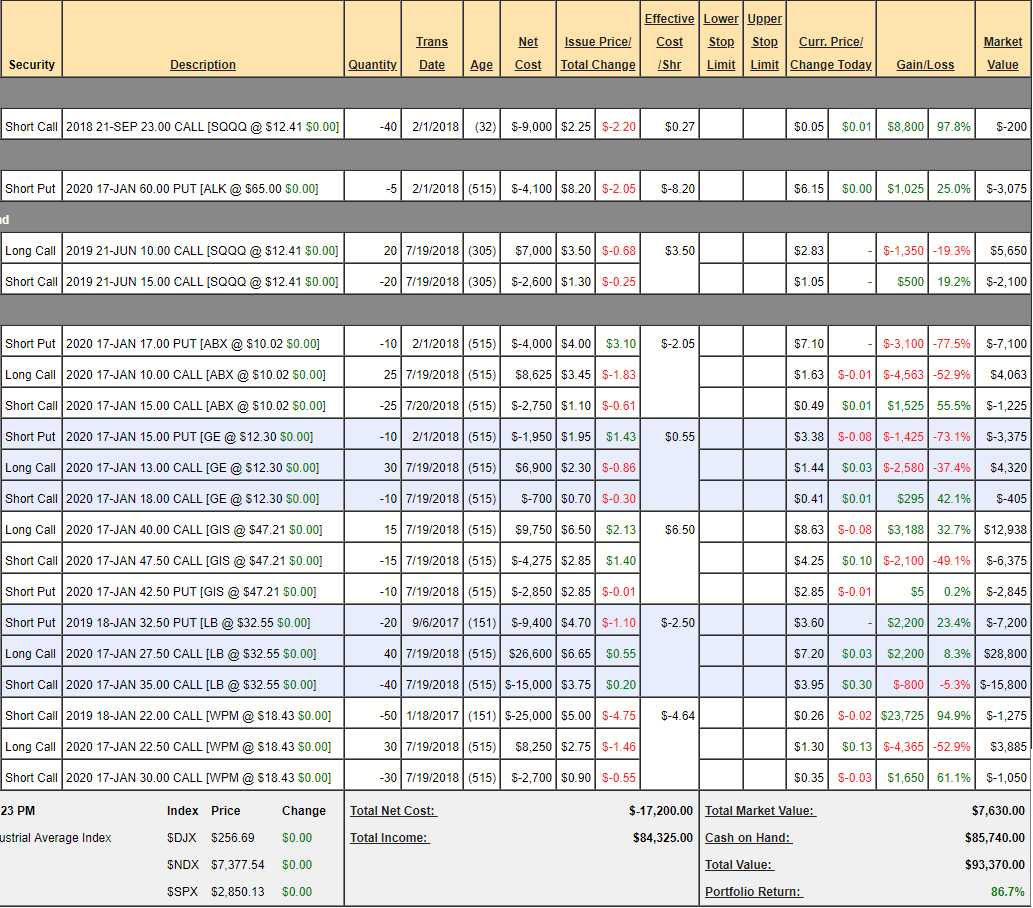

We already have plenty of downside bets on our portfolios and, since Options expired on Friday, let's have a look at our hedge in the context of our public Money Talk Portfolio, which we feature on BNN's Money Talk about once a quarter. We only make changes on the show, so it's a very low-touch portfolio and we're coming up on the one year anniversary on 9/6, as we only begin doing this one year ago but, already, the portfolio is up 86.8% from $50,000 to $93,370 as of Friday's close.

Remember – every single trade AND adjustment was announced live, on TV, before they were made in the portfolio. We're simply showing people how to use our Be the House – NOT the Gambler techiques and hedging strategies in real-time market situations:

We cashed out a lot of winners in July as I was too nervous about the summer markets to leave what were, as the time, $34,300 worth of gains on the table and we can't make any adjustments until the next time I'm on the show in September – so better safe than sorry… We had $34,490 in cash at the time and, as you can see, we raised our cash holdings to $85,740 (91.8% of the portfolio's value) but we still managed to gain another $9,070 from our remaining positions in the past 30 days. You do not need to keep a lot of cash in the market to make great gains if you know how to properly apply leverage!

