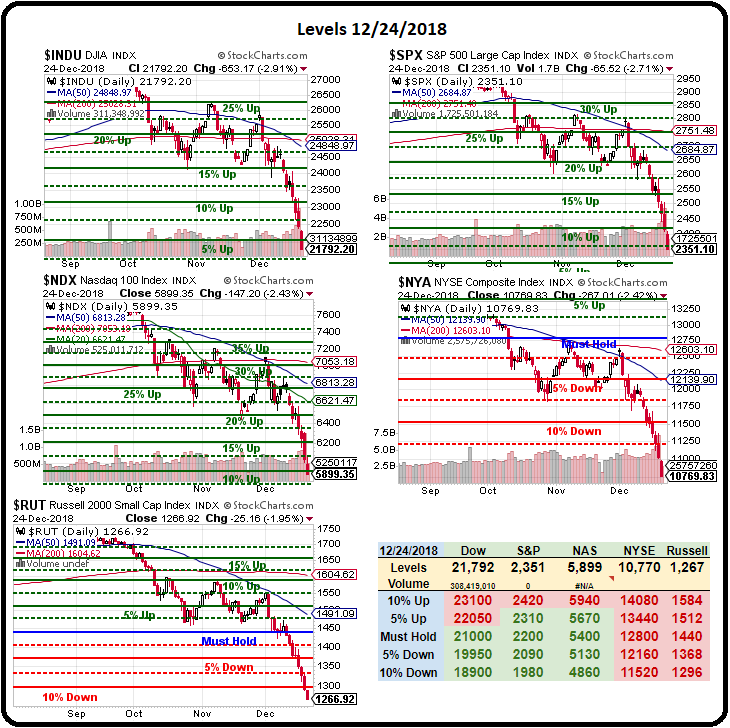

As you can see from the small image of the Big Chart (click to enlarge) the marekts have been in free-fall for the month of December with the indexes giving up about 20% of their gains (not 20% from the top) in just over 20 days with almost no up days the whole month.

This Government shut-down is different and the conservative, Financial News Media as well as many of the Top 1%-owned Media Outlets tend to ignore the fact that the previous shut-downs (1995 Newt Gingrich, 2013 Obmacare and 2018 Dreamer) were acts by the opposing party house against the President so there was confidence that our LEADER would work to resolve the temper-tantrum the House leaders were having.

This time is different as it's our "leader" having a temper-tantrum and his party controls both the House and the Senate so how are people going to be confident that this will be resolved when you have an incoming Democratic House in just two more weeks? 400,000 Government employees are already out of work and millions of contractors aren't going to get paid and projects won't get done and things won't get ordered… The US Government is the largest part of the US economy, spending over $4Tn a year, call it $350Bn/month and that's money the economy can't actually live without – 20% of our entire GDP is Government Spending.

Each month the Government is closed knocks 2% off our GDP and the slowing economy will contract wages and Corporate Profits and, guess what? That will make the deficit explode as it lowers the rate of tax collections. That's why the market had such a harsh reaction to this shut-down but it's still been an over-reaction nonetheless and we are certainly now looking for at least a weak-bounce correction, which would be a 4% gain on the indexes from these levels. Let's call it from the 20% correction lines:

- Dow 27,000 to 21,600 is 5,400 points so 1,080-point bounces to 22,680 (weak) and 23,760 (strong)

- S&P 2,950 to 2,360 is 590 points so 120-point bounces to 2,480 (weak) and 2,600 (strong)

- Nasdaq 7,700 to 6,160 is 1,540 points so 300-point bounces to 6,460 (weak) and 6,760 (strong)

- NYSE 13,200 to 10,560 is 2,640 points so 528-point bounces to 11,058 (weak) and 11,586 (strong)

- Russell 1,750 to 1,400 is 350 points so 70-point bounces to 1,470 (weak) and 1,540 (strong)

These are the lines we need to take back JUST to call the market stable but, as you can see, we're not even holding the -20% lines on the Nasdaq (5,956) or the Russell, which is miles below at 1,276. So we have to consider what 1,276 is on the Russell and 1,250 is pretty much a 27.5% drop on that index, which would be a strong (2 4% moves) overshoot of the 20% drop. We can factor in the panic and how deeply Trump's Government Shut-Down will affect small caps vs multinational large caps and consider that maybe the Russell, in this case, isn't a leading indicator but if ANY of the other indexes confirm this move – then we're likely only halfway done correcting!

Think about it, if people aren't willing to buy stocks for 20% less than they were trading at a month ago – what happens when more sellers show up. The real danger in a sell-off like this is more bad news hitting a tipping point and forcing people to capitulate out of perfectly good positions and, to that end, that's what we have hedges for.

It's very simple to protect yourself from another 20% move down in the Russell (to 1,050) as that's another 225-point drop from here and we're at 1,275 so that's another 17.5% and a 17.5% move down on the Russell should correspond to a 52.5% gain on the Ultra-Short Russell ETF (TZA), which is currently at $18.50 so our target would be $28.21.

Now that we have our target, we can look at some option spreads that can protect us. Let's say we're worried about the market through earnings (though I think earnings will save us as they probably aren't that bad) so the Jan spreads are too soon and so are Febs and the next set is April so we look at the April contracts and those contracts only go up to $30 because NOBODY thinks we're going to drop more than 40%.

With TZA at $18, the $17 contracts and $20 contracts have the most premium, at $4 and $2.80 and the $13s have very little at $6 but we're not looking to lock in gains, we're looking for protection so I'd rather sell the $25s for $2 against the $20s for $2.80 and that's just net 0.80 on the $5 spread so we make $4.20 (525%) on a 20% drop in the Russell. That means, if we want to mitigate $100,000 worth of damage we might expect to take on a 20% drop (basically, whatever damage you had so far would be doubled) then $20,000 in this hedge would pay back $125,000 – more than you plan to lose!

Of course we don't want to over-insure because the market might NOT fall 20% more and, as a rule of thumb, unless we're exremely bearish, we only look to mitigate about half the damage so $10,000 would pay us $62,500, which offsets 2/3 of the loss and, more importantly, if the market were to recover and we lose our $10,000 – it would be in the context of getting much of our $100,000 back from the first 20% drop. That's how you calculate what kind of hedge we need.

Hedges are insurance policies against portfolio damage and, like any insurance policy, they are money you expect to lose and you don't HOPE your hedges pay off because that would mean something catastrophic happened to your long positions. Keep that in persepective and consider the hedges a simple cost of doing business in the market and you'll feel much better about them.

We're HOPING (not a valid investing strategy) that we at least get to our weak bounce lines by Friday and that we won't have to add more hedges to our portfolios but we're not going to be fooled by false rallies, we need to see a lot more green on our chart before deploying the green that, thankfully, is in our accounts.

Be careful out there,

– Phil