That was easy!

That was easy!

In yesterday morning's PSW Report I said:

25,600 would be a great place to short the Dow Futures (/YM) if it fails, with tight stops above but ONLY ENTER AS IT CROSSES BELOW! At $5 per point, per contract, if you give it 20 points to the stop (25,620, you risk $100 but the Dow is up 600 points off Monday's lows and up 3,600 points since Christmas so it's very likely we get a 20% retrace of 600 in the short run and that's 120 points for $600 per contract reward and, if we get lucky, we retrace the larger rally by 720 points for a $3,600 gain – so I think it's worth a toss – especially in light of these frightening charts

Well, that's exactly what happened first thing in the morning for a nice, quick gain and we're right back there this morning for another chance to go short – but keep those stops in place! If they are going to keep giving us the set-up, we're not too proud to keep making money off it, right? Remember: I can only tell you what's likely to happen and how to profit from it – the rest is up to you!

If you would like to subscribe to the PSW Report so you can have money-making ideas like this delivered to you every day, before the market opens – just CLICK HERE.

Yesterday we placed tight stops at the 25,480 line but today is the 2nd attempt at a fail and we think the indexes will succeed… at failing… There's no way Retail Sales held up during a month-long Government Shutdown and we get that report this morning while leading Economorons haven't changed their estimates since the last time we got a report – way back in November (delayed due to the Government Shutdown).

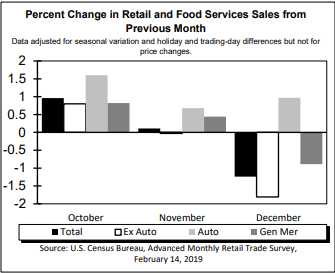

8:30 Update: Oops, DISASTER! Retail Sales are down 1.2% for the month and, if it wasn't for a nice gain in Auto Sales, it would have been DOOM. Check out that trend – not pretty… Not only that but Gasoline sales, which are 8% of all Retail Sales are up 13.1% for the year (due to higher prices, not demand) and, if not for that, Annual Retail Sales would be down another 1%.

8:30 Update: Oops, DISASTER! Retail Sales are down 1.2% for the month and, if it wasn't for a nice gain in Auto Sales, it would have been DOOM. Check out that trend – not pretty… Not only that but Gasoline sales, which are 8% of all Retail Sales are up 13.1% for the year (due to higher prices, not demand) and, if not for that, Annual Retail Sales would be down another 1%.

Categories showing a decline in December include furniture, electronics, health and personal care stores, clothing stores, sporting goods and even nonstore retailers (Amazon and dot com gang that was supposed to be taking over). This is the biggest monthly drop since 2009 so it looks like we can expect at least a 240-point drop on /YM this morning – down to 25,360 and, frankly, we'll be lucky if that holds as I don't see any major catalysts for the day.

Tomorrow we get the Empire State Manufacturing Report at 8:30 and Industrial Production at 9:15 followed by Consumer Sentiment at 10 am and the Fed's Bostic is scheduled to speak at 9:55 – so I think that timing is to get ahead of a poor set of reports so the market doesn't go into free-fall into a long weekend. We'll see how that all pans out.

Speaking of predictions that come true, it's time to finally say goodbye to the A380, a plane I pronounced dead before they built it. Airbus could have saved tens of Billions in write-downs if they had only subscribed to our Live Member Chat Room PSW:

Submitted on 2007/02/08 at 6:30 am

A380 – I’ll see your monkey and raise you a mule! Even if they get it flying where are they going to land it? Other than the few European airports that have made a commitment and some in Asia/PG, who is going to be redesigning gates to handle a super-plane that only uses it a few times a week.

It’s a huge chicken and egg problem for Airbus and wait until you see the bad press when they try to put 600 people in a plane at one time (and with 100 first class seats I bet you I STILL can’t get an upgrade!). How does this mesh with any airline gate you’ve ever seen. Will the airlines triple the staff at the gate or willl you wait on a 200 person line to ask a question? Have you ever been on a plane that was waiting for the catering car? Times 3! What happens when they scap a flight? Do all 800 of you race to the customer service counter to try to get on the next plane? What redesigns of the luggage system are being put in place to handle 5-800 people’s bags on the same belt? How many additional customs agents will they put on staff every time an A380 lands in a foreign country – or will we just wait 2 hours?

