The turmoil continues.

The turmoil continues.

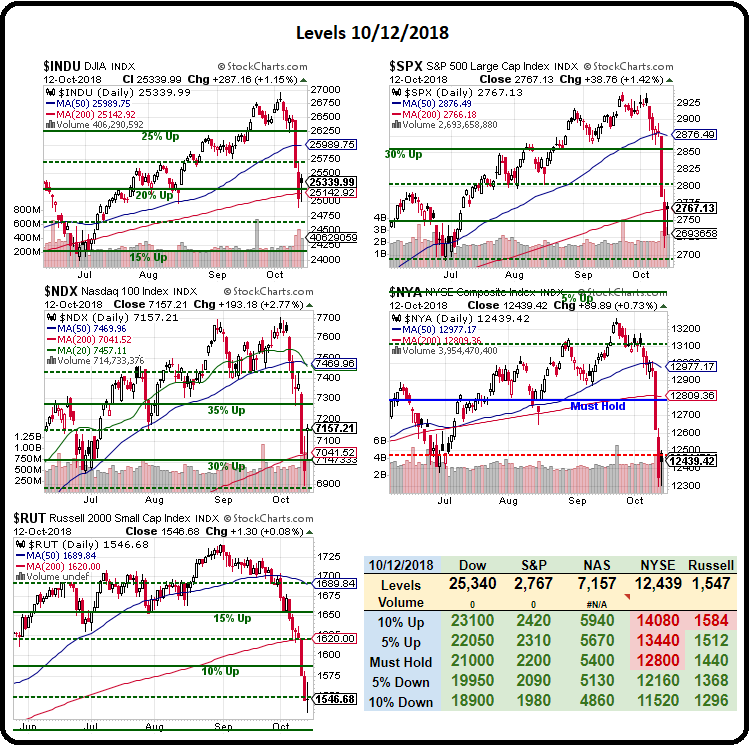

Already this morning the Futures were down 100 points but back to flat into 8am. Of course, nothing that happens on a Monday has any meaning for the Markets as it's generally a low-volume affair with little news or data driving things towards real change. We laid our our bounce lines for the major indexes last Thursday and congratulation to those of you who followed us into those longs and caught that nice rally into the weekend. The summary of our bounce levels is:

- Dow (/YM): 25,450 (weak) and 25,700 (strong) – now 25,317

- S&P (/ES): 2,775 (weak) and 2,800 (strong) – now 2,766

- Nasdaq (/NQ): 7,100 (weak) and 7,250 (strong) – now 7,157

- Apple (AAPL): $223.50 (weak) and $226 (strong) – now $222

- Russell (/RTY): Anything below 1,552 is catastrophic – now 1,545

That's right, I forgot about the Russell. It was the small caps index that gave us the early indication the rally was breaking down and now they are going to give us an early indication as to whether this is the end of a small correction or just the beginning of a larger one.

As you can see from the daily chart of the index, there's no recovery here at all in the broadly measured 2,000-stock index and these are the companies that are least able to adjust to the damage caused by Trade Wars and slowing US Consumer Spending so they do give us an early glimps of the things that will begin showing up in the S&P 500 over time.

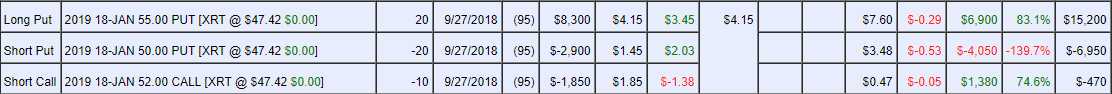

Meanwhile, we're skeptical about recoveries that occur on low-volume and without actual reasons – we much prefer to see the market move on upside reports or at least upside earnings surprises and not from single companies or even single sectors – like Friday's bank-driven rally. For example, one of the recent hedges we added to our Short-Term Portfolio was featured in the 9/27 PSW Report, which was:

