We're back!

We're back!

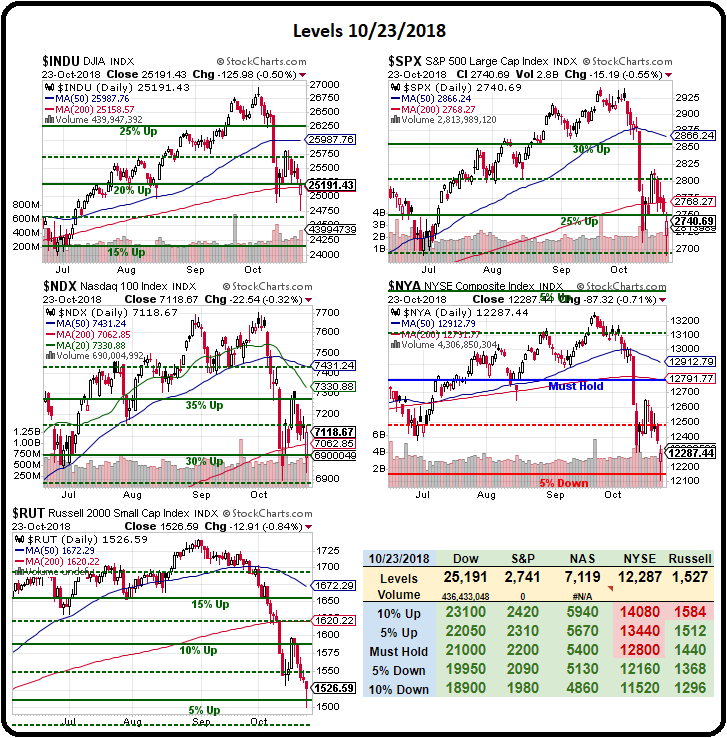

Yesterday was a wild one and today should be interesting as well as markets attempt to shake off a fairly catastrophic failure of their 200-day moving averages. As you can see from our Big Chart, all 5 indexes failed at some point, effectively earasing 100 days of gains and threatening to turn negative for the year. New lows gave us new bounce lines to look for and, yesterday morning, we reran our 5% Rule™ and came up with:

- Dow (/YM) 24,800 (weak) and 25,300 (strong)

- S&P (/ES) 2,710 (weak) and 2,780 (strong)

- Nasdaq (/NQ) 7,080 (weak) and 7,230 (strong)

- Russell (/RTY) 1,530 (weak) and 1,575 (strong)

As you can see, the Dow and the Russell are right on their test lines so we can pretty much make our bets this morning depening on which way those two levels (1,530 and 25,300) break but we think the market is set to give the strong bounce lines a good try, which makes /RTY a good lagging bet if it breaks above 1,530, with very tight stops below because failure there would be a very bad sign for all the indexes (in which case we could short /YM below 25,300 with tight stops above).

We still have the same problems we have last week: Crazy President, Brexit, Italy, Trade Wars, Debt, Iran, Saudi Arabia, Venezuela, Inflation, Economic Slowdown… combine the last two and we get the dreaded Stagflation! NONE of these things have gotten better so the question is whether or not a 10% correction of a record-breaking rally is enough to put us into a rational zone or if we still have another 10-20% correction ahead of us?

We still have the same problems we have last week: Crazy President, Brexit, Italy, Trade Wars, Debt, Iran, Saudi Arabia, Venezuela, Inflation, Economic Slowdown… combine the last two and we get the dreaded Stagflation! NONE of these things have gotten better so the question is whether or not a 10% correction of a record-breaking rally is enough to put us into a rational zone or if we still have another 10-20% correction ahead of us?

While I'd say another 10% would be very likely, 20% seems a bit of a stretch because there are companies like Apple (AAPL) who are making fantastic amounts of money and have valuations that are well-justified and unlikely to suffer much from the above factors (the ones we know about anyway). That does kind of put a floor on how far down we think things can fall but, spoiler alert, that's still more than 10%!

