The Next 20 Years

Courtesy of Michael Batnick

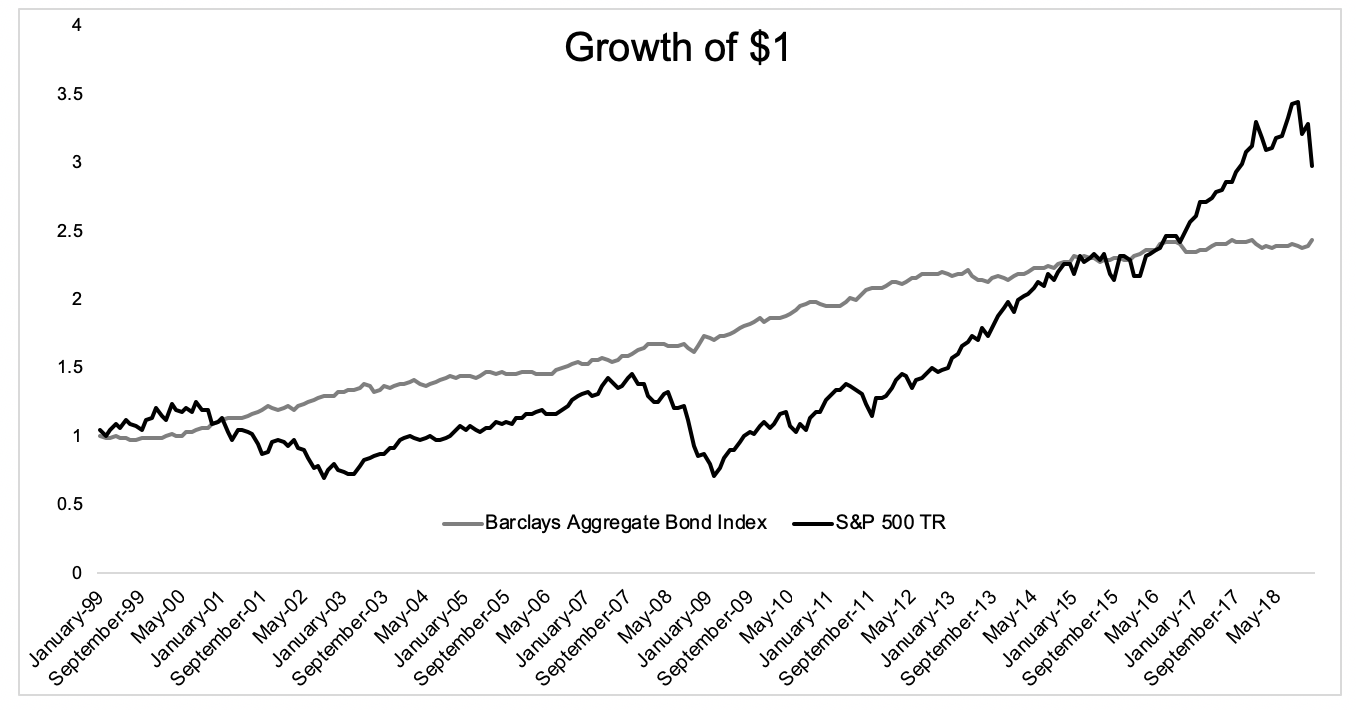

There was an article in Barron’s over the weekend, It’s Been a Rough 20 Years for Stocks. The Next 20 Should Be a Lot Better. The first part of that headline is factually correct. From 1999-2018, the stock market experienced two crashes, and investors received just 5.6% annually for their troubles. Over the same time, the Barclays aggregate bond index gained 4.6% and experienced a max drawdown of less than 5%.

Looking at the chart below, sure stocks came out ahead, but did they adequately compensate investors for all of the sleepless nights? In my opinion, they did not.

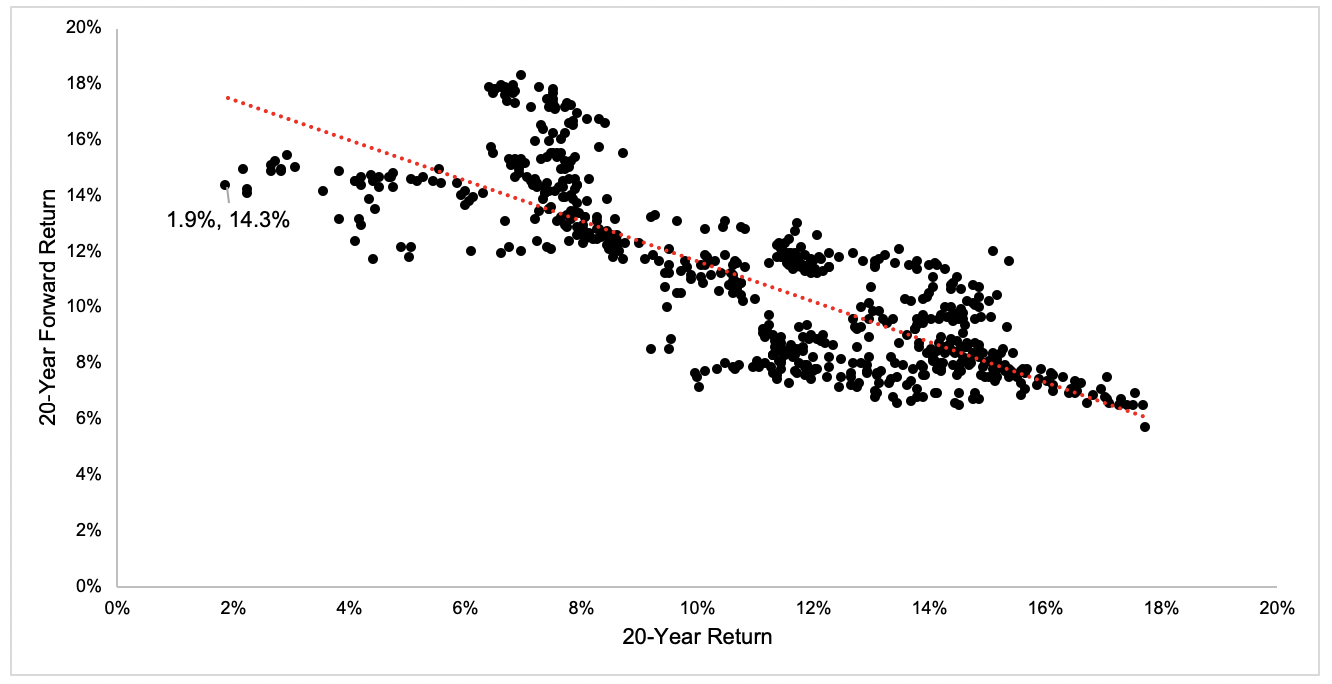

Which brings us to the second part of the headline, “The next 20 years should be a lot better.” Historically, this is true. As you can see in the chart below, if U.S. stocks experienced a lousy twenty years, the next 20 generally did quite well.

In the 20 years following the peak in 1929, stocks returned a paltry 1.9%. And in the twenty years following that, they returned 14.3%.

Here’s the problem with data points like this, I don’t think they’re particularly meaningful. Does having this information make you feel any differently about your investments? Will it help you stay the course during the next this bear market?

20 years is a long time.

The fact that a 5.6% annualized return is the worst twenty year period for stocks tells you a lot about how strong the U.S. stock market has been over the last century. Unfortunately it doesn’t provide any clarity into the future.