As I noted on Tuesday, we are already getting swamped by companies who are issuing negative guidance for Q3 and the good news is that's going to lower the expecations bar considerably, so it won't be as easy to disappoint but Bed Bath and Beyond just reported a rough quarter and that stock tumbled 15% after hours. The Retail ETF (XRT) is trading at record highs – it was only at $22 before collapsing to $8 in 2008 and now it's at $52, so it makes a fun short if you are worried about Retail Stocks (and we are). For our Short-Term Portfolio (STP) we can add the following hedge:

- Sell 10 XRT Jan $52 calls for $1.85 ($1,850)

- Buy 20 XRT Jan $55 puts for $4.15 ($8,300)

- Sell 20 XRT Jan $50s for $1.45 ($2,900)

That's net $3,550 on the $10,000 spread that's more than 1/2 in the money to start so the upside potential below $50 is $6,450 (181%), not bad for 3 months and a great way to hedge potential losses on retail stocks.

As you can see, as of Friday's close, XRT was down at $47.42 and the spread, so far, is netting $7,780, which is already up $4,230 (119%) but still has another $2,220 (28.5%) left to gain if XRT stays below $50 and, so far, we haven't seen any good reason to cash in this hedge early though if XRT is back over $48, we're likely to take $7,000 and run – as we can always add another hedge. Other hedges were discussed in great detail early this month in these two posts and of course, in the Weekly Webinar:

- Which Way Wednesday – S&P 2,940 or Bust (again)!

- The PhilStockWorld.com Weekly Trading Webinar – 10-03-18

- Thousand Dollar Thursday – Our Webinar Trades Make Quick Profits

Chart-wise, things are already very ugly with only the Dow above its 200-day moving average now and the NYSE and Russell, the broader indexes, have massivley failed and are below their summer lows while the Dow, Nasdaq and S&P have another 5% to fall to catch up to the Russell and that would be very ugly indeed!

Retail Sales were already a huge miss this morning at 0.1% vs 0.6% expected by leading Economorons and, if you take out Auto Sales, we're down to NEGATVIE 0.1%, the first negative number in the Trump Error.

That's also WITH Gasoline Sales being up 14% from last year, not because we're driving more (we're driving less) but because gasoline is 16% more expensive than it was last year – and that's after the big sell-off so, back in September, it was closer to 25% more per gallon than last year or what President Trump calls – winning!

Speaking of "winning" – Sears (SHLD) is finally, officially, Bankrupt and Eddie Lampert has stepped down as Chairman, which will allow his company to pick up all the assets for pennies on the Dollar – completing his total screw job of the investors and creditors who've suffered from his year's-long destruction of the once-great company.

Speaking of "winning" – Sears (SHLD) is finally, officially, Bankrupt and Eddie Lampert has stepped down as Chairman, which will allow his company to pick up all the assets for pennies on the Dollar – completing his total screw job of the investors and creditors who've suffered from his year's-long destruction of the once-great company.

Unfortunately for the Retail Sector, this will cause Sears' $3Bn of inventory to be massively marked down right into the holidays, which will hurt their sales and then the companies that are waiting to get paid for that inventory will suffer in their earnings (as well as writing off Billions more in never-to-be-paid debt) and, of course, the mall operators will have to deal with a tsunami of empty space that may never be filled again and that then devalued the leases that are held by all retailers as the market rates plunge against their existing contracts.

Don't forget Toys R Us also shut 800 large stores so the inventory of empty retail space in the US has never been higher and SHLD still employs 70,000 people, which will be a long-term blow to the jobs numbers as it won't happen all of a sudden but various debtors will take over various stores and begin unwinding things – so we'll have a drag on Q4 and Q1 earnings for connected companies in the very least – including those lenders who, ultimately, will also take major losses.