My issue with the market all summer long is that traders have been ignoring the risks – much like they did in 2007 and they've been trading the market like it will go up and up forever and never, ever, ever run into any problems when, CLEARLY, things are actually not that perfect. It's only when you can recognize the risks and imperfections, as well as the advantages and opportunities, that you can truly understand the value of the things you are trading.

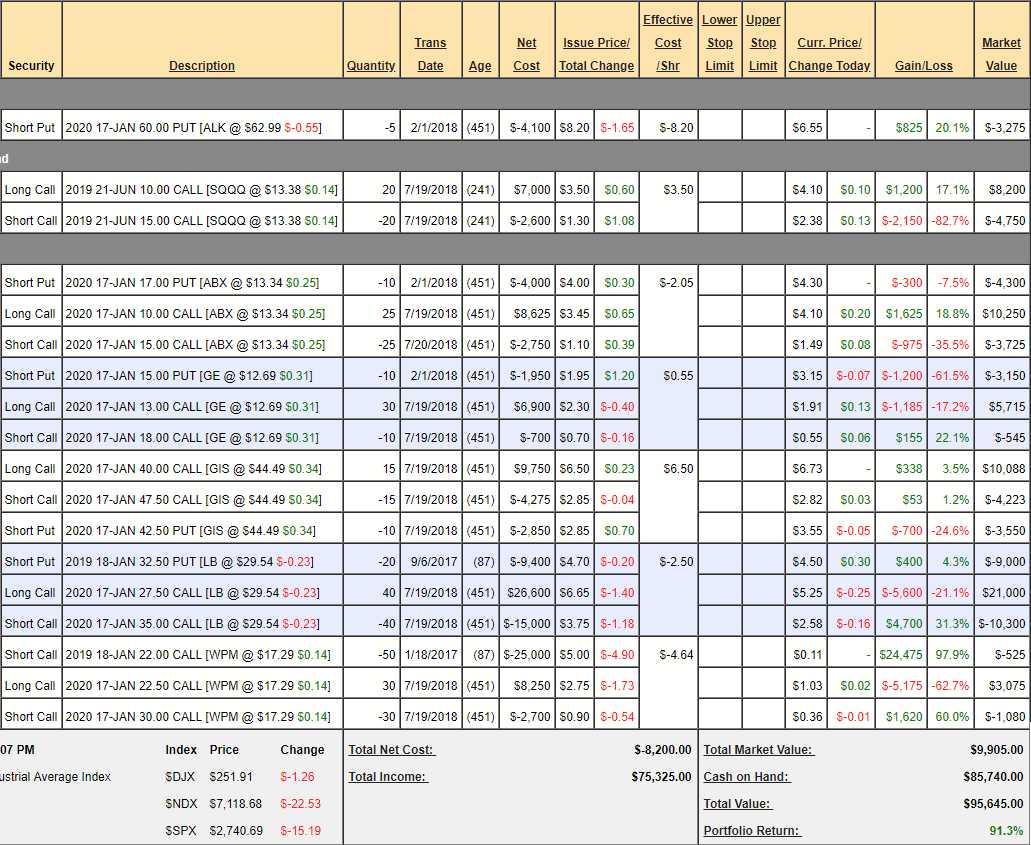

Speaking of trading, I am scheduled to be on BNN's Money Talk tonight at 7:30 which means it's time to adjust our Money Talk Portfolio. We did a review last Thursday and the Portfolio was at $97,037 with the S&P at 2,802 and, as of yesterday's close, we had dropped $1,394 to $95,645 but that's still up $45,645 (91.3%) for the year so not terrible but it lets us know we need to do a bit more to lock in the gains (ie. more hedges).

- ALK – A short put we are confident in, should gain another $3,275 at maturity.

- SQQQ – A good hedge that's $6,760 in the money but only showing net $3,450 out of a $10,000 potential. Hopefully we lose the $3,450 because the market does well as it's simply insurance and not a bet.

- ABX – A long-term bet on gold that pays up to $12,500 and is currently on track at net $2,225 so good for a new trade with another $10,275 (460%) left to gain at $15.

- GE – Been in everyone's dog house but I like them long-term. If they recover, could be a $15,000 net at $18 but we'll be happy with $6,000 at $15 and the current net is just $2,020 so call it $3,980 (197%) at $15 as a realistic goal.

