"U.S. Seizes on Chinese Economic Vulnerability in Trade Talks."

"U.S. Seizes on Chinese Economic Vulnerability in Trade Talks."

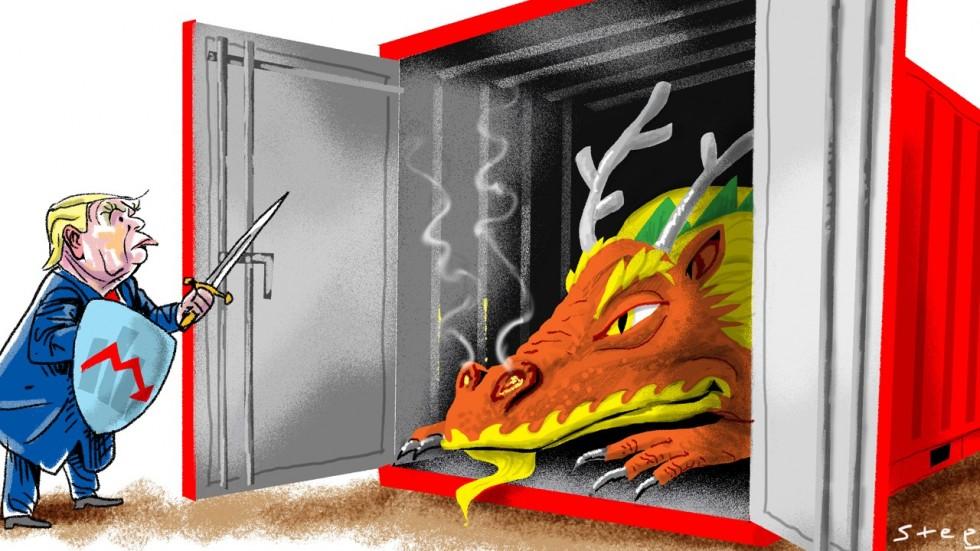

That's the headline in the Wall Street Journal this morning and, frankly, that's NOT the way to enter into a negotiation. Of course the WSJ has drunken all of Trump's Kool-Aid and they think he's a master negotiator who gets the upper hand by bullying and insulting the people he is dealing with so that, when he makes even the smallest concession, they are thrilled to accept it. That may work in real estate, where you can burn bridges and move on but this is Geopolitics and those are the same countries you need to do business with tomorrow – you can't just screw everyone over without repercussions.

As the "failing" NY Times (BOO, fake news, BOO!!!) noted yesterday, Chinese state media has been putting out videos depicting Trump as a bumbling bufoon of little consequence, releasing one video thanking President Trump for helping make China stronger. It shows him in unflattering poses, his brow furrowed and his mouth agape. Its sarcastic title: “Thanks Mr. Trump, you are GREAT!” “They sense his (TRUMP's) increasing domestic weakness and see a chance to pile pressure on,” said Kerry Brown, a professor of Chinese politics at King’s College London.

Sadly, I had to insert "(TRUMP's)" in that quote because SOME people in this country are so brainwashed that they don't even know Trump is weak or that he's already expended all of his political capital and may be taken out of the oval office in handcuffs in the near future and they actually believe it's possible that Trump is the one negotiating from strength. It's amazing, but it's true!

Sadly, I had to insert "(TRUMP's)" in that quote because SOME people in this country are so brainwashed that they don't even know Trump is weak or that he's already expended all of his political capital and may be taken out of the oval office in handcuffs in the near future and they actually believe it's possible that Trump is the one negotiating from strength. It's amazing, but it's true!

Keep in mind, this is China's state-run TV that's mocking Trump – that is not something they are likely to do if they are about to bend over for him in trade talks this afternoon more tariffs have already been put into effect as of 12:01 this morning! More likely, today's negotiations will go something like this SNL classic from the Obama years.

Xi Jinping has been the President of China since 2012 and before that was the Governor of Fujan Province (1999) and Zhejang Province (2002) before becomming Party Secretary in 2007, where he was groomed as the successor to Hu Jintao. Trump, on the other hand, has been President for 18 months yet Trump walks into these negotiations thinking he has the upper hand? That is how you end up with a disaster!

Nonetheless, the markets have been making record highs on the assumption that we will be settling our trade war with China today or tomorrow. This morning, China’s Commerce Ministry also said it plans to file a complaint with the World Trade Organization about the latest round of U.S. tariffs. “The Chinese side resolutely opposes this and we cannot but continue to take necessary countermeasures,” the ministry said in a statement.

That's why we're continuing to short into the rally and we're back at S&P (/ES) 2,860 this morning, which is our primary shorting line (with tight stops above) along with 7,430 on the Nasdaq (/NQ) and 1,725 on the Russell (/ES) but the Dow (/YM) is already 100 points down from 25,850 – where we made a lovely $270 shorting it yeasterday afternoon. So, if the Dow is over 25,750 or ANY of the others are over the line – DON'T SHORT – otherwise, we can short the laggards.

Thursday’s tariffs follow an earlier round of 25% levies on $34 billion worth of each other’s exports. The Trump administration is holding hearings this week on targeting another $200 billion in Chinese goods and could impose those penalties as early as next month. Since China imports far less from America than the U.S. does from China, Beijing plans to retaliate by slapping levies on $60 billion in U.S. exports.

Thursday’s tariffs follow an earlier round of 25% levies on $34 billion worth of each other’s exports. The Trump administration is holding hearings this week on targeting another $200 billion in Chinese goods and could impose those penalties as early as next month. Since China imports far less from America than the U.S. does from China, Beijing plans to retaliate by slapping levies on $60 billion in U.S. exports.

The Trump administration has unleashed tariffs to try to pressure Beijing into curbing a trade imbalance that was $375 billion in China’s favor last year and to end practices that the U.S. says discriminate against American companies. Beijing attributes the trade imbalance to larger macroeconomic trends such as a lower U.S. savings rate, and denies its policies put foreign companies at a disadvantage.

The secret to all this is that Trump doesn't want to settle the Trade War because the Tariffs are nothing more than a TAX on the American people – especially American poor people, who buy the bulk of Chinese goods. Taxing $200Bn worth of Chinese Imports by 25% costs US Consumers $50Bn and that money goes into Trump's budget and allows him to give $50Bn worth of tax breaks to his Billionaire Buddies – that's what this is really about. If Trump resolves the trade issues – his excuse for sticking it to the taxpayers goes away – so we're betting there's no resolution and, once again, the American people lose while Trump gets richer.

That's been the Russian model ever since Putin has been in power – why would they change a winning strategy now?

SDS is the 2x Ultra-Short ETF for the S&P 500 so even a 2.5% corrction in the S&P will send SDS from $34.50 to $36.22 and you can buy the Sept $33 ($1.60)/35.50 (0.50) bull call spread for $1.10 so you start out $1.50 in the money with the potential of a $2.50 payout, which would be a gain of $1.40 (127%) if the S&P pulls back to 2,785.

Compare that to a single, short /ES Futures contract which requires $6,380 in margin and would make $3,750 at 2,785. There's no limit to the risk on /ES and it can be very painful if it turns against you while just 25 SDS spread contracts at $2,750 would make $3,500 on the same move so, in this particular case – it's more efficient to take the SDS spread as a hedge.