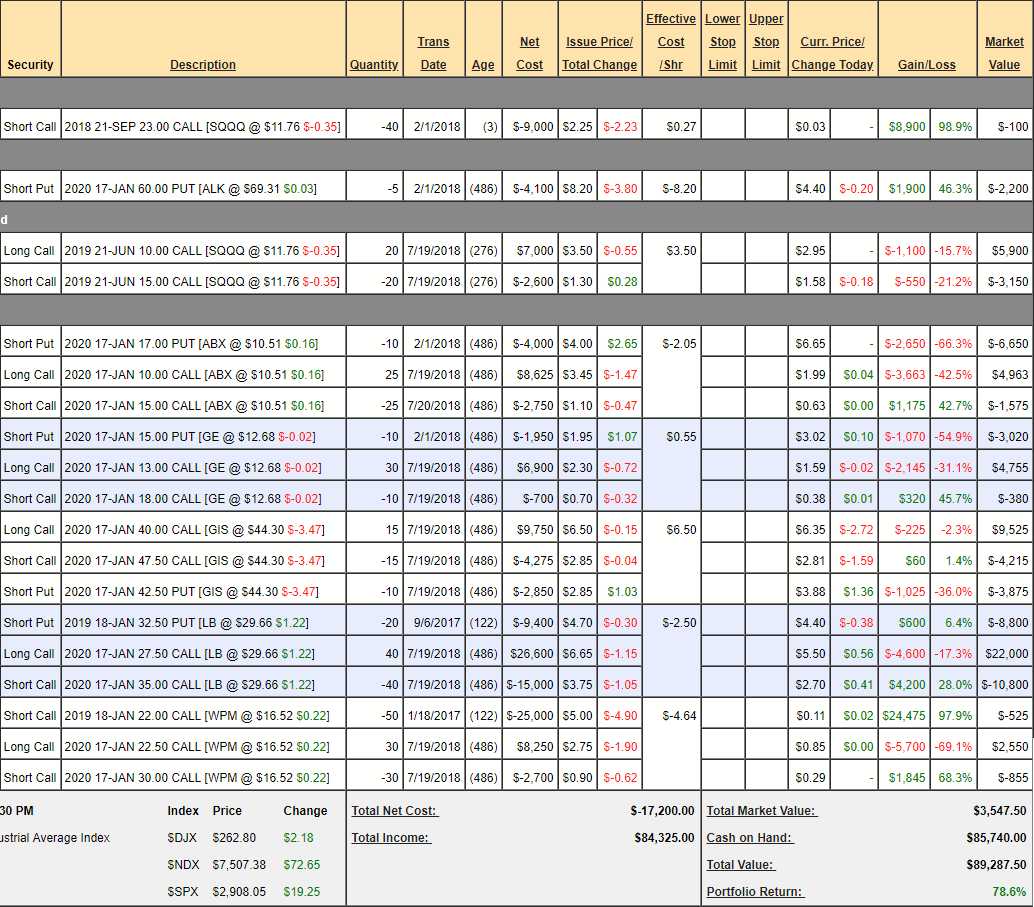

One year anniversary for the Money Talk Portfolio and we can't make any adjustments (as I only do them on the show) so here it is. We haven't looked at it since I did the show back in July (17th) and we were at $84,300 and, since then, we've moved to $89,287 so up 78.6% for the year. Keep in mind we went to much more CASH!!! last time as I didn't want to stay open for the summer and we have dogs like WPM, ABX, LB and GE left in the portfolio but, BECAUSE we keep plugging away and we keep selling premium – we just keep making profits!

I would certainly encourage you to go back and read the last review and contemplate how conservatively we play this ultra low-touch (once a quarter, never in between) portfolio. All year long we simply take off the maturing winners and add a new play each Q and, despite several very disappointing stocks – we make money anyway because we keep selling premium and we take non-greedy exits.

In fact, that $24,475 profit on short WPM calls was the short leg of a long spread but we CASHED out the long leg because $22 was the top of our expected range. So we got more than the full expected profit on the long end and now we owe nothing to the short caller. The new bull call spread was only set up to cover the short 50 calls, we didn't expect WPM to go that high.

All in all, I'm very happy with this portfolio – despite the restrictions.