- GIS – A newish trade still good for a new entry with a potential return of $11,250 and currently net $2,315 so $8,935 (385%) more if all goes well.

- LB – Another sleeper but our goal is a modest $35 though we'll have to roll the 20 Jan $32.50 puts at $4.50 ($9,000) to 12 2021 $30 puts at $7.50 ($9,000). At $35, this trade pays $30,000 and is currently trading at net $1,700 so a nice $28,300 (1,665%) at $35 would be great!

- WPM – Possibly my favorite as they are so undervalued. The short Jan calls will expire worthless and, this low in the channel we can sell 10 2021 $17.50 puts for $3 ($3,000) and roll the 30 2020 $22.50 calls at $1.03 ($3,075) to 25 of the 2021 $15 calls at $4.40 ($11,000) and sell 25 of the 2021 $22.50 calls at $1.80 ($4,500) and buy back the 30 short 2020 $30 calls for 0.36 ($1,080). So, to recap, we're essentially closing this whole trade and opening a new 2021 $15/22.50 bull call spread at net $2.60 ($6,500) and selling 10 of the 2021 $17.50 puts for $3 ($3,000) so our net/net on the new trade is $3,500 with a potential gain of $15,250 (435%) at $22.50.

We have a small hedge and I like our 5 spreads and the short put which, if all works out, these positions will make another $70,015 between now and 2021 so all we really have to do, between now and then, is check on them each quarter to make sure they are on track and this portfolio will gain another 140%.

Since we do have $85,740 in cash and are only using $30,000 in margin, we can add a hedge and a new trade:

As a hedge, I'd like to add TZA with a short put that pays for it:

- Sell 5 CAT 2021 $100 puts for $10 ($5,000)

- Buy 40 TZA April $10 calls for $2.25 ($9,000)

- Sell 40 TZA April $15 calls for $1 ($4,000)

The net cost of this spread is zero but we are obligated to buy CAT for $100 if it goes that low (20% lower) and that's not likely to be the case if our TZA bet fails to win. The spread pays up to $20,000 and is currently $5,400 in the money so you can't lose unless the Russell is higher in April (which keeps us on the path to making another $70,015) and that should be good for the short puts.

Also, just because they are such a good deal, I'd like to add a Micron (MU) trade idea:

- Sell 5 MU 2021 $35 puts for $6.40 ($3,200)

- Buy 10 MU 2021 $35 calls for $12.40 ($12,400)

- Sell 10 MU 2021 $50 calls for $7 ($7,000)

That's net $2,200 on the $15,000 spread so the upside potential is $12,800 (582%) in two years if MU can get back to $50.

A late addition for the live show is the Cannabis ETF (MJ), which TD Bank was kind enough to let us include in the show:

- Sell 10 MJ 2021 $30 puts for $7 ($7,000)

- Buy 20 MJ 2021 $25 calls for $9.50 ($19,000)

- Sell 20 MJ 2021 $45 calls for $5.25 ($10,500)

That's net $1,500 on the $40,000 spread that's currently $16,000 in the money with a $38,500 (2,566%) upside potential. It's crazy volatile but a lot easier than trying to pick an individual winner in the Cannabis Industry!

In fact, it's a little early but I think this may be my 2019 Trade of the Year and that means, since it pays $40,000, which would be a 4-year Premium Membership at PSW, I can tell you that if you buy an Annual Premium Membership this month (October) and this trade doesn't make at least $10,000 by next November 1st (2019), we will give you another year of PSW Premium FOR FREE!!!! You don't have to make the trade, we'll honor it anyway but I think it will be $1,500 in cash (plus margin) well spent!

Today is a busy, busy day with 4 Fed Speakers (Bostic, Bullard, Mester and Bostic again) ahead of the Fed's Beige Book at 2pm, during our Live Trading Webinar so tune in for that at 1pm, EST! Last week we made thousands of Dollars trading the Futures in the course of 2 lively hours so, unless you are busy making thousands of Dollars doing something else between 1 and 3 – why not give it a try?