BNN Money Talk portfolio – update 8/20/2018

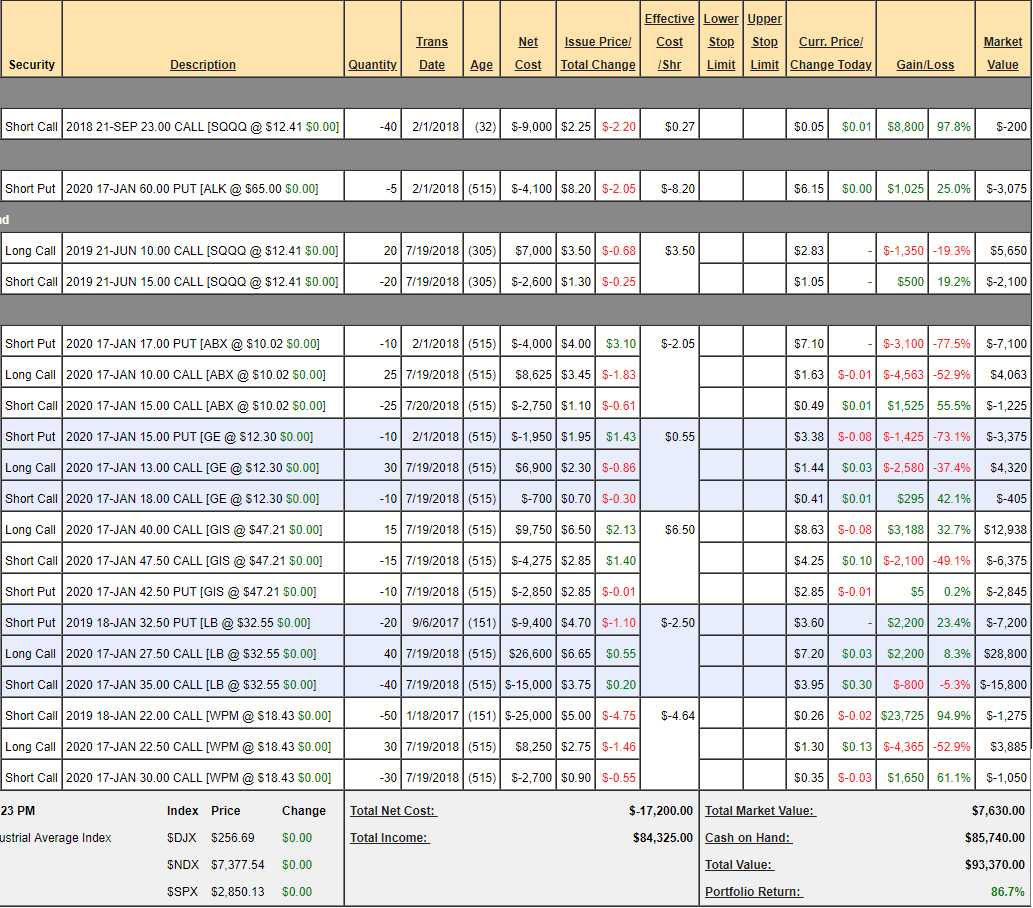

We already have plenty of downside bets on our portfolios and, since Options expired on Friday, let's have a look at our hedge in the context of our public Money Talk Portfolio, which we feature on BNN's Money Talk about once a quarter. We only make changes on the show, so it's a very low-touch portfolio and we're coming up on the one year anniversary on 9/6, as we only begin doing this one year ago but, already, the portfolio is up 86.8% from $50,000 to $93,370 as of Friday's close.

Remember – every single trade AND adjustment was announced live, on TV, before they were made in the portfolio. We're simply showing people how to use our Be the House – NOT the Gambler techiques and hedging strategies in real-time market situations:

We cashed out a lot of winners in July as I was too nervous about the summer markets to leave what were, as the time, $34,300 worth of gains on the table and we can't make any adjustments until the next time I'm on the show in September – so better safe than sorry… We had $34,490 in cash at the time and, as you can see, we raised our cash holdings to $85,740 (91.8% of the portfolio's value) but we still managed to gain another $9,070 from our remaining positions in the past 30 days. You do not need to keep a lot of cash in the market to make great gains if you know how to properly apply leverage!

