Another record high!

Another record high!

We're finishing August off with a bang as ANY news is good news these days, even making progress on keeping NAFTA, which Trump promised to throw out and was enacted almost 25 years ago (Jan, 1994) so the only reason there's an "accomplishment" to fixing it is because Trump broke it in the first place. Of course the Administration will say they won big concessions but so will the Mexican Administration and, so far, Canada isn't even playing with Trump – so it's not really "fixed" at all.

It doesn't matter though as the Dow (/YM) is up 140 points (25,927) and the Nasdaq (/NQ) is up 35 points (7,530) in the Futures along with 2,887 on the S&P 500 (/ES) and 1,730 on the Russell (/TF), which also well above the June high of 1,708, depsite the weakening Dollar and rising oil prices ($69), which are considered bad for small-cap stocks.

Word of progress on NAFTA lifted Asia's stocks as it's seen as more likely the US will begin to negotiate with Japan and China and China's Central Bank took steps over the weekend to strengthen the Yuan, sending their market up 2% overnight – another reason our Futures look so good at the moment. That's despite the fact that China's Industrial Profits continued to cool off, down to $75Bn in May from $93Bn in June. There's also some alarming internals as Producers and Refiners of raw materials like oil companies and steel mills have accounted for roughly 2/3 of the gains this year. Smaller firms are facing much tougher business conditions that are squeezing profit margins.

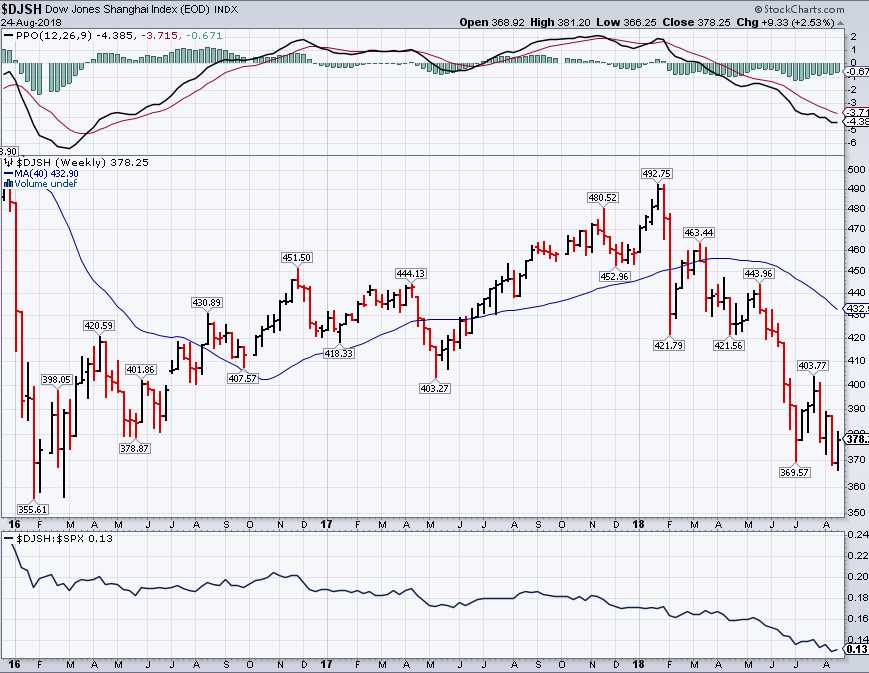

Despite this morning's 2.5% rally, China's Shanghai Composite still has a long way to go before recovering, after falling 25% from 492 to 379 since topping out in January. It will take 5% just to make a weak bounce off that so 390 will be the line to watch and then 410 would be a real recovery at the strong bounce line.

Despite this morning's 2.5% rally, China's Shanghai Composite still has a long way to go before recovering, after falling 25% from 492 to 379 since topping out in January. It will take 5% just to make a weak bounce off that so 390 will be the line to watch and then 410 would be a real recovery at the strong bounce line.

For the purposes of our 5% Rule™, it's a 100-point rejection (20%) from 500 to 400 and a 20% overshoot to 380 which makes the real lines 420 (weak) and 440 (strong) and the 50-day moving average has already fallen below the strong bounce line so there's going to be a lot of resistance on the way up and it won't take much for the bears to re-assert themselves.

We're also going to keep our eye on the DAX, which still has another 1,000 points (8%) to go before it gets back to highs of 13,500, which were twice rejected. It's rare for the US and Europe to decouple to such an extent and the German ETF (EWG) is only just getting back over $30, down from $35 in Jan, and 8% of $30 is $2.40 so let's say $32.50 is our target if this recovery is real. We can then set up the following bullish play:

- Buy 20 EWG Oct $29 calls for $1.70 ($3,400)

- Sell 20 EWG Oct $31 calls for 0.60 ($1,200)

- Sell 4 LB 2020 $27.50 puts for $5.30 ($2,120)

That's net $80 on the $4,000 spread that is $3,000 in the money. We love LBrands (LB) and wouldn't mind owning 400 shares for net $27.70 so that's like free money to play with and all EWG has to do is squeek 0.50 higher and we make $3,920 (4,900%) in 53 days – that's the way to get a little more bullish with a little bit of our sidelined cash!

IF the rally is real, then that's how easy it will be to make money as the bubble continues to grow but, if not, then we have our hedges, like the SDS trade we discussed over the weekend, as well as the hedging positions in our Short-Term Portfolio and our Options Opportunity Portfolio. I know I'm getting more worried as I didn't put out a Top Trade Alert last week – meaning there wasn't anything I felt that strongly about. I did feel strongly about LB on 8/23 and our Trade Ideas from that Alert was:

- Sell 10 LB 2020 $30 puts for $6.40 ($6,400)

- Buy 20 LB 2020 $20 calls for $9.40 ($18,800)

- Sell 15 LB 2020 $27.50 calls for $6 ($7,500)

That's net $4,900 on the $15,000 spread that's 3/4 covered so you have room to sell 5-10 short calls like (but not now) the Jan $30s at $2 so, even if you just sold 5 for $1,000, that's 148 days out of 512 there is to sell so, even at that pace, you could knock your net down to $1,900 on a spread that's 100% in the money to start.

LB has gotten worse since then, now testing $27.50 and the puts are now $7 ($7,000) and the spread is now $8.65/4.35 ($10,775) for net $3,775 so a bit cheaper now than where we picked it up (or you could sell the $27.50 puts instead) but that just makes me bank the table harder on this ridiculously undervalued company.

"If you are not going to buy stocks when they are cheap – when are you going to buy them?" – Davis

The same goes for hedges and our Long-Term Portfolio is now up 38.5% for the year at $692,291 (as of Friday's close) and that's up $57,850 since our Aug 2nd review (again, this rally is ridiculous!) with barely any changes while our Short-Term Portfolio, which hedges the LTP is also up at $231,107 (up 131% for the year) as we had huge winners from our Tesla (TSLA) and iQIYI (IQ) shorts to offset the losses in the actual hedges. So certainly we will be "wasting" more money pressing our hedges though it's not a waste at all because having these hedges in the STP allows us to maintain the aggressive long positions in the LTP for A LOT longer than we might have been comfortable with.

That's how you ride out a bubble – we keep reaping profits from our long positions by adjusting our spreads while keeping ourselves well-hedged – just in case things fall apart. If they never do, we probably will make about 1/3 less than we could have made without the hedges but, if things do collapse, we will lock in the majority of our gains and that would put us in a fantastic position to scoop up bargains while others are scrambling for cash.

It's been over 3,500 days without a market corection (20%) and maybe it will be 3,500 more but I feel better knowing that our gains are protected – just in case.