Holy cow!

I guess it's because I'm one of the last macro fundamentalists left in the markets that I am surprised – no, shocked, by the complete and utter denial the bulls are in regarding what is already the biggest Trade War since the 1930s and will very soon be the biggest Trade War in human history. As noted on the chart to the right though, it's a very normal psychological phenomena – especially when experienced by those unprepared for a loss and, after 10 years of stimulus – there's a whole generation of traders who don't even know what a market loss is…

The market is clearly in denial and the Financial Media is merely a tool of the Investment Banks, so don't expect them to explain things to you and, unfortunately, very few people know what a Trade War actually is or what it does – thanks to a very poor education system – especially when it comes to Finance in this country.

/https://www.thestar.com/content/dam/thestar/opinion/editorial_cartoon/2018/04/08/greg-perry-china-us-trade-war/greg_perry_china_u_s_trade_war.jpg) China does know what a Trade War is and, just this weekend, the Chinese Government's Global Times said "China will not be content to only play defense in an escalating trade war with the United States. It is nothing new for the U.S. to try to escalate tensions so as to exploit more gains at the negotiating table." Beijing may also decline to participate in proposed trade talks with Washington later this month if the Trump administration goes ahead with the additional tariffs, the Wall Street Journal reported on Sunday, citing Chinese officials.

China does know what a Trade War is and, just this weekend, the Chinese Government's Global Times said "China will not be content to only play defense in an escalating trade war with the United States. It is nothing new for the U.S. to try to escalate tensions so as to exploit more gains at the negotiating table." Beijing may also decline to participate in proposed trade talks with Washington later this month if the Trump administration goes ahead with the additional tariffs, the Wall Street Journal reported on Sunday, citing Chinese officials.

The Journal report quoted one senior Chinese advisory official saying China would not negotiate "with a gun pointed to its head." Besides retaliating with tariffs, China could also restrict export of goods, raw materials and components core to U.S. manufacturing supply chains, former finance minister Lou Jiwei told a Beijing forum on Sunday, according to an attendee. "Lou Jiwei's approach would feed the most hawkish sentiments in the U.S. government," the person said, declining to be identified given the sensitivity of the matter.

As I have warned since Trump first began messing with China on trade – you don't threaten a trading partner who provides you with vital products and China's rare earth materials are literally something the US economy cannot live without. If China does something that drastic, within two weeks they can make Trump crawl on his knees through Red Square to kiss Xi's ass if they want to – there is no possible way to replace China's supply in any reasonable period of time nor do we have stockpiles of rare earths – if we get cut off, tech manufacturing dies quickly.

As I have warned since Trump first began messing with China on trade – you don't threaten a trading partner who provides you with vital products and China's rare earth materials are literally something the US economy cannot live without. If China does something that drastic, within two weeks they can make Trump crawl on his knees through Red Square to kiss Xi's ass if they want to – there is no possible way to replace China's supply in any reasonable period of time nor do we have stockpiles of rare earths – if we get cut off, tech manufacturing dies quickly.

Of course, it is very possible that this is exactly the reaction that Donald Trump is looking to provoke as a cut-off by China of rare earth materials would give Trump the excuse he needs to declare a State of Emergency, which would allow him to tear up EPA regulations and open Federal lands to strip mining because rare earths are called that not because they are only found in China, but because their concentration in rocks and soil is so minute that you must decimate the environment if you want to mine them. China has been willing to do this and so, they supply the world with rare earths.

If Trump is able to excercise executive power and hand out "emergency" contracts on rare earths, he will control Billions of Dollars worth of potential profits he can hand out in exchange for political and financial favors and, given how fast the noose is tightening on his administration – this may be the quick, fast score he needs to make as he may not be in office long enough to finish his more elaborate enrichment schemes. Given how badly he'll be needing support soon, provocing China into causing an "emergency" is his best self-interested move.