- SQQQ – Is our hedge yet notice we're hedging for a profit as we rolled our old Sept $16 calls into the new June spread while leaving the short Sept $23 calls to expire worthless, for an eventual $9,000 profit if they expire below $23 in a month (a pretty good bet at this point). You don't have to lose all your money hedging if you manage it correctly and these are very passively managed hedges – our Short-Term Portfolio is much more active and turns a nice profit hedging. Still, for budgeting purposes, we assume we will lose the entire $3,550 remaining value on this hedge – anything less than that is an upside surprise. Hedges are insurance – you have them just to protect the longs and this spread pays $10,000 if the Nasdaq falls (+$6,450) – so that's our insurance policy at the moment.

- ALK – That is a leftover short put from a trade we cashed in. I'm very confident we'll hold $60 so I expect to collect $3,075 by next Jan.

- ABX – We're down $4,289 on this one but I still love them, so great as a new trade. We need gold to recover but ABX is a solid producer and in for the long run. While we'll probably have to roll our short puts as $17 is a tall order from $10, I don't see why we can't get back to $13 easily and that would put our 25 $10 calls $3 in the money for $7,500 less a $4 loss on 10 short puts would be $4,000 but that's still +$3,500 from currently -$4,289 so the upside potential here is $7,789 – clearly still good for a new trade!

- GE – Kind of baffling how low this stock has gotten. $12.30/share is a $107Bn market cap for a company with $121Bn in sales which they usually make $9Bn on but they had a lot of restructuring charges last year and showed a $5.7Bn loss but what do we care, we didn't buy them then, we bought them now and that means we'll get that tax write-off down the road. Last quarter GE had $30Bn in sales and made $789M so not back on track yet but it's a big company and takes a long time to turn around. As with ABX, we may have to roll the short $15 puts down the line but our 30 $13 calls can easily see $15 (these are very conservative numbers) and that would be $6,000 less a $2,000 loss in the puts is + $4,000 against the current net $540 so we expect to easily make $3,460 on this position – hopefully a lot more.

- GIS – Was our new addition last month and we're already up $1,093 (41.6%) from our net $2,625 entry, so pretty good for the first month but it's an $11,250 spread if all goes well so we're only "on track" for our expected $8,625 (328%) profit with another $4,907 left to gain. And all GIS has to do is hold the $47.50 line!

If you are looking for a new trade – this one is pretty good still as it's net $3,718 on the way to $11,250 so it can still gain $7,532 (202%) from here in 16 months – that's pretty good and you don't have the risk we took on 7/19 of calling the bottom!

- LB – This was our Trade of the Year but, due to timing issues, we switched to HBI but our BNN viewers were fortunate enough to get a crack at LB while it was low, so they never suffered from the crazy ups and downs and this position is already nicely ahead. Still, it's a big position and we see no reason we won't hit our $35 goal and that would be net $30,000 vs our current net of $5,800 so another one that's great for a new trade with $14,200 (244%) left to gain. See how easy this stuff is?

- WPM – This was our 2017 Trade of the Year and we LOVE IT – even though they are back near their lows. That's because we knew this would happen and I wish I could buy back the short Jan $22 calls right now rather than risk them going back up but that's not the rules. Still, if all goes well, WPM stays below $22, the short calls go worthless and the 30 spreads net out for $22,500 from the current $1,560 so $20,940 left tto gain on this one is a very nice 1,342% – not bad for a new trade, right?

That is a nice, well-balanced portfolion and I'm thrilled we cashed out all of our less-certain positions because just the ones we have left are positioned to make us another $54,371 into Jan of next year less $3,550 on the hedges (though there will, of course, be more hedges and more positions over time) for net $50,821, which is over 100% of our original $50,000. If we can gain 100% every year – we'll be in pretty good shape, right?

Trading doesn't have to be hard and trading doesn't have to be stressful if you learn to Be the House – NOT the Gambler!