- SQQQ – Is our hedge yet notice we're hedging for a profit as we rolled our old Sept $16 calls into the new June spread while leaving the short Sept $23 calls to expire worthless, for an eventual $9,000 profit if they expire below $23 in a month (a pretty good bet at this point). You don't have to lose all your money hedging if you manage it correctly and these are very passively managed hedges – our Short-Term Portfolio is much more active and turns a nice profit hedging. Still, for budgeting purposes, we assume we will lose the entire $3,550 remaining value on this hedge – anything less than that is an upside surprise. Hedges are insurance – you have them just to protect the longs and this spread pays $10,000 if the Nasdaq falls (+$6,450) – so that's our insurance policy at the moment.

- ALK – That is a leftover short put from a trade we cashed in. I'm very confident we'll hold $60 so I expect to collect $3,075 by next Jan.

- ABX – We're down $4,289 on this one but I still love them, so great as a new trade. We need gold to recover but ABX is a solid producer and in for the long run. While we'll probably have to roll our short puts as $17 is a tall order from $10, I don't see why we can't get back to $13 easily and that would put our 25 $10 calls $3 in the money for $7,500 less a $4 loss on 10 short puts would be $4,000 but that's still +$3,500 from currently -$4,289 so the upside potential here is $7,789 – clearly still good for a new trade!

- GE – Kind of baffling how low this stock has gotten. $12.30/share is a $107Bn market cap for a company with $121Bn in sales which they usually make $9Bn on but they had a lot of restructuring charges last year and showed a $5.7Bn loss but what do we care, we didn't buy them then, we bought them now and that means we'll get that tax write-off down the road. Last quarter GE had $30Bn in sales and made $789M so not back on track yet but it's a big company and takes a long time to turn around. As with ABX, we may have to roll the short $15 puts down the line but our 30 $13 calls can easily see $15 (these are very conservative numbers) and that would be $6,000 less a $2,000 loss in the puts is + $4,000 against the current net $540 so we expect to easily make $3,460 on this position – hopefully a lot more.

- GIS – Was our new addition last month and we're already up $1,093 (41.6%) from our net $2,625 entry, so pretty good for the first month but it's an $11,250 spread if all goes well so we're only "on track" for our expected $8,625 (328%) profit with another $4,907 left to gain. And all GIS has to do is hold the $47.50 line!

If you are looking for a new trade – this one is pretty good still as it's net $3,718 on the way to $11,250 so it can still gain $7,532 (202%) from here in 16 months – that's pretty good and you don't have the risk we took on 7/19 of calling the bottom!

- LB – This was our Trade of the Year but, due to timing issues, we switched to HBI but our BNN viewers were fortunate enough to get a crack at LB while it was low, so they never suffered from the crazy ups and downs and this position is already nicely ahead. Still, it's a big position and we see no reason we won't hit our $35 goal and that would be net $30,000 vs our current net of $5,800 so another one that's great for a new trade with $14,200 (244%) left to gain. See how easy this stuff is?

- WPM – This was our 2017 Trade of the Year and we LOVE IT – even though they are back near their lows. That's because we knew this would happen and I wish I could buy back the short Jan $22 calls right now rather than risk them going back up but that's not the rules. Still, if all goes well, WPM stays below $22, the short calls go worthless and the 30 spreads net out for $22,500 from the current $1,560 so $20,940 left tto gain on this one is a very nice 1,342% – not bad for a new trade, right?

That is a nice, well-balanced portfolion and I'm thrilled we cashed out all of our less-certain positions because just the ones we have left are positioned to make us another $54,371 into Jan of next year less $3,550 on the hedges (though there will, of course, be more hedges and more positions over time) for net $50,821, which is over 100% of our original $50,000. If we can gain 100% every year – we'll be in pretty good shape, right?

Trading doesn't have to be hard and trading doesn't have to be stressful if you learn to Be the House – NOT the Gambler!