Do you want $1,000?

Do you want $1,000?

How about $1,237.50? That's what we made during our Live Trading Webinar yesterday in the S&P Futures alone. And that was at 2,925 – this morning, our two remaining Futures contracts stopped out at 2,915 after testing 2,912 and that was good for an additional $500 per contract gain – another $1,000 to start your day!

Futures trading is not hard and it is not scary or complicated – that's one of the things we try to teach our Members in our weekly live trading Webinars. In fact, in yesterday morning's PSW Report, we made an entire case for shorting the S&P Futures (/ES) at 2,640 so all we did at the 1pm Webinar was follow our own advice. A 15-point drop on the /ES Futures is good for $750 for each contract and each contract requires $6,600 in margin and changes $50 for each point the S&P moves.

So, the way we like to enter a trade in the Futures is to find a good line of support or resistance – in this case S&P 2,640 – and then we use that for a stop, say at 2,645, so we're limiting our loss to $250 but, ideally, we prefer to catch a move on the way under the line – so momentum is on our side and then we keep very tight stops over the line.

Usually we win or lose $250 but, once in a while, we win a lot more on a nice move in our favor. If we can keep our small wins and losses about even then those big wins become our profits. Our other calls from yesterday's morning Report were:

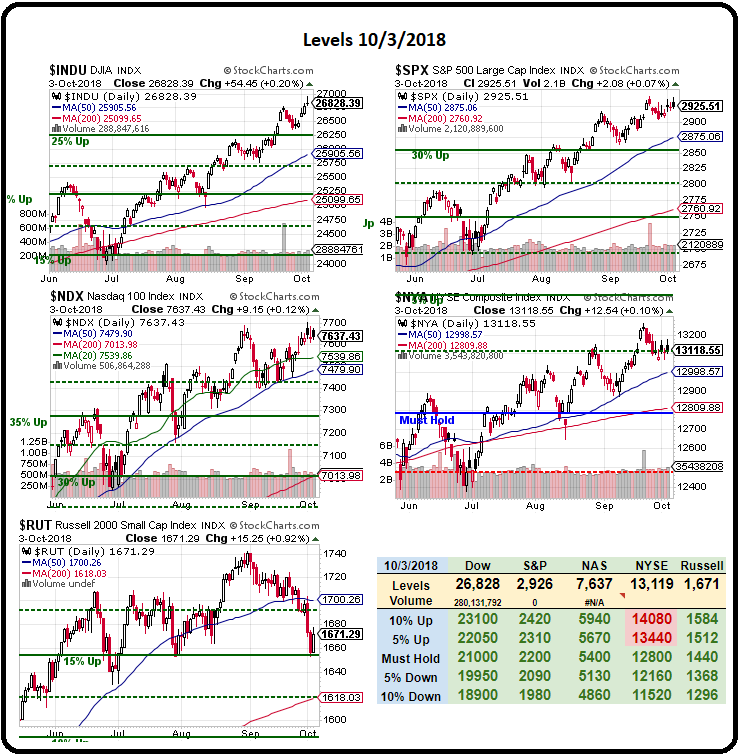

We're still shorting the S&P (/ES) at 2,940 with tight stops above the line and the Dow (/YM) at 26,900 – also with tight stops above and we're shorting Oil (/CL) Futures at $75.50 – but very dangerous into inventories at 10:30 and, other than that – it's another "watch and wait" sort of day while we wait to see if the S&P can break over 2,940 and make a serious run at 3,000 because – why not?

See, that's all there is to it. Even this morning you can still catch the Oil (/CL) Futures short at $76.30, still well above our target though missing the boat a bit from yesterday's PSW Report, which would be delivered to your inbox every morning (unless I'm late) at around 8:35, while the report is "IN PROGRESS" if you were to SUBSCRIBE FOR $3/day and, of course, you have access to the full report every day before the market opens at 9:30 – or as soon as I'm done writing it but usually on time.

Of course, if you don't think it's worth $3 to get trade ideas that make thousands – save your money. If you think Futures trading is too difficult for you, try opening what they call a Paper Money Account at TD Ameritrade's Think or Swim (my favorite and no, they don't pay me but they should!) or any broker's practice account and then see if it's really not for you or if you are just being a wimp.

Like many things in life, good trading is about being in the right place at the right time and the hardest thing to teach people is PATIENCE. People are not generally patient – especially in these days of instand gratification. I was fortunate to learn trading from my Grandpa Max, back when I was very young and, in those days, the newspapers only published stock information on Sundays so you really didn't have a choice other than to wait weeks and months to see your trades play out.

Often enough, my grandfather would decide to keep an eye on a stock when I saw him in the spring and, in the winter, he would still be "watching" to see if it would give him a good entry. That's how I learned to trade stocks so it's the IMPATIENCE of most investors that is difficult for me to adapt to. While trading futures is a very quick in and out sort of game – waiting for the right set-up to trade is the exact opposite.

Often enough, my grandfather would decide to keep an eye on a stock when I saw him in the spring and, in the winter, he would still be "watching" to see if it would give him a good entry. That's how I learned to trade stocks so it's the IMPATIENCE of most investors that is difficult for me to adapt to. While trading futures is a very quick in and out sort of game – waiting for the right set-up to trade is the exact opposite.

The key to being in the right place at the right time is to keep putting yourself in the right place and, eventually, it will be the right time. Take people who audition for shows – they could be very talented but not look the part or "sound right" at any given audition so they can give up after a few tries or they can keep trying until they find a show they fit into. You'll find most successful actors are very, very persistent people. Successful traders are too!

We look for good lines of support and resistance but we also go in with a Fundamental view that the stock or commodity should be higher or lower than it is at the moment. If all the stars don't line up for a trade – we move on and try to find something else. That's why last year's Top Trade Ideas were 85.7% successful in 2017 – going 54 and 7 but some of those "losers" turned into winners in the end anyway.

We only send out a Top Trade Alert to our Members for the set-ups we think have a very high probability of success and those are stock and options trade ideas, not Futures. Our most recent Top Trade Alert had 9 trade ideas in it – that's a bit unusual but, as we discussed yesterday – I saw a great opportunity to take advantage of a toppy market and make $100,000 by Christmas – so we jumped on it!

You can't take advantage of great trade ideas if you have all your money tied up in mediocre trades. That's why we regularly purge our Member Portfolios and always try to keep a good amount of CASH!!! on the sidelines because – when the right trade comes along – we want to be ready, willing AND able to pull the trigger on it.

This is a really crazy market and the political climate is even crazier and the economic climate is all over the place so it's a good time to stay flexible and stay very well-hedged. While we're waiting PATIENTLY, there will be many many trades we're able to take advantage of but don't over-expose yourself in either direction. I'd love to get more bearish but it's been a suicide play for the last two years so, for now, we're going with the flow but keeping one hand firmly on the exits – just in case.