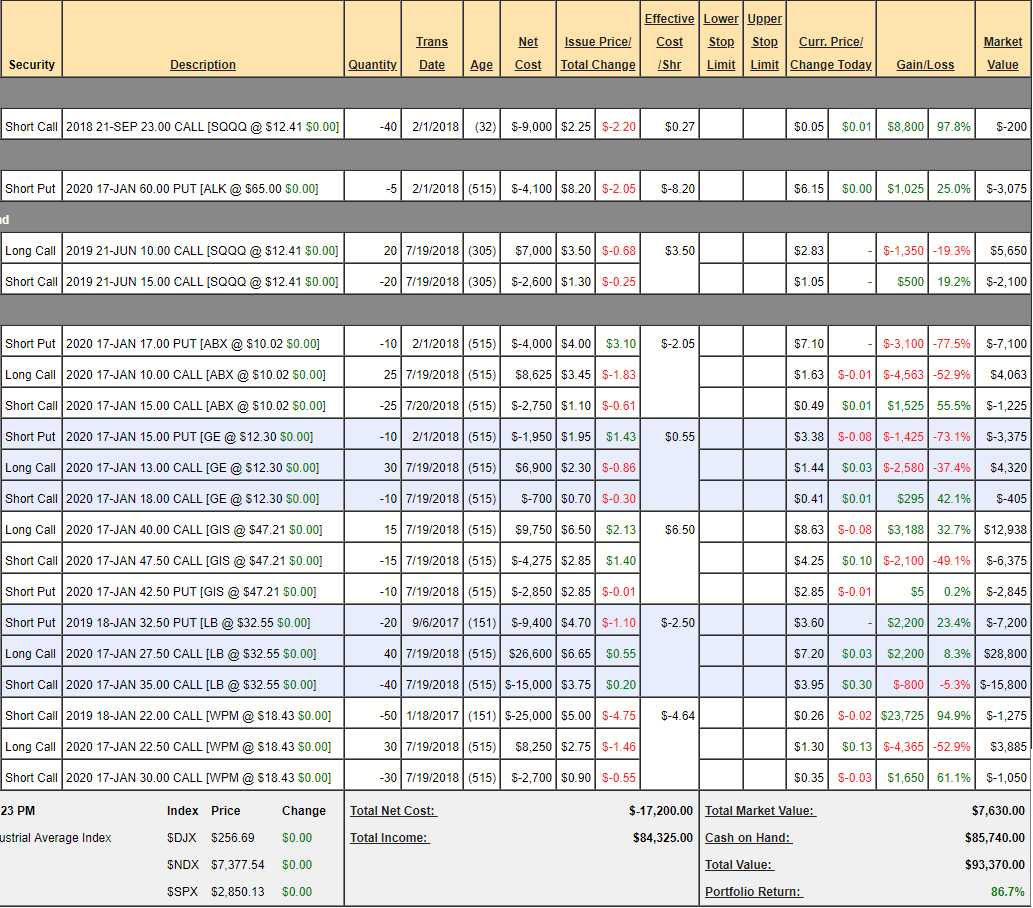

We already have plenty of downside bets on our portfolios and, since Options expired on Friday, let's have a look at our hedge in the context of our public Money Talk Portfolio, which we feature on BNN's Money Talk about once a quarter. We only make changes on the show, so it's a very low-touch portfolio and we're coming up on the one year anniversary on 9/6, as we only begin doing this one year ago but, already, the portfolio is up 86.8% from $50,000 to $93,370 as of Friday's close.

Remember – every single trade AND adjustment was announced live, on TV, before they were made in the portfolio. We're simply showing people how to use our Be the House – NOT the Gambler techiques and hedging strategies in real-time market situations:

We cashed out a lot of winners in July as I was too nervous about the summer markets to leave what were, as the time, $34,300 worth of gains on the table and we can't make any adjustments until the next time I'm on the show in September – so better safe than sorry… We had $34,490 in cash at the time and, as you can see, we raised our cash holdings to $85,740 (91.8% of the portfolio's value) but we still managed to gain another $9,070 from our remaining positions in the past 30 days. You do not need to keep a lot of cash in the market to make great gains if you know how to properly apply leverage!