I know it’s a nightmare when 2 planes with 200 people land at the same time and hit customs, imagine 2 A380s dropping 1,600 people off at once!

All the traffic flow studies they do rest on the fatally flawed assumption that these planes take off on time, land on time, have available gates and never break down. I’d say I would avoid them until they get the bugs out but I may be too old to fly by then…

Submitted on 2007/12/11 at 10:53 amFAA – that’s because BA wisely made the 787 a logical extension of the line, not a radical departure so everyone along the process is very comfortable with what they are doing, including the regulators. The worst thing EADS can do is start actually flying A380s because the clusterf*ck they will cause at 80% of the airports they land in will lead to massive order cancellations. The A380s are designed to be customized, how stupid is that for something you intend to mass market? Ford had it right with the Model T when he said, “You can have any color you want, as long as it’s black.”

Submitted on 2007/12/11 at 11:01 am

Airbus – Has anyone heard of a single airport that has made modifications for the A380?

Submitted on 2007/12/11 at 11:31 am

A380 – it’s the gates that will be the problem more so than the runways although I’d hate to be landing in the snow in most US airports as they will be cutting it really close on length.

Submitted on 2008/02/24 at 8:12 am

NOC’s deal is an EADS parnership that will create maybe half as many US jobs. As with the 787, BA went with a smaller, lighter design than EADS and I would have to think that Airbus’s problems with the A380 would have to make procurement people think twice about a critical replacement program that they absolutely need to get done before the Dems take over and cut their budget.

If BA loses, it is absolutely a buy on the dip play as this tanker deal represents, at best, 3% of their Net in 2010 and less in subsequent years.

I don’t think the “virtual fence” is in place of the actual fence plan, it’s just easier to get started. Of course, it’s a BS scam to enrich some tech company Chertoff is in bed with. In reality, there are a couple of thousand miles of border that need to be patrolled 24 hours a day so let’s say 1 man per mile = 6,000 people to patrol a fence 24/7 OR you can hire 100 people per state to verify that businesses don’t have illegals working for them. No illegal jobs = no incentive to come in illegally and we don’t have to look like Berlin (which doesn’t even look like that anymore because Ronald Reagan declared a wall between a free and an impoverished nation was an immoral outrage that would not be tolerated by the United States of America (well the USA that used to exist anyway).

Submitted on 2008/02/26 at 1:25 pm

BA – high oil should be good for them. Not even Emirates can afford to fly an A380 around at $100 a barrel. Fuel is 1/3 of the cost of running an airline and planes are leased so, assuming you can roll a lease from one plane to the next, saving 20% on fuel is going to add 6.5% to the bottom line. LUV, for example has $9.2Bn in expenses and $645M in profits. Saving 20% on 1/3 of their expenses is a 100% increase in net profit. How can airlines NOT switch?

Submitted on 2010/11/08 at 7:50 amBA/Hoss – Remind me if they do go down, it’s not like Airbus is in better shape on deliveries. I’ve been thinking about that since I was at the airport. Even Orlando has only a couple of bays for the A380 so it’s going to be virtually impossible to knock BA out of US airports, who have no money to re-fit terminals. Also, A380s have those Rolls-Royce engines (GE is a good pickup on that news too) that may have a fatal design flaw and that can cause massive delays as plane and engine design are entwined.

So, in short, I was never a fan of the A380 but look how long it took for me to be right. Notice we were also having a Wall debate 10 years before it became popular and I already solved that problem by suggesting we simply step up employment enforcement. Hiring 5,000 people to simply go around to businesses and check that their workers are all legal would cost (at $50,000 per job) $250M per year and that's that…

See how easy it is to pick stocks and solve problems when you just think about the Fundamentals!