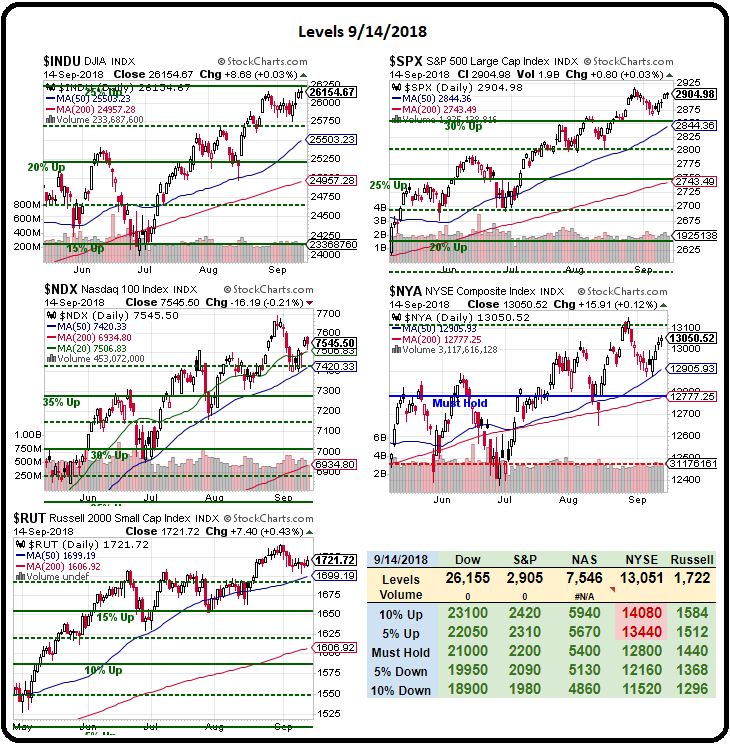

Meanwhile, as the Sword of Damocles hangs over the heads of US manufacturers, US investors seem completely oblivious to the danger and the Dow is opening this morning at 26,160 – right where it left off on Friday despite the escalation of tensions over the weekend.

Now, I know I sound like Chicken Little when I say the market is going to fall but it IS going to fall – I jsut don't know when. The Dollar has been driven down 0.4% this morning and that's supporting the indexes at the moment but, once again, we'll take a long off the 94 line on /DX, looking for at least a bounce to 94.20 but Friday we hit 94.50, which was over our 94.40 goal for the day and was good for gains of $400 per contract from our Morning Report – you're welcome!

Also from Friday's morning Report we had our call to short the S&P (/ES) Futures at 2,915 and that gave us a lovely 10-point drop to 2,905, which was good for gains of $500 per contract and a great way to finish perfect week on the Futures and today we have another chance to jump into Coffee (/KCN9) long at $106.50, which is $98 on the front-month contract and should be bouncy for at least 2 points, which is $750 per contract, so certainly worth a toss with tight stops below.

Of course, /KCN9 is next July's contacts and what we're doing is taking short-term profits and leaving a few open for the long haul as we expect to hit 120 between now and than and that's $7,500 per contract if things go well on coffee. At the moment, there is a surplus of coffee after Brazil's big harvest and that is projected to continue into next year (Vietnam is also projecting a huge harvest), so prices may indeed have further to fall, but long-term users like Starbucks (SBUX) and Dunkin Brands (DNKN) will begin locking in long-term supplies at these rock-bottom prices so we expect the 100 line to be supported and then, down the road, any negative news between now and July will lead to a lot of short covering that should give us a nice rally.

As far as the indexes go, we still like /ES short at 2,915 and if the Dow (/YM) makes it back to 26,200, that's a good shorting line as well. For the Futures challenged – I point you to last week's DXD trade idea.

Meanwhile, whether you accept or deny that Trade Wars will affect the markets, I urge you to pay attention to what's happening on that front as it won't take much to send the Dow 100-200 points lower in very short order. That will be fantastic and fun for those of us holding onto shorts and hedges but very un-fun for those who are not.

This whole week is a bust as far as data goes with Empire State this morning and then nothing big happening until Thursday, when we get the Philly Fed, Home Sales and Leading Indicators and then Friday we have the PMI and end-of-quarter Quadruple Witching and then the next week ends the Q so we expect window-dressing through the 28th but October is shaping up to be a real wild card and November is the election – when things can change drastically.

At least it will be an interesting fall.