Don't forget Toys R Us also shut 800 large stores so the inventory of empty retail space in the US has never been higher and SHLD still employs 70,000 people, which will be a long-term blow to the jobs numbers as it won't happen all of a sudden but various debtors will take over various stores and begin unwinding things – so we'll have a drag on Q4 and Q1 earnings for connected companies in the very least – including those lenders who, ultimately, will also take major losses.

The last time I was in a Sears it was Wayne, NJ early this summer but only because they opened a Dave and Busters (PLAY) inside the store. It was maybe the second time my kids had seen a Sears in their entire lives and not because we're snobby (they love TGT) but because "no one shops there" and, walking around what looked like a set from Dawn of the Dead – I wasn't surprised. The shelves were already half bare and there was hardly any staff – consider that they only have about 100 people per large store which is generally open 80 hours a week – that's very thinly staffed!

So I'm not sure what having a Bankruptcy sale will do for them. Despite my encouragement to look around, both of my teenage girls came back empty from a walk around the aisles. If kids don't want things, it doesn't matter how little you charge for them…

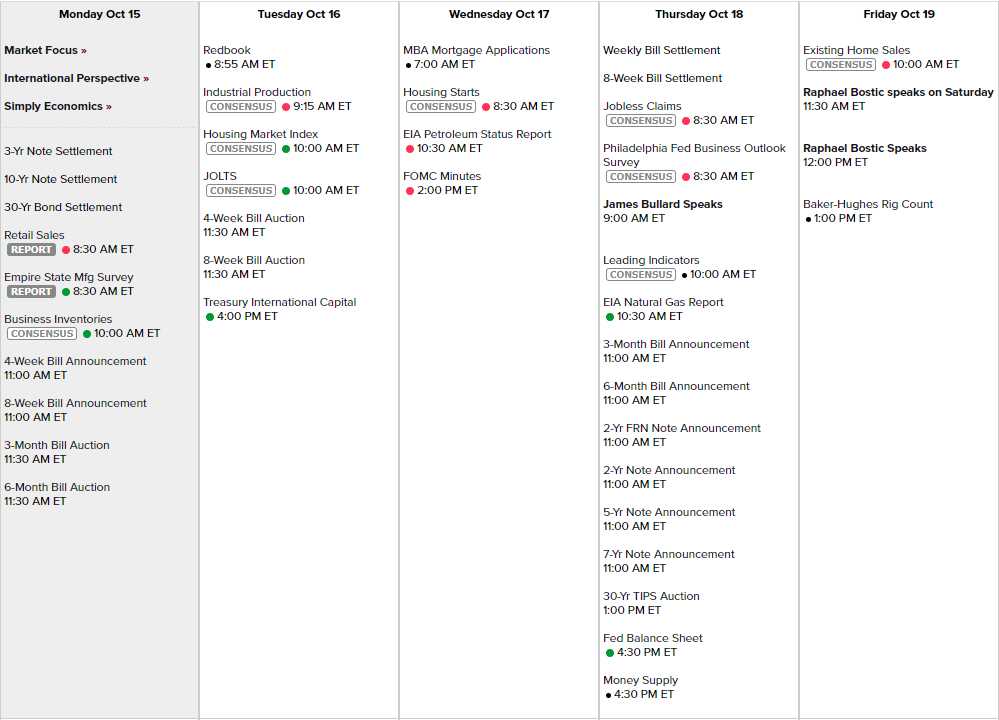

Sears was the Amazon of it's day. The biggest building in Chicago is the Sears Tower and it was once the biggest building in the World. Amazon doesn't have a tower… We shorted Amazon last month and that worked out well as they failed at $2,050 (now $1,788) but today we'll wait and see how the bounce lines work out before we jump in and add more hedges. It's a very quiet data week with only 3 Fed speakers and 2 of them are Bostic on Friday, after the Fed Minutes come out on Wednesday.

We get the early earnings reporters and that will be interesting but not enough data to start betting on so it's mostly going to be a "watch and wait" week but that's good as we have 5 Member Portfolios to review: