"Here come those tears again

Just when I was getting over you

Just when I was going to make it throughBaby here we stand again

Like we've been so many times before

Even though you looked so sure" – J Browne

While it's been fun watching the Dow 30 blast higher, the S&P 500 has been struggling to get back to where we were at the end of August when I warned on "Toppy Tuesday – S&P 2,900 so it’s 3,000 or Bust!" as well as "Will We Hold It Wednesday – Record Highs Edition" and we were shorting the S&P (/ES) Futures at 2,915 and we got another entry yesterday as we topped out at 2,917 just before 3pm.

At the time, we were shorting Gasoline (/RB) at $2.10 and now it's $2, which was good for gains of $4,200 per contract if you rode it out all the way (we were in and out several times since) and we shorted Oil (/CL) at $70 (and we're short again now) and went long on Coffee (/KCN9) as it tested $100, which worked at the time but now it's down to $94 so a lot of things are not improving – including the Nasdaq, which is down from 7,700 to 7,500 (2.5%) while the S&P has bounced back.

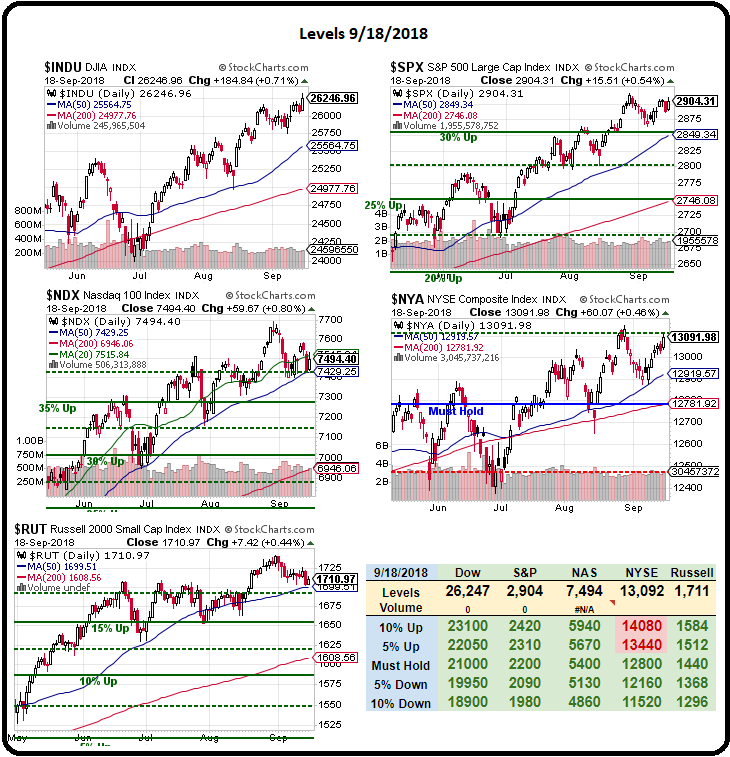

As the song asks – what's different this time? Aren't we just setting ourselves up for more heartache as we're teased yet again by the record highs? I believe there's a better chance in profiting from a re-test of 2,860 (our 30% Line on the Big Chart) than there is of seeing 2,920 so it's a very nice risk/reward play as stopping out at 2,921 is a $300 per contract loss while 2,870 (which we hit last time) is a $2,500 per contract gain. Futures trading is all about looking for risk/reward scenarios that are massively in your favor and then trying not to be wrong more than 80% of the time!

Our Index shorts are based on the fact that we think the market is fully valued here as well as our feeling that many risk factors are being ignored and it won't take much of an incident to panic traders out of positions – when they will find there are very, very few buyers willing to take their high-priced stocks off their hands at anywhere near the prices they've been paying.

We still have PLENTY of long positions and, in fact, we've just started doing our September Portfolio Reviews as September options expire on Friday and, while we have no TECHNICAL reason to take them off the table, as long as those 50-day moving averages hold up – we're also making sure we are well-hedged – just in case. Being well-hedged includes dabbling in the Futures on the short side, as the only reason we'd be losing is if our long positions are doing better.