- SQQQ – Is our hedge yet notice we're hedging for a profit as we rolled our old Sept $16 calls into the new June spread while leaving the short Sept $23 calls to expire worthless, for an eventual $9,000 profit if they expire below $23 in a month (a pretty good bet at this point). You don't have to lose all your money hedging if you manage it correctly and these are very passively managed hedges – our Short-Term Portfolio is much more active and turns a nice profit hedging. Still, for budgeting purposes, we assume we will lose the entire $3,550 remaining value on this hedge – anything less than that is an upside surprise. Hedges are insurance – you have them just to protect the longs and this spread pays $10,000 if the Nasdaq falls (+$6,450) – so that's our insurance policy at the moment.

- ALK – That is a leftover short put from a trade we cashed in. I'm very confident we'll hold $60 so I expect to collect $3,075 by next Jan.

- ABX – We're down $4,289 on this one but I still love them, so great as a new trade. We need gold to recover but ABX is a solid producer and in for the long run. While we'll probably have to roll our short puts as $17 is a tall order from $10, I don't see why we can't get back to $13 easily and that would put our 25 $10 calls $3 in the money for $7,500 less a $4 loss on 10 short puts would be $4,000 but that's still +$3,500 from currently -$4,289 so the upside potential here is $7,789 – clearly still good for a new trade!

- GE – Kind of baffling how low this stock has gotten. $12.30/share is a $107Bn market cap for a company with $121Bn in sales which they usually make $9Bn on but they had a lot of restructuring charges last year and showed a $5.7Bn loss but what do we care, we didn't buy them then, we bought them now and that means we'll get that tax write-off down the road. Last quarter GE had $30Bn in sales and made $789M so not back on track yet but it's a big company and takes a long time to turn around. As with ABX, we may have to roll the short $15 puts down the line but our 30 $13 calls can easily see $15 (these are very conservative numbers) and that would be $6,000 less a $2,000 loss in the puts is + $4,000 against the current net $540 so we expect to easily make $3,460 on this position – hopefully a lot more.

- GIS – Was our new addition last month and we're already up $1,093 (41.6%) from our net $2,625 entry, so pretty good for the first month but it's an $11,250 spread if all goes well so we're only "on track" for our expected $8,625 (328%) profit with another $4,907 left to gain. And all GIS has to do is hold the $47.50 line!

If you are looking for a new trade – this one is pretty good still as it's net $3,718 on the way to $11,250 so it can still gain $7,532 (202%) from here in 16 months – that's pretty good and you don't have the risk we took on 7/19 of calling the bottom!

- LB – This was our Trade of the Year but, due to timing issues, we switched to HBI but our BNN viewers were fortunate enough to get a crack at LB while it was low, so they never suffered from the crazy ups and downs and this position is already nicely ahead. Still, it's a big position and we see no reason we won't hit our $35 goal and that would be net $30,000 vs our current net of $5,800 so another one that's great for a new trade with $14,200 (244%) left to gain. See how easy this stuff is?

- WPM – This was our 2017 Trade of the Year and we LOVE IT – even though they are back near their lows. That's because we knew this would happen and I wish I could buy back the short Jan $22 calls right now rather than risk them going back up but that's not the rules. Still, if all goes well, WPM stays below $22, the short calls go worthless and the 30 spreads net out for $22,500 from the current $1,560 so $20,940 left tto gain on this one is a very nice 1,342% – not bad for a new trade, right?

That is a nice, well-balanced portfolion and I'm thrilled we cashed out all of our less-certain positions because just the ones we have left are positioned to make us another $54,371 into Jan of next year less $3,550 on the hedges (though there will, of course, be more hedges and more positions over time) for net $50,821, which is over 100% of our original $50,000. If we can gain 100% every year – we'll be in pretty good shape, right?

Trading doesn't have to be hard and trading doesn't have to be stressful if you learn to Be the House – NOT the Gambler!