Courtesy of Chris Kimble.

The latest stock market correction and swing lower has seen momentum drop to extreme lows (on a intermediate-term basis). This poses a bit of a conundrum because stocks have been struggling since hitting historic longer-term momentum highs.

So what do investors make of this going forward? Let’s look at a couple of four-pack charts.

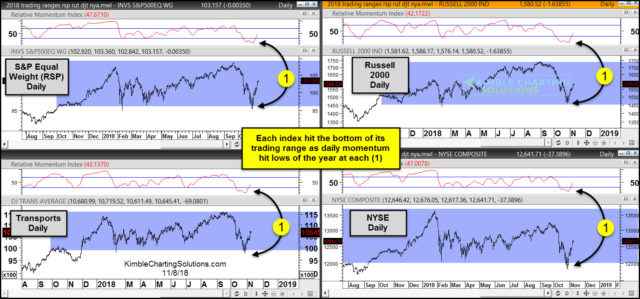

The first 4-pack of charts looks at the “daily” Equal Weight S&P 500, Russell 2000, Dow Transports and NYSE Composite. All of these important stock indexes are in horizontal trading ranges with momentum at the lowest levels in the past couple of years.

This has helped stocks bounce nearly 8 percent off the lows.

Stock Market Index “Ranges” (support at momentum lows)

CLICK ON CHART TO ENLARGE

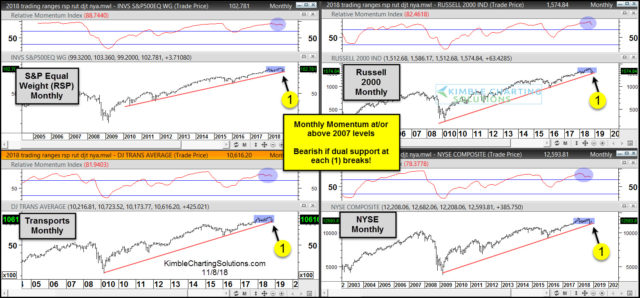

The next 4-pack of charts is a longer-term look at “monthly” bars for the Equal Weight S&P 500, Russell 2000, Dow Transports and NYSE Composite. In addition to testing the bottom of their trading ranges, the stock indexes are also testing 8-year+ rising support at each (1)… with momentum at/or above 2007 levels.

CLICK ON CHART TO ENLARGE

How these two timeframes reconcile will be important for investors.

If support at each (1) would give way, monthly momentum has a long way to go to get oversold. From a big picture perspective, the support test a (1) could be huge!

This article was first written for See It Markets.com. To see original post CLICK HERE

–

To become a member of Kimble Charting Solutions, click here.