CELG/Alter - Like STT, they are down with their sector more so than having their own troubles.

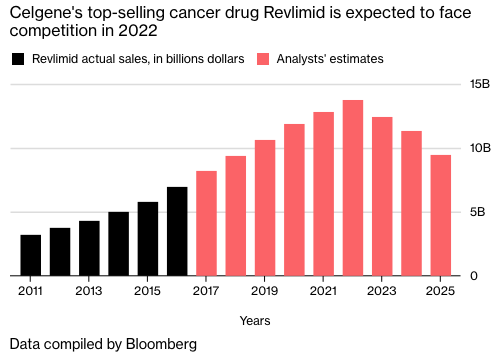

Trump threatens to reign in drug pricing (which is really a threat to step up GOP contributions) and Revlimid sales are still a big part of their Revenues that is going away over time as they lose exclusivity - but it's a long way off, so shouldn't be considered by shorter-term investors:

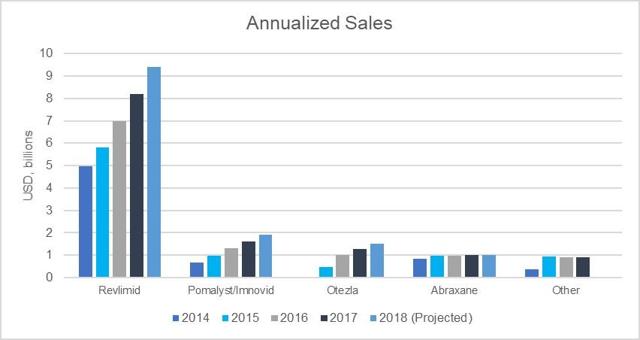

Currently, Revlimid is about 1/2 of CELG's sales and essentially all of it's profits so they've acquired Juno to pump up their pipeline but, at the moment - there is no immediate replacement for Rev:

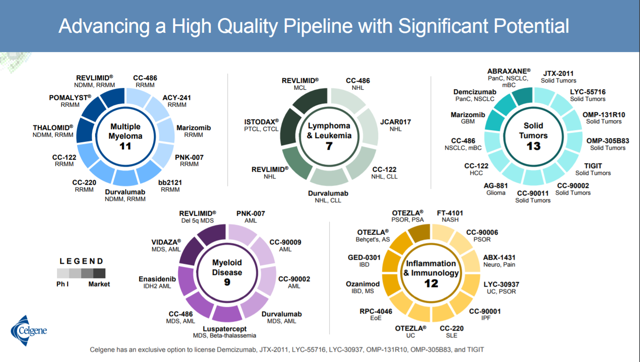

They can also reformulate and re-package Rev to improve its lifetime - any announcement to that effect would be a market-booster. Even in their pipeline presentation - 3 of their 5 main rollouts depend on Revlimid variations:

CELG may be a one-trick pony, but it's a great trick:

He's a one-trick pony

One trick is all that horse can do

He does, one trick only

It's the principal source of his revenue

But when he steps into the spotlight

You can feel the heat of his heart

Come rising throughHe's just a one-trick pony, that's all he is,

But he turn that trick with prideHe's a one-trick pony

He either fails or he succeeds

So we're paying $48Bn at $70 with $4Bn in earnings and we should hit $5Bn, maybe $6Bn at the peak of the Rev cycle so anything else they figure out between now and 2022 is bonus money. I don't know that I'd want to play them aggressively but we can add the following to the LTP:

- Sell 5 CELG 2021 $65 puts for $9 ($4,500)

- Buy 15 CELG 2021 $70 calls for $14.20 ($21,300)

- Sell 15 CELG 2021 $85 calls for $8.60 ($12,900)

That puts us into the $22,500 spread that's 1/3 in the money for $3,900 so our upside potential is $18,600 (476%) at $85 but, as you know, the reason I generally go with 15 longs is because I like to sell 5 short calls that I could easily split if they go against me and still not be in trouble.