Looking good this morning.

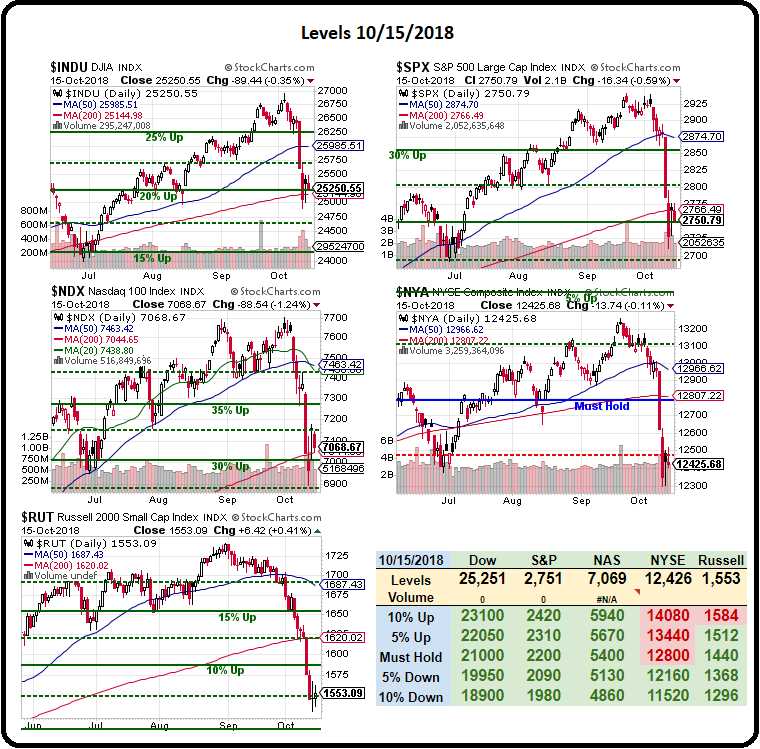

As of 8am, the Dow Futures (/YM) are at 25,386 – almost to our weak bounce line and the S&P Futures (/ES) are at 2,768, not at 2,775 but the Russell (/RTY) is back over the DOOM!!! line at 1,552, now 1,561 and the Nasdaq (/NQ) is actually over the weak bounce line (7,100) at 7,150 but AAPL is still warning us to be cautious at $219, still shy of it's weak bounce at $223.50.

The bounce lines of our 5% Rule™ prevent us from running in and buying dips prematurely. While we do love making bottom calls at PSW, it's best not to do that when the entire market is down – as there tends to be no safe haven in a major sell-off. While the S&P hourly chart looks like it might be moving higher, it's really just a matter of having low expectations as the index has barly moved off the bottom and, since last Thursday, we've been making lower and lower highs – that's more likely to be consolidation for a move down than up!

The bounce lines tell us whether or not a move is real and, for the S&P, 2,775 is weak and 2,750 is strong (see Thursday's Morning Report for how we got there) and, although we use a chart to illustrate it, it has nothing to do with those squiggly lines – it's just math! Math tells us 2,775 is the first inflection point and, other than a brief spike over on Thursday – we've failed at that line Friday and yesterday. That's NOT a sign of strength – especially when it's the weak bounce line that's failing…

When and if we take back 2,775, we'll begin looking for the strong bounce line at 2,800, which has obviously been significant during the downturn and should be again if we begin to recover. Once we are over the strong bounce, we can make bullish plays using that as a stop line but, until we are – it's best to just watch and wait and gather more data.

Earnings Data is good this morning with Morgan Stanley (MS) and Goldman Sachs (GS) both turning in very good reports and Uber is looking to price their IPO at a $120Bn valuation – which is making people think anything is possible, though not necessarily realistic. Speaking of unrealistic, Elon Musk says you should still buy Teslas, despit having the worst self-driving tech of any care because "in six months, we will release a chip that will improve Autopilot performance between 500 and 2,000%" said the CEO who cries wolf so often that no one believes a word he says anymore.

Well, not no one – TSLA is up $3 pre-market (1%). You really can fool some of the people all of the time! Keep in mind that, unlike other car makers, TSLA relies on cameras rather than more expensive Lidar Sensors to perceive the World and THAT is what most experts consider a fatal flaw. A faster chip won't fix a basic design flaw and continuing down this path is very disturbing but TSLA can't move to Lidar without admitting they made a mistake on all the "self-driving" cars they've already sold.

Even if Musk's new chip is 20x faster, “The performance claims are against what they have in the vehicle today, which are three years old,” says NVIDIA’s director of automotive Danny Shapiro. NVIDIA’s latest silicon is at least 10 times faster than that, which would put it on a par with Tesla’s chip. Musk is essentially claiming he has invented the World's fastest chip but you can't see it for 6 months but you should buy the car now and he'll put the chip in later. Also, I love this note:

Losing Tesla as a customer isn’t going to impact NVIDIA; the company says sales were so small that it won’t have a material impact.

And speaking of fooling some of the people all of the time. Electrek is TSLA's PR magazine and releases any BS the company wants to spin as if Christ came down and hand-delivered it. Yesterday they went a bit to far as they published pictures of great-looking Model 3 Drive Units – holding up very well after 1M miles of driving.

And speaking of fooling some of the people all of the time. Electrek is TSLA's PR magazine and releases any BS the company wants to spin as if Christ came down and hand-delivered it. Yesterday they went a bit to far as they published pictures of great-looking Model 3 Drive Units – holding up very well after 1M miles of driving.

The problem with that claim is MATH as 1M is a very big number and, if you think about it, you'd have to drive a Model 3 at 70 miles and hour for 14,285 hours, which is 595 days so – even if you assume they never had to turn or get off the road or change drivers or charge the batteries – Musk is still claiming this model 3 has been driven for about 8 months longer than there was a Model 3 prototype.

Like our President, Elon Musk doesn't let facts get in the way of a good story but, as in investor – you'd better check the facts and not just jump in on a good story. That's especially true for Cannabis Stocks, which are on fire but, if you look at the numbers on a lot of these companies and consider what is realistic growth compared to projected growth – you realize that a lot of these valuations are as ridiculous as Tesla's.

Don't jump in on the bull stories either – a lot of stocks looked tempting in March of 2008, when the S&P had fallen from 1,600 to 1,280 (20%) and seemed to be stabilizing. By June, we were back up to 1,400, which was the strong bounce (weak was 1,344) but we failed there and collapsed all the way to 666 over the next 9 months. THAT is why we watch our bounce lines – it's very easy to get suckered into "bargains" that turn out to be just pauses on the way to far lower prices.

Let's be careful out there!

- Goldman says the sell-off is just about over and tells investors to get back into growth stocks.

- Hedge Funds at the ‘Core’ of Stock Slump May Be Done Offloading