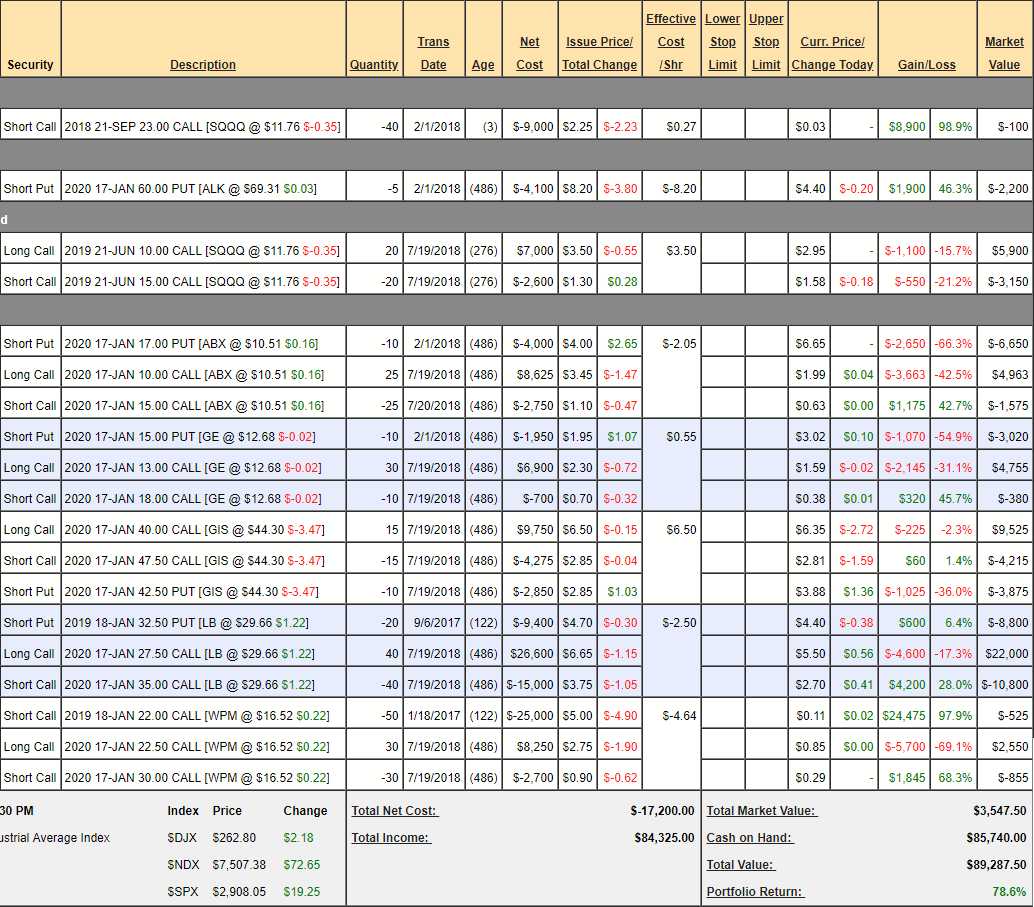

Despite the market essentially going nowhere in the past month, our Options Opportunity Portfolio gained 6% since our Aug 21st review and our Money Talk Portfolio is up 10% since July but off it's August highs by about 5% but that's a portfolio we only adjust quarterly, live on TV – so we're unable to take full advantage of these market gyrations like we do with our Live Trading Portfolios. Nonetheless, the Money Talk Portfolio is now done with it's first year with a 78.6% gain – from $50,000 to $89,287 and that's not bad – especially considering that we now have $85,740 in CASH!!! on the sidelines, which makes me very happy!

Since we cashed out all our winners, ALL of these "losers" are good for new trades so you can build a portfolio like this using net $3,547 in cash and, if you don't sell the 50 short WPM Jan $22 calls, it would take up just $1,275 more cash but leave you with tons of margin to play with as well. So, after one year running the Money Talk Portfolio, new people can still get in on the ground floor – though the ground is 78.6% higher than it was before…

Meanwhile, on a higher note, some of our Members have also been playing around in the very hot marijuana market through PSW Investments, who recently acquired a stake in New Age Ventures, who own Jade House Genetics – a medical marijuana specialist. We've been watching with fascination this month as Tilray (TLRY), a company that was literally FORMED this year and jumped onto the US exchanges as a marijuana grower and, as of this morning, is trading at over 13x the IPO price ($17), at $227.50, which is DESTROYING the shorts – including the venerable Citron Research.

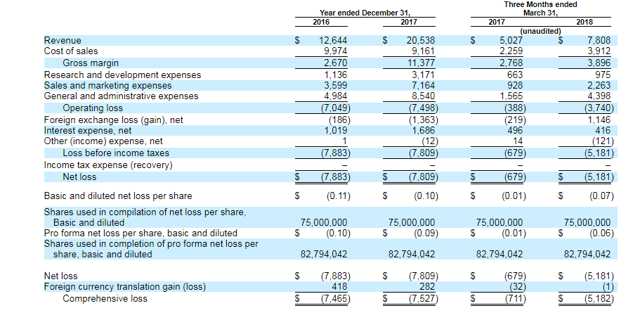

TLRY benefits from being the Nasdaq's first cannabis stock as well as the fact that they got regulatory approval to export their products to Germany but, as a reality check, only had $20M in total revenue last year and lost $7.5M making that happen. They raised $135M in the IPO but that doesn't translate into 10x revenues (and hopefully not 10x losses) and even their IPO was only projecting 50% revenue growth in 2018 and still losing $5M.

If you are looking for exciting growth, look at the cannabis sector. It's an embedded $200Bn annual market and only $20Bn worth of the sales are legal at the moment and US companies, like New Age, who are fighting a state by state battle to win distribution liscenses, will also have access to the same International markets as Tilray while Tilray, for the moment, is restricted from selling into the US market.

I certainly don't want to chase high-flyers like TLRY after they popped but I sure wouldn't short them – even with their now $14Bn valuation because the market is out there – the trick, I believe, is to find early stage companies and get a bit of the action in several of those. In the case of Tilray, 100% of the Class 1 stock is still held by Privateer Holdings, who have 3 votes per share and the Class 2 shares they are selling get 1 vote per share, insuring Privateer complete control of the company going forward.

When you are investing in one of these companies – it's far, far better to be in on those Class 